Speciality Fats and Oils market Size (2024 – 2030)

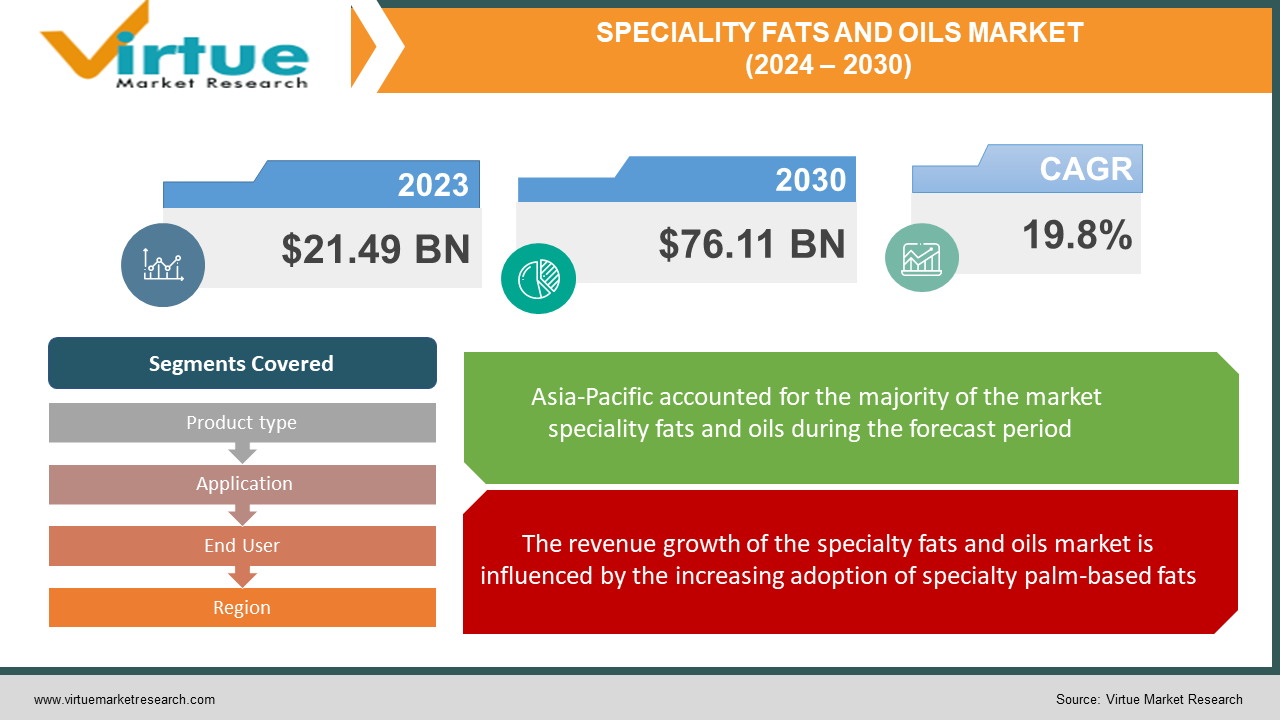

The Global Specialty Fats & Oils Market size was valued at USD 21.49 billion in 2023 and is estimated to reach a value of USD 76.11 billion in 2030. The Specialty Fats & Oils market analysis shows that it will grow with a CAGR of 19.8% over the forecast period of 2024 to 2030.

Specialty fats and oils are intricately crafted to emulate the favorable characteristics of cocoa butter, milk fats, butter, and analogous fats, rendering them suitable for diverse applications. Notably, their predominant use is observed in the confectionery and ice cream industry. Additionally, they serve as binding agents in the pharmaceutical sector, substitutes for milk fats, and play a role in the cosmetic industry. Basic confectionery applications, including molding, coating, filling, and extrusion, leverage specialty fats and oils, offering superior attributes such as gloss, gloss retention, bloom resistance, and resistance to temperature changes. Furthermore, these specialized fats exhibit an exceptional melting profile and release properties enhancing flavor.

Key Market Insights:

The global market for specialty fats and oils is propelled by the escalating demand for high-quality fats and oils, aiming to develop products that not only excel functionally but also address consumer concerns about heart health by enhancing nutritional content. Distinguished by unique characteristics and superior functional properties compared to traditional counterparts like margarine and shortening, specialty fats and oils owe their superiority to a modified crystal structure of fat molecules. This distinctive structure facilitates customized applications across various food products, initially conceptualized to emulate the organoleptic features of cocoa butter. The market has experienced heightened demand for cocoa butter, yet the scarcity due to seasonal harvesting has thrust specialty fats and oils into prominence. Their ability to replicate desired characteristics in dairy, bakery, confectionery, and cosmetics products drives market growth. Leading manufacturers such as Cargill focus on niche applications, developing a range of lauric specialty fats and oils for confectionery. Industry players emphasize new product development and expanded distribution channels to secure or augment their market share in specialty fats and oils.

The robust demand for high-quality, safe, and indulgent bakery and confectionery products fuels the sales growth of specialty fats and oils globally. Major players in the confectionery and baking sectors prioritize consumer health concerns, positioning specialty fats and oils as a balance between health and indulgence in processed food products. Nevertheless, fluctuations in oil crop prices, influenced by weather, political, and economic instability, pose a potential hindrance to the growth of the specialty fats and oils market.

Global Speciality Fats and Oils Market Drivers:

The revenue growth of the specialty fats and oils market is influenced by the increasing adoption of specialty palm-based fats.

A rise in global oils and fats production, coupled with the demand for alternatives and value-added ingredients in the food and beverages industry, is anticipated to contribute to the market's revenue growth. Over recent years, substantial growth has been witnessed in the global specialty fats and oils market due to the heightened consumption of specialty oils in various industrial applications. Researchers actively explore novel alternatives, ranging from mango seed to hump fat, responding to the escalating demand for value-added ingredients in the food and beverages industry. Shea butter and palm oil derivatives stand out as common sources of cocoa butter alternatives, while ongoing research aims to create innovative and healthier substitutes.

Fluctuations in Global Cocoa Production to Drive Specialty Fats and Oils Market

Fluctuations in global cocoa production, influenced by unpredictable weather in main cocoa-producing countries, have impacted the total world production of cocoa beans. This situation has prompted the specialty fats and oils market to emerge as an alternative solution to the challenges posed by the increasing demand and decreasing production volumes of cocoa. Cocoa butter, prized for its texture and flavor, faces challenges such as volatility in pricing. Consequently, companies in the global specialty fats and oils market seek substitutes offering similar functionality at a more stable and economical cost. Specialty fats, customizable for various properties, have gained traction as viable substitutes, offering advantages such as cost-effectiveness and price stability across the global market.

Global Speciality Fats and Oils Market Restraints and Challenges:

The impediment to market growth stems from concerns surrounding the excessive consumption of fats and oils. A pivotal factor influencing demand is the heightened emphasis on healthy eating and sustainability. This shift in consumer preferences, away from processed foods towards natural ingredients, is particularly pronounced in the United States. Notably, sales of specialty fats and oils have witnessed a decline in recent years as a consequence.

Furthermore, the ascendancy of plant-based alternatives has contributed to the impact on the demand for the specialty fats and oils market. In response to consumers seeking to reduce meat consumption for health or environmental reasons, companies are progressively introducing plant-based alternatives to conventional animal-based products. This trend is anticipated to persist, further encroaching upon the market share of specialty fats and oils.

Global Speciality Fats and Oils Market Opportunities:

Over the years, there has been a notable surge in the preference for natural products over synthetic chemicals in the beauty and personal care industry. The Asia-Pacific region, in particular, has witnessed substantial growth in the market for organic cosmetics and personal care products. The driving forces behind this surge include the expanding millennial population, increased online presence and internet usage, and a rise in per capita income, fostering awareness of environmentally friendly products. Consequently, there has been a recent upswing in demand for specialty oils in response to these evolving market dynamics.

SPECIALITY FATS AND OILS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

19.8% |

|

Segments Covered |

By Product type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AAK AB (Sweden), Bunge Limited (US), Cargill, Incorporated (US), Fuji Oil (Japan), IFFCO (UAE), IOI Loders Croklaan (Malaysia), Manildra (Australia), Mehwah International (Singapore), Musim Mas (Singapore), Wilmar International (Singapore) |

Global Speciality Fats and Oils market Segmentation: By Product Type

-

Fats

-

Cocoa Butter Alternatives

-

Coating Fats

-

Dairy Fat replacers

-

Others

-

-

Oils

-

Palm Oil

-

Coconut Oil

-

Soyabean Oil

-

Sunflower Oil

-

Others

In terms of product type, oils dominate the global specialty fats and oils market, holding a significant market share of 78.3%. Conversely, the fats segment is anticipated to exhibit steady growth with a projected Compound Annual Growth Rate (CAGR). The current market scenario witnesses heightened demand for specialty oils, driven by the expanding global population, evolving lifestyles, and increased health consciousness among consumers.

The food industry stands out as the primary consumer of specialty oils, accounting for over 50% of the total demand in the global specialty fats and oils market. These oils find applications in various food products, including salad dressings, sauces, marinades, and baking mixes, offering benefits such as enhanced flavor and texture, prolonged shelf life, and improved nutrition. Additionally, the cosmetics and pharmaceutical industries are substantial consumers of specialty oils, incorporating them into products like skin care creams, lotions, ointments, gels, shampoos, conditioners, and capsules, providing advantages such as improved skin tone, increased moisture retention, and better absorption of active ingredients.

Global Speciality Fats and Oils market Segmentation: By Application

-

Bakery

-

Confectionery

-

Cosmetics

-

Dairy Products

-

Home Cooking

-

Pharmaceutical Products

Within the application segmentation, the confectionery segment secured a 27% market share in 2023, while the home cooking segment is poised to experience the highest CAGR. The confectionery industry is swiftly transitioning towards cleaner labels and healthier ingredients, aligning with the growing consumer preference for a healthier lifestyle. Specialty fats and oils are gaining traction in home cooking, serving as an ideal choice for everyday culinary needs, providing richness and enhanced flavor compared to regular oils.

Global Speciality Fats and Oils market Segmentation: By End User

-

Food & Beverage

-

Pharma

-

Hospitality

-

Residential

-

Others

The Food & Beverage segment contributes over 42.7% of the revenue to the global specialty fats and oils market. The food and beverage industry, a crucial sector in the economy, continually evolves, with a recent trend being the increasing demand for specialty fats and oils. These tailored fats and oils cater to diverse applications, including baking, frying, and incorporation into processed foods, enhancing taste, texture, and shelf life. Changing consumer preferences towards healthier alternatives, coupled with the need for compliance with stringent regulations, fuels the rising demand for specialty fats and oils in the market.

Global Speciality Fats and Oils market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is anticipated to maintain its prominence as a leading market for specialty fats and oils due to robust production, strong export potential, and increasing demand in bakery, confectionery, and dairy sectors. Consumers in the region recognize the health benefits of specialty fats and oils, exhibiting a preference for ingredients that are not only healthy but also retain the sensory characteristics of food products. Specialty oils and fats, accompanied by genuine certifications, attract manufacturers in developed markets, driving the development of high-value premium offerings. Consumers' willingness to pay a premium for products developed using specialty oils further boosts manufacturers' confidence, contributing to the overall growth of the specialty fats and oils market.

COVID-19 Impact Analysis on the Global Speciality Fats And Oils market:

Amid the COVID-19 pandemic, the specialty oils market encountered significant disruptions in both supply and demand. The response to the coronavirus led to stringent measures, causing a shift in the global Specialty Oils Market and heightened uncertainty regarding the prices of these commodities. Palm Oil, the most widely produced oil globally, shared the impact, facing a substantial decline in demand amidst price uncertainties. Key producers in the vegetable oil markets, such as Wilmar International and Mahwah Group in Indonesia and Malaysia, reported disruptions in palm oil trade and production due to the epidemic. Conversely, the bakery and confectionery industries observed an upswing in sales as consumers stockpiled these products during lockdowns.

Recent Trends and Developments in the Speciality Fats and Oils Market:

In November 2022, AAK made a strategic move to enhance its presence in southeast India's specialty fats and oils market by acquiring Arani Agro Oil Industries Ltd. The acquisition aimed to expand AAK's geographic footprint and strengthen its high-quality specialty oil and fats business, enabling better service to customers in the region and capitalizing on the growing demand for specialty products.

Key Players:

-

AAK AB (Sweden)

-

Bunge Limited (US)

-

Cargill, Incorporated (US)

-

Fuji Oil (Japan)

-

IFFCO (UAE)

-

IOI Loders Croklaan (Malaysia)

-

Manildra (Australia)

-

Mehwah International (Singapore)

-

Musim Mas (Singapore)

-

Wilmar International (Singapore)

Chapter 1. Speciality Fats and Oils market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Speciality Fats and Oils market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Speciality Fats and Oils market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Speciality Fats and Oils market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Speciality Fats and Oils market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Speciality Fats and Oils market – By Product Type

6.1 Introduction/Key Findings

6.2 Fats

6.3 Cocoa Butter Alternatives

6.4 Coating Fats

6.5 Dairy Fat replacers

6.6 Others

6.7 Oils

6.8 Palm Oil

6.9 Coconut Oil

6.10 Soyabean Oil

6.11 Sunflower Oil

6.12 Others

6.13 Y-O-Y Growth trend Analysis By Product Type

6.14 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Speciality Fats and Oils market – By End User

7.1 Introduction/Key Findings

7.2 Food & Beverage

7.3 Pharma

7.4 Hospitality

7.5 Residential

7.6 Others

7.7 Y-O-Y Growth trend Analysis By End User

7.8 Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 8. Speciality Fats and Oils market – By Application

8.1 Introduction/Key Findings

8.2 Bakery

8.3 Confectionery

8.4 Cosmetics

8.5 Dairy Products

8.6 Home Cooking

8.7 Pharmaceutical Products

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Speciality Fats and Oils market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End User

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Speciality Fats and Oils market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 AAK AB (Sweden)

10.2 Bunge Limited (US)

10.3 Cargill, Incorporated (US)

10.4 Fuji Oil (Japan)

10.5 IFFCO (UAE)

10.6 IOI Loders Croklaan (Malaysia)

10.7 Manildra (Australia)

10.8 Mehwah International (Singapore)

10.9 Musim Mas (Singapore)

10.10 Wilmar International (Singapore)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Speciality Fats and Oils market size is valued at USD 21.49 billion in 2023.

The worldwide Global Speciality Fats and Oils market growth is estimated to be 19.8% from 2024 to 2030.

The Global Speciality Fats and Oils market is segmented by Product Type (Fats and Oils), by Application (Bakery, Confectionery, Cosmetics, Dairy Products, Home Cooking, Pharmaceutical Products), by End User (F&B, Pharma, Hospitality, Residential, Others.

Clean-label, plant-based product demand is expected to fuel expansion in the global specialty fats and oils market. Possibilities include reducing trans-fat, developing healthier, sustainable substitutes, and growing uses in cosmetics, candies, and bio-lubricants by using processing and extraction technology breakthroughs.

The COVID-19 pandemic caused supply chain difficulties, erratic demand patterns, and logistical limitations, which caused disruptions in the global specialty fats and oils industry. Product necessities became more popular, which changed consumer preferences and affected market dynamics. Resilience, digitization, and adaptive tactics are critical for recovery and future expansion.