Europe Pet Food Market Size (2024-2030)

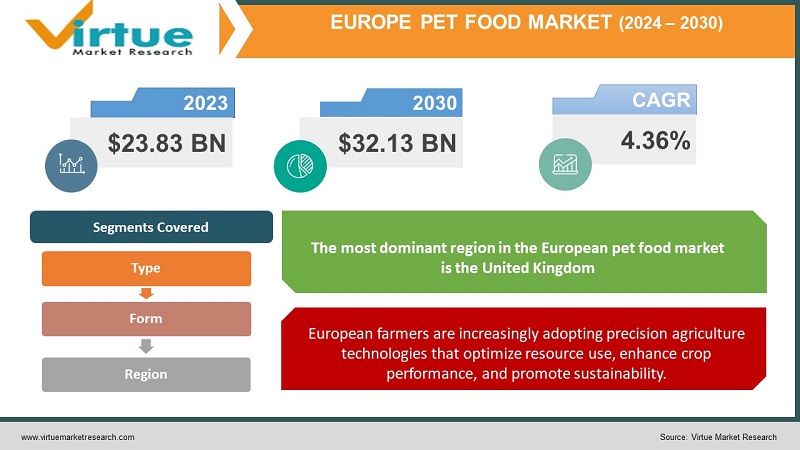

The Europe Pet Food Market is valued at USD 23.83 Billion and is projected to reach a market size of USD 32.13 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.36%.

Europe boasts a long-standing love affair with pets. Cats and dogs reign supreme, but birds, fish, and smaller mammals also hold a special place in many European homes. This deep-rooted companionship creates a robust and growing market for pet food, with key trends shaping its evolution. Pets are increasingly seen as beloved family members. This drives a desire for premium, nutritious pet food, mirroring human food trends. A shift towards higher-quality ingredients, specialized formulations, and super-premium brands is evident as owners look to provide the best possible nutrition for their furry companions. Pet food trends often follow human health and wellness trends. Grain-free, organic, clean-label, and limited-ingredient options are gaining traction. Age-specific pet foods (puppy, adult, senior), breed-specific formulations, and diets tailored for health conditions (weight management, allergies) are in demand. Functional foods and supplements addressing joint health, skin and coat health, digestion, and even cognitive function reflect a desire for proactive pet healthcare.

Key Market Insights:

Throughout the forecast period, the eco-friendly and sustainable pet food market is anticipated to rise at a CAGR of 9.2%. Of the entire European pet food market, the United Kingdom holds about 25% of the share.

The dry pet food segment dominates the market, accounting for around 60% of the total share, driven by its convenience, long shelf life, and affordability. The treat and complementary pet food segment is experiencing significant growth due to the rising trend of pet pampering and the desire for indulgent and functional treats.

Supermarkets and hypermarkets hold 45% of the market share, making them the primary distribution channels. With their extensive selection of high-end and specialist pet food products, pet specialty stores are becoming more and more popular.

Throughout the projected period, pet specialty stores are expected to increase at a CAGR of 6.8%. Online retail channels are expected to develop at a CAGR of 8.2% between 2023 and 2027.

Dogs account for approximately 65% of the total pet food market share. The cat food segment is projected to grow at a CAGR of 5.1% during the forecast period. The market for premium pet food is expected to develop at a compound annual growth rate (CAGR) of 7.2% between 2023 and 2027.

Europe Pet Food Market Drivers:

In Europe, there's an undeniable shift in the way pets are perceived. Increasingly, they are seen as integral family members rather than simply animals. This humanization trend is a major driver shaping the pet food market.

Loneliness, the desire for companionship, and the mental health benefits derived from pet ownership are fueling pet adoption across Europe. This leads to a greater willingness to invest in providing the best possible care for these furry companions. Owners who consider their pets as a family are more inclined to seek high-quality pet foods that mirror their preferences for healthy, natural, and premium ingredients. Just as with human food trends, there's a desire to offer pets food and treats that are not just nutritious but also enjoyable. This fuels demand for gourmet flavors, unique textures, and a wider variety of pet food options. Pet food brands focusing on high-quality, human-grade ingredients, often with claims like "organic," "grain-free," or "limited ingredient" are flourishing in this environment. Functional ingredients for digestive health, joint support, and addressing age-specific needs find a receptive market, fueled by owners seeking the best for their pet companions. The humanization trend favors tailored nutrition, leading to growth in breed-specific, life-stage-focused, and veterinary-prescribed pet food options. Pampering pets translates into a booming market for gourmet treats, dental treats, and other products that combine enjoyment with potential functional benefits.

European farmers are increasingly adopting precision agriculture technologies that optimize resource use, enhance crop performance, and promote sustainability.

Obesity is recognized as a major health concern for pets, just as it is with humans. This drives the demand for weight management solutions within the pet food sector. Pet food manufacturers are focusing on formulations that help manage common pet health issues such as allergies, skin problems, kidney disease, and other chronic conditions. Pet food manufacturers are focusing on formulations that help manage common pet health issues such as allergies, skin problems, kidney disease, and other chronic conditions. Ingredients like probiotics, prebiotics, omega-3 fatty acids, and various botanicals are being incorporated into pet food formulas to offer health benefits beyond basic nutrition. Veterinarians play an influential role in recommending specialized diets and fostering trust in the efficacy of pet foods with targeted health claims. Consumers are seeking pet food with scientifically backed claims based on research, shifting away from purely anecdotal product assertions. Owners invested in health-focused pet foods demand greater transparency in sourcing, ingredient lists, and manufacturing processes. We expect to see more partnerships between pet food brands and veterinary professionals to develop and promote nutrition plans that offer health management solutions.

Europe Pet Food Market Restraints and Challenges:

Rising inflation and economic uncertainty across Europe can cause consumers to scrutinize their spending habits. Pet food, especially premium options, might be perceived as a discretionary expense where consumers could seek cost-saving alternatives. With rising costs across various household necessities, competition for consumers' budgets intensifies. This might lead pet owners to re-evaluate their pet food choices. Global supply chain issues and geopolitical events can drive up the costs of raw materials, ingredients, packaging, and energy required in pet food production. This squeezes manufacturers' margins. The extent to which manufacturers can pass increased costs onto consumers is limited. This could lead to reduced profitability or force companies to reformulate products, potentially impacting quality or consumer perception. The growing emphasis on sustainable ingredients and eco-friendly packaging adds another layer of cost considerations, potentially limiting options for cost-conscious producers. Pet owners are becoming increasingly discerning about the ingredients in pet food. Concerns about artificial additives, by-products, and ingredient origins can lead consumers to avoid certain brands. Consumers expect clear labeling, detailed nutritional information, and traceability of ingredients. Meeting these demands can increase costs for manufacturers.

Europe Pet Food Market Opportunities:

The deepening bond between European pet owners and their furry companions fuels a desire to provide the highest quality nutrition. This drives the demand for premium and super-premium pet foods. Consumers seek formulas with natural, whole-food ingredients, limited additives, and clear sourcing transparency. Grain-free, high-protein, and functional pet foods are gaining popularity. Recipes addressing specific pet needs like weight management, food sensitivities, age-related issues, and breed-specific formulations offer growth potential. The trend towards personalization extends to pet nutrition. There's growing interest in tailored food solutions based on a pet's breed, life stage, activity level, and individual health concerns. Customized pet food subscriptions offering tailored blends and convenient home delivery are finding a receptive audience, particularly among busy pet owners. Emerging pet food brands are leveraging direct-to-consumer models and targeted online marketing to reach niche audiences and offer personalized experiences.

EUROPE PET FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

4.36% |

|

Segments Covered |

By Type, Form, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Nestlé Purina Petcare, Mars Petcare, Hill's Pet Nutrition, Affinity Petcare , Dechra Pharmaceuticals, United Petfood , Butcher's Pet Care, Fressnapf |

Europe Pet Food Market Segmentation-

Europe Pet Food Market Segmentation: By Type

- Dog Food

- Cat Food

- Other Pet Foods

Dog food often accounts for approximately 60-70% of the total European pet food market, depending on the source and boundaries of the data. Dogs hold a special place in many European households, with high rates of pet ownership contributing to the largest market share within the pet food sector. The sheer variety of dog breeds, ranging from tiny companions to large working breeds, leads to a wide range of nutritional requirements. This translates into diverse market offerings for dog food. Dog food often caters meticulously to varying needs based on life stages – from puppy formulas with growth support to specialized senior dog food for aging joints and cognitive function. The rise of breed-specific diets, claiming to be tailored to the unique characteristics of certain breeds, contributes to further diversification within the dog food segment.

Cat food holds a significant portion of the market, making up roughly 30-40% of the European pet food landscape. This segment is demonstrating faster growth compared to dog food in certain regions. Smaller living spaces in urban areas, along with busy lifestyles, make cats appealing pets for many Europeans. Growing cat ownership contributes to the expanding market share of cat food. Cats are known for their discerning palates and distinct dietary needs as obligatory carnivores. This necessitates specialized cat food formulations focusing on high protein content and appealing textures. Cat owners are increasingly aware of feline-specific conditions like urinary tract health, kidney issues, and weight management. This drives the demand for specialized and functional cat food.

Europe Pet Food Market Segmentation: By Form

- Dry Pet Food

- Wet Pet Food

- Treats

- Semi-Moist

Dry food comprises the largest segment of the European pet food market, estimated to hold over 60% of the market share. Easy to store, portion, and feed with a long shelf life. Often the most budget-friendly option compared to other product forms. The texture of kibble can help with dental cleaning and oral health. Wide range of formulas for different ages, breeds, and specific health needs. Dry food will continue to be a staple due to its practicality, affordability, and role in certain pet healthcare solutions.

Wet pet food holds a sizable portion of the market, with estimates often ranging between 20-30%. While dry food maintains its dominance, the wet pet food and treat segments are experiencing significant growth. Increased focus on fresh, high-quality ingredients fuels the growth of the wet food segment. Wet food is often seen as a healthier alternative due to moisture content and the perception of higher-quality ingredients. The rise of single-serve pouches appeals to on-the-go lifestyles and caters to smaller breeds. Expect wet food innovation, both in everyday formulas and specialized diets, to drive further growth in this segment.

Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The most dominant region in the European pet food market is the United Kingdom, accounting for approximately 25% of the total market share. The UK is characterized by a strong preference for premium and super-premium pet food products, as well as a growing demand for locally sourced and sustainable options. The country boasts a high pet ownership rate, with dogs and cats being the most common pets. The UK market is characterized by a strong preference for premium and super-premium pet food products, driven by pet owners' willingness to invest in their pets' well-being.

The fastest-growing region in the European pet food market is the Rest of Europe category, which includes countries like Poland and the Netherlands. The remaining regions of Europe, including countries like Poland, the Netherlands, Belgium, Sweden, and Switzerland, collectively account for approximately 24% of the European pet food market. These regions exhibit diverse preferences and market dynamics, with varying emphases on premium, natural, and specialized pet food products. These regions are witnessing significant growth due to increasing pet ownership rates, rising disposable incomes, and a growing demand for premium and specialized pet food products.

COVID-19 Impact Analysis on the Europe Pet Food Market:

Border closures, factory disruptions, and logistical bottlenecks led to potential delays and shortages in pet food supplies and ingredients. Heightened anxiety caused some pet owners to stockpile pet food, creating temporary fluctuations in demand. Lockdowns and increased time at home spurred a rise in pet adoptions and fostered deeper bonds with existing pets. This expanded the overall market for pet food. Concerns about health and well-being extended to pets. Increased awareness of pet nutrition and quality ingredients benefited the premium pet food segment. Online sales of pet food soared as shopping habits shifted due to store closures, social distancing, and the sheer convenience of home delivery. Increased focus on pet health and well-being, paired in some cases with higher disposable income due to decreased spending on other activities, accelerated the premiumization trend in pet foods. Pet owners sought pet foods that mirrored their healthy eating trends – natural ingredients, functional foods, and even customized diets gained further traction. Manufacturers and retailers worked towards greater resilience, diversifying supply networks, and strengthening inventory management to handle future disruptions. E-commerce for pet food is here to stay. Direct-to-consumer models, online subscription services, and targeted digital marketing have become paramount. COVID-19 indirectly amplified discussions about the environmental impact of pet food. More consumers may seek sustainable options and ethically sourced ingredients in the future.

Latest Trends/ Developments:

Consumers are scrutinizing labels and demanding transparent information about ingredients, sourcing practices, and the overall environmental footprint of pet food production. The growing interest in plant-based and alternative proteins extends to the pet food aisle. Insect-based proteins and cell-cultured meat innovations are on the radar, though still niche. Concepts like utilizing food by-products or surplus ingredients to create nutritious pet food resonate with ethically driven consumers seeking to minimize waste. Demand for recyclable, compostable, or reduced-packaging pet food is increasing, making sustainability a competitive differentiator. The deepening human-pet bond drives owners to seek the absolute best for their companions, fueling the premium and super-premium pet food sectors. Pet food trends reflect human food preferences – clean labels, grain-free options, ancient grains, and whole-food ingredients. Pet owners are embracing a proactive approach to pet health, seeking pet foods not just for sustenance but for promoting long-term well-being. Partnerships between veterinarians and pet food companies are evolving, emphasizing tailored nutrition plans and proactive health monitoring. The use of AI, analytics, and wearable pet trackers could enable hyper-personalized nutrition plans tailored to a pet's activity levels, breed, and even specific health markers.

Key Players:

- Nestlé Purina Petcare

- Mars Petcare

- Hill's Pet Nutrition

- Affinity Petcare

- Dechra Pharmaceuticals

- United Petfood

- Butcher's Pet Care

- Fressnapf

Chapter 1. Europe Pet Food Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Pet Food Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Pet Food Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Pet Food Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Pet Food Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Pet Food Market– By Type

6.1. Introduction/Key Findings

6.2. Dog Food

6.3. Cat Food

6.4. Other Pet Foods

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Pet Food Market– By Form

7.1. Introduction/Key Findings

7.2 Dry Pet Food

7.3. Wet Pet Food

7.4. Treats

7.5. Semi-Moist

7.6. Y-O-Y Growth trend Analysis By Form

7.7. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 8. Europe Pet Food Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Form

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Pet Food Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Nestlé Purina Petcare

9.2. Mars Petcare

9.3. Hill's Pet Nutrition

9.4. Affinity Petcare

9.5. Dechra Pharmaceuticals

9.6. United Petfood

9.7. Butcher's Pet Care

9.8. Fressnapf

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The ever-deepening bond between Europeans and their companion animals drives them to provide the absolute best care, including premium pet foods that support their pet's health and well-being.

Similar to human health trends, pet obesity is a major concern across Europe, fueled by overfeeding, lack of exercise, and a potential misunderstanding of nutritional needs.

Nestlé Purina Petcare, Mars Petcare, Hill's Pet Nutrition, Affinity Petcare

Dechra Pharmaceuticals, United Petfood, Butcher's Pet Care, Fressnapf.

The UK currently holds the largest market share, estimated at around 25%.

The fastest-growing region in the European pet food market is the Rest of Europe category, which includes countries like Poland and the Netherlands. These regions are witnessing significant growth due to increasing pet ownership rates, rising disposable incomes, and a growing demand for premium and specialized pet food products.