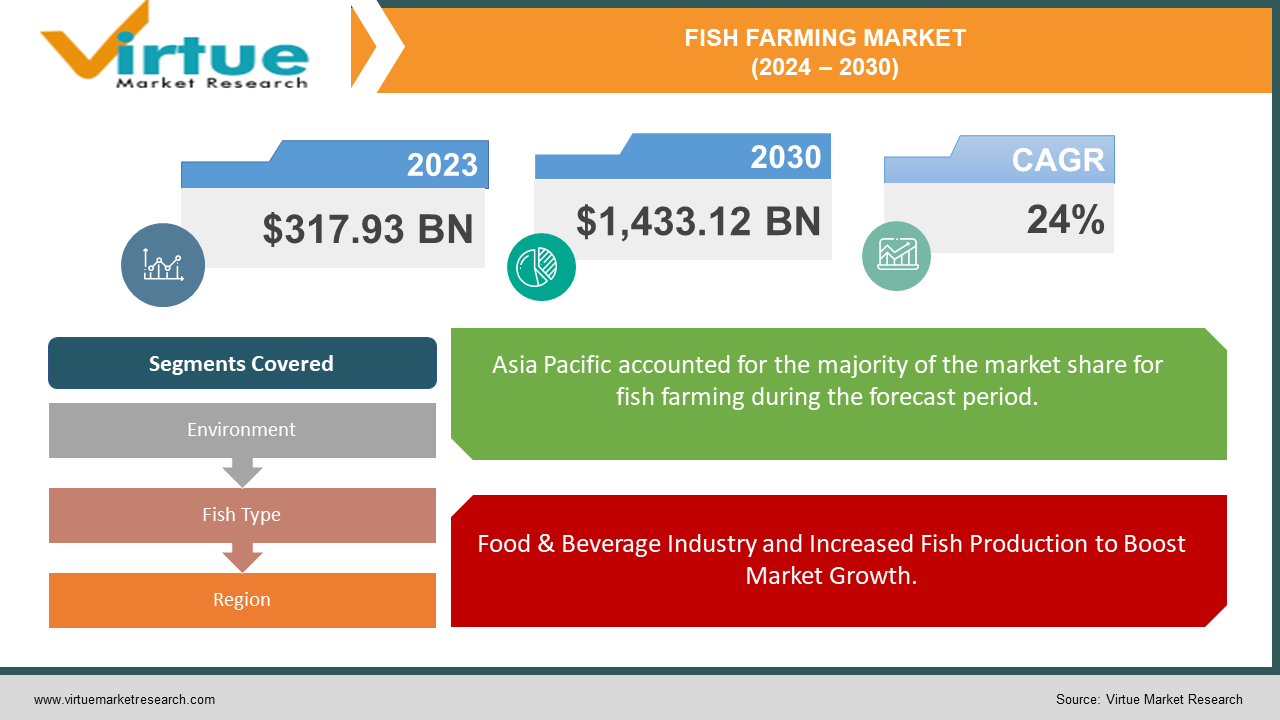

Fish Farming Market Size (2024 – 2030)

The Fish Farming Market was valued at USD 317.93 Billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1,433.12 Billion by 2030, growing at a CAGR of 24%.

Aquaculture, also known as fish farming, refers to the systematic cultivation of fish. This method entails various interventions during the rearing phase to boost yield, including consistent restocking, providing nourishment, and safeguarding against predators.

The global concern over food supply security, driven by population growth and increasing demand for protein, catalyzes the expansion of the fish farming market. Additionally, the utilization of zooplankton, a significant protein source, contributes to the growth of the aquaculture sector. Advancements in technology related to fish farming and seaweed agriculture further fuel the expansion of this industry. External factors, both physical and social, exert influence over the consumption and production of food in Pacific Island nations. Climate change, in particular, poses a significant concern, as it is expected to exacerbate deficiencies in coastal fisheries productivity, thereby driving the need for increased aquaculture production.

Key Market Insights:

Aquaculture encompasses the farming of 580 species globally, showcasing extensive genetic diversity both within and among species. This practice is undertaken by individual farmers in developing nations as well as by multinational corporations that may own the cultivated stock. Consuming fish is deeply embedded in the cultural traditions of many communities and offers significant health benefits due to its excellent nutritional profile. Fish provides a rich source of protein, fatty acids, vitamins, minerals, and essential micronutrients.

Fish Farming Market Drivers:

Food & Beverage Industry and Increased Fish Production to Boost Market Growth.

The global food and beverage industry has experienced significant growth in recent years, driven by innovations in the food system, enhanced logistics, rising affordability, increased international trade, and higher consumer spending. Additionally, the sector has evolved to meet changing consumer demands. The growing preference for ready-to-eat and cost-effective foods has led to a surge in the demand for packaged and convenience foods. Moreover, the recent growth of the food processing industry is expected to boost the demand for fast food, thereby increasing global demand for meat and fish. Collectively, these factors contribute to the expansion of the global market.

With the global population exceeding 7.8 billion, addressing food security is becoming increasingly critical. To tackle this challenge, fish production has been significantly ramped up. The rise in coastal fish farming has contributed to this growth, supported by government initiatives aimed at promoting aquaculture. To ensure the sustainability of the global food supply, effective management systems must be developed to enhance fish production. Certain highly migratory, straddling, and other fishery resources, particularly those fishing in the high seas, are in a more vulnerable state. The United Nations Fish Stocks Agreement, which came into effect in 2001, provides the legal framework for managing high-seas fisheries and supports the expansion of the fish farming market.

Fish Farming Market Restraints and Challenges:

The Temperature Rise and Water Pollution to Hinder Market Growth.

The impacts of climate change, including rising sea levels and temperatures, altered monsoon and rainfall patterns, and extreme weather events, disrupt the natural balance of the world's aquatic ecosystems. Global warming adversely affects aquaculture in temperate regions, as temperatures may exceed the optimal range for farmed species. These environmental changes disrupt the reproductive cycles of various fish species, potentially hindering the growth of the fish farming industry. Additionally, increasing water contamination levels heighten the risk of disease among fish, further constraining the fish farming market.

Fish Farming Market Opportunities:

New technologies, such as recirculating aquaculture systems (RAS) and aquaponics, which involve raising plants and animals together, enhance production and reduce water pollution. These technologies are especially beneficial when powered by renewable energy and designed to prevent water loss through evaporation. Additionally, integrating multi-trophic polyculture technology offers a way to minimize organic waste in water while increasing fish output, presenting a significant opportunity for the aquaculture industry. Although the application of genetic principles to aquatic animal production is less advanced compared to the plant and livestock sectors, only a limited number of aquaculture species have undergone genetic enhancement projects. Nonetheless, biotechnology and genetics hold substantial potential to boost productivity and improve ecological sustainability. Advances in biotechnology in fish farming result in healthy, fast-growing animals that are environmentally friendly.

FISH FARMING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24% |

|

Segments Covered |

By Environment, Fish Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cooke Aquaculture Inc., Cermaq Group AS , Leroy SeaFood Group, Grupo Farallon Aquaculture , P/F Bakkafrost, Marine Harvest ASA , Selonda Aquaculture S.A. , Tassal Group Limited , Stolt Sea Farm, Thai Union Group Public Company Limited. |

Fish Farming Market Segmentation: By Environment

-

Marine Water

-

Fresh Water

-

Brackish Water

The freshwater segment is projected to grow at a compound annual growth rate (CAGR) of 6.3% and is expected to hold the largest market share. Freshwater is naturally present on Earth's surface in various forms, including ice sheets, glaciers, icebergs, bogs, ponds, lakes, rivers, and streams. Additionally, it exists as groundwater in aquifers and underground streams.

Common fish species in freshwater ecosystems include salmon, trout, and tench. China leads in freshwater fish farming in Asia, which accounts for approximately 95% of global freshwater fish farming. The country produces large quantities of tilapia, catfish, and other species, with carp being the most widely cultivated. Fisheries policies regulate fish farms and aquaculture in various regions, including China, Bangladesh, and Thailand.

The marine water segment is expected to hold the second-largest market share. Marine ecosystems constitute a significant portion of the world's aquatic environments and are crucial to the health of both terrestrial and marine habitats. These ecosystems typically have high biodiversity and are thus resistant to invasive species. Common fish species in marine environments include hamlets, sharks, angelfish, eels, lionfish, and rays. The market for marine fish farming is growing due to the ideal conditions for fish raising, resulting from improved methods and technologies in the catchment areas. Factors such as favorable regulations and international trade relations are anticipated to create lucrative opportunities for expanding the fish farming sector.

Fish Farming Market Segmentation: By Fish Type

-

Pompano

-

Snappers

-

Groupers

-

Salmon

-

Milkfish

-

Tuna

-

Tilapia

-

Catfish

-

Sea Bass

-

Others

Tuna and bonito are common species within the mackerel family, which are abundant along coastal regions, making mackerel fishing feasible. The term "sea bream" refers to various fish, including porgies and pomfrets, which inhabit oceans and seas of diverse temperatures. Trout is a general term for freshwater fish in the Salmonidae family, serving as a significant nutritional source for both humans and animals. Within this classification, chub mackerel is a heavily fished and essential species.

The salmon segment is projected to hold the second-largest market share. "Salmon" encompasses several species of ray-finned fish that are highly demanded in the food and nutrition industry, leading to intensive farming across various regions globally. Salmon are unique in their life cycle, being born in freshwater, migrating to the ocean, and returning to freshwater to breed. Atlantic salmon, alongside tilapia and carp, is among the most extensively farmed salmonids worldwide. Highly valued for its flavor and health benefits, salmon is rich in vitamin B, vitamin D, potassium, and lean protein, making it a favored seafood choice. Additionally, as a fatty fish, salmon is a vital source of fish oil for the fish feed and nutritional supplement industries.

Fish Farming Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region will dominate the market, holding the largest share and growing at a compound annual growth rate (CAGR) of 6.4%. This region comprises numerous emerging nations with substantial water resources, facilitating fish farming. Countries such as Vietnam, China, and Indonesia are witnessing a rapid increase in fish farming activities due to rising per capita disposable income and growing interest from aquaculture giants attracted by low labor costs and supportive government initiatives. Additionally, the fish farming market in Australia is expanding quickly due to increased domestic seafood consumption.

The Middle East & Africa is the fastest-growing segment in the market. Technological advancements in countries like Brazil, South Africa, and Argentina are expected to drive the fish farming market share in the Latin America, Middle East, and Africa (LAMEA) region. Moreover, infrastructural and technological advancements in the Middle East are key drivers of growth in the LAMEA market. Bilateral and multilateral trade agreements have played a crucial role in the international trade of aquaculture products. Changes in development processes and macroeconomic policies that foster open competition in the aquaculture industry in Latin American countries are driving the expansion of the sector. Future aquaculture development in LAMEA necessitates strategic planning to ensure the efficient utilization of available resources.

COVID-19 Pandemic: Impact Analysis

The outbreak of the novel coronavirus has significantly impacted the global market's growth. The disruption of supply chains and the reduction in out-of-home food consumption during the COVID-19 pandemic led to a slight decrease in fish product sales. However, the increase in at-home fish consumption has offset this decline, and it is expected to enhance the market's profitability in the coming years.

Latest Trends/ Developments:

In 2022, Cermaq Group AS, in partnership with BioSort, introduced iFarm, a cutting-edge mechanism. This innovative technology harnesses the power of artificial intelligence (AI) and machine learning to optimize fish health and welfare.

Key Players:

These are the top 10 players in the Fish Farming Market: -

-

Cooke Aquaculture Inc.

-

Cermaq Group AS

-

Leroy SeaFood Group

-

Grupo Farallon Aquaculture

-

P/F Bakkafrost

-

Marine Harvest ASA

-

Selonda Aquaculture S.A.

-

Tassal Group Limited

-

Stolt Sea Farm

-

Thai Union Group Public Company Limited.

Chapter 1. Fish Farming Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fish Farming Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fish Farming Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fish Farming Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fish Farming Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fish Farming Market – By Environment

6.1 Introduction/Key Findings

6.2 Marine Water

6.3 Fresh Water

6.4 Brackish Water

6.5 Y-O-Y Growth trend Analysis By Environment

6.6 Absolute $ Opportunity Analysis By Environment, 2024-2030

Chapter 7. Fish Farming Market – By Fish Type

7.1 Introduction/Key Findings

7.2 Pompano

7.3 Snappers

7.4 Groupers

7.5 Salmon

7.6 Milkfish

7.7 Tuna

7.8 Tilapia

7.9 Catfish

7.10 Sea Bass

7.11 Others

7.12 Y-O-Y Growth trend Analysis By Fish Type

7.13 Absolute $ Opportunity Analysis By Fish Type, 2024-2030

Chapter 8. Fish Farming Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Environment

8.1.3 By Fish Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Environment

8.2.3 By Fish Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Environment

8.3.3 By Fish Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Environment

8.4.3 By Fish Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Environment

8.5.3 By Fish Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Fish Farming Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cooke Aquaculture Inc.

9.2 Cermaq Group AS

9.3 Leroy SeaFood Group

9.4 Grupo Farallon Aquaculture

9.5 P/F Bakkafrost

9.6 Marine Harvest ASA

9.7 Selonda Aquaculture S.A.

9.8 Tassal Group Limited

9.9 Stolt Sea Farm

9.10 Thai Union Group Public Company Limited.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global food and beverage industry has experienced significant growth in recent years, driven by innovations in the food system, enhanced logistics, rising affordability, increased international trade, and higher consumer spending.

The top players operating in the Fish Farming Market are - Cooke Aquaculture Inc., Cermaq Group AS, Leroy SeaFood Group, Grupo Farallon Aquaculture, P/F Bakkafrost, Marine Harvest ASA, Selonda Aquaculture S.A., Tassal Group Limited, Stolt Sea Farm, Thai Union Group Public Company Limited.

The outbreak of the novel coronavirus has significantly impacted the global market's growth. The disruption of supply chains and the reduction in out-of-home food consumption during the COVID-19 pandemic led to a slight decrease in fish product sales.

New technologies, such as recirculating aquaculture systems (RAS) and aquaponics, which involve raising plants and animals together, enhance production and reduce water pollution. These technologies are especially beneficial when powered by renewable energy and designed to prevent water loss through evaporation.

The Middle East & Africa is the fastest-growing segment in the market. Technological advancements in countries like Brazil, South Africa, and Argentina are expected to drive the fish farming market share in the Latin America, Middle East, and Africa (LAMEA) region.