Face Wash and Cleanser Market Size (2024 – 2030)

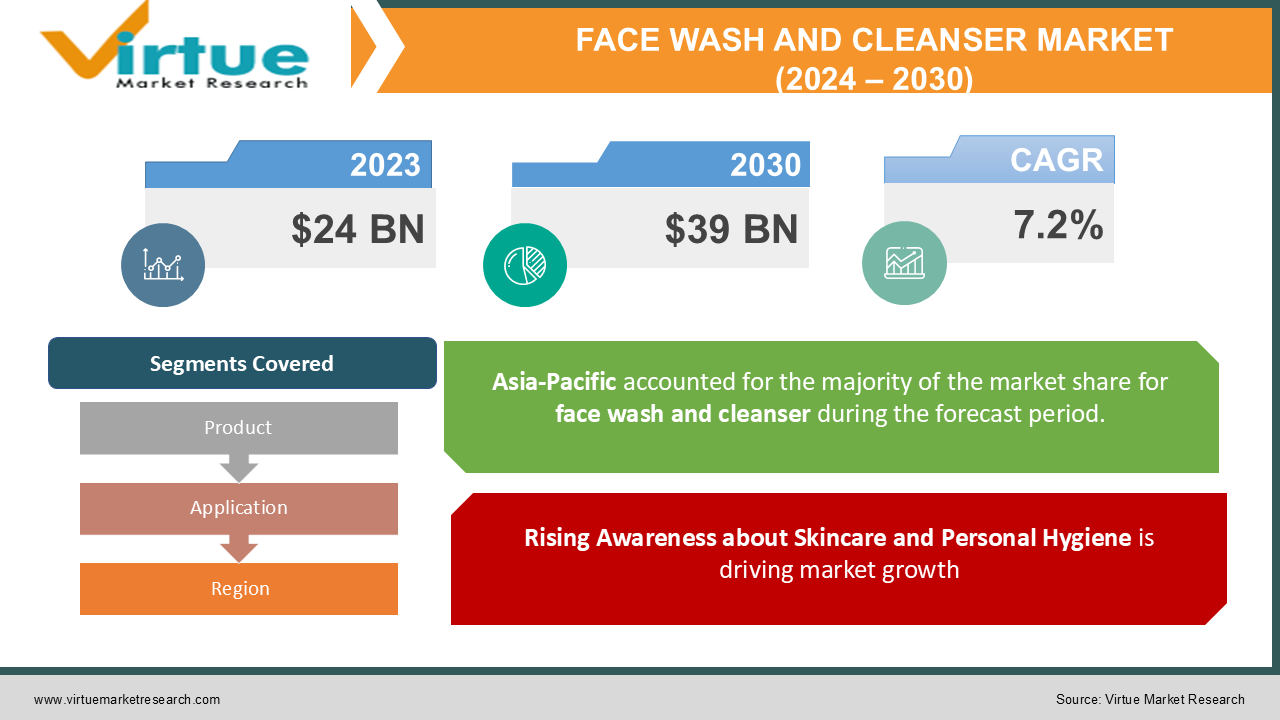

The Global Face Wash and Cleanser Market was valued at USD 24 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030, reaching USD 39 billion by 2030.

The Face Wash and Cleanser Market revolves around personal care products formulated to remove dirt, oil, makeup, and impurities from the skin. These products cater to diverse skin types and preferences, ranging from foaming and gel-based face washes to cream and micellar water cleansers. Increasing consumer awareness of skincare routines and the rising popularity of premium and organic products are driving market growth. Additionally, the market benefits from evolving beauty standards and the expansion of online retail channels, making face wash and cleanser products more accessible globally.

Key Market Insights

-

In terms of demand, natural and organic face cleansers grew at a year-to-year rate of 15 percent, driven by consumer preferences for green, chemical-free skincare products.

-

More than 40 percent of the Asian-Pacific share across the globe can be attributed to some key countries such as China and India, where the growth is high because the middle class is expanding. People are also much more aware of grooming.

-

Anti-acne and oil-control face washes are the fastest-growing product category, with an 8% CAGR, supported by the widespread appearance of skin issues among younger consumers.

-

E-commerce-based sales now form 30% of the market's revenue. Post-pandemic trends are increasing purchases of skincare products through online channels.

-

Consumers in North America had a capex of $200 per capita on skincare products in 2023, which shows a high premium on facial care.

-

Men's grooming products, from distinct men's face washes, increased 10% more than last year, which confirms that men are eager to be better groomed.

Global Face Wash and Cleanser Market Drivers

Rising Awareness about Skincare and Personal Hygiene is driving market growth: An overall expansion in the awareness levels of the world about skincare and personal care has elevated the emphasis on maintaining healthy skin through the practice of daily face cleaning. One of the primary drivers in the face wash and cleanser market is the heightened inclination to maintain a routine for cleansing the face at regular intervals. Social media, influencers, and beauty bloggers influence the adoption of products for skincare routines as well. Such awareness does not reach women alone; men also look after their grooming needs, thereby paving the way for specific products for both genders.

Demand for Natural and Organic Ingredients is driving market growth: Clean beauty has been the new tide in the skincare market for face washes and cleansers. Consumers are searching for products that have aloe vera, tea tree oil, and chamomile and avoid parabens and sulfates, among other harsh chemicals. Consumers' favorites include brands that use sustainability and cruelty-free testing and eco-friendly packaging. This trend follows a broader trend of consumer preference for wellness-oriented and holistic skincare solutions, which compels companies to step up their game in innovating plant-based and organic formulations.

Growth of E-commerce and Digital Retail Channels is driving market growth: The online economy has significantly played a role in the face wash and cleanser market because it allows shoppers access to a huge list of products under one roof. This has been augmented with online portals that offer product comparisons, detailed reviews, and virtual consultations, thereby making shopping seamless. This has meant that the coronavirus pandemic's influence has significantly hastened the trend of digital retail, in which online shopping is preferred over visiting brick-and-mortar stores. Furthermore, subscription-based services providing periodic supplies of skincare goods have emerged as a new trend, thereby highlighting growth in the market.

Global Face Wash and Cleanser Market Challenges and Restraints

Intense Market Competition and Pricing Pressure are restricting market growth: There is intense competition in the face wash and cleanser space with several players, both local, regional, and international. While the more expensive options are on the higher-income market, what is unacceptably large is the number of low-price items in the mass market, consequently putting pressure on prices across all categories. This puts a problem of differentiation in the midst of such a competitive marketplace for smaller brands. It also contributes to a high risk of brand dilution for the same reasons, which result in frequent rising product launches and shifting consumer preferences, making the struggle to sustain customer loyalty hard.

Regulatory Hurdles and Consumer Safety Concerns are restricting market growth: The skincare industry needs to abide by severe rules regulating its product safety along with labeling of the ingredients. The complexity in developing and promoting a product arises due to other differing standards prevalent in various regions. Negative publicity and product recalls arise when severe side effects or allergic reactions occur, and the brand as well as the consumers lose trust in the brand. With consumers increasingly informed about the contents of product ingredients, brands are on notice to keep up and maintain transparency, demonstrating respect for the sophisticated evolution of new regulations.

Market Opportunities

Opportunities for the Face Wash and Cleanser Market are significant since there are new trends and consumer demands. One particular segment for growth will be in products that offer multifunctions - cleansers that can hydrate and exfoliate, or combine cleansing with sun protection. The product is all about the needs of busy consumers who want simplicity in their skincare routine without losing impact. Men's grooming is another area that will do well, as more males are paying heed to the importance of skincare. There could be scopes in creating separate product lines for men, like oil-control or beard care-specific cleansers. Establishment in new markets also bodes great for further expansion with regions like Asia-Pacific and Latin America enjoying the advantage of increasing incomes and urbanization translating into a growth story for personal care products. Moreover, companies that favor sustainability by having recyclable packaging and responsible sourcing tend to gain the good graces of green consumers. Offering clinically validated products through collaboration with dermatologists and skincare specialists will also help increase brand credibility and expand its reach.

FACE WASH AND CLEANSER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

L'Oréal, Unilever, Procter & Gamble, Beiersdorf AG, Johnson & Johnson, Estée Lauder, Shiseido, Himalaya Herbals, Kiehl’s, Neutrogena |

Face Wash and Cleanser Market Segmentation - By Product

-

Gel-Based Face Wash

-

Cream-Based Face Wash

-

Foam Cleansers

-

Micellar Water

-

Oil-Based Cleansers

Gel-based face washes are the most dominant segment, accounting for approximately 35% of the market share. Their popularity stems from their versatility, as they are suitable for most skin types, including combination and oily skin. Gel-based formulations are lightweight, non-greasy, and effective at removing dirt and oil without stripping the skin of moisture.

Face Wash and Cleanser Market Segmentation - By Application

-

Acne Treatment

-

Oil Control

-

Hydration and Moisturization

-

Skin Brightening

-

Sensitive Skin Care

Acne treatment holds the largest share within the application segment, driven by the high prevalence of acne-related issues among teenagers and young adults. Anti-acne face washes with ingredients like salicylic acid and benzoyl peroxide are in high demand, offering consumers targeted solutions to manage breakouts and blemishes.

Face Wash and Cleanser Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the most dominant region in the global face wash and cleanser market, contributing over 40% of the total market share. The region’s dominance is attributed to the growing popularity of skincare routines in countries like South Korea, Japan, and China. Rising disposable incomes, an expanding middle class, and increased awareness about skincare have further boosted demand. Additionally, the influence of K-beauty trends has played a significant role in shaping consumer preferences for innovative and effective cleansing products.

COVID-19 Impact Analysis on the Face Wash and Cleanser Market

The impact of the COVID-19 pandemic has been mixed for the face wash and cleanser market. Certainly, the reduced socialization and adoption of remote work arrangements have created negative demand in the short term for some personal care products; however, the COVID-19 pandemic has also increased interest in self-care routines as more consumers made healthy skin a priority while at home. Among the basics of skincare are skin cleansers and face washes, so to that extent, demand is constant. While volumes were somewhat increased throughout the pandemic due to a shift to digital channels, other trends like buying skincare online were abundant, and those brands that had invested in digital marketing, as well as online retail channels, continued sales despite the traditional retail shutting down entirely. Also, as face mask usage became widespread during the pandemic, this practice led to many developing what was later called "maskne," or acne, resulting from the wearing of masks, and anti-acne cleansers also experienced increased demand.

Latest Trends/Developments

Face wash and cleansing products are among several trends happening in space. Another important trend is microbiome-friendly products that seek to assist in keeping the skin's natural flora in balance. Consumers are becoming more and more interested in sulfate-free, paraben-free, and fragrance-free products as they embrace the growing tide of clean beauty. The new trend that has hit markets is skincare through technology. While some brands have developed AI diagnostics for choosing a cleanser that best suits an individual's needs, others provide virtual consultations. Sustainability remains a driving force behind what companies will do, and the firms prefer recyclable packs along with offering various refill products. Another trend that is slowly gaining momentum with brands launching products that are gender-neutral. Cleansers that now come for all types of skin and genders are launched on the market. Travel-friendly, mini-sized, sold more in the market, mostly due to the convenience and portability of the product.

Key Players

-

L'Oréal

-

Unilever

-

Procter & Gamble

-

Beiersdorf AG

-

Johnson & Johnson

-

Estée Lauder

-

Shiseido

-

Himalaya Herbals

-

Kiehl’s

-

Neutrogena

Chapter 1. Face Wash and Cleanser Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Face Wash and Cleanser Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Face Wash and Cleanser Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Face Wash and Cleanser Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Face Wash and Cleanser Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Face Wash and Cleanser Market – By Product

6.1 Introduction/Key Findings

6.2 Gel-Based Face Wash

6.3 Cream-Based Face Wash

6.4 Foam Cleansers

6.5 Micellar Water

6.6 Oil-Based Cleansers

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Face Wash and Cleanser Market – By Application

7.1 Introduction/Key Findings

7.2 Acne Treatment

7.3 Oil Control

7.4 Hydration and Moisturization

7.5 Skin Brightening

7.6 Sensitive Skin Care

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Face Wash and Cleanser Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Face Wash and Cleanser Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 L'Oréal

9.2 Unilever

9.3 Procter & Gamble

9.4 Beiersdorf AG

9.5 Johnson & Johnson

9.6 Estée Lauder

9.7 Shiseido

9.8 Himalaya Herbals

9.9 Kiehl’s

9.10 Neutrogena

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Face Wash and Cleanser Market was valued at USD 24 billion in 2023 and is projected to reach USD 39 billion by 2030, growing at a CAGR of 7.2%.

Key drivers include rising awareness about skincare, growing demand for natural and organic products, and the expansion of e-commerce platforms.

The market is segmented by product into gel-based, cream-based, foam cleansers, micellar water, and oil-based cleansers. By application, it includes acne treatment, oil control, hydration, brightening, and sensitive skin care.

Asia-Pacific is the dominant region, driven by rising disposable incomes, grooming awareness, and the influence of K-beauty trends.

Leading players include L'Oréal, Unilever, Procter & Gamble, Johnson & Johnson, and Beiersdorf AG.