Liquid Soap Market Size (2024 – 2030)

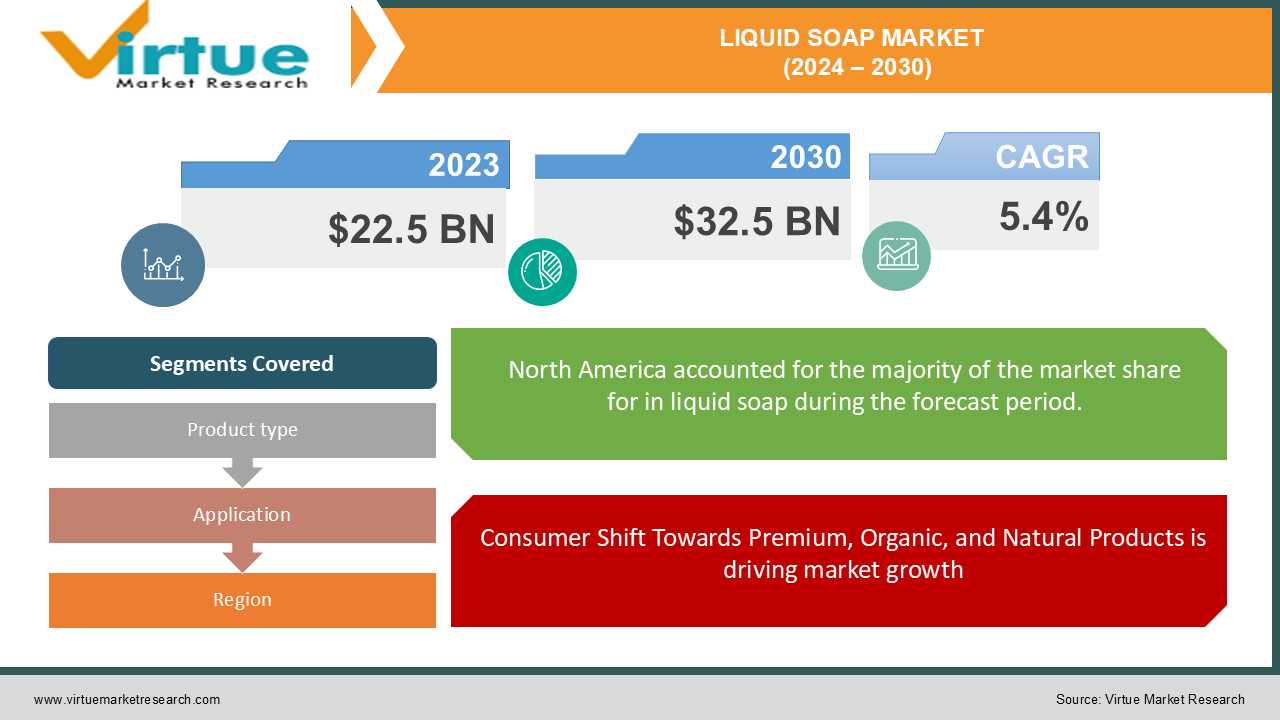

The Global Liquid Soap Market was valued at USD 22.5 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030, reaching an estimated USD 32.5 billion by 2030.

Liquid soap, a key product in personal hygiene and care, is preferred over traditional bar soap due to its convenience, hygienic properties, and ability to incorporate various formulations like moisturizers and antibacterial agents. The market's growth is driven by heightened awareness of personal hygiene, especially post-COVID-19, which emphasizes handwashing and sanitation as preventive measures against infections. Furthermore, innovations in liquid soap formulas, such as the inclusion of natural ingredients and eco-friendly packaging, are contributing to market expansion.

Key Market Insights:

-

Hand washing dominates the liquid soap market, accounting for over 40% of total revenue in 2023, as hand hygiene remains a priority in households, healthcare, and hospitality sectors. Handwashing campaigns by governments and health organizations have significantly contributed to this trend.

-

North America and Europe hold nearly 50% of the global market share, with the U.S. leading due to stringent hygiene practices, widespread awareness, and the availability of premium liquid soap products. Brands such as Dial, Softsoap, and Method are popular in these regions.

-

Organic and natural liquid soaps are the fastest-growing segment, with a projected CAGR of 7.1% from 2024 to 2030. Growing consumer awareness about the harmful effects of synthetic chemicals and a shift towards sustainability are driving the demand for plant-based and toxin-free liquid soap options.

-

E-commerce platforms account for around 30% of liquid soap sales globally, with online shopping gaining momentum after the COVID-19 pandemic. Online platforms such as Amazon, Walmart, and specialty retailers have become popular avenues for purchasing liquid soap, offering a wide range of choices to consumers.

Global Liquid Soap Market Drivers:

Consumer Shift Towards Premium, Organic, and Natural Products is driving market growth:

In recent years, there has been a noticeable shift in consumer preferences towards premium personal care products, particularly those that feature natural and organic ingredients. Many consumers are becoming increasingly concerned about the harmful effects of synthetic chemicals, such as parabens, sulfates, and artificial fragrances, often found in conventional liquid soaps. This has led to a surge in demand for liquid soaps formulated with plant-based, natural ingredients that are not only safe for the skin but also environmentally sustainable. Premium brands are capitalizing on this trend by offering a range of liquid soaps infused with natural essential oils, herbal extracts, and moisturizing agents, catering to consumers looking for luxurious and eco-friendly options. As a result, the organic and natural liquid soap market is expected to grow at a faster rate than traditional segments.

Rising Demand for Convenient and Hygienic Personal Care Products is driving market growth:

Liquid soap’s ease of use, convenience, and hygienic properties have contributed to its growing popularity over bar soap. Unlike bar soap, liquid soap is dispensed through a pump, reducing the potential for cross-contamination and making it a preferred option in public spaces and shared environments like offices, schools, and hospitals. The growing focus on germ protection has further fueled demand for antibacterial liquid soaps that offer added benefits. In addition, liquid soap is available in various packaging options, including bulk and travel-sized versions, catering to different consumer needs. This versatility, combined with an increasing emphasis on hygiene and convenience, has made liquid soap a preferred choice for consumers worldwide.

Global Liquid Soap Market Challenges and Restraints:

Environmental Impact of Liquid Soap Packaging is Restricting Market Growth:

One of the major challenges facing the liquid soap market is the environmental impact associated with its packaging. Liquid soap is typically packaged in plastic bottles, contributing to the global plastic waste crisis. Despite efforts by manufacturers to adopt more sustainable practices, such as using recyclable materials or offering refill options, the liquid soap industry still faces significant pressure from environmental organizations and consumers to reduce its reliance on plastic. The production and disposal of plastic bottles contribute to pollution, and in regions where recycling infrastructure is lacking, the environmental footprint of liquid soap remains a key concern. Additionally, the energy-intensive processes involved in producing plastic packaging further exacerbate the environmental impact of these products. As environmental awareness grows, manufacturers will need to invest in more sustainable packaging solutions to meet consumer expectations and regulatory requirements.

Price Sensitivity in Emerging Markets is restricting market growth:

While the liquid soap market is experiencing growth in emerging economies, price sensitivity remains a major challenge. In price-conscious regions such as Southeast Asia, Latin America, and Africa, consumers may still opt for traditional bar soap, which is significantly cheaper than liquid soap. The higher cost of liquid soap, particularly premium and organic variants, can limit its adoption in lower-income populations. Additionally, the presence of private-label brands and local manufacturers offering low-cost alternatives increases competition and pressures established brands to lower their prices or risk losing market share. As a result, international liquid soap brands may face challenges in expanding their footprint in these regions without adjusting their pricing strategies to align with local consumer preferences.

Market Opportunities:

The growing emphasis on hygiene and personal care presents numerous opportunities for the liquid soap market. One of the most promising opportunities lies in the increasing consumer preference for natural and organic products. As more consumers become aware of the potential health risks associated with synthetic chemicals in personal care products, they are actively seeking safer, natural alternatives. Liquid soaps made from organic ingredients, free from harmful additives, and formulated with eco-friendly practices are expected to gain significant traction in the coming years. This shift towards sustainability is also driving demand for biodegradable packaging and refill options. Brands that can successfully innovate in these areas by introducing products that are both effective and environmentally friendly will likely capture a larger share of the market. Additionally, the development of specialized liquid soaps for different skin types and conditions, such as moisturizing, sensitive skin, and antibacterial formulations, offers manufacturers an opportunity to cater to niche markets. Another opportunity lies in expanding distribution channels, particularly in emerging economies where hygiene awareness is increasing. With growing internet penetration, e-commerce platforms are becoming important sales channels, offering manufacturers the chance to reach a wider audience. Strategic partnerships with online retailers and digital marketing efforts can help companies tap into new markets, especially in regions where brick-and-mortar retail infrastructure is underdeveloped.

LIQUID SOAP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Unilever, Procter & Gamble, Colgate-Palmolive, Reckitt Benckiser Group plc, Henkel AG & Co., Kao Corporation, Lion Corporation, Godrej Consumer Products, Method Products, PBC, The Caldrea Company |

Liquid Soap Market Segmentation: By Product Type

-

Hand Wash

-

Body Wash

-

Face Wash

-

Specialized Liquid Soaps (e.g., for babies, sensitive skin, etc.)

The Hand Wash segment dominates the liquid soap market, accounting for over 40% of the total market share in 2023. With heightened awareness of hand hygiene, particularly in the wake of the COVID-19 pandemic, handwashing remains a primary preventative measure against the spread of germs and illnesses, making hand-wash products the most sought-after liquid soap variant.

Liquid Soap Market Segmentation: By Application

-

Household

-

Healthcare

-

Hospitality

-

Industrial

The Household segment is the most dominant application area for liquid soap, as personal hygiene practices in homes are key to maintaining health and safety. Household demand accounts for the largest share of the market, particularly for hand wash and body wash products, as daily use of liquid soap has become essential for modern families.

Liquid Soap Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the liquid soap market, accounting for a substantial share of global revenue. High consumer awareness about hygiene, coupled with the widespread availability of premium and specialty liquid soaps, has driven demand in this region. The U.S., in particular, is a leading market, supported by a strong retail infrastructure and the presence of major players.

COVID-19 Impact Analysis on the Liquid Soap Market:

The COVID-19 pandemic had a significant impact on the global liquid soap market, driving unprecedented demand for hygiene products. Governments and public health organizations emphasized frequent handwashing as one of the most effective ways to prevent the spread of the virus, leading to a surge in liquid soap sales, particularly hand wash products. This spike in demand was witnessed across both developed and emerging markets, as consumers stockpiled hygiene products in response to the pandemic. Many companies ramped up production to meet this surge, and liquid soap became a staple household item. The healthcare sector also played a pivotal role in boosting demand for liquid soap during the pandemic, as hospitals and clinics increased hygiene protocols to manage the influx of patients. The increased usage of liquid soap in public spaces such as schools, offices, and retail outlets further drove market growth. Even as the pandemic subsides, the heightened awareness of hygiene is expected to persist, ensuring steady demand for liquid soap products in the post-COVID-19 era. However, manufacturers may face challenges in maintaining the extraordinary growth rates seen during the peak of the pandemic.

Latest Trends/Developments:

The liquid soap market is witnessing several notable trends, including the shift towards natural and organic formulations, the increasing focus on sustainable packaging, and the growing influence of e-commerce. Consumers are becoming more conscious of the ingredients used in personal care products, with a preference for those that are plant-based and free from harmful chemicals. This trend has led to a proliferation of natural and organic liquid soaps, which are now seen as premium offerings in the market. Sustainability has also become a key focus for both consumers and manufacturers. In response to growing concerns about plastic waste, many companies are adopting biodegradable packaging or introducing refillable containers. This move towards eco-friendly practices is expected to be a major driver of innovation in the liquid soap market. E-commerce has become an increasingly important sales channel for liquid soap, with more consumers opting to shop online due to convenience and the wide variety of products available. The rise of digital marketing and social media influencers promoting personal care products has further amplified this trend, especially among younger consumers.

Key Players:

-

Unilever

-

Procter & Gamble

-

Colgate-Palmolive

-

Reckitt Benckiser Group plc

-

Henkel AG & Co.

-

Kao Corporation

-

Lion Corporation

-

Godrej Consumer Products

-

Method Products, PBC

-

The Caldrea Company

Chapter 1. Liquid Soap Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Liquid Soap Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Liquid Soap Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Liquid Soap Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Liquid Soap Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Liquid Soap Market– By Product Type

6.1 Introduction/Key Findings

6.2 Hand Wash

6.3 Body Wash

6.4 Face Wash

6.5 Specialized Liquid Soaps (e.g., for babies, sensitive skin, etc.)

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Liquid Soap Market– By Application

7.1 Introduction/Key Findings

7.2 Household

7.3 Healthcare

7.4 Hospitality

7.5 Industrial

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Liquid Soap Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Liquid Soap Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Unilever

9.2 Procter & Gamble

9.3 Colgate-Palmolive

9.4 Reckitt Benckiser Group plc

9.5 Henkel AG & Co.

9.6 Kao Corporation

9.7 Lion Corporation

9.8 Godrej Consumer Products

9.9 Method Products, PBC

9.10 The Caldrea Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Liquid Soap Market was valued at USD 22.5 billion in 2023 and is expected to reach USD 32.5 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030.

Key drivers include heightened hygiene awareness post-COVID-19, a consumer shift toward premium and natural products, and the rising demand for convenient and hygienic personal care products.

The market is segmented by product type (Hand Wash, Body Wash, Face Wash, Specialized Liquid Soaps) and by application (Household, Healthcare, Hospitality, Industrial).

North America is the dominant region, accounting for a substantial share of the market due to high hygiene standards and the availability of premium products.

Leading players include Unilever, Procter & Gamble, Colgate-Palmolive, Reckitt Benckiser Group plc, and Henkel AG & Co., among others.