Fish Processing Market Size (2024 – 2030)

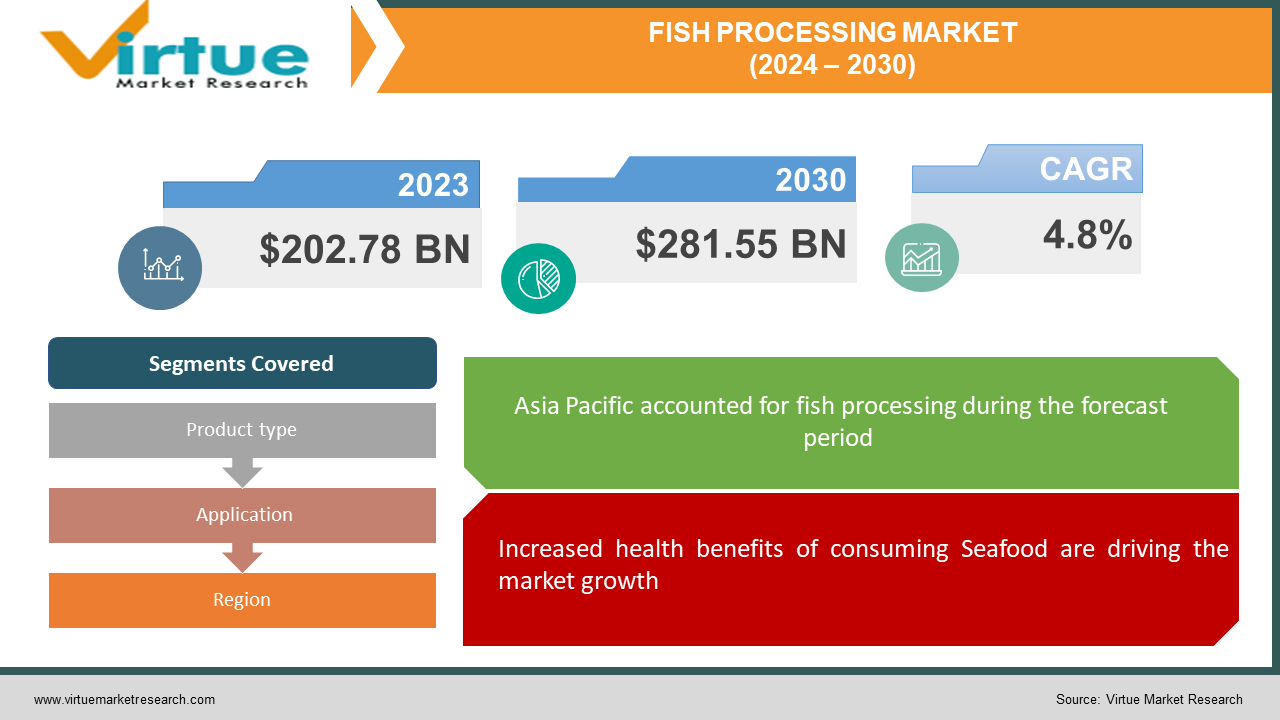

The Global Fish Processing Market was valued at USD 202.78 billion in 2023 and will row at a CAGR of 4.8% from 2024 to 2030. The market is expected to reach USD 281.55 billion by 2030.

Key Market Insights:

The Fish Processing Market is experiencing steady growth, driven by factors like rising consumer health consciousness and increasing demand for protein. Aquaculture's rapid expansion ensures a consistent supply of fish, further fueling market growth. Consumers are drawn to the convenience and variety offered by processed fish products, particularly those boasting added health benefits like omega-3 fatty acids found in fish oil. However, challenges remain, such as ensuring sustainable fishing practices and minimizing waste throughout the processing chain. Despite these hurdles, the market is ripe with opportunities, with growing demand in developing regions and the potential for innovative processing technologies to enhance efficiency and product quality.

Global Fish Processing Market Drivers:

Increased health benefits of consuming Seafood are driving the market growth

Consumers are increasingly turning to seafood due to its well-documented health benefits. Fish is a powerhouse of lean protein, essential for building and maintaining muscle mass. But it's the omega-3 fatty acids that truly set fish apart. These fats have been linked to a reduced risk of heart disease, stroke, and even cognitive decline. Fish is also a natural source of essential vitamins and minerals like vitamin D, selenium, and iodine, all crucial for various bodily functions. As awareness of these advantages spreads, people are actively seeking out ways to incorporate more seafood into their diets. This trend is driving the fish processing market, as consumers look for convenient and consistent ways to reap the health rewards of fish. The process of cleaning, prepping, and storing fresh fish can be a deterrent for some. Processed fish products like frozen fillets, canned options, and ready-to-eat meals offer an accessible and versatile solution, making it easier than ever to enjoy the health benefits of seafood regularly.

Increased Disposable Income is driving the market growth

Economic prosperity in developing nations is fueling a surge in seafood consumption. As disposable incomes rise, consumers have more money to allocate towards discretionary spending, including food. Traditionally, fresh fish has been a delicacy or a special occasion protein source due to its price point. However, with increased buying power, incorporating seafood into regular meals becomes a more realistic option. This shift in consumer behavior presents a significant opportunity for the processed fish market. Processed fish products, like frozen fillets, canned options, and ready-to-eat meals, are generally more affordable than their fresh counterparts. Additionally, these processed options offer convenience, extended shelf life, and consistent quality, making them ideal for busy lifestyles. As a result, rising disposable income in developing countries is acting as a major driver for the growth of the processed fish market.

Rising Demand for Convenience Foods is driving the market growth

The relentless pace of modern life is reshaping our eating habits, with convenience reigning supreme. Busy schedules leave little time for elaborate meal preparation, propelling the demand for quick and easy food options. This is where processed fish products are making a splash. Frozen fish fillets offer a perfect solution - simply pop them in the oven or pan for a nutritious and delicious meal. Canned tuna, a pantry staple for decades, continues to enjoy immense popularity for its versatility and affordability. It can be tossed into salads, turned into sandwiches, or incorporated into countless recipes. But the market doesn't stop there. Ready-to-eat seafood meals are the ultimate time-savers, offering pre-cooked and seasoned fish options that require minimal preparation or heating. This convenience factor is particularly appealing to young professionals, families with limited time, and anyone seeking a healthy and delicious meal without the hassle. As our lives get busier, processed fish products are poised to remain a major player in the convenient and nutritious food category.

Global Fish Processing Market challenges and restraints:

Environmental Concerns and Sustainability is restricting the market growth

The Fish Processing Market faces a triple threat to sustainability. Overfishing depletes fish stocks, jeopardizing the future of the industry and pressuring processors to source responsibly. Polluted waterways contaminate fish, impacting safety and consumer trust. Additionally, processing generates significant waste, including water and discarded byproducts, demanding proper management to minimize environmental harm. These challenges necessitate a focus on sustainable practices to ensure the industry's long-term viability.

Price Fluctuations restricting the market growth

Fish processors walk a tightrope on profit margins. The raw material itself is a variable cost, fluctuating due to seasonality, unpredictable weather impacting catches, and rising fuel prices that affect transportation. This constant price flux makes it difficult for processors to plan and invest in advancements that could improve efficiency or product quality. Adding to the pressure, competition from developing countries with lower production costs creates a race to the bottom, further squeezing profit margins and limiting the resources available for innovation.

Market Opportunities:

The fish processing industry is brimming with exciting market opportunities. The growing health consciousness of consumers presents a prime target audience for innovative processed fish products. Emphasis on convenience can be a key differentiator, with pre-marinated options, single-serve portions, and ready-to-heat meals tailored for busy lifestyles. Sustainability is another key trend, with consumers increasingly seeking responsibly sourced fish. Processors can capitalize on this by using eco-friendly packaging and highlighting ethical sourcing practices. Emerging markets with rising disposable incomes offer vast potential for processed fish products, particularly those catering to affordability and convenience. Technological advancements in processing and preservation can unlock new possibilities for product variety, improved quality, and extended shelf life. By catering to these trends and remaining adaptable, fish processors can ensure they continue to reel in success in a dynamic and ever-evolving market.

FISH PROCESSING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thai Union Group, Mitsubishi Corporation, Nissui, High Liner Foods, Cargill, Carrefour, American Seafoods Group, Hawker Food Products, Marine Harvest ASA, Charoen Pokphand Foods PCL |

Fish Processing Market segmentation - By Product Type

-

Fresh & Frozen Fish

-

Canned Fish

-

Smoked & Dried Fish

-

Value-Added Products

-

Fish Oil & Supplements

While the Fish Processing Market offers a diverse range of products, from fresh and frozen fish to fish oil supplements, the dominant segment currently lies with Frozen Fish. This is driven by factors like convenience, extended shelf life, and affordability. Frozen fish offers consumers year-round access to a variety of species and minimizes waste compared to fresh options. The increasing popularity of ready-to-cook meals further fuels the demand for frozen fish, making it a convenient and versatile protein source for busy consumers.

Fish Processing Market segmentation - By Application

-

Human Consumption

-

Animal Feed

-

Industrial Applications

The clear frontrunner in terms of application within the Fish Processing Market is Human Consumption. This segment encompasses a wide variety of processed fish products enjoyed by consumers globally. Canned fish, frozen fillets, smoked salmon, fish sticks, and even fish oil supplements all fall under this category. The rising health consciousness and increasing demand for protein contribute significantly to the dominance of human consumption. Consumers are drawn to the convenience and variety offered by processed fish, with some products boasting additional health benefits like omega-3 fatty acids. While animal feed and industrial applications utilize a portion of processed fish, the sheer volume and diverse offerings catering directly to human consumption solidify its position as the leading application segment.

Fish Processing Market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region reigns supreme in the Global Fish Processing Market. This dominance is fueled by several factors. Firstly, a large portion of the world's population resides in this region, creating a massive consumer base for processed fish products. Secondly, aquaculture, the farming of fish, is a booming industry in the Asia Pacific, ensuring a consistent and readily available supply of raw materials. Furthermore, a strong cultural affinity for seafood in many Asian countries translates to high per capita consumption of processed fish. Finally, the presence of major processing hubs and a growing middle class with rising disposable income further contribute to the dominance of the Asia Pacific region in the Global Fish Processing Market.

COVID-19 Impact Analysis on the Global Fish Processing Market

The COVID-19 pandemic delivered a significant blow to the global fish processing market. Disruptions began at the very start of the crisis. Lockdowns and travel restrictions hampered the movement of fish catches, stalling supply chains and causing gluts in certain regions. The closure of restaurants, a major consumer of fresh fish, led to a sharp decline in demand, particularly for high-value species. Processors faced challenges in maintaining social distancing protocols within facilities, impacting efficiency and productivity. Additionally, consumer behavior shifted towards shelf-stable options like canned fish and frozen fillets at the expense of fresh varieties. This created a temporary imbalance in processing needs. However, the market showed signs of resilience. The surge in home cooking spurred demand for convenient processed fish products. E-commerce platforms emerged as a vital sales channel, enabling processors to reach consumers directly. As restaurants reopened with adapted dining models, demand for processed fish gradually recovered. The crisis also highlighted the importance of robust supply chains and flexible processing techniques. Looking ahead, the long-term impact of COVID-19 on the fish processing market remains to be seen. While some challenges persist, the industry has demonstrated its ability to adapt. A focus on innovation, diversification, and catering to evolving consumer preferences will be crucial for navigating the post-pandemic landscape.

Latest trends/Developments

The fish processing industry is experiencing a wave of innovation driven by consumer preferences and technological advancements. Sustainability remains a top priority, with processors implementing eco-friendly practices like using biodegradable packaging and highlighting ethical sourcing methods. Minimally processed, ready-to-cook options are gaining traction as consumers seek healthy convenience. Pre-marinated fish fillets, single-serve portions, and seasoned varieties cater to busy lifestyles and reduce prep time. Technology is playing a pivotal role in this evolution. High-pressure processing (HPP) extends shelf life and preserves nutrients, while innovations like cold plasma technology enhance food safety. There's also a growing interest in utilizing byproducts from fish processing. Upcycling these remnants into valuable products like fishmeal for animal feed or collagen supplements for human consumption promotes resource efficiency and reduces waste. Plant-based seafood alternatives are emerging as a new frontier, with some processors exploring plant-based options that mimic the taste and texture of fish. This caters to the growing flexitarian and vegetarian demographic while offering a sustainable alternative. Overall, the fish processing market is transforming sustainability, convenience, and innovation. Processors who embrace these trends and adapt to evolving consumer preferences are well-positioned to thrive in the years to come

Key Players:

-

Thai Union Group

-

Mitsubishi Corporation

-

Nissui

-

High Liner Foods

-

Cargill

-

Carrefour

-

American Seafoods Group

-

Hawker Food Products

-

Marine Harvest ASA

-

Charoen Pokphand Foods PCL

Chapter 1. FISH PROCESSING MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. FISH PROCESSING MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. FISH PROCESSING MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. FISH PROCESSING MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. FISH PROCESSING MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. FISH PROCESSING MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Fresh & Frozen Fish

6.3 Canned Fish

6.4 Smoked & Dried Fish

6.5 Value-Added Products

6.6 Fish Oil & Supplements

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. FISH PROCESSING MARKET – By Application

7.1 Introduction/Key Findings

7.2 Human Consumption

7.3 Animal Feed

7.4 Industrial Applications

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. FISH PROCESSING MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. FISH PROCESSING MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Thai Union Group

9.2 Mitsubishi Corporation

9.3 Nissui

9.4 High Liner Foods

9.5 Cargill

9.6 Carrefour

9.7 American Seafoods Group

9.8 Hawker Food Products

9.9 Marine Harvest ASA

9.10 Charoen Pokphand Foods PCL

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Fish Processing Market was valued at USD 202.78 billion in 2023 and will row at a CAGR of 4.8% from 2024 to 2030. The market is expected to reach USD 281.55 billion by 2030.

Increased health benefits of consuming Seafood and rising Demand for Convenience Foods are the reasons that are driving the market.

Based on application it is divided into four segments – Fresh & Frozen Fish, Canned Fish, Smoked & Dried Fish, Value-Added Products, Fish Oil & Supplement

Asia-Pacific is the most dominant region for the Fish Processing Market.

Thai Union Group, Mitsubishi Corporation, Nissui, High Liner Foods, Cargill