Fats and Oils Market Size (2024 – 2030)

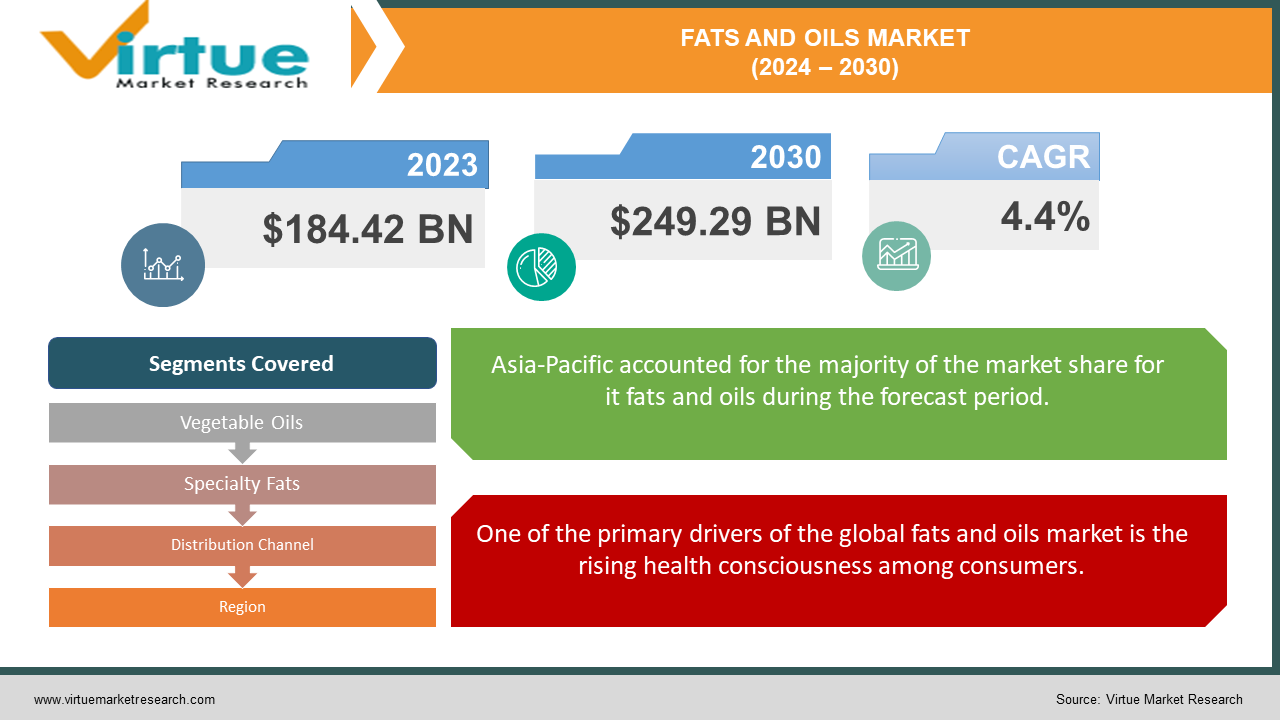

The Global Fats and Oils Market was valued at USD 184.42 Billion in 2023 and is projected to reach a market size of USD 249.29 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.4%.

Within the food business, the global fats and oils market is a crucial sector that includes a wide range of goods that come from both plant and animal sources. These goods are essential for food processing, everyday human nutrition, and many industrial uses. The market offers a wide range of products, including animal fats like lard and tallow as well as culinary oils like olive, palm, soybean, and canola oil. These items are important to the global economy because of their many uses and adaptability. Essential components for food preparation and cooking are fats and oils. They improve nutrient value, taste, and texture. Products like shortening, margarine, and different types of cooking oils are used in both residential and commercial kitchens around the globe. Consuming healthy fats, such as avocado and olive oils, which are rich in monounsaturated fats, is becoming more and more popular. These oils are recommended because of their antioxidant and heart-healthy qualities.

Key Market Insights:

The consumption of soybean oil is expected to reach 56 million metric tons by 2030. In 2023, the global production of palm oil was 75 million metric tons. The animal fats segment is projected to grow at a CAGR of 3.1% over the forecast period. The market for olive oil is expected to grow by 5.2% annually from 2024 to 2030. Global consumption of fats and oils reached 200 million metric tons in 2023. Margarine and spreads represent 15% of the total market.

The biofuel application segment is expected to grow at a CAGR of 6.5% from 2024 to 2030.In 2023, the global fats and oils market for food applications was valued at USD 156.4 billion. The industrial usage of fats and oils constituted 20% of the market share in 2023. The confectionery fats segment holds a 10% share of the total market. The CAGR for the fats and oils market in the cosmetics industry is projected at 5.8%. By 2030, the market for sunflower oil is expected to reach 20 million metric tons.

In 2023, biodiesel production used 10 million metric tons of fats and oils. The consumption of rapeseed oil in 2023 was recorded at 27 million metric tons. Lard and tallow together make up 7% of the animal fats market. In the year 2023, coconut oil accounted for 4% of the total market share. The market for corn oil is expected to grow at a rate of 3.9% per annum. The dairy fat segment saw a market share of 5% in 2023. Palm kernel oil production reached 7 million metric tons in 2023.

Global Fats and Oils Market Drivers:

One of the primary drivers of the global fats and oils market is the rising health consciousness among consumers.

Unsaturated fat-rich oils like canola, avocado, and olive oil are becoming more and more popular than conventional saturated fats. These oils have been linked to a host of health advantages, such as better cholesterol control, less inflammation, and enhanced heart health. The need for particular kinds of fats and oils is also being driven by the trend toward functional meals, which provide extra health advantages on top of basic nourishment. Oils fortified with omega-3 and other nutritionally improved goods are becoming more and more popular. The attempts to inform customers about the health risks associated with certain fats and oils are beginning to bear fruit. Consumers are becoming more capable of making educated decisions because to public health initiatives and easier access to information online.

Emerging economies, particularly in Asia-Pacific, Latin America, and Africa, are witnessing rapid urbanization and economic growth.

As more people move to urban areas, their dietary patterns shift towards higher consumption of processed foods, which often contain fats and oils. The convenience of ready-to-eat meals and fast food is also contributing to this trend. With increased disposable incomes, consumers in emerging markets can afford a more diverse and higher-quality diet. This includes the incorporation of premium oils and fats into their daily food intake. The expansion of food industries in these regions is another significant factor. Local food manufacturers are increasingly using a variety of fats and oils to cater to evolving consumer preferences and to meet the growing demand for processed and packaged foods.

Global Fats and Oils Market Restraints and Challenges:

One of the main reasons for deforestation in tropical areas is the growth of oil palm plantations. This contributes to climate change and endangers biodiversity in addition to destroying important ecosystems. Purchase decisions are being influenced by a growing consumer knowledge of the environmental effects of the manufacturing of fats and oils. Producers are under pressure to implement more sustainable methods due to the increased demand for products obtained responsibly. Many countries are implementing stringent regulations to limit the use of trans fats in food products. This includes bans and mandatory labeling requirements, which are forcing food manufacturers to reformulate their products. As consumers become more health-conscious, there is a shift away from products high in trans fats and saturated fats. This is driving demand for healthier alternatives, such as oils rich in monounsaturated and polyunsaturated fats. Many countries are implementing stringent regulations to limit the use of trans fats in food products. This includes bans and mandatory labeling requirements, which are forcing food manufacturers to reformulate their products.

Global Fats and Oils Market Opportunities:

Because more consumers want natural and chemical-free products, there is an increasing demand for organic fats and oils in the market. Health-conscious customers can feel reassured knowing that products follow particular requirements for cultivation and processing when they are certified organic. Non-GMO oils and fats are becoming more and more well-liked. Genetically modified organisms (GMOs) are causing consumers to become more cautious, and they are looking for products without GMOs. Particularly significant examples of this tendency may be seen in North America and Europe. In a competitive market, providing organic and non-GMO choices helps companies stand out with their goods. Health-conscious consumers may become more brand loyal as a result, and premium pricing may result. There is a growing market for specialty oils, such as avocado oil, flaxseed oil, and walnut oil. These oils are valued for their unique flavour profiles and nutritional benefits, making them popular choices among gourmet chefs and health-conscious consumers. Continuous innovation in product development is key to capturing this opportunity. This includes creating new blends, introducing novel packaging, and highlighting the health benefits of specialty and functional oils.

FATS AND OILS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.4% |

|

Segments Covered |

By Vegetable Oils, Specialty Fats, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company (ADM), Bunge Limited, Cargill Incorporated, Wilmar International Limited, Louis Dreyfus Company, Unilever, Nestle, PepsiCo, Kraft Heinz Company, The Coca-Cola Company, AAK AB, Fuji Oil Co., Ltd., IOI Corporation Bhd, Borges International Group, S.A., Solae |

Fats and Oils Market Segmentation: By Vegetable Oils

-

Palm Oil

-

Soybean Oil

-

Canola Oil

-

Sunflower Oil

-

Olive Oil

When it comes to vegetable oils, palm oil is the most common kind, holding a substantial portion of the market. Due to its great adaptability and affordability, it is a well-liked option for both culinary and non-food applications. Palm oil is widely used in processed goods, baking, and cooking. In the food business, its extended shelf life and ability to withstand high temperatures make it a highly favoured component. Derivatives from palm oil are also utilized in detergents, biofuels, and personal hygiene items. Nonetheless, there is a rising market for palm oil that is supplied responsibly due to the negative environmental effects of palm oil extraction, such as habitat damage and deforestation.

Olive oil is widely valued for its delicious flavour and health advantages, especially extra virgin olive oil. It's a mainstay in Mediterranean cooking, used in sautéing, baking, and salad dressings. Olive oil is favoured by people who are health-conscious due to its strong antioxidant and monounsaturated fat content. Growing knowledge of olive oils' health advantages is driving up demand for premium and organic olive oils.’

Fats and Oils Market Segmentation: By Specialty Fats

-

Cocoa Butter

-

Shea Butter

-

Exotic Oils

A crucial component of chocolate and confectionery goods is cocoa butter. Its melting qualities and silky smoothness make it valuable. The market for cocoa butter is expanding due to consumer demand for high-quality, organic chocolate products.

Because of their distinct tastes and advantageous properties, exotic oils like walnut, flaxseed, and avocado oil are becoming more and more well-liked. These oils are frequently found in gourmet cookery, health-conscious goods, and salad dressings. Growing consumer knowledge of premium and specialty oils' nutritional advantages is driving demand for them.

Fats and Oils Market Segmentation: By Distribution Channel

-

Retail Stores

-

Online Platforms

-

Direct-to-Consumer (DTC) Channels

The most common way that fats and oils are distributed is still through retail establishments, such as hypermarkets, supermarkets, and specialty shops. With a large selection of goods and affordable prices, these retailers serve a diverse customer base. The capacity to visually view things before making a purchase and the ease of one-stop shopping are two important reasons why retail establishments are so dominant. The wide variety of fats and oils that supermarkets and hypermarkets provide, including well-liked vegetable oils, animal fats, and specialty fats, makes them very well-liked. Specialty retailers, which serve customers looking for premium, artisanal goods as well as those who are health-conscious, also have a big impact.

The distribution route for fats and oils that is expanding the quickest is online, thanks to shifting customer tastes and the increased use of e-commerce. Online shopping's ease and its capacity to compare items and read consumer evaluations are what is fueling this channel's expansion. The COVID-19 epidemic has expedited the trend of customers purchasing online, with a growing dependence on e-commerce for their grocery needs. Online platforms are expanding as a result of the emergence of direct-to-consumer channels, in which producers offer goods to customers directly via their websites. This channel appeals to current consumers with features like tailored suggestions, cheaper costs, and subscription services.

Fats and Oils Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

As the largest market for fats and oils worldwide, with a significant 35% share, is the Asia-Pacific area. The region's vast and expanding population, varied food preferences, and substantial agricultural production are some of the reasons for its supremacy. In order to extract vegetable oils like coconut oil, soybean oil, and palm oil, the Asia-Pacific area is a significant producer of a number of important oilseeds and crops. Palm oil is widely used in culinary goods, cosmetics, and biofuels. The two countries that produce the most of it worldwide are Indonesia and Malaysia. Not to mention, major production of soybean oil and other vegetable oils is produced in nations like China and India.

The Middle East and Africa area accounts for 5% of the worldwide fats and oils market, which is a lesser percentage. However, because of its expanding economy and shifting eating patterns, the area offers tremendous development potential. The Middle East and Africa are seeing rapid economic expansion, which is resulting in rising disposable incomes and shifting consumer tastes. The need for a range of fats and oils used in cooking and food processing is driven by this economic expansion.

COVID-19 Impact Analysis on the Global Fats and Oils Market:

Lockdowns and travel restrictions disrupted global supply chains for oilseeds, the raw materials for many fats and oils. Movement restrictions hampered the transportation of crops from farms to processing facilities, impacting production timelines and ingredient availability. Pandemic-induced lockdowns led to a surge in home cooking. This initially increased demand for cooking oils like vegetable and olive oil, as people stocked up on pantry staples. However, with restaurants closed or operating at limited capacity, demand for frying oils used in the food service industry plummeted. Heightened health awareness during the pandemic may have influenced some consumers to choose fats and oils perceived as healthier options. This could have led to an increased demand for olive oil, avocado oil, and nut-based oils perceived to offer health benefits.

Latest Trends/ Developments:

There is a growing demand for fats and oils that are viewed as advantageous due to consumers' increased health consciousness. Because of their link to heart health, monounsaturated fats (found in avocado and olive oils) and polyunsaturated fats (found in large amounts in canola and soybean oils) are becoming more and more popular. Because of their alleged health advantages, fats, and oils enhanced with useful components including vitamins, antioxidants, and Omega-3 fatty acids are gaining attention. This movement encourages fortified foods for better nutrition and possible health benefits. The industrial sector in the Middle East & Africa is expanding, leading to increased demand for fats and oils used in manufacturing, including biofuels, cosmetics, and food processing. This industrial growth is a significant factor driving the market.

Key Players:

-

Archer Daniels Midland Company (ADM)

-

Bunge Limited

-

Cargill Incorporated

-

Wilmar International Limited

-

Louis Dreyfus Company

-

Unilever

-

Nestle

-

PepsiCo

-

Kraft Heinz Company

-

The Coca-Cola Company

-

AAK AB

-

Fuji Oil Co., Ltd.

-

IOI Corporation Bhd

-

Borges International Group, S.A.

-

Solae

Chapter 1. Fats and Oils Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fats and Oils Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fats and Oils Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fats and Oils Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fats and Oils Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fats and Oils Market – By Vegetable Oils

6.1 Introduction/Key Findings

6.2 Palm Oil

6.3 Soybean Oil

6.4 Canola Oil

6.5 Sunflower Oil

6.6 Olive Oil

6.7 Y-O-Y Growth trend Analysis By Vegetable Oils

6.8 Absolute $ Opportunity Analysis By Vegetable Oils, 2024-2030

Chapter 7. Fats and Oils Market – By Specialty Fats

7.1 Introduction/Key Findings

7.2 Cocoa Butter

7.3 Shea Butter

7.4 Exotic Oils

7.5 Y-O-Y Growth trend Analysis By Specialty Fats

7.6 Absolute $ Opportunity Analysis By Specialty Fats, 2024-2030

Chapter 8. Fats and Oils Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Retail Stores

8.3 Online Platforms

8.4 Direct-to-Consumer (DTC) Channels

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Fats and Oils Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Vegetable Oils

9.1.3 By Specialty Fats

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Vegetable Oils

9.2.3 By Specialty Fats

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Vegetable Oils

9.3.3 By Specialty Fats

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Vegetable Oils

9.4.3 By Specialty Fats

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Vegetable Oils

9.5.3 By Specialty Fats

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Fats and Oils Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Archer Daniels Midland Company (ADM)

10.2 Bunge Limited

10.3 Cargill Incorporated

10.4 Wilmar International Limited

10.5 Louis Dreyfus Company

10.6 Unilever

10.7 Nestle

10.8 PepsiCo

10.9 Kraft Heinz Company

10.10 The Coca-Cola Company

10.11 AAK AB

10.12 Fuji Oil Co., Ltd.

10.13 IOI Corporation Bhd

10.14 Borges International Group, S.A.

10.15 Solae

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

A growing population translates to a heightened demand for essential food ingredients like fats and oils. This necessitates increased production and efficient resource management to meet expanding dietary needs.

The market is susceptible to price fluctuations due to factors like weather patterns, geopolitical tensions, and trade policies. These uncertainties create challenges for both producers and consumers, impacting production planning, profit margins, and ultimately, food affordability.

Archer Daniels Midland Company (ADM), Bunge Limited, Cargill Incorporated, Wilmar International Limited, Louis Dreyfus Company, Unilever, Nestle, PepsiCo, Kraft Heinz Company, The Coca-Cola Company, AAK AB, Fuji Oil Co., Ltd., IOI Corporation Bhd, Borges International Group, S.A., Solae.

As the largest market for fats and oils worldwide, with a significant 35% share, is the Asia-Pacific area. The region's vast and expanding population, varied food preferences, and substantial agricultural production are some of the reasons for its supremacy.

The Middle East and Africa area accounts for 5% of the worldwide fats and oils market, which is a lesser percentage. However, because of its expanding economy and shifting eating patterns, the area offers tremendous development potential.