Europe Popcorn Market Size (2025-2030)

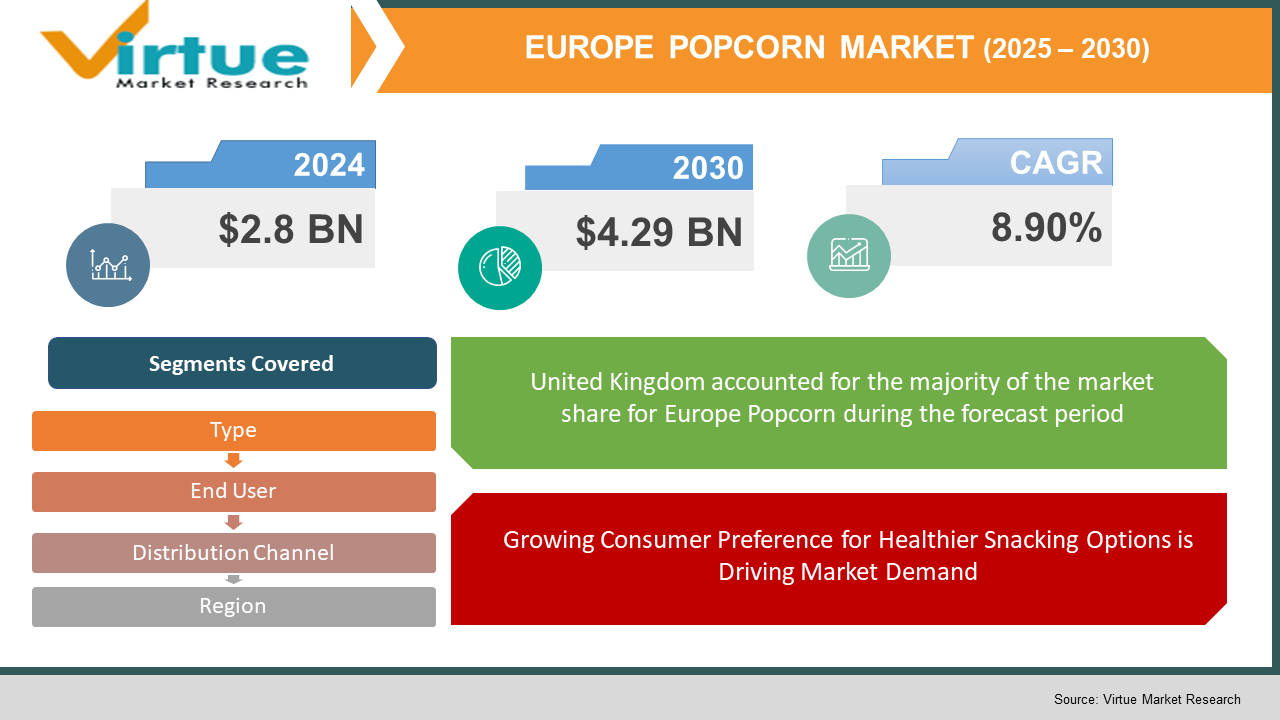

The Europe Popcorn Market was valued at USD 2.8 billion in 2024 and is projected to reach a market size of USD 4.29 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.90%.

The Europe popcorn market is experiencing steady growth, fueled by evolving consumer preferences toward healthier snacking options and convenience. Popcorn, traditionally associated with cinemas and leisure activities, has expanded into a mainstream snack category, with increasing demand for ready-to-eat (RTE) and microwaveable variants. The rising awareness of low-calorie, high-fiber snacks has led to a shift in consumer choices, fueling market expansion across both urban and rural regions. Additionally, manufacturers are introducing a variety of flavors, including cheese, caramel, spicy, and exotic blends, catering to diverse tastes and preferences. The rise in e-commerce and retail distribution channels has further boosted popcorn sales, making it more accessible to consumers across Europe. Moreover, the growing influence of sustainability trends has encouraged the use of eco-friendly packaging and organic ingredients. As innovation in flavors and product offerings continues, the European popcorn market is poised for further expansion, with manufacturers focusing on healthier and premium product lines to attract health-conscious consumers.

Key Market Insights:

- The European popcorn market is witnessing a steady rise in demand, primarily because of the increasing preference for healthier snacking options. Consumers are actively looking for snacks that are low in calories and high in fiber, making popcorn a preferred choice. In fact, studies show that popcorn contains approximately 15 grams of fiber per 100 grams, making it a high-fiber snack compared to traditional chips and other processed foods. Additionally, the demand for gluten-free and whole-grain snacks has surged, with over 60% of European consumers seeking out healthier snack alternatives in recent years.

- The premium and gourmet popcorn segment is experiencing remarkable growth across Europe, fueled by innovative flavor offerings. The popularity of flavored popcorn has increased by nearly 40% over the past five years, with caramel, cheese, and spicy varieties leading the way. The UK and Germany remain the dominant markets for gourmet popcorn, with a growing number of artisanal brands introducing organic and non-GMO products. As a result, the share of premium popcorn in total popcorn sales has surpassed 35%, signaling a shift towards high-quality and unique flavors.

- Retail expansion and digitalization have played a key role in driving popcorn sales across Europe. Supermarkets, convenience stores, and online retail platforms collectively account for over 80% of total popcorn sales in the region, with e-commerce witnessing the fastest growth. Online popcorn sales have increased by more than 50% in the last three years, driven by the convenience of home delivery and the growing number of direct-to-consumer (DTC) brands. The surge of subscription-based snack services has also contributed to increased consumption, particularly among millennials and Gen Z consumers.

Europe Popcorn Market Drivers:

Growing Consumer Preference for Healthier Snacking Options is Driving Market Demand

The growing awareness of health and wellness among European consumers is significantly influencing the demand for healthier snack alternatives, including popcorn. With rising concerns about obesity, diabetes, and lifestyle-related diseases, more people are shifting towards low-calorie, fiber-rich, and whole-grain snacks. Popcorn, being a naturally gluten-free and low-fat snack, has gained traction among health-conscious consumers. Additionally, the growing trend of clean-label and organic products is pushing manufacturers to introduce preservative-free, non-GMO, and air-popped popcorn varieties to cater to the evolving consumer preferences.

Expansion of Gourmet and Flavored Popcorn is Enhancing Market Growth

The need for gourmet and flavored popcorn is rapidly increasing across Europe as consumers seek unique and indulgent snacking experiences. The market has witnessed a surge in exotic flavors, including truffle, spicy cheese, caramelized nuts, and even alcohol-infused varieties. This trend is particularly popular in urban regions where premium and artisanal snack products are highly valued. Foodservice establishments, movie theaters, and specialty snack brands are capitalizing on this opportunity by offering innovative flavors and premium packaging, further driving market expansion.

Rising Popularity of E-Commerce and Online Retail is Boosting Sales

The rapid digitalization of retail and the widespread adoption of e-commerce platforms have significantly contributed to the growth of the European popcorn market. Online grocery shopping has surged in recent years, with many consumers preferring the convenience of doorstep delivery. Popcorn brands are leveraging online platforms, direct-to-consumer (DTC) models, and subscription-based services to enhance their reach and attract a wider customer base. The ability to showcase a diverse range of popcorn products, provide discounts, and enable bulk purchasing online has further strengthened sales in the region.

Growing Demand for Sustainable and Eco-Friendly Packaging is Driving Innovation

Environmental sustainability has become a major concern for European consumers and regulatory bodies, influencing the packaging strategies of snack manufacturers. Many companies are adopting biodegradable, compostable, and recyclable packaging solutions to align with Europe’s strict sustainability goals. As a result, popcorn brands that emphasize eco-friendly packaging and ethical sourcing of ingredients are gaining a competitive edge in the market. The increasing number of consumers willing to pay a premium for sustainable products is expected to further drive the market’s growth in the coming years.

Europe Popcorn Market Restraints and Challenges:

High Competition and Fluctuating Raw Material Prices Pose Challenges to Market Growth

The European popcorn market faces significant challenges because of intense competition among established brands, private labels, and new entrants, leading to pricing pressures and reduced profit margins. Additionally, the fluctuating prices of key raw materials, such as corn and vegetable oils, due to climate change, supply chain disruptions, and geopolitical uncertainties, impact production costs and profitability. Strict food safety regulations and labeling requirements in Europe also pose compliance challenges for manufacturers, increasing operational complexities. Moreover, while healthier and premium popcorn variants are growing in demand, some consumers still perceive popcorn as an occasional treat rather than a staple snack, limiting its consistent consumption and market penetration.

Europe Popcorn Market Opportunities:

The rising shift toward healthier snacking habits in Europe presents significant opportunities for the popcorn market, particularly in the organic, low-calorie, and functional snack segments. Consumers are increasingly seeking guilt-free indulgences, driving demand for air-popped, non-GMO, and gluten-free popcorn varieties. Additionally, the trend of premiumization is creating a niche for gourmet flavors such as truffle, sea salt, and artisanal cheese, catering to sophisticated palates. The rapid expansion of e-commerce and direct-to-consumer channels further enhances market reach, allowing brands to introduce innovative products and personalized offerings. Sustainable packaging and eco-friendly initiatives also provide an opportunity for differentiation, aligning with Europe’s strong environmental consciousness.

EUROPE POPCORN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.90% |

|

Segments Covered |

By Type, end user, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Europe |

|

Key Companies Profiled |

Propercorn, Metcalfe’s Skinny Popcorn, Joe & Seph’s, and The Hershey Company |

Europe Popcorn Market Segmentation:

Europe Popcorn Market Segmentation: By Type:

- Microwave

- Ready-to-Eat

The Ready-to-Eat (RTE) popcorn segment dominates the European popcorn market, fueled by increasing consumer preference for convenience, premium flavors, and healthier snacking options. With busy lifestyles and on-the-go consumption habits, RTE popcorn offers an easy, flavorful, and often healthier alternative to traditional fried snacks, making it the preferred choice across supermarkets, convenience stores, and online retail platforms. The availability of gourmet and organic variants further strengthens its dominance, catering to evolving consumer preferences.

The Microwave popcorn segment is the fastest-growing because of rising home consumption trends, particularly after the pandemic, as people seek affordable, theater-like experiences at home. The segment is gaining traction with innovations such as reduced-fat, air-popped, and minimally processed options. Additionally, the increasing penetration of smart kitchens and microwaves in European households, along with sustainable and biodegradable microwaveable packaging, is propelling its rapid growth in the market.

Europe Popcorn Market Segmentation: By End User:

- Household

- Commercial

The Household segment dominates the European popcorn market as consumers increasingly prioritize at-home snacking experiences, whether for movie nights, casual consumption, or as a healthier alternative to traditional fried snacks. The widespread availability of microwave and ready-to-eat popcorn has made it more convenient for individuals and families to enjoy a quick, flavorful, and low-calorie snack at home. Additionally, the rise of health-conscious eating has led to a surge in need for organic, air-popped, and reduced-fat variants, further solidifying the dominance of this segment. Innovative flavors, premium gourmet options, and sustainable packaging solutions are also attracting a wider customer base, making household consumption the leading segment in the market.

The Commercial segment is the fastest-growing, driven by the expanding presence of cinemas, entertainment venues, and food service establishments across Europe. The resurgence of movie theater attendance post-pandemic, coupled with the growing trend of gourmet popcorn in premium cinemas and themed cafes, has driven significant growth in this category. Additionally, partnerships between popcorn brands and large commercial establishments, such as amusement parks, stadiums, and live events, are amplifying demand. The rise of experiential dining, where popcorn is incorporated into innovative snack menus, has further propelled the segment’s expansion.

Europe Popcorn Market Segmentation: By Distribution Channel:

- Supermarkets

- Convenience Stores

- Online Retail Stores

- Others

The Supermarkets segment dominates the European popcorn market as they serve as the primary distribution channel for both microwaveable and ready-to-eat popcorn. Supermarkets offer an extensive range of popcorn brands, flavors, and packaging sizes, making them the preferred shopping destination for consumers looking for convenience and variety. The availability of promotional discounts, bulk purchasing options, and strategic in-store placements further boost sales. Additionally, supermarkets provide private-label popcorn options at competitive prices, attracting budget-conscious buyers and strengthening their dominance in the market.

The Online Retail Stores segment is the fastest-growing, driven by the growing trend of e-commerce and direct-to-consumer snack delivery services. Consumers increasingly prefer ordering gourmet, organic, and specialty popcorn varieties online, benefiting from doorstep delivery, exclusive discounts, and subscription-based models. The growing influence of social media and digital marketing has further fueled demand, with brands launching limited-edition flavors and customized popcorn gift boxes exclusively through online platforms. As digital shopping habits continue to rise, the online retail segment is expected to witness rapid expansion in the coming years.

Europe Popcorn Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The United Kingdom stands as the dominant market for popcorn in Europe, holding the largest share at approximately 30%. This is fueled by the strong snacking culture, increasing demand for healthier alternatives, and the widespread presence of ready-to-eat popcorn brands in supermarkets and convenience stores. British consumers are also highly receptive to gourmet and flavored popcorn varieties, further fueling market expansion.

On the other hand, Germany is the fastest-growing market, with a 25% share and rapid expansion due to changing consumer preferences, rising health awareness, and the growing trend of home entertainment. The increasing availability of innovative popcorn flavors and the surge in online retail sales have further contributed to its fast-paced growth. Other significant markets include France (15%), where premium and organic popcorn is gaining traction, and Italy (8%) and Spain (7%), where traditional snacking habits are evolving to include healthier, ready-to-eat options. The Rest of Europe collectively contributes 15%, with growing consumption in emerging markets such as Poland and the Netherlands.

COVID-19 Impact Analysis on the Europe Popcorn Market:

The COVID-19 pandemic significantly impacted the Europe popcorn market, initially causing disruptions in supply chains and the temporary closure of cinemas and entertainment venues, leading to a decline in need for on-trade sales. However, the market saw a surge in home consumption, as lockdowns and restrictions led to increased demand for ready-to-eat and microwave popcorn. The shift toward home entertainment and streaming services further boosted sales, particularly through online retail channels. Post-pandemic, the market has continued to expand, with a growing preference for healthier, gourmet, and organic popcorn options, reflecting evolving consumer snacking habits.

Latest Trends/ Developments:

The Europe popcorn market is witnessing a shift towards health-conscious and gourmet varieties, as consumers demand snacks with natural ingredients, reduced salt, and no artificial additives. Brands are increasingly introducing organic, gluten-free, and non-GMO popcorn options to cater to this trend. Additionally, flavor innovation is driving market growth, with unique offerings such as truffle, rosemary, cheddar-jalapeño, and caramel sea salt gaining popularity. The rise in vegan and plant-based diets has also led to the development of dairy-free cheese and butter-flavored popcorn, expanding the market’s reach to a wider audience.

Another significant trend is the rapid growth of online retail channels, driven by e-commerce expansion and the convenience of doorstep delivery. Subscription-based popcorn snack boxes have gained traction, allowing consumers to explore different flavors monthly. Additionally, sustainable packaging solutions, such as biodegradable bags and recyclable pouches, are becoming a key focus for brands looking to meet environmental concerns. The increasing presence of popcorn in movie nights, streaming binges, and social snacking is ensuring steady demand, with private-label brands and premium popcorn options witnessing higher sales across Europe.

Key Players:

- Propercorn

- Metcalfe’s Skinny Popcorn

- Joe & Seph’s

- The Hershey Company

- PepsiCo (PopWorks)

- Conagra Brands (Orville Redenbacher’s)

- Quinn Snacks

- Eagle Foods

- Snyder’s-Lance (Pop Secret)

- Planet Organic

Chapter 1. Europe Popcorn Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Popcorn Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Popcorn Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Type Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Popcorn Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Europe Popcorn Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Popcorn Market – By Distribution Channel

6.1 Introduction/Key Findings

6.2 Supermarkets

6.3 Convenience Stores

6.4 Online Retail Stores

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Distribution Channel :

6.7 Absolute $ Opportunity Analysis By Distribution Channel :, 2025-2030

Chapter 7. Europe Popcorn Market – By Type

7.1 Introduction/Key Findings

7.2 Microwave

7.3 Ready-to-Eat

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 8. Europe Popcorn Market – By End User

8.1 Introduction/Key Findings

8.2 Household

8.3 Commercial

8.4 Y-O-Y Growth trend Analysis End User

8.5 Absolute $ Opportunity Analysis End User, 2025-2030

Chapter 9. Europe Popcorn Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type

9.2.3. By End User

9.2.4. By Distribution Channel

9.2.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Popcorn Market – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

10.1 Propercorn

10.2 Metcalfe’s Skinny Popcorn

10.3 Joe & Seph’s

10.4 The Hershey Company

10.5 PepsiCo (PopWorks)

10.6 Conagra Brands (Orville Redenbacher’s)

10.7 Quinn Snacks

10.8 Eagle Foods

10.9 Snyder’s-Lance (Pop Secret)

10.10 Planet Organic

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe Popcorn Market was valued at USD 2.8 billion in 2024 and is projected to reach a market size of USD 4.29 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.90%.

Rising consumer demand for healthy, convenient, and gourmet snacking options.

Based on Type, the Europe Popcorn Market is segmented into Microwave and Ready-to-Eat.

. The UK is the most dominant region for the Europe Popcorn Market.

Propercorn, Metcalfe’s Skinny Popcorn, Joe & Seph’s, and The Hershey Company are the leading players in the Europe Popcorn Market.