Europe Snack Products Market Size (2023-2030)

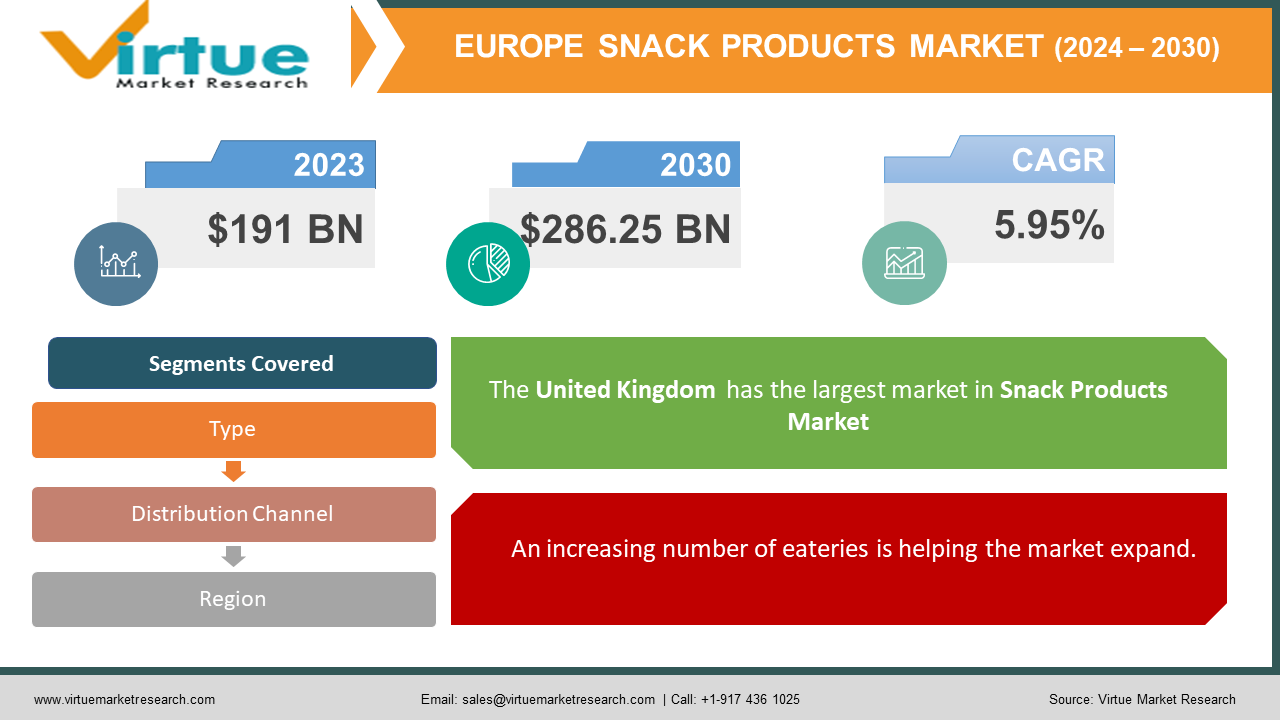

The European snack products market was valued at USD 191 billion in 2023 and is projected to reach a market size of USD 286.25 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.95%.

A snack is a little meal that is often consumed in between meals. There are many different types of snacks, such as packaged meals and other processed foods, as well as homemade snacks created with fresh ingredients. Snacks in Europe have a rich history, with popular products being pastries, pretzels, stroopwafel, kinder delicacies, etc. The trading of these foot items helps strengthen the economy. Presently, with many diversifications and innovations, these products have undergone various changes, including organic, vegan, gluten-free, and many more. In the future, with a growing focus on health and wellness trends, the changing retail landscape, and other technological advancements, this market is set to generate more revenue.

Key Market Insights:

- According to Western European countries' retail sales of snacks, the UK topped the podium in 2019 and is predicted to do so again in 2023.

- Germany produced around 117.14 thousand tonnes of potato sticks and chips in 2022.

- The savory snack business in Europe was estimated to be worth 21.7 billion US dollars in 2020. With an estimated 3.6 billion US dollars in sales, Germany was the largest savory snack market in Europe. But the size of the market in the UK was almost the same.

- According to IDF projections, the number of individuals with diabetes (61 million) and its prevalence (9.2%) in the EUR Region will rise by 13% by 2045. With 31,000 new cases yearly, the EUR Region has the greatest incidence of type 1 diabetes and the highest number of children and adolescents with the disease (295,000). The second highest average cost per diabetic person (USD 3,086) is likewise found in the EUR Region. Diabetes accounted for 189.3 billion USD in spending in 2021, or 19.6% of global spending. To tackle this, the food and beverage industry has been renovating its products with less sugar or other sugar alternatives to align with consumer trends.

Europe Snack Products Market Drivers:

Changing lifestyles and consumer preferences are fueling market expansion.

The way people live has changed throughout time, due in large part to urbanization and rising income. Considerable strides have been made in boosting the economy and generating new employment possibilities. The new normal is dual incomes. This is linked to busy schedules that prevent people from having time to cook. Simple and ready-to-eat choices have become the go-to option. Aside from this, these options are helpful for bachelors and those who are unable to prepare food. People can save a great deal of time and use it for other daily tasks. This factor is helping the market develop tremendously.

Product diversification and innovation are boosting the growth rate.

The culinary industry is keen on exploring different varieties of food products. Taste, texture, quality, and blending have been significantly improved over the years. The food and beverage industry is aligning with various fitness goals. They are introducing healthier alternatives for commercialization. This includes sugar-free options, plant-based products, and low-calorie snacks. Moreover, many snacks are being customized as per an individual's needs. This has resulted in the creation of a broader consumer base.

An increasing number of eateries is helping the market expand.

Over the past ten years, there has been a significant increase in the number of hotels, eateries, and other fast-food franchises. People love to try new foods and explore new locations. The continental cuisine offers a wide variety of options. Many dineries offer specialization in any one type of food snack that holds cultural significance. Couples and college students have a tendency to explore and try new things, which contributes to the growth of these locations. Furthermore, many roadside trucks are renowned for their superior flavor and reasonable prices.

Europe Snack Products Market Restraints and Challenges:

Health issues, competition, and environmental concerns are the main barriers in the market.

Snack products are associated with heavy amounts of oil, fat, and sugar. This increases the incidence of chronic illnesses, which include diabetes, heart disease, and blood pressure variation. There have been numerous studies that have proven the harm that extreme amounts of junk can cause to the human body. This rising consumer awareness has been posing a risk to the market. Secondly, heavy competition is faced by the local food outlets. Consumers rely on popular and recognized brands in the industry. Thirdly, many organizations use plastic and other non-recyclable materials for packaging purposes. This leads to waste accumulation.

Europe Snack Products Market Opportunities:

Veganism is the practice of incorporating plant-based products into the daily diet. There has been a growing popularity for vegan-based products. This provides the market with an ample number of possibilities. Secondly, there is a rising demand for functional snacks like prebiotics, probiotics, yogurt, and other protein-rich options. This has been helping the market make more sales. Thirdly, eco-friendly practices are being implemented to cause minimal destruction to the environment. Even though this is still at the starting stage, momentous progress is predicted during the forecast period. Moreover, organic snacks that have no chemicals, pesticides, or other harmful toxins are in demand. Furthermore, subscription boxes that include delicacies and detailed options are being emphasized.

EUROPE SNACK PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.95% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

PepsiCo, Mondelēz International, Nestlé, Ferrero Group, Kellogg's, Intersnack Group, Lorenz Snack-World, Unilever, Orkla ASA, Mars Incorporated |

Europe Snack Products Market Segmentation Analysis:

Europe Snack Products Market Segmentation: By Type:

- Salted Snacks

- Bakery Snacks

- Frozen Snacks

- Savory Snacks

- Confectionary

- Others

Confectionery is the most dominant and the largest segment in the market, with a share of approximately 44% in 2023. This is owing to the taste, varieties, flavors, demand, availability, international shipping, the presence of superior organizations, the greater number of food chains offering the product, and the population. Besides, there is a growing popularity of healthier options, helping the segment flourish. Bakery products were also among the top leading categories due to their savor. Frozen snacks are one of the fastest-growing segments owing to healthier alternatives, plant-based options, delicacies, demand, organic options, longer shelf-life, easy storage, and availability. Salted snacks are also growing quickly due to cravings, diversity, and taste.

Europe Snack Products Market Segmentation: By Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

Supermarkets and hypermarkets are the largest distribution channels in the industry. Their overall share is more than 55%. This is due to reasons like availability, originality, authenticity, face-to-face interaction, visual inspection, convenience, and presence. Online retail is the fastest-growing, as a result of the continuous digital revolution. They own around 30% of the revenue share. A growing number of consumers are choosing online meal delivery services due to increased knowledge and the trend of trying new foods. They can order food from the comfort of their house. This makes it simpler for residents of different areas to purchase these food items. Additionally, internet retailers have been providing better customer support and ensuring the freshness of products.

Europe Snack Products Market Segmentation: Regional Analysis:

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

Based on region, the United Kingdom is the largest growing market, holding a rough share of 31%. This is because of the population, presence of key companies, bulk manufacturing, demand, uniqueness, innovations, cultural relevance, appeal, and flavor developments. Germany is the fastest-growing owing to increasing restaurants and fast-food franchises in these areas, a rising number of inhabitants, emerging companies, global operations, urbanization, investments, and culinary explorations. This region holds an approximate share of 25%.

COVID-19 Impact Analysis on the Europe Snack Products Market:

The outbreak of the virus hurt the market. The new standard was mobility restrictions, social isolation, and lockdowns. To stop the virus from spreading, guidelines and standards told hotels, fast-food franchises, and restaurants to close. As a result, the food and beverage sector had to suffer large losses. Moreover, a lot of individuals lost their employment as a result of financial constraints. There weren’t enough personnel in a few other areas to manage daily operations. Transportation, logistics, and the supply chain were all severely disrupted. These factors had a significant impact on import-export commerce. Tourists' consumption of local cuisine decreased as a result of the closure of the tourism business. Furthermore, people realized the importance of having a healthy mind and body and were leaning towards the consumption of home-cooked meals. These all led to a significant downturn in the economy. However, for many local sellers, internet channels became their primary source of income around the middle of the epidemic. According to a report, the number of restaurant delivery customers in France increased by 24% during the pre-pandemic period. Producers began to learn about new technologies and how to sell their produce online. This market has begun to take up and is growing steadily due to the suppliers' present upskilling and digitization.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing creations while maintaining competitive pricing.

Retail outlets are focusing on building online channels. Online food ordering has become very common because of the convenience it offers. This helps people all over the world order their products, thereby helping in the generation of profits.

Key Players:

- PepsiCo

- Mondelēz International

- Nestlé

- Ferrero Group

- Kellogg's

- Intersnack Group

- Lorenz Snack-World

- Unilever

- Orkla ASA

- Mars Incorporated

- In June 2023, Fooditive, a Rotterdam, Netherlands-based Company, used precise fermentation to create its vegan casein, a protein present in milk and dairy products, from a bacterial strain. The business claimed that although it is completely animal-free and kinder to the planet, it is genetically similar to dairy.

- In July 2022, Jack Link's, the biggest meat snack manufacturer in Europe, was working together with Huhtamaki to create recyclable mono-material packaging. The objective was to promote environmental protection and sustainability in EMEA, among other things, by working to transition to greener packaging for the European market. This was launched in the next year.

- In September 2021, the leading frozen food company in Europe, Nomad Foods, and the cutting-edge food company BlueNalu, which is creating a range of seafood products straight from fish cells, partnered to investigate the introduction of cell-cultured seafood in Europe, where there is a growing consumer demand for wholesome, sustainably produced seafood.

Chapter 1. Europe Snack Products Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Type of Material s

1.5. Secondary Type of Material s

Chapter 2. Europe Snack Products Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Snack Products Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Snack Products Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Snack Products Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Snack Products Market– By Type

6.1. Introduction/Key Findings

6.2. Salted Snacks

6.3. Bakery Snacks

6.4. Frozen Snacks

6.5. Savory Snacks

6.6. Confectionary

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Europe Snack Products Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3. Specialty Stores

7.4. Online Retail

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2023-2030

Chapter 8. Europe Snack Products Market, By Geography – Market Size, Forecast, Trends & Insights

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Snack Products Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. PepsiCo

9.2. Mondelēz International

9.3. Nestlé

9.4. Ferrero Group

9.5. Kellogg's

9.6. Intersnack Group

9.7. Lorenz Snack-World

9.8. Unilever

9.9. Orkla ASA

9.10. Mars Incorporated

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The European snack products market was valued at USD 191 billion in 2023 and is projected to reach a market size of USD 286.25 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.95%.

Changing lifestyles and consumer preferences, product diversification and innovation, and an increasing number of eateries are the main drivers propelling the Europe Snack Products Market.

Based on Type, the Europe Snack Products Market is segmented into Salted Snacks, Bakery Snacks, Frozen Snacks, Savory Snacks, Confectionary, and Others.

The United Kingdom is the most dominant region for the Europe Snack Products Market.

PepsiCo, Mondelēz International, and Nestlé are the key players operating in the Europe Snack Products Market.