Process Automation Market Size (2024 – 2030)

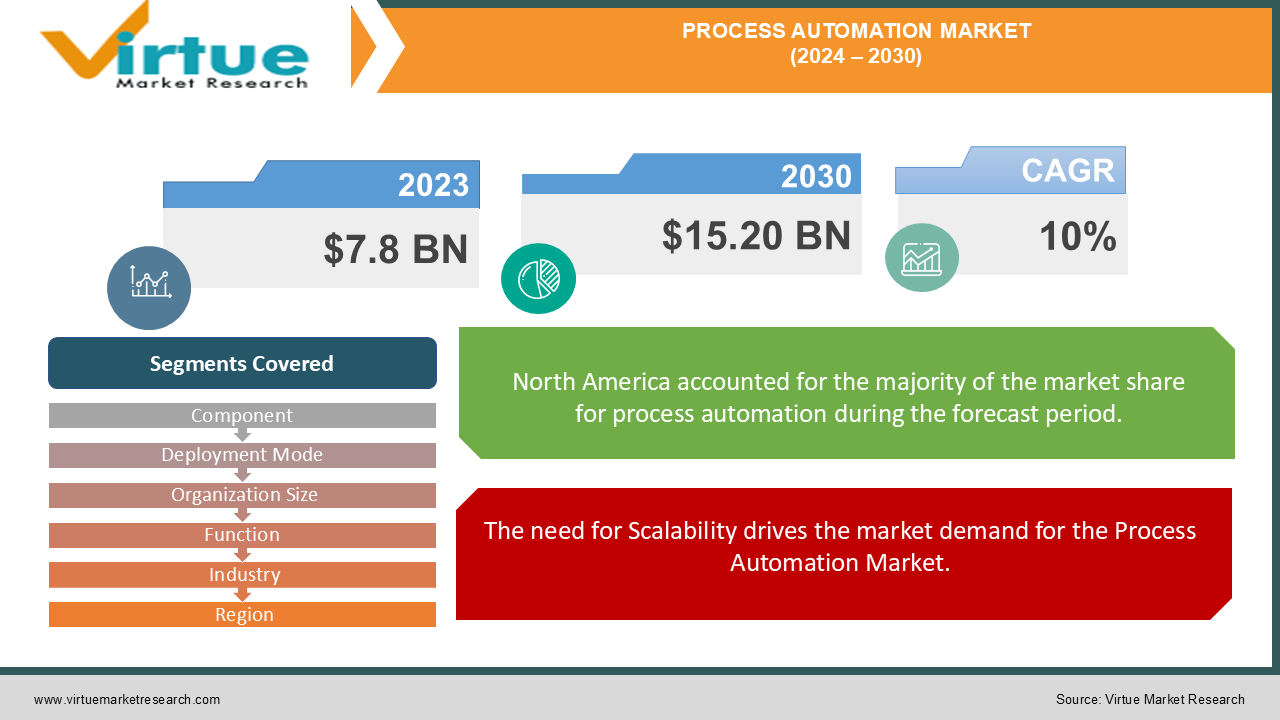

The Process Automation Market is valued at USD 7.8 Billion and is projected to reach a market size of USD 15.20 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10%.

The increasing demand for efficiency in business operations is driving the growth of the process automation market. Companies are looking for ways to cut down on manual work and improve overall productivity. Automation tools help businesses achieve these goals by automating repetitive tasks, reducing errors, and speeding up processes. This immediate need for operational efficiency is pushing companies to invest in automation technologies to stay competitive and meet growing customer expectations.

An opportunity in the process automation market is the integration of automation with other emerging technologies like the Internet of Things (IoT). By combining automation with IoT, businesses can create smarter systems that communicate and make decisions based on real-time data.

A notable trend observed in the industry is the rise of low-code and no-code automation platforms. These platforms allow users to design and implement automation workflows without needing extensive programming knowledge.

Key Market Insights:

The Process Automation Market is projected to expand at a compound annual growth rate of over 10% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

UiPath (USA), Automation Anywhere (USA), and Blue Prism (UK) are some examples of the Process Automation Market.

North America & Asia Pacific account for approximately 65-70 % of the Process Automation Market, driven by the Pursuit of Operational Efficiency, Technological Advancements, the Need for Scalability & Enhancement of Customer Experience.

Process Automation Market Drivers:

The pursuit of Operational Efficiency drives the market demand for Process Automation Market.

One of the primary drivers of the Process Automation Market is the relentless pursuit of operational efficiency. Businesses are always looking for ways to streamline their processes, reduce unnecessary manual work, and cut costs. Automation plays a crucial role in handling repetitive and routine tasks, which reduces the likelihood of human errors and speeds up operations. This allows companies to operate more smoothly and effectively, freeing up human resources to focus on more strategic and creative tasks. By implementing automation, companies can achieve significant gains in productivity and efficiency, making it a key driver in the market.

Technological Advancements drive the market demand for the Process Automation Market.

Technological advancements are another major driver of the Process Automation Market. Innovations in artificial intelligence (AI), machine learning, and robotics have greatly enhanced the capabilities of automation systems. AI-powered tools, for example, can analyze large amounts of data, recognize patterns, and make informed decisions in real-time. These advancements make automation solutions more powerful and versatile, enabling them to handle more complex tasks and adapt to changing needs. As technology continues to evolve, automation becomes more sophisticated, driving greater adoption and integration across various industries.

The need for Scalability drives the market demand for the Process Automation Market.

The need for scalability is a significant driver for process automation. As organizations grow and expand, their operational processes become increasingly complex. Managing these processes manually can become cumbersome and inefficient. Automation offers a scalable solution by allowing businesses to handle larger volumes of tasks without needing a proportional increase in staff. This means that companies can maintain high levels of efficiency and consistency as they grow, managing larger and more complex operations effectively. Scalability through automation helps businesses adapt to increased demand and expansion while keeping operational costs in check.

Enhancement of Customer Experience drives the market demand for the Process Automation Market.

Improving customer experience is a crucial driver for adopting process automation. In a competitive market, delivering fast, reliable, and consistent service is essential for maintaining customer satisfaction and loyalty. Automation helps businesses achieve this by managing customer interactions efficiently, handling inquiries, processing orders, and providing support around the clock. Automated systems can operate 24/7, ensuring that customers receive timely and accurate responses. By enhancing the quality and speed of service, automation helps businesses build stronger relationships with their customers and stay ahead of competitors, making it a key driver in the market.

Process Automation Market Restraints and Challenges:

One of the significant restraints in the Process Automation Market is the high cost of implementation. Setting up automation systems often requires substantial investment in technology, software, and infrastructure. Small to medium-sized enterprises (SMEs) may find these costs prohibitive, limiting their ability to adopt automation solutions. Additionally, there can be ongoing expenses related to maintenance, upgrades, and training, which can further strain budgets. These high initial and recurring costs can be a barrier for many organizations considering automation, impacting the overall growth of the market.

Another challenge is the complexity involved in integrating automation systems with existing processes and technologies. Businesses often have legacy systems that were not designed with automation in mind, making integration difficult and time-consuming. Ensuring that new automation tools work seamlessly with old systems requires careful planning, customization, and sometimes significant modifications to existing workflows. This complexity can lead to disruptions during the transition period and may require specialized skills and expertise, adding to the challenge of adopting automation solutions.

Process Automation Market Opportunities:

One significant opportunity in the Process Automation Market is the expansion into emerging markets. As economies in regions like Asia Pacific, Latin America, and parts of Africa continue to grow, there is a rising demand for modern technologies to improve efficiency and productivity. Businesses in these emerging markets are increasingly recognizing the benefits of process automation, such as cost savings, improved accuracy, and streamlined operations. By offering automation solutions tailored to the specific needs and challenges of these regions, companies can tap into new customer bases and drive growth. The expansion into emerging markets represents a major opportunity for automation providers to capture a share of a rapidly developing market and contribute to the modernization of businesses worldwide.

PROCESS AUTOMATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Component, Deployment Mode, Organization Size, Function, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

UiPath (USA), Automation Anywhere (USA), Blue Prism (UK), Pega Systems (USA), NICE Systems (Israel), IBM (USA), Kofax (USA), WorkFusion (USA), AntWorks (Singapore), HelpSystems (USA) |

Process Automation Market Segmentation: By Component

-

Software

-

Services

In the Process Automation Market, the largest segment by component is software. This is because automation software is essential for implementing and managing automated processes across various business functions. The software provides the tools and platforms needed to design, execute, and monitor automation workflows. It includes a wide range of applications such as robotic process automation (RPA) tools, business process management (BPM) systems, and artificial intelligence (AI) solutions. These software solutions are crucial for automating repetitive tasks, integrating different systems, and enhancing operational efficiency. As businesses increasingly seek to streamline operations and reduce manual work, the demand for automation software continues to grow, making it the largest segment in the market.

The fastest-growing component in the Process Automation Market is services. This includes consulting, implementation, and support services related to automation technologies. As more companies adopt automation solutions, there is a growing need for expert guidance and support to ensure successful deployment and integration. Service providers offer critical assistance in customizing automation solutions, training staff, and maintaining systems to maximize their effectiveness. The rise in demand for these services is driven by the increasing complexity of automation projects and the need for ongoing support to adapt to evolving business needs and technologies. This trend highlights the growing importance of specialized services in complementing automation software and enhancing overall market growth.

Process Automation Market Segmentation: By Deployment Mode

-

On-Premises

-

Cloud-Based

In the Process Automation Market, the largest deployment mode is on-premises solutions. On-premises deployment refers to installing and running automation software within a company's own IT infrastructure. This approach remains popular among large enterprises and organizations with strict data security and compliance requirements. On-premises solutions offer greater control over data and systems, allowing businesses to tailor their automation tools to specific needs and integrate them deeply with existing processes. Despite the increasing popularity of cloud-based solutions, the need for robust security and customization keeps on-premises deployment as the largest segment in the market.

The fastest-growing deployment mode in the Process Automation Market is cloud-based solutions. Cloud-based deployment involves hosting automation software on remote servers accessed via the Internet. This model is rapidly gaining traction due to its flexibility, scalability, and cost-effectiveness. Cloud-based solutions eliminate the need for extensive on-site infrastructure, allowing businesses to quickly scale their automation efforts based on demand. They also offer ease of access from any location, which supports remote and distributed work environments. The growing adoption of cloud technology and the increasing need for agile, scalable automation solutions contribute to the rapid growth of this segment in the market.

Process Automation Market Segmentation: By Organization Size

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

In the Process Automation Market, large enterprises are the largest segment by organization size. These organizations often have complex and extensive operations that benefit significantly from automation. With substantial resources and a need for streamlined processes, large enterprises are well-positioned to invest in advanced automation technologies. They deploy automation across various functions, including finance, human resources, and supply chain management, to enhance efficiency and reduce operational costs. The scale and complexity of their operations require robust and customizable automation solutions, making large enterprises the dominant segment in the market.

The fastest-growing segment by organization size in the Process Automation Market is Small and Medium Enterprises (SMEs). Traditionally, SMEs have been slower to adopt automation due to budget constraints and limited resources. However, the increasing availability of affordable and scalable automation solutions is changing this trend. Cloud-based automation platforms and low-code/no-code tools have made it easier for SMEs to implement and benefit from automation without requiring significant upfront investment or extensive technical expertise. As SMEs recognize the value of automation in improving operational efficiency and competitiveness, their adoption rates are rising rapidly, driving significant growth in this segment.

Process Automation Market Segmentation: By Function

-

-

IT Operations

-

Human Resources

-

Sales and Marketing

-

Finance and Accounting

-

Supply Chain Management

-

Customer Service

-

In the Process Automation Market, finance and accounting functions are the largest segment. This is because financial operations are highly repetitive and data-intensive, making them ideal candidates for automation. Automation tools in this area help with tasks such as invoicing, expense management, payroll processing, and financial reporting. By automating these processes, companies can reduce errors, speed up transactions, and ensure compliance with regulatory standards. The large volume of routine financial tasks and the critical need for accuracy and efficiency make finance and accounting the most prominent functions for process automation adoption.

The fastest-growing function in the Process Automation Market is customer service. Automation in customer service includes tools like chatbots, automated response systems, and intelligent customer support platforms. These solutions help businesses manage customer inquiries, provide support, and handle service requests more efficiently. The growth in this area is driven by the increasing demand for 24/7 support and the need for personalized, rapid responses to customer issues. As companies strive to enhance customer satisfaction and streamline service operations, the adoption of automation technologies in customer service is expanding rapidly, reflecting the sector’s dynamic growth.

Process Automation Market Segmentation: By Industry

-

-

Banking, Financial Services, and Insurance (BFSI)

-

Manufacturing

-

Healthcare

-

Retail

-

Telecommunications

-

Government

-

Energy and Utilities

-

Others (e.g., Education, Transportation)

-

In the Process Automation Market, the Banking, Financial Services, and Insurance (BFSI) industry is the largest segment. This sector relies heavily on automation due to its complex and data-rich operations. Financial institutions need to manage large volumes of transactions, comply with strict regulatory requirements, and ensure high levels of accuracy and security. Automation helps by streamlining processes such as transaction processing, fraud detection, compliance reporting, and customer account management. The critical nature of these functions and the need for efficiency and accuracy drive the extensive use of automation solutions in the BFSI sector, making it the largest industry in this market segment.

The fastest-growing industry in the Process Automation Market is healthcare. This growth is fueled by the increasing adoption of automation to improve patient care, streamline administrative processes, and enhance operational efficiency. Automation in healthcare includes solutions for managing patient records, scheduling appointments, processing claims, and supporting telemedicine. The need to handle vast amounts of patient data, coupled with a focus on reducing administrative burdens and improving care quality, is driving rapid growth in this sector. As healthcare organizations seek to modernize and optimize their operations, the demand for process automation solutions in healthcare is expanding swiftly.

Process Automation Market Segmentation: By Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

In the Process Automation Market, North America is the largest region. The dominance of North America in this segment can be attributed to its advanced technological infrastructure and early adoption of automation technologies. The United States and Canada have been at the forefront of integrating process automation across various industries, including finance, manufacturing, and healthcare. Large enterprises in North America are investing heavily in automation to enhance operational efficiency, reduce costs, and maintain a competitive edge. Additionally, the presence of numerous technology providers and a strong focus on innovation further bolster North America's leading position in the process automation market.

The fastest-growing region in the Process Automation Market is Asia Pacific. This rapid growth is driven by the region's expanding economies, increasing industrialization, and rising adoption of automation technologies across various sectors. Countries such as China, India, and Japan are investing significantly in automation to improve manufacturing processes, enhance business operations, and support digital transformation initiatives. The increasing need for operational efficiency and productivity, combined with the availability of affordable automation solutions, is accelerating market expansion in Asia Pacific. As businesses in this region continue to modernize and seek competitive advantages, the demand for process automation solutions is growing rapidly, making Asia Pacific the fastest-growing region in the market.

COVID-19 Impact Analysis on Process Automation Market:

The COVID-19 pandemic significantly accelerated the adoption of process automation across various industries. With the sudden shift to remote work and the need to maintain business continuity amidst lockdowns and social distancing measures, companies turned to automation to manage their operations more effectively. Automation tools became essential for handling increased workloads, maintaining efficiency, and ensuring that business processes could continue uninterrupted despite the physical constraints. The pandemic highlighted the benefits of automation, such as improved operational resilience, reduced reliance on human intervention, and the ability to adapt quickly to changing circumstances, leading to a surge in demand for automation solutions.

Latest Trends/ Developments:

One of the latest trends in the automation market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advancements are transforming how automation systems operate by enabling more intelligent and adaptive solutions. AI and ML allow automation tools to analyze vast amounts of data, recognize patterns, and make data-driven decisions in real-time. This capability enhances the effectiveness of automation by enabling systems to handle complex tasks, predict outcomes, and continuously improve their performance based on new information. As a result, businesses are increasingly adopting AI and ML to drive more sophisticated automation solutions, streamline operations, and gain competitive advantages.

Key Players:

-

UiPath (USA)

-

Automation Anywhere (USA)

-

Blue Prism (UK)

-

Pega Systems (USA)

-

NICE Systems (Israel)

-

IBM (USA)

-

Kofax (USA)

-

WorkFusion (USA)

-

AntWorks (Singapore)

-

HelpSystems (USA)

Chapter 1. Process Automation Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Process Automation Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Process Automation Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Process Automation Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Process Automation Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Process Automation Market – By Component

6.1 Introduction/Key Findings

6.2 Software

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Process Automation Market – By Deployment Mode

7.1 Introduction/Key Findings

7.2 On-Premises

7.3 Cloud-Based

7.4 Y-O-Y Growth trend Analysis By Deployment Mode

7.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 8. Process Automation Market – By Organization Size

8.1 Introduction/Key Findings

8.2 Small and Medium Enterprises (SMEs)

8.3 Large Enterprises

8.4 Y-O-Y Growth trend Analysis End-Use Industry

8.5 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Process Automation Market – By Function

9.1 Introduction/Key Findings

9.2 IT Operations

9.3 Human Resources

9.4 Sales and Marketing

9.5 Finance and Accounting

9.6 Supply Chain Management

9.7 Customer Service

9.8 Y-O-Y Growth trend Analysis By Function

9.9 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 10. Process Automation Market – By Industry

10.1 Introduction/Key Findings

10.2 Banking, Financial Services, and Insurance (BFSI)

10.3 Manufacturing

10.4 Healthcare

10.5 Retail

10.6 Telecommunications

10.7 Government

10.8 Energy and Utilities

10.9 Others (e.g., Education, Transportation)

10.10 Y-O-Y Growth trend Analysis By Industry

10.11 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 11.Process Automation Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Component

11.1.2.1 By Deployment Mode

11.1.3 By Organization Size

11.1.4 By Industry

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Component

11.2.3 By Deployment Mode

11.2.4 By Organization Size

11.2.5 By Function

11.2.6 By Industry

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Component

11.3.3 By Deployment Mode

11.3.4 By Organization Size

11.3.5 By Function

11.3.6 By Industry

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Component

11.4.3 By Deployment Mode

11.4.4 By Organization Size

11.4.5 By Function

11.4.6 By Industry

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Component

11.5.3 By Deployment Mode

11.5.4 By Organization Size

11.5.5 By Function

11.5.6 By Industry

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Process Automation Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 UiPath (USA)

12.2 Automation Anywhere (USA)

12.3 Blue Prism (UK)

12.4 Pega Systems (USA)

12.5 NICE Systems (Israel)

12.6 IBM (USA)

12.7 Kofax (USA)

12.8 WorkFusion (USA)

12.9 AntWorks (Singapore)

12.10 HelpSystems (USA)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Process Automation Market is valued at USD 7.8 Billion and is projected to reach a market size of USD 15.20 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10%.

Pursuit of Operational Efficiency, Technological Advancements, Need for Scalability & Enhancement of Customer Experience are the major drivers of the Process Automation Market.

Software and services are the segments under the Process Automation Market by component.

North America is the most dominant region for the Process Automation Market.

Asia Pacific is the fastest-growing region in the Process Automation Market.