Popcorn Market Size (2024-2030)

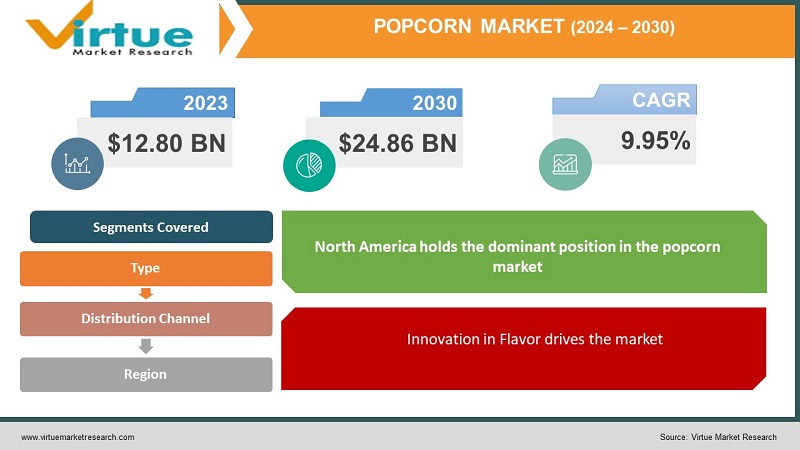

The Popcorn Market was valued at USD 12.80 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 24.86 billion by 2030, growing at a CAGR of 9.95%.

The primary reason behind popcorn's widespread popularity is its convenience, simplicity, and nutritional value. The process involves heating corn kernels in various vessels like kettles, pots, or stovetops, typically with vegetable oil or butter. This age-old snack holds a prominent place in the culinary culture of movie theaters, fairs, carnivals, and sports stadiums globally. Its minimal preparation requirements render it suitable for both home cooking and immediate consumption. Notably, popcorn stands out as a rich source of essential nutrients including proteins, antioxidants, fiber, and B vitamins, making it a favored option for breakfast and various meals in numerous households.

Key Market Insights:

Popcorn enjoys popularity as a snack food due to its rich nutritional profile. Serving as a potent source of proteins, potassium, sodium, and fibers, popcorn stands out as a vibrant and concentrated dietary option. Originating from wild grass, popcorn is a cereal grain characterized by six distinct types of corn. Among these types, it uniquely possesses the ability to expand from its kernel and "pop" when exposed to heat. Consumers commonly enjoy popcorn in two primary forms: microwave popcorn and ready-to-eat (RTE) popcorn. Additionally, there exists a lesser-known form known as kernel form.

Popcorn Market Drivers:

Innovation in Flavor drives the market

Personal health and sustainable development, once relegated to niche interests, have now taken center stage in consumers' minds, particularly concerning food purchases. There is a growing demand for healthy, convenient, and sustainably produced foods, with plant-based proteins experiencing unprecedented popularity. The pandemic has notably influenced consumers to prioritize sustainability and make more health-conscious shopping decisions, leading to a significant shift in expectations.

Furthermore, the popcorn market is being driven by the increasing demand for various flavors. The convenience food sector is experiencing rapid growth due to evolving social and economic dynamics, higher expenditure on food and beverages, increased awareness of healthier food options, changes in meal patterns and entrenched eating habits, and a desire for flavor experimentation.

Key market players are capitalizing on this trend by offering a range of healthy ready-to-eat popcorn options in diverse flavors, thereby further fueling the growth of the popcorn market. Additionally, there is a surge in demand for popcorn among the younger demographic, who seek readily available snacks with a variety of flavors.

Consumers are particularly drawn to flavor innovation in the popcorn category, as the pre-popped convenience of ready-to-eat popcorn lends itself well to experimentation with different tastes and toppings. Many individuals are purchasing new and innovative flavors, including options featuring dried cranberries, candies, and seasonal varieties such as pumpkin spice and gingerbread, alongside classic flavors like cheese, chocolate, or caramel-covered popcorn.

Personal health and sustainable development, previously considered niche interests, have now become key considerations for consumers, particularly about food purchases. There is a growing demand for healthy, convenient, and sustainably produced foods, with plant-based proteins experiencing heightened popularity. The pandemic has prompted a significant shift in consumer expectations, leading individuals to make more health-conscious shopping decisions and prioritize sustainability in their purchasing choices.

Moreover, the popcorn market is being propelled by the increasing demand for diverse flavors. As consumers seek variety and novelty in their snacks, the demand for popcorn with different flavor profiles continues to rise, driving market growth further.

Popcorn Market Restraints and Challenges:

Different competition hinders market growth.

The expansion of the marketplace is hindered by several factors, including the easy availability of alternative snacking options and the presence of a large number of market players, which pose barriers to market growth.

Popcorn Market Opportunities:

A growing trend towards the fusion of snacks and caramel candies is emerging in the market. Companies are introducing popcorn coated with melted caramels in small packs, marketed as sweet snacks. With the increasing market emphasis on ingredient transparency and traceability, companies are now maintaining stringent quality standards by clearly listing ingredients and utilizing specific packaging formats.

POPCORN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.95% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Hershey Company, ConAgra Brands, Inc., FLAMES FOODS, Quinn Foods LLC PepsiCo, Metcalfe’s, Propercorn, CORNPOPPERS LTD, Pop Secret, Weaver Popcorn Company, Inc. |

Popcorn Market Segmentation

Popcorn Market Segmentation By Type:

- Microwave Popcorn

- Ready-to-Eat Popcorn

Ready-to-eat popcorn has captured the largest market share and is expected to maintain its dominance throughout the forecast period. As individuals lead increasingly busy and fast-paced lifestyles, there's a growing emphasis on health consciousness, leading to a higher demand for healthier dietary options. With rising disposable incomes, consumers prioritize convenience over price, thus propelling the ready-to-eat (RTE) popcorn market forward. Additionally, the proliferation of commercial establishments like movie theaters, multiplexes, and stadiums in both developed and developing regions further augments the growth of the RTE popcorn market.

Popcorn Market Segmentation By Distribution Channel:

- hypermarkets/supermarkets

- convenience stores

- online retail stores

- other distribution channels

The B2C segment has emerged as the dominant force in the industry and is poised for continued expansion at a rapid pace, maintaining its leading position throughout the forecast years. The proliferation of internet distribution channels has significantly influenced people's purchasing behavior, with options available at supermarkets/hypermarkets and convenience stores offering enticing benefits such as doorstep service, convenient payment options, considerable cost savings, and a wide array of products on a single platform.

Driven by increased internet usage and consumer preference for shopping apps, major market players are swiftly establishing e-commerce websites in promising markets. The growing consumer inclination towards e-commerce is expected to propel the segment's growth further. Moreover, the price variability of products in supermarkets/hypermarkets, coupled with the availability of a diverse range of brands to suit various budgets, has contributed to consumer preferences in this segment.

Furthermore, there has been a notable increase in consumer demand for salty snacks, including popcorn, leading to product portfolio expansions at supermarkets and hypermarkets to cater to this growing trend.

Popcorn Market Segmentation- by Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

North America holds the dominant position in the popcorn market, boasting the highest market share. As the largest consumer of popcorn in the region, the USA is expected to experience significant growth during the forecasted period. The country's thriving film industry, recognized as one of the most prosperous, plays a pivotal role in driving popcorn sales, with movie theaters serving as the primary distribution channel. Consequently, popcorn sales are witnessing a notable increase primarily due to this channel. In response to the growing demand for popcorn, major companies are introducing a wide range of product flavors. Additionally, Europe and Asia-Pacific are poised to make considerable strides in capturing shares of the popcorn market in the upcoming years.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic, coupled with the growing affordability of electronic goods, has spurred an increase in demand for microwave popcorn. This health crisis significantly impacted the industry, prompting a notable shift in consumer purchasing preferences. There's a rising demand for nutritious, convenient, and sustainably produced foods, with plant-based proteins gaining popularity among consumers. Consumers are now prioritizing products that align with various health and environmental preferences, seeking options that are vegan, natural, organic, clean, reef-friendly, GMO-free, gluten-free, soy-free, and recyclable.

Numerous companies are also actively engaged in developing new product lines within the ready-to-eat/ready-to-cook sectors, aiming to offer healthier and more versatile snack options suitable for all-day consumption, as well as better-for-you snacks that cater to evolving consumer preferences.

Latest Trends/ Developments:

- In November 2022, the University of Nebraska in Lincoln embarked on a project aimed at developing popcorn varieties enriched with higher levels of lysine, an essential amino acid that enhances the nutritional value of popcorn. Conagra Brands, Inc. is providing financial support for this research endeavor and has initiated testing on two popcorn varieties, both of which boast nearly double the lysine content compared to standard popcorn.

- In September 2022, General Mills expanded its popular Trix cereal brand into the snacking sector with the introduction of Trix Popcorn. This new product launch complements General Mills' existing lineup of snackable popcorn, which includes well-known brands like Cinnamon Toast Crunch and Cocoa Puffs.

- In January 2022, PepsiCo's Frito-Lay North America division unveiled a novel popcorn snack seasoned with the iconic Cheetos "Cheetle" seasoning. Available in Cheddar (7-oz bags) and Flamin' Hot (6.6-oz bags) varieties, the ready-to-eat popcorn offers consumers a flavorful snacking experience at a suggested retail price of USD 3.99 per bag.

Key Players:

These are the top 10 players in the Popcorn Market: -

- The Hershey Company

- ConAgra Brands, Inc.

- FLAMES FOODS

- Quinn Foods LLC

- PepsiCo

- Metcalfe’s

- Propercorn

- CORNPOPPERS LTD

- Pop Secret

- Weaver Popcorn Company, Inc.

Chapter 1. GLOBAL POPCORN MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL POPCORN MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL POPCORN MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL POPCORN MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL POPCORN MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL POPCORN MARKET – By Type

6.1. Introduction/Key Findings

6.2. Microwave Popcorn

6.3. Ready-to-Eat Popcorn

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL POPCORN MARKET – By Distribution channel

7.1. Introduction/Key Findings

7.2 hypermarkets/supermarkets

7.3. convenience stores

7.4. online retail stores

7.5. other distribution channels

7.6. Y-O-Y Growth trend Analysis By Distribution channel

7.7. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 8. GLOBAL POPCORN MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution channel

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution channel

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution channel

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution channel

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL POPCORN MARKET – Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

9.1 The Hershey Company

9.2. ConAgra Brands, Inc.

9.3. FLAMES FOODS

9.4. Quinn Foods LLC

9.5. PepsiCo

9.6. Metcalfe’s

9.7. Propercorn

9.8. CORNPOPPERS LTD

9.9. Pop Secret

9.10. Weaver Popcorn Company, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Personal health and sustainable development, once relegated to niche interests, have now taken center stage in consumers' minds, particularly concerning food purchases. There is a growing demand for healthy, convenient, and sustainably produced foods, with plant-based proteins experiencing unprecedented popularity. The pandemic has notably influenced consumers to prioritize sustainability and make more health-conscious shopping decisions, leading to a significant shift in expectations.

The top players operating in the popcorn Market are -The Hershey Company, ConAgra Brands, Inc., FLAMES FOODS, Quinn Foods LLC, PepsiCo, Metcalfe’s, Propercorn, CORNPOPPERS LTD, Pop Secret, and Weaver Popcorn Company, Inc.

The COVID-19 pandemic, coupled with the growing affordability of electronic goods, has spurred an increase in demand for microwave popcorn. This health crisis significantly impacted the industry, prompting a notable shift in consumer purchasing preferences.

A growing trend towards the fusion of snacks and caramel candies is emerging in the market. Companies are introducing popcorn coated with melted caramels in small packs, marketed as sweet snacks. With the increasing market emphasis on ingredient transparency and traceability, companies are now maintaining stringent quality standards by clearly listing ingredients and utilizing specific packaging formats.

Europe and the APAC region are poised to make considerable strides in capturing shares of the popcorn market in the upcoming years