Filling Machines Market Size (2024 – 2030)

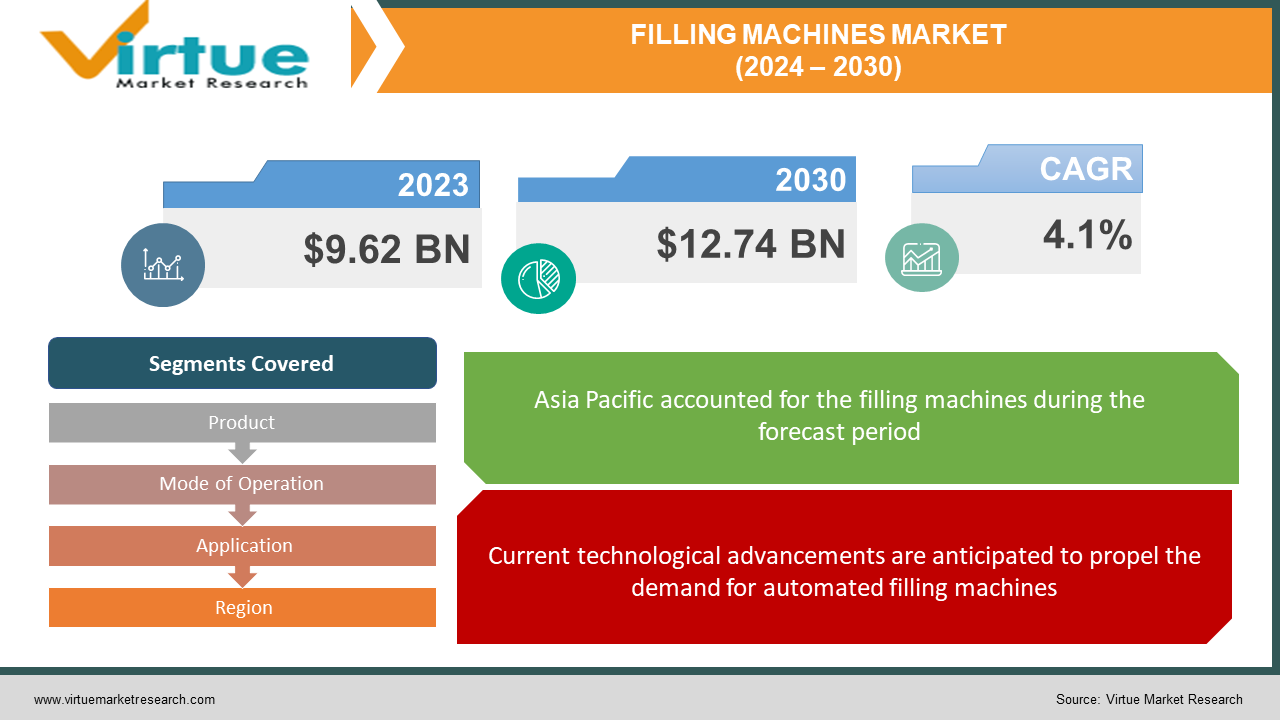

The Global Filling Machines Market size was exhibited at USD 9.62 billion in 2023 and is projected to hit around USD 12.74 billion by 2030, growing at a CAGR of 4.1% during the forecast period from 2024 to 2030.

A filling machine, classified as a packing apparatus, quantifies a product from a bulk source based on pre-established criteria such as container level, mass, or volume. After the measurement, the machine proceeds to load the merchandise into a designated receptacle, such as a box, bag, or other packaging container. Filling machines are employed for the meticulous packaging of liquids and powders, adhering to stringent hygienic standards. Their predominant applications span the food and beverage, pharmaceutical, cosmetic, and packaging industries.

Within the food and beverage sector, filling machines play a crucial role in dispensing food substances into various containers such as packets, bags, bottles, cans, and similar storage vessels. The pharmaceutical industry utilizes filling machines for filling liquid medicine bottles, vials, ampoules, and capsules. Beyond these, industries involved in personal care, tobacco, chemicals, and other consumable products also necessitate the deployment of filling machines. The distinct types include liquid filling, powder filling, and solid filling machines. Commonly used variants encompass rotary fillers, volumetric fillers, aseptic fillers, net weight fillers, and other specialized equipment.

Key Market Insights:

The escalating demand for packaged and processed food is propelling the growth of the Filling Machines Market. This surge is attributed to lifestyle changes, particularly in response to sedentary and stressful work patterns, alongside an increase in income. Evolving consumer preferences towards processed and packaged foods, coupled with a burgeoning global population and various socio-political and economic factors, are reshaping the landscape of the processed and packaged food industry.

Anticipated growth in the demand for food and beverage products in the Asia Pacific region, driven by its rapidly expanding population, is poised to augment the Filling Machines Market in the area. Moreover, temperature-sensitive pharmaceutical products, such as medicated liquids, vaccines, and drugs, are contributing significantly to the growth of the Filling Machines Market. Factors like the rapid expansion of diverse industries, elevated adoption of automatic and advanced machinery, a heightened need for product standardization, and consumer preferences for packaged products are also expected to fuel market growth.

However, the substantial capital investment and relatively high maintenance costs pose challenges to the expansion of the Filling Machines Market. Many industries are transitioning to automatic and advanced filling machines to reduce manpower and enhance efficiency, but the associated installation and maintenance expenses may act as deterrents. Despite these challenges, government emphasis on the development of small and medium enterprises presents an opportunity for the Filling Machines Market to thrive in the future. Additionally, manufacturers focusing on technological advancements in filling machinery represent lucrative growth prospects for the market.

Global Filling Machines Market Drivers:

Current technological advancements are anticipated to propel the demand for automated filling machines.

The utilization of automated filling machines streamlines assembly line processes, enhancing the overall efficiency of the packaging procedures. The packaging industry has undergone significant expansion in recent years, leading to the introduction of versatile packaging solutions, including automatic filling machines. This development has attracted the attention of consumers seeking cutting-edge equipment. Consequently, there is a global increase in the demand for automated filling machines, which is projected to stimulate the growth of the worldwide filling machines market in the forecast period.

Growing demand from the food and beverage sector is poised to contribute to market expansion.

Over the past few years, the food and beverage industry has exhibited robust growth, transitioning from imitation to innovative practices. The global demand for packaged food and beverages is on the rise, prompting the integration of novel technologies in the packaging sector. As the food service industry experiences continual growth across various regions, the market is witnessing an increased demand for filling machines. This trend is expected to be a driving force behind the growth of the global filling machines market throughout the forecast period.

Global Filling Machines Market Restraints and Challenges:

The lack of standardization in machines, attributed to evolving regulations, is poised to impede the market's progress.

Equipment standardization in packaging involves specifying safety requirements for a machine or a category of machines. These standards encompass potential hazards, risks, and dangerous occurrences, applying to the design, construction, and usage guidelines for packaging equipment. However, the variations in standards and regulations across different regions pose challenges for manufacturers in tailoring machines to comply with specific regional regulations. This is anticipated to hinder the growth of the global filling machines market in the forecast period.

The substantial costs associated with initial procurement and maintenance are anticipated to pose challenges to the market.

Establishing a packaging industry requires a significant capital investment due to the high costs associated with machinery. While many packaging businesses opt for modular filling equipment that integrates labeling and sealing functions, the overall maintenance costs rise substantially, directly impacting the adoption of such machinery. The initial purchase cost of a filling machine is influenced by its size and the range of operations it offers, which can be considerable in certain regions. These factors are thus expected to act as deterrents to the growth of the global filling machines market throughout the forecast period.

Global Filling Machines Market Opportunities:

The forecast period is expected to bring about growth opportunities in the global filling machines market, driven by the rising trend of urbanization and heightened consumer health consciousness. Filling machines, renowned for their ease of use, low maintenance requirements, and excellent performance, find widespread application in packaging various industrial and food products. The escalating demand for healthy food products, in tandem with increasing urbanization, is anticipated to fuel the demand for filling machines. Consequently, the market is poised to encounter favorable business prospects in the foreseeable future.

The global filling machine market is set to benefit from lucrative opportunities arising from the growing applications of automated filling machines. As automation continues to advance, the scope of applications for filling machines expands. Automated machines efficiently handle repetitive tasks such as placing and tightening caps on bottles. Various industries, including pharmaceuticals, e-liquids, and food and beverages, utilize automatic filling tools. The ongoing growth in these industries is expected to contribute to the global filling machine market's positive trajectory.

FILLING MACHINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By Product, Mode of Operation, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Barry- Wehmiller Companies, Inc., Ronchi Mario S.P.A., KHS Group, Accutek Packaging Equipment Companies, Inc, Gea Group Ag, Tetra Laval International S.A., Krones Ag, JBT Corporation, Coesia S.P.A., Robert Bosch GmbH |

Global Filling Machines Market Segmentation: By Product

-

Aseptic

-

Rotary

-

Net Weight

-

Volumetric

-

Others

The market is categorized based on equipment type into Aseptic, Rotary, Volumetric, Net Weight, and Other Equipment Types. Aseptic is poised to lead the global market during the forecast period. This dominance is attributed to the escalating demand for aseptic filling machines, driven by their advantages, including flexibility compared to manual processes and the minimization of product and waste loss. The expanding packaging industry is also a significant factor propelling the growth of this segment, given its potential to meet product requirements and ensure uniform quality.

The Rotary segment is anticipated to experience substantial growth in the foreseeable future. This growth is fueled by the increasing adoption of rotary filling machines in the packaging industry. These machines are instrumental in filling various containers with liquid, granular, and powder products. For instance, Shemesh Automation, a prominent provider of high-end packaging machines, introduced Asterra in June 2022, a robust Industry 4.0-ready rotary piston filling machine. Initiatives embracing rotary filling machines are expected to contribute significantly to the growth of this segment.

Global Filling Machines Market Segmentation: By Mode of Operation

-

Automatic

-

Semi-automatic

The automatic filling machines segment has asserted its dominance in the global market. The heightened demand for automatic filling machines is driven by the increasing emphasis on efficiency and accuracy in the filling process. Automatic filling machines offer advantages such as higher production capacity, reduced labor costs, and enhanced product quality. Moreover, the rising adoption of automation in the manufacturing sector is anticipated to further amplify the demand for automatic filling machines.

The semi-automatic filling machines segment emerges as the fastest-growing segment. While automatic filling machines gain popularity, many small and medium-sized enterprises (SMEs) still prefer semi-automatic options due to their cost-effectiveness and flexibility. Semi-automatic filling machines strike a balance between manual and automatic counterparts, easily adapting to different products and containers. This adaptability makes semi-automatic filling machines an appealing choice for SMEs needing to fill diverse products in various container sizes.

Global Filling Machines Market Segmentation: By Application

-

Beverages

-

Food

-

Chemicals

-

Personal Care

-

Pharmaceuticals

-

Others

The global market is segmented based on application into Beverages, Food, Chemicals, Personal Care, Pharmaceuticals, and Others. The beverage segment, encompassing carbonated drinks, fruit juices, and alcoholic beverages, established dominance in the global market. The surge in worldwide consumption of these products propels the demand for filling machines in the beverage industry. Additionally, the increasing adoption of lightweight and eco-friendly packaging materials is anticipated to further drive the demand for filling machines.

The pharmaceuticals segment emerges as the fastest-growing category. The heightened demand for medicines and healthcare products propels the segment's growth. The pharmaceutical industry necessitates filling machines capable of handling small and precise doses, leading many companies to invest in advanced technologies to meet these requirements. The growing demand for personalized medicines and the rising adoption of biopharmaceuticals are expected to further propel the growth of this segment.

Global Filling Machines Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The market is segmented geographically into North America, Asia-Pacific, Europe, South America, and the Middle East and Africa. Asia-Pacific dominates the global filling machines market. The rapid expansion of the food and beverage industry in countries such as China, India, and Japan fuels the demand for filling machines in the region. Additionally, the increased consumption of packaged food and beverages, particularly in developing countries, significantly contributes to market growth. According to a report by the Asian Development Bank, the food and beverage sector in the Asia-Pacific region is projected to grow by 7% annually, generating substantial demand for filling machines.

Conversely, the Middle East and Africa (MEA) are anticipated to be the fastest-growing region in the global filling machines market during the forecast period. The escalating demand for food and beverages, especially in countries like Saudi Arabia and the United Arab Emirates, propels market growth in the region. Furthermore, the rising popularity of packaged foods and increased investments by international players in the food and beverage sector further fuel the market's expansion.

COVID-19 Impact on the Global Filling Machines Market:

The global filling machines market experienced the repercussions of the COVID-19 pandemic, marked by the enforcement of stringent lockdown measures to mitigate the disease's spread. Numerous end-use industries faced closures during the pandemic peak due to factors such as trade barriers, governmental regulations, shortages of raw materials and labor, supply-demand imbalances, and disruptions in logistics and the supply chain. Nevertheless, industries dealing in essential commodities, notably the food and beverage and pharmaceutical sectors, continued operations amid the lockdowns, positively influencing the global filling machines market. The demand for bottles and other rigid containers surged during the pandemic, driven by their use in filling newly developed drugs and medications. Overall, the evaluation of the filling machines market indicated a moderate impact during the peak of the COVID-19 pandemic.

As the situation gradually reverted to pre-COVID levels, end-use industries resumed operations at full capacity, with manufacturers undertaking expansion efforts to recover losses incurred. This shift created growth prospects for the global filling machines market, and the growth forecast for the market appears positive during the forecast period.

Recent Trends and Innovations in the Global Filling Machines Market:

In December 2022, Sovda unveiled its Precision Fill Mini Coffee Bagging Machine, allowing users to fill four to ten bags per minute based on their preferences. Equipped with a foot pedal and a touchscreen control panel, the machine enables the semi-automatic filling of multiple bags, demonstrating Sovda's commitment to innovative solutions.

In November 2022, Krones, a leading provider of packaging and filling solutions, acquired an 80.5% majority stake in R+D Custom Automation LLC. R+D, a Wisconsin-based company with over 40 years of experience, specializes in producing tools and equipment for container creation and filling in the pharmaceutical industry. This strategic acquisition reflects Krones' focus on expanding its capabilities in the life science sector.

October 2022, witnessed Liquibox's introduction of its latest Bag-In-Box filling equipment, integrating advanced filling machinery with the company's extensive expertise in flexible packaging. The A-Series and S-Series, comprising automatic and semi-automatic options, respectively, showcase Liquibox's commitment to providing cutting-edge solutions in the filling machines market.

Key Players:

-

Barry- Wehmiller Companies, Inc.

-

Ronchi Mario S.P.A.

-

KHS Group

-

Accutek Packaging Equipment Companies, Inc.

-

Gea Group Ag

-

Tetra Laval International S.A.

-

Krones Ag

-

JBT Corporation

-

Coesia S.P.A.

-

Robert Bosch GmbH

Chapter 1. Filling Machines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Filling Machines Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Filling Machines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Filling Machines Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Filling Machines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Filling Machines Market – By Product

6.1 Introduction/Key Findings

6.2 Aseptic

6.3 Rotary

6.4 Net Weight

6.5 Volumetric

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Filling Machines Market – By Mode of Operation

7.1 Introduction/Key Findings

7.2 Automatic

7.3 Semi-automatic

7.4 Y-O-Y Growth trend Analysis By Mode of Operation

7.5 Absolute $ Opportunity Analysis By Mode of Operation, 2024-2030

Chapter 8. Filling Machines Market – By Application

8.1 Introduction/Key Findings

8.2 Beverages

8.3 Food

8.4 Chemicals

8.5 Personal Care

8.6 Pharmaceuticals

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Filling Machines Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Mode of Operation

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Mode of Operation

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Mode of Operation

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Mode of Operation

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Mode of Operation

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Filling Machines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Barry- Wehmiller Companies, Inc.

10.2 Ronchi Mario S.P.A.

10.3 KHS Group

10.4 Accutek Packaging Equipment Companies, Inc.

10.5 Gea Group Ag

10.6 Tetra Laval International S.A.

10.7 Krones Ag

10.8 JBT Corporation

10.9 Coesia S.P.A.

10.10 Robert Bosch GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Filling Machines Market size is valued at USD 9.62 billion in 2023.

The worldwide Global Filling Machines Market growth is estimated to be 4.1% from 2024 to 2030.

The Global Filling Machines Market is segmented By Product (Aseptic, Rotary, Net Weight, Volumetric, Others), By Mode of Operation (Automatic, Semi-automatic), and By Application (Beverages, Food, Chemicals, Personal Care, Pharmaceuticals, Others).

Anticipated future trends and opportunities for the Global Filling Machines Market include continued advancements in automation technology, heightened focus on sustainable and eco-friendly packaging solutions, increased demand in emerging economies, and innovative adaptations to cater to evolving requirements in pharmaceuticals, food and beverage, and other key industries.

The COVID-19 pandemic significantly impacted the Global Filling Machines Market, leading to temporary closures and disruptions in the supply chain. Essential sectors like pharmaceuticals and food & beverage remained operational, but overall, the market experienced moderate effects. Recovery ensued as industries adapted, with growth opportunities emerging in response to evolving market dynamics.