Snack Products Market Size (2024 – 2030)

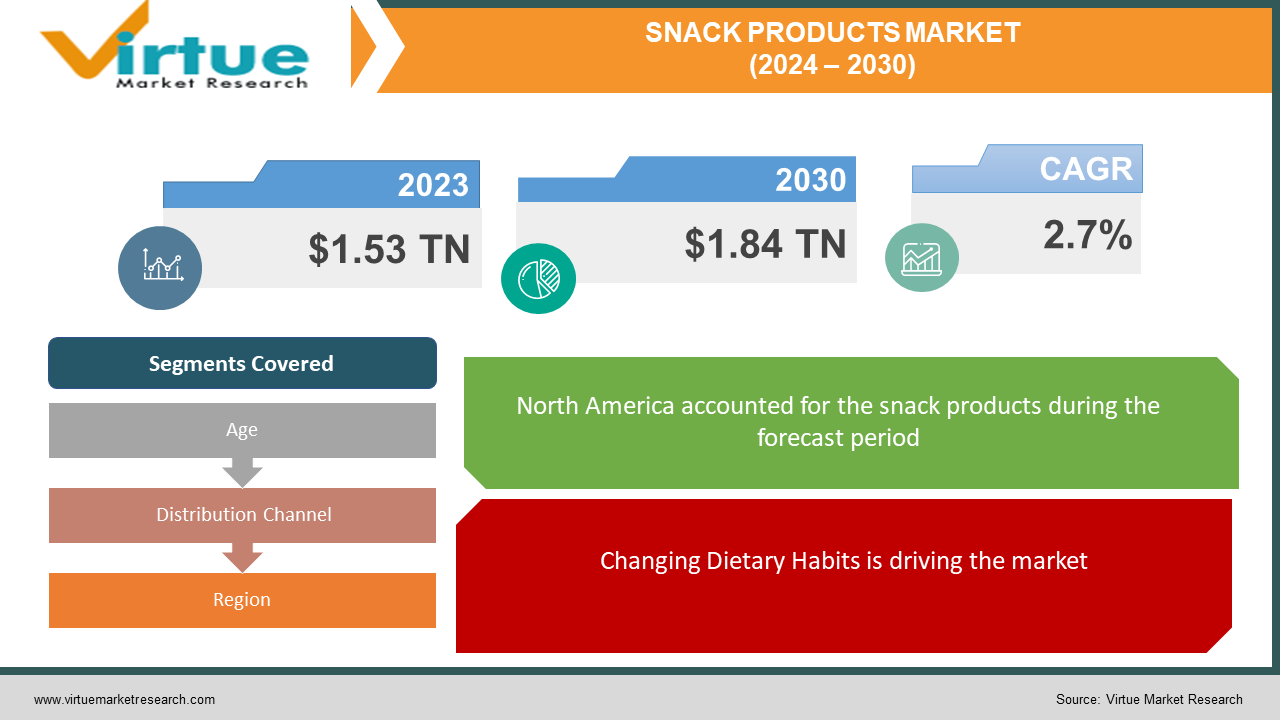

The Global Snack Products Market was valued at USD 1.53 Trillion in 2023 and will grow at a CAGR of 2.7% from 2024 to 2030. The market is expected to reach USD 1.84 Trillion by 2030.

Key Market Insights:

The snack market thrives on convenience and caters to evolving consumer preferences. Busy lifestyles and on-the-go consumption drive demand for healthy, portion-controlled options. Transparency in ingredients and ethical sourcing resonate with health-conscious consumers, while indulgence snacking remains popular. Sustainability is a growing concern, with recyclable packaging and eco-friendly practices gaining traction. Targeting specific demographics with unique flavor profiles and functional benefits (like protein or digestive health) is key. E-commerce platforms offer significant growth potential for snack brands, with convenience and direct-to-consumer models flourishing

Global Snack Products Market Drivers:

Changing Dietary Habits is driving the market.

The tide is turning towards healthier snacking choices as consumers become increasingly health conscious. Gone are the days of mindless indulgence - today's savvy snackers seek options that are lower in calories, fat, and sugar without sacrificing taste or convenience. This shift in preferences has fueled the booming healthy snack market, offering a plethora of nutritious and delicious alternatives. Think of wholesome options like nuts and seeds packed with protein and healthy fats, protein-rich yogurts that keep you satiated, and fruit bars that deliver a burst of natural sweetness and essential vitamins. This trend isn't just about guilt-free indulgence; it's about embracing snacks as a way to fuel an active lifestyle and nourish your body with the good stuff. Manufacturers are taking note, constantly innovating with new ingredients and flavor combinations to cater to this health-focused snacking revolution.

Rising Disposable Income is driving the market

Rising disposable income acts like rocket fuel for the snacking industry, particularly in developing nations. The emergence of a strong middle class translates to more money in pockets, and a larger chunk of that is being directed towards discretionary spending, including snack foods. This newfound financial freedom allows people to move beyond just fulfilling basic needs and indulge in treats and conveniences. Snacking becomes not just a necessity to curb hunger pangs, but also a pleasurable experience. It's a chance to explore new flavors, try trendy items, and satisfy cravings. Manufacturers capitalize on this by introducing premium snack options with unique ingredients and packaging, further propelling the growth of the market. As disposable income continues to rise in developing countries, the snacking scene is poised for an exciting transformation, with consumers driving the demand for tastier, more innovative, and experience-driven snacking options.

Increasing Urbanization is driving the market

Urbanization acts as a major catalyst for the snacking boom. City life is synonymous with busy schedules, long commutes, and limited time for elaborate meal preparations. This fuels the demand for convenient, portable, and quick bites. Snacks become a go-to option for urban dwellers, satisfying hunger pangs between meals or on-the-go commutes. With increased disposable income and exposure to various cultures, urban consumers are drawn to a wider variety of snack options. This creates a market ripe for innovation, with manufacturers offering healthy snacks for the calorie-conscious, indulgent treats for those seeking a break, and even globally-inspired flavors to cater to adventurous palates. As cities continue to grow, so will the snacking phenomenon, constantly evolving to meet the dynamic needs of urban life.

Global Snack Products Market challenges and restraints:

Snack products are high in calories, sugar, unhealthy fats, salt, and artificial additives restricting the market growth

The snack industry is facing a health reckoning. Consumers, bombarded with information about the negative effects of excessive sugar, unhealthy fats, sodium, and artificial additives, are shunning traditional snack options laden with these ingredients. This shift is driven by a growing awareness of the link between diet and chronic diseases like obesity and diabetes. As a result, the market for sugary cookies, greasy chips, and artificially flavored treats is feeling the pinch, forcing manufacturers to innovate and develop healthier snack alternatives that prioritize whole foods, balanced nutrition, and clean labels

The rise of obesity rates globally is a major concern, and snacking is often seen as a contributing factor

The global obesity epidemic is casting a long shadow over the unhealthy snack market. With rates steadily climbing, snacking, particularly on high-calorie, low-nutrient options, is increasingly viewed as a culprit. This perception is fueled by research highlighting the link between sugary drinks, processed snacks, and weight gain. Consumers, bombarded with media messages and health campaigns, are becoming more conscious of this connection. As a consequence, the market for chips, candy bars, and other indulgence-oriented treats is experiencing a decline. This shift in consumer behavior presents a major challenge for snack manufacturers. They need to navigate a landscape where unhealthy options are seen as a threat to public health, requiring them to reformulate products or develop entirely new lines that prioritize portion control, balanced ingredients, and transparency in labeling.

Market Opportunities:

The global snack market presents a wealth of opportunities for companies that can capitalize on shifting consumer trends. The demand for healthier options is booming, opening doors for innovative snack products that are high in protein, fiber, good fats, and whole grains. Functional ingredients like probiotics, antioxidants, and botanicals are gaining traction as consumers seek snacks that not only satisfy hunger but also deliver added health benefits. Ethnic flavors and globally-inspired ingredients are trending, offering exciting taste profiles that cater to adventurous palates. Sustainability is a growing concern, creating opportunities for snacks with eco-friendly packaging and those that are organic, non-GMO, or fair-trade certified. Convenience remains a key factor, and portion-controlled, single-serve packages are ideal for busy lifestyles. Finally, indulgence still has a place, but with a healthier twist. Consumers are interested in treats that use real ingredients, lower sugar content, and cater to specific dietary needs. By tapping into these trends and offering delicious, nutritious, and convenient snack options, companies can win big in the ever-evolving snack market.

SNACK PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.7% |

|

Segments Covered |

By Age, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PepsiCo, Mondelez International, Nestlé, Kellogg's, Mars Incorporated, The Hershey Company, Danone SA, Strauss Group, Utz Brands, Archer Daniels Midland Company |

Snack Products Market Segmentation - By Age

-

Children (Ages 5-12)

-

Teenagers (Ages 13-19)

-

Young Adults (Ages 20-35)

-

Adults (Ages 36-50)

-

Seniors (Ages 50+)

Children (ages 5-12) are generally considered the most dominant consumers. Their sweet tooth, love for fun packaging, and frequent need for energy between meals make them a prime target for snack manufacturers. From vibrantly colored candies to character-themed cookies, the snack industry caters heavily to this group's desires.

Snack Products Market Segmentation - By Distribution Channel

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online Retail Stores

supermarkets and hypermarkets reign supreme in the snack distribution game. Their one-stop-shop approach provides the widest variety of snacks, from budget-friendly private labels to national brands and even bulk options for stocking up. This caters to various needs and price points, making it the go-to destination for most snack purchasers.

Snack Products Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America currently holds the title for the largest snack market, boasting a mature market with established giants and a strong consumer base willing to spend on snacks. However, when it comes to the fastest growth, Asia-Pacific is the rising star. This region is fueled by a booming middle class with rising disposable incomes and a growing urbanization trend.

COVID-19 Impact Analysis on the Global Snack Products Market

The COVID-19 pandemic delivered a surprising jolt to the global snack market. Initial lockdowns triggered panic buying, leading to a surge in demand for shelf-stable snacks as consumers stocked up their pantries. This resulted in a temporary boom for established snack brands, particularly chips, cookies, and other familiar comfort foods. However, as the pandemic progressed, consumer behavior shifted. Increased focus on health and immunity led to a rise in demand for healthier snack options like nuts, seeds, and dried fruits. People spending more time at home also fueled a trend towards convenient, portion-controlled, single-serve snack packs. Supply chain disruptions caused temporary product shortages and price fluctuations, but also presented opportunities for local and regional snack producers. The rise of e-commerce platforms facilitated online snack purchases, offering a safe and convenient alternative to traditional brick-and-mortar stores. While the long-term impact of COVID-19 on the snack market is still unfolding, it has undeniably accelerated pre-existing trends toward healthier snacking and convenient formats. Manufacturers who can adapt their offerings to cater to these evolving consumer preferences and navigate potential supply chain challenges will be well-positioned to thrive in the post-pandemic snack landscape.

Latest trends/Developments

The global snack market is pulsating with innovation, fueled by a confluence of health-conscious consumers and a dash of global influence. On the health front, protein is king, with consumers seeking out snacks packed with nuts, seeds, legumes, and even insect-based options for a satisfying crunch. Functional ingredients are also on the rise, with prebiotics, probiotics, and immunity-boosting vitamins finding their way into snack bars, trail mixes, and even yogurt dips. Clean labels with recognizable, whole-food ingredients are a top priority, with consumers ditching products overloaded with artificial additives and hidden sugars.

Flavor innovation is another exciting trend, with global inspiration taking center stage. Spicy and savory profiles are exploding beyond traditional chip flavors, incorporating ethnic spices like gochujang and harissa for an adventurous twist. Ancient grains like quinoa and amaranth add a unique textural element and a dose of whole-grain goodness. Plant-based snacks are surging in popularity, with innovative meat alternatives like jackfruit and tempeh finding their way into jerky and burger bites. Sustainability is also a growing concern, with companies offering eco-friendly packaging and snacks made with organic, non-GMO, or fair-trade certified ingredients. Convenience remains paramount, with portion-controlled, single-serve packs catering to busy on-the-go lifestyles. However, indulgence hasn't been forgotten – it's simply getting a healthier makeover. Consumers are embracing treats made with real ingredients, lower sugar content, and options that cater to specific dietary needs, like keto-friendly or vegan chocolates. By tapping into these trends and offering a delicious, nutritious, and convenient snacking experience, companies can win big in this dynamic and ever-evolving market.

Key Players:

-

PepsiCo

-

Mondelez International

-

Nestlé

-

Kellogg's

-

Mars Incorporated

-

The Hershey Company

-

Danone SA

-

Strauss Group

-

Utz Brands

-

Archer Daniels Midland Company

Chapter 1. SNACK PRODUCTS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SNACK PRODUCTS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SNACK PRODUCTS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SNACK PRODUCTS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SNACK PRODUCTS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SNACK PRODUCTS MARKET – By Age

6.1 Introduction/Key Findings

6.2 Children (Ages 5-12)

6.3 Teenagers (Ages 13-19)

6.4 Young Adults (Ages 20-35)

6.5 Adults (Ages 36-50)

6.6 Seniors (Ages 50+)

6.7 Y-O-Y Growth trend Analysis By Age

6.8 Absolute $ Opportunity Analysis By Age, 2024-2030

Chapter 7. SNACK PRODUCTS MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets & Hypermarkets

7.3 Convenience Stores

7.4 Specialty Stores

7.5 Online Retail Stores

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. SNACK PRODUCTS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Age

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Age

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Age

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Age

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Age

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. SNACK PRODUCTS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 PepsiCo

9.2 Mondelez International

9.3 Nestlé

9.4 Kellogg's

9.5 Mars Incorporated

9.6 The Hershey Company

9.7 Danone SA

9.8 Strauss Group

9.9 Utz Brands

9.10 Archer Daniels Midland Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Snack Products Market was valued at USD 1.53 Trillion in 2023 and will grow at a CAGR of 2.7% from 2024 to 2030. The market is expected to reach USD 1.84 Trillion by 2030.

Increasing Urbanization, Rising Disposable Income, and Changing Dietary Habits are the reasons that drive the market.

Based on Age it is divided into five segments – Children (Ages 5-12), Teenagers (Ages 13-19), Young Adults (Ages 20-35), Adults (Ages 36-50), Seniors (Ages 50+).

North America is the most dominant region for the Snack Products Market.

PepsiCo, Mondelez International, Nestlé, Kellogg's