Natural Fiber Prepreg Market Size (2024 – 2030)

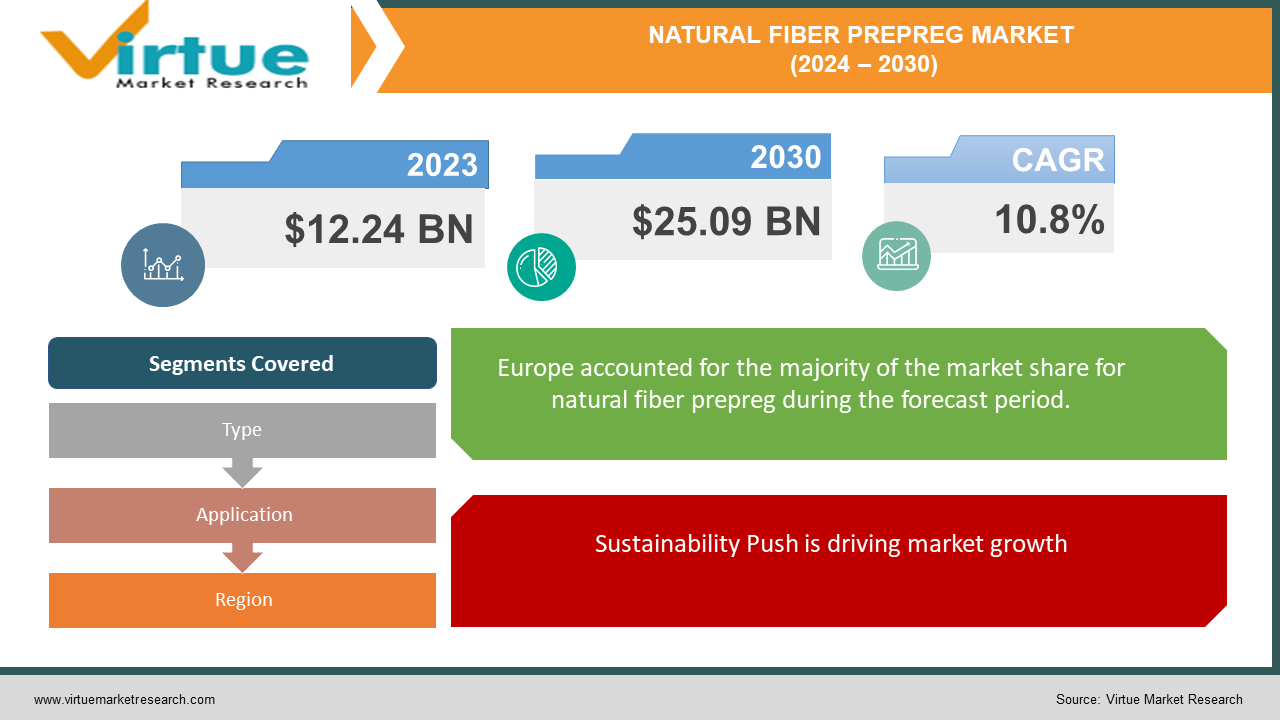

The Global Natural Fiber Prepreg Market was valued at USD 12.24 billion in 2023 and will grow at a CAGR of 10.8% from 2024 to 2030. The market is expected to reach USD 25.09 billion by 2030.

The Natural Fiber Prepreg Market deals with pre-impregnated natural fibers like flax, hemp, and sisal embedded in resin. This niche market is currently smaller than the synthetic fiber prepreg segment, but it's expected to grow rapidly due to rising demand for sustainable materials and advancements in processing techniques that enhance the performance of natural fibers.

Key Market Insights:

Natural fibers like flax, hemp, and sisal offer a more eco-friendly alternative to synthetic fibers like carbon fiber. This aligns with the growing demand for sustainable materials across various industries. Innovations in processing techniques are enhancing the mechanical properties of natural fibers, making them more competitive with synthetics in terms of strength and performance.

Stringent regulations promoting the use of eco-friendly materials in sectors like automotive and aerospace could further propel the natural fiber prepreg mark. Compared to readily available synthetic fibers, the production and supply chain for natural fibers might be less established in some regions. Natural fiber prepregs might currently be more expensive than their synthetic counterparts due to processing costs and lower production volume.

Global Natural Fiber Prepreg Market Drivers:

Sustainability Push is driving market growth:

The environmental crisis is prompting a major shift towards sustainable materials, and natural fibers like flax, hemp, and sisal are stepping up as eco-friendly heroes. Unlike their synthetic counterparts like carbon fiber, these plant-based alternatives are renewable resources that can be continuously replanted. They also biodegrade at the end of their lifespan, minimizing waste and avoiding the environmental burden of synthetic fibers that linger in landfills for centuries. Most importantly, the production of natural fibers requires significantly less energy and emits fewer greenhouse gasses compared to the high-heat, high-pollution processes involved in synthetic fiber manufacturing. This translates to a smaller carbon footprint, making natural fibers a clear winner for a greener future. As sustainability concerns become paramount, natural fibers are poised to revolutionize various industries, offering a responsible and eco-conscious alternative to traditional materials.

Technological Advancements are driving market growth:

The game is changing for natural fibers. No longer relegated to niche applications, advancements in processing techniques are unlocking their full potential. These innovations are transforming natural fibers like flax, hemp, and sisal into serious contenders against synthetic giants like carbon fiber. Traditionally, natural fibers faced limitations in strength, stiffness, and overall performance. However, new processing methods are addressing these shortcomings. Techniques like mercerization, which improves fiber alignment and bonding, and bio-modification, which alters the fiber structure at the molecular level, are significantly enhancing mechanical properties. Additionally, treatments like plasma modification improve the compatibility of natural fibers with resins, leading to stronger bonds and improved stress transfer in prepregs. These advancements are not just theoretical. They are leading to the creation of high-quality natural fiber prepregs with properties that rival synthetics. This opens doors for natural fibers in applications where previously only synthetics were viable. From lightweight yet sturdy car parts to high-performance sporting goods, the potential for natural fiber prepregs is vast. As processing techniques continue to evolve, the gap between natural and synthetic fibers is rapidly closing, paving the way for a more sustainable future in material science.

Government Regulations are driving market growth:

The winds of change are blowing in the natural fiber prepreg market thanks to a powerful alliance: environmental responsibility and government regulations. Governments around the world are taking a firm stance on sustainability, enacting stricter regulations that promote the use of eco-friendly materials in industries with a hefty environmental footprint. This is particularly true for sectors like automotive and aerospace, where traditional materials often leave a significant carbon footprint. These regulations are essentially pushing manufacturers out of their comfort zones and into the welcoming arms of sustainable alternatives like natural fiber prepregs. This is a golden opportunity for the natural fiber prepreg market, as manufacturers are now actively seeking ways to comply with regulations. The shift is not merely driven by enforcement; it's also fueled by the environmental consciousness that these regulations cultivate. As both regulators and consumers become more environmentally aware, the demand for sustainable materials like natural fibers will soar, further propelling the natural fiber prepreg market forward.

Global Natural Fiber Prepreg Market challenges and restraints:

Limited Raw Material Availability is a significant hurdle for Natural Fiber Prepreg:

The Achilles' heel of the natural fiber prepreg market lies in its raw material source. Unlike the readily available and well-established supply chains of synthetic fibers like carbon fiber, natural fibers like flax, hemp, and sisal face geographical limitations. Production of these plant-based materials might be concentrated in specific regions, leading to logistical hurdles and potential shortages in other areas. This disrupts the smooth flow of raw materials, causing fluctuations in availability for prepreg manufacturers. Furthermore, the nascent stage of natural fiber production compared to synthetics means economies of scale haven't fully taken effect. The additional processing steps involved in treating and improving natural fibers for prepreg applications add to the overall cost. This limited availability and higher production costs can translate to a price premium for natural fiber prepregs compared to their synthetic counterparts. However, this challenge presents an opportunity for investment in developing a more robust and geographically diverse supply chain for natural fibers. As production scales up and regional availability improves, the cost competitiveness of natural fiber prepregs is expected to increase, paving the way for wider adoption in the future.

Cost Competitiveness is throwing a curveball at the Natural Fiber Prepreg market:

The price tag of natural fiber prepregs faces a double hurdle compared to synthetic options. Firstly, natural fibers like flax, hemp, and sisal require additional TLC (tender loving care) before they become prepreg-ready. Unlike their synthetic counterparts, these natural fibers undergo extra processing steps to enhance their properties for composite applications. These treatments, such as chemical modifications to improve adhesion or physical processes to enhance strength, add to the overall production cost. Secondly, the economics of scale haven't yet tipped in favor of natural fibers. While synthetic fiber production is a well-oiled machine with an established infrastructure, natural fiber production is still in its early stages. This limited production volume means manufacturers can't reap the cost benefits that come with large-scale operations. The combination of these processing costs and lower production volumes currently makes natural fiber prepregs more expensive than their synthetic alternatives. However, as advancements are made in processing techniques and natural fiber production ramps up, the price gap is expected to narrow, making natural fiber prepregs a more cost-competitive option in the future.

Performance Optimization is a growing nightmare for Natural Fiber Prepreg:

Bridging the performance gap is a key hurdle for natural fibers. While advancements are constantly improving their mechanical properties, natural fibers like flax and hemp might still require further optimization to fully compete with high-end synthetic fibers in specific applications. This is particularly true for stiffness, a crucial factor in applications like aerospace components. For instance, to achieve the same level of stiffness in a particular part, a natural fiber prepreg might require a higher fiber content compared to a synthetic alternative. This can be a double-edged sword. While it delivers the desired stiffness, the increased fiber content translates to a heavier final product. In weight-sensitive applications like aircraft parts, this additional weight can be a significant drawback. Researchers are actively developing strategies to address this challenge. One approach involves exploring advanced fiber modification techniques to enhance the inherent stiffness of natural fibers. Additionally, optimizing the design and layup of natural fiber prepregs can help achieve the desired performance without compromising weight. By overcoming this performance gap, natural fibers can become more competitive across a wider range of applications, further accelerating their adoption in the future.

Market Opportunities:

The Natural Fiber Prepreg Market presents a compelling opportunity driven by the convergence of sustainability concerns, technological advancements, and regulatory tailwinds. Consumers and governments are increasingly demanding eco-friendly alternatives, and natural fibers like flax, hemp, and sisal offer a clear advantage over traditional synthetic fibers. These plant-based materials boast a smaller carbon footprint due to their renewable nature and lower processing energy requirements. Furthermore, advancements in processing techniques are addressing the historical limitations of natural fibers. Through methods like mercerization and bio-modification, natural fibers are gaining significant strength, stiffness, and overall performance, making them more competitive with synthetics. This paves the way for their adoption in a wider range of applications, including lightweight car parts, high-performance sporting goods, and even furniture with improved acoustic and thermal insulation properties. Additionally, stringent government regulations promoting the use of eco-friendly materials in sectors like automotive and aerospace are creating a favorable environment for the Natural Fiber Prepreg Market. These regulations essentially push manufacturers to embrace sustainable alternatives, accelerating the adoption of natural fiber prepregs. While challenges like limited raw material availability, higher processing costs, and the need for further performance optimization in certain applications remain, the market holds immense potential. As production scales up, processing techniques become more efficient, and the natural fiber supply chain strengthens, the cost competitiveness of natural fiber prepregs is expected to improve. This, coupled with growing environmental awareness and supportive regulations, will likely propel the Natural Fiber Prepreg Market toward significant growth in the coming years.

NATURAL FIBER PREPREG MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bcomp Ltd., DuPont, Lingrove Inc, JELU-WERK J. Ehrler GmbH & Co. KG, Teijin Limited, Toray Industries, Inc., Solvay Group, Hexcel Corporation, Mitsubishi Chemical Holdings Corporation, SGL Group |

Natural Fiber Prepreg Market Segmentation - by Type

-

Flax Fiber Prepregs

-

Hemp Fiber Prepregs

While both flax and hemp fiber prepregs hold promise in the Natural Fiber Prepreg Market, flax currently occupies the more prominent position. Flax fibers boast a high strength-to-weight ratio and good stiffness, making them ideal for a wider range of applications in the automotive industry (interior parts, door panels) and sporting goods (bicycle frames) compared to hemp. However, hemp fibers are gaining traction in specific sectors due to their fire retardancy and sound insulation properties, making them well-suited for building materials and certain automotive parts. As the market evolves and processing techniques improve, both flax and hemp fiber prepregs have the potential to become even more prominent players in the drive toward sustainable composites.

Natural Fiber Prepreg Market Segmentation - By Application

-

Automotive Industry

-

Sporting Goods

Currently, the Automotive Industry is the more prominent sector for Natural Fiber Prepregs compared to Sporting Goods. This is because the automotive industry demands large volumes of materials for car parts and natural fiber prepregs offer a lightweight and sustainable alternative to traditional materials. While sporting goods benefit from the high strength-to-weight ratio of natural fibers, the market size for these products is generally smaller. However, as technology advances and natural fiber prepregs become more cost-competitive, they have the potential to gain significant ground in the Sporting Goods sector as well.

Natural Fiber Prepreg Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe currently holds a lead in the broader prepreg market, and its established infrastructure and focus on sustainability make it a prime candidate for natural fiber prepreg adoption. However, Asia's booming automotive industry and growing environmental awareness position it as a potential frontrunner as well. North America is also expected to experience significant growth but may lag slightly behind Europe and Asia in terms of overall dominance. South America, the Middle East, and Africa have potential for future growth, but their current market share is likely to be smaller due to developing infrastructure and varying environmental regulations.

COVID-19 Impact Analysis on the Global Natural Fiber Prepreg Market

The COVID-19 pandemic threw a curveball at the burgeoning Natural Fiber Prepreg Market. Disruptions in the global supply chain initially hampered the flow of raw materials like flax and hemp, impacting production and availability of natural fiber prepregs. This coincided with a slowdown in major end-use sectors like automotive manufacturing due to lockdowns and economic uncertainty. The net effect was a temporary setback for the market's growth trajectory. However, there were silver linings. The pandemic heightened awareness of environmental issues, potentially accelerating the long-term shift towards sustainable materials like natural fibers. Additionally, some industries like sporting goods, which benefit from the lightweight properties of natural fiber prepregs, may have seen a boost in demand as people focused on home fitness activities during lockdowns. As the global economy recovers and manufacturing sectors regain momentum, the Natural Fiber Prepreg Market is expected to bounce back. Furthermore, ongoing research and advancements in processing techniques are continuously improving the performance of natural fibers, making them even more competitive with synthetics in the long run. While the short-term impact of COVID-19 was undeniable, it may have inadvertently spurred a renewed focus on sustainability, potentially paving the way for a stronger and more resilient Natural Fiber Prepreg Market in the future.

Latest trends/Developments

The Natural Fiber Prepreg Market is brimming with exciting trends and developments driven by sustainability and innovation. Firstly, advancements in processing techniques are unlocking the full potential of natural fibers like flax and hemp. Methods like mercerization and bio-modification are significantly enhancing their strength, stiffness, and overall performance, making them more competitive with traditional synthetic fibers. Secondly, a growing focus on eco-friendly materials is propelling the market forward. Stringent government regulations in key sectors like automotive and aerospace are pushing manufacturers to adopt sustainable alternatives, creating a favorable environment for natural fiber prepregs. This trend is further fueled by rising consumer demand for environmentally responsible products. Thirdly, research is actively addressing the limitations of natural fibers. Strategies like advanced fiber modification and optimized prepreg design are tackling the performance gap with synthetics in specific applications like high-stiffness aerospace components. Finally, the market is witnessing a geographic shift. While Europe currently holds an edge due to its established prepreg infrastructure and sustainability focus, Asia's booming automotive industry and growing environmental awareness position it as a potential future leader. As the natural fiber supply chain strengthens, processing techniques become more efficient, and the cost competitiveness of natural fiber prepregs improves, this exciting market is poised for significant growth, revolutionizing the future of composite materials.

Key Players:

-

Bcomp Ltd.

-

DuPont

-

Lingrove Inc

-

JELU-WERK J. Ehrler GmbH & Co. KG

-

Teijin Limited

-

Toray Industries, Inc.

-

Solvay Group

-

Hexcel Corporation

-

Mitsubishi Chemical Holdings Corporation

-

SGL Group

Chapter 1. Natural Fiber Prepreg Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Natural Fiber Prepreg Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Natural Fiber Prepreg Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Natural Fiber Prepreg Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Natural Fiber Prepreg Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Natural Fiber Prepreg Market – By Type

6.1 Introduction/Key Findings

6.2 Flax Fiber Prepregs

6.3 Hemp Fiber Prepregs

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Natural Fiber Prepreg Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive Industry

7.3 Sporting Goods

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Natural Fiber Prepreg Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Natural Fiber Prepreg Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bcomp Ltd.

9.2 DuPont

9.3 Lingrove Inc

9.4 JELU-WERK J. Ehrler GmbH & Co. KG

9.5 Teijin Limited

9.6 Toray Industries, Inc.

9.7 Solvay Group

9.8 Hexcel Corporation

9.9 Mitsubishi Chemical Holdings Corporation

9.10 SGL Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Natural Fiber Prepreg Market was valued at USD 12.24 billion in 2023 and will grow at a CAGR of 10.8% from 2024 to 2030. The market is expected to reach USD 25.09 billion by 2030.

Sustainability Push, Technological Advancements, and Government Regulations These are the reasons that are driving the market.

Based on Application it is divided into two segments – Automotive Industry, Sporting Goods.

Europe is the most dominant region for the luxury vehicle Market.

Bcomp Ltd., DuPont, Lingrove Inc, JELU-WERK J. Ehrler GmbH & Co. KG, Teijin Limited.