European mushroom Cultivation Market Size (2024-2030)

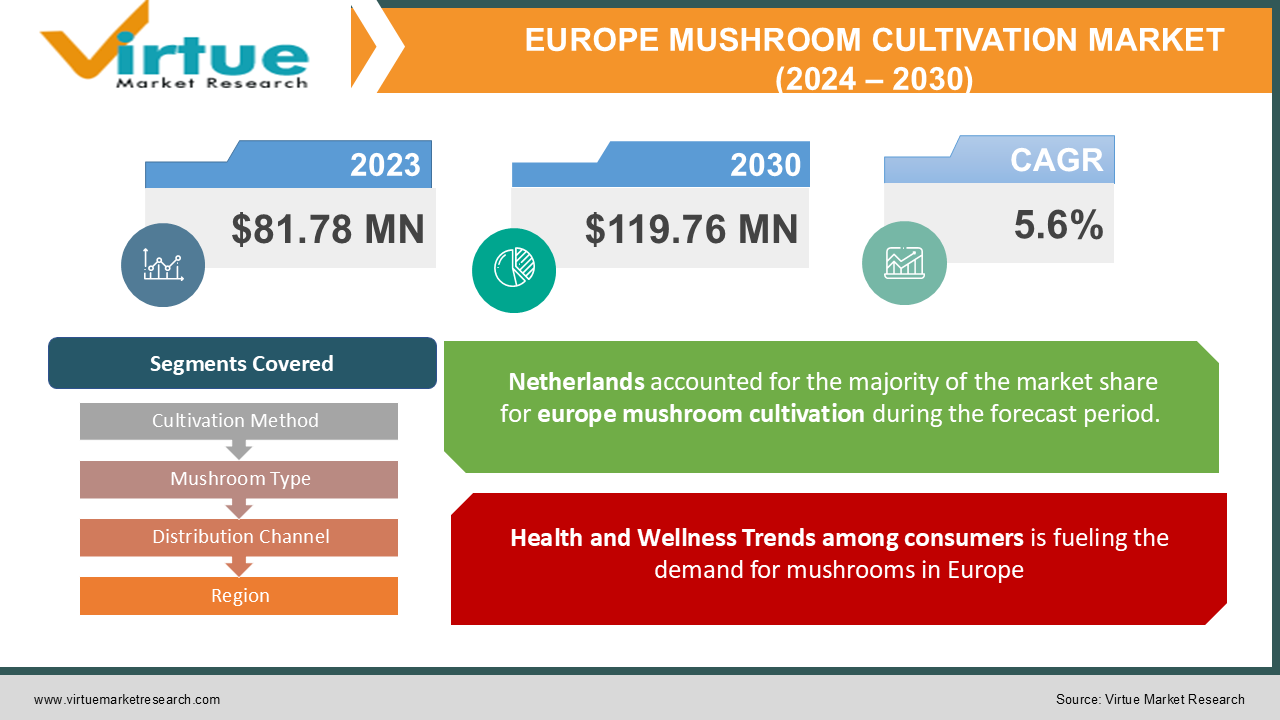

The European mushroom Cultivation Market was valued at USD 81.78 Million and is projected to reach a market size of USD 119.76 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%.

The European mushroom cultivation market is experiencing steady growth driven by increasing consumer awareness of the nutritional benefits and culinary versatility of mushrooms. Factors like rising health consciousness, dietary preferences, and the popularity of plant-based diets have boosted demand for mushrooms. Additionally, the expansion of the organic and gourmet food sectors has further driven market growth. European countries are actively investing in innovative cultivation techniques, sustainability practices, and product diversification, positioning the region as a significant player in the global mushroom market. However, challenges related to climate change, supply chain disruptions, and regulatory constraints continue to influence market dynamics, prompting the industry to adapt and innovate to meet evolving consumer demands.

Key Market Insights:

- In Europe, more than 286,000 tons of fresh cultivated mushrooms were produced from 2015 to 2020. The Netherlands, Poland, and Spain were the leading countries in mushroom production during this period.

- Europe accounts for approximately 10% of the world's dried mushroom market. In 2019, European dried mushroom imports reached 11 thousand tonnes, valued at EUR 150 million. Around 45% of the European dried mushroom trade consists of imports from developing countries.

- Import prices for dried mushrooms are generally higher in Europe than in the rest of the world.

- In the next five years, the European market for dried mushrooms is likely to increase with an annual growth rate of 1-3%.

- Germany is a particularly attractive market for organic dried mushrooms, as the country is the largest European market for organic food.

- The rapid growth of the vegan lifestyle is exemplified by data from the United Kingdom, where a survey conducted by the Vegan Society revealed that the vegan population in Britain has surged by over 360% in the last ten years, resulting in more than 500,000 individuals embracing a vegan diet and driving the growth of mushroom cultivation market in Europe.

Europe Mushroom Cultivation Market Drivers:

Health and Wellness Trends among consumers is fueling the demand for mushrooms in Europe

Growing consumer awareness and emphasis on health and wellness has fueled the demand for mushrooms in Europe. Mushrooms are recognized for their nutritional benefits, low-calorie content, and potential health-promoting properties. They are a rich source of vitamins, minerals, antioxidants, and fiber, making them appealing to health-conscious consumers. As individuals seek healthier food options and incorporate mushrooms into their diets, the market continues to expand. Additionally, mushrooms are being explored for their potential medicinal applications, further contributing to market growth.

Sustainability and Environmental Concerns are accelerating the growth of the mushroom cultivation market in Europe

The European market has witnessed a surge in sustainability initiatives and eco-friendly practices, and mushroom cultivation aligns well with these trends. Mushroom farming is often considered environmentally friendly due to its low carbon footprint and ability to recycle agricultural waste materials. Consumers and businesses are increasingly seeking sustainable food sources, and mushrooms fit this profile as they can be grown on various organic substrates. Additionally, the circular economy approach in the mushroom industry, where byproducts are utilized as valuable resources, resonates with Europe's commitment to reducing food waste and environmental impact, bolstering the market's growth prospects.

Europe Mushroom Cultivation Market Restraints and Challenges:

Climate Vulnerability poses a hindrance to the cultivation of mushrooms, limiting the growth of this market

Mushroom cultivation is sensitive to climate conditions, particularly temperature and humidity. Variability in weather patterns, including extreme temperatures, droughts, and excessive rainfall, can disrupt mushroom growth cycles and reduce yields. As climate change continues to impact European regions, growers may face increased unpredictability and risk in their operations. This necessitates investments in climate-controlled facilities and adaptive farming practices, which can be financially burdensome for smaller producers.

Supply Chain Disruptions disrupt the positive trajectory of the mushroom cultivation market

The mushroom industry relies heavily on a complex supply chain, including the sourcing of raw materials, transportation, and distribution. Supply chain disruptions, such as those caused by the COVID-19 pandemic or transportation bottlenecks, can significantly affect the availability and cost of mushrooms in the market. Mushroom cultivation's relatively short shelf life further exacerbates these challenges. Finding ways to secure supply chain resilience, reduce transportation-related emissions, and improve storage and distribution systems is vital for ensuring a stable and efficient mushroom market in Europe.

Europe Mushroom Cultivation Market Opportunities:

The European mushroom cultivation market presents promising opportunities for growth through innovations in sustainable and organic farming practices, diversification of mushroom varieties, and increased focus on value-added products like mushroom extracts and powders for the food and healthcare industries. Furthermore, leveraging technology for precision farming, exploring new distribution channels, and capitalizing on the rising demand for plant-based and healthier food options provide avenues for market expansion and competitiveness in the evolving European culinary and wellness landscapes.

EUROPE MUSHROOM CULTIVATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6 % |

|

Segments Covered |

By Cultivation Method , Mushroom Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

U.K, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Monaghan Mushrooms Ltd , Bonduelle Group , Okechamp S.A. , Scelta Mushrooms BV , Prochamp BV , Italspwan Group , Banken Champignons , Flemming Dreisig A/S , Hughes Mushrooms Ltd , Monalisa SpA |

Segmentation Analysis

Europe Mushroom Cultivation Market - By Cultivation Method:

- Conventional Cultivation

- Organic Cultivation

- Hydroponic Cultivation

The largest segment among these cultivation methods in the Europe mushroom cultivation market is Conventional Cultivation holding over 40% share in the market. This dominance is primarily due to its long-standing history, established infrastructure, and cost-effectiveness. Conventional methods have been widely adopted by commercial mushroom growers for their ability to yield high quantities of mushrooms reliably and efficiently. The simplicity and lower production costs associated with conventional cultivation make it a preferred choice for meeting the substantial demand for mushrooms in various culinary and industrial applications.

The fastest-growing segment among these cultivation methods is Organic Cultivation. This growth is propelled by the increasing consumer demand for organic and sustainably produced food products. Organic cultivation methods, which avoid synthetic chemicals and prioritize environmental sustainability, resonate with health-conscious and eco-friendly consumers who seek premium-quality mushrooms. As awareness of the benefits of organic products continues to rise, the organic cultivation segment is expected to sustain rapid growth, driven by the premium pricing it commands and its alignment with evolving consumer preferences for healthier and environmentally responsible choices.

Europe Mushroom Cultivation Market - By Mushroom Type:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Portobello Mushroom

- Others

Button mushrooms are typically the largest segment among the various mushroom types in the Europe region, holding approximately 60% of the market share. This dominance is primarily because button mushrooms are widely consumed and used in various culinary applications, making them a staple in European diets. They have a broad consumer base and are versatile in both home cooking and the food service industry. Additionally, their straightforward cultivation process and adaptability to different growing conditions contribute to their large-scale production, ensuring consistent supply and demand stability.

The Shiitake mushroom segment is anticipated to experience the fastest growth at a CAGR of 11.5% in the European mushroom cultivation market. Shiitake mushrooms have gained popularity for their unique umami flavor and potential health benefits, appealing to a growing number of health-conscious and gourmet-focused consumers in Europe. As more people embrace plant-based diets, Shiitake mushrooms are seen as a versatile meat substitute, further driving demand. Additionally, their adaptability to indoor and outdoor cultivation methods and relatively shorter cultivation cycles make them an attractive choice for growers, leading to increased production and availability in the market.

Europe Mushroom Cultivation Market - By Distribution Channel:

- Supermarkets

- Specialty Stores

- Online Retail

- Wholesalers

Among the distribution channels in the Europe mushroom cultivation market, the supermarket segment is the largest accounting for over 38% revenue share. This is primarily because supermarkets have a vast consumer reach, making mushrooms readily available to a wide and diverse customer base. These retail giants offer convenience and accessibility, ensuring that mushrooms are a staple in most households. Their consistent supply, prominent shelf space, and competitive pricing contribute to the high volume of mushroom sales through these channels, making them the largest segment in the market.

The fastest-growing segment among these distribution channels is Online Retail growing at a CAGR of 10%. This growth is primarily driven by the increasing consumer preference for online shopping and the convenience it offers. The ability to order fresh and perishable products like mushrooms online has gained popularity, especially during the COVID-19 pandemic. Online platforms also provide access to a wider range of mushroom varieties and specialty products, appealing to diverse consumer preferences. As e-commerce continues to expand and evolve, the online retail segment in the mushroom market is expected to sustain its rapid growth.

Europe Mushroom Cultivation Market - By Regional:

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

The Netherlands held the largest market share, accounting for over 31.3% of market revenue in the Europe Mushroom Cultivation market. The country has invested heavily in modern and sustainable farming practices, including advanced technology and controlled environment agriculture, enabling year-round mushroom production. Additionally, the Netherlands has a well-developed infrastructure for distribution and export, making it a major supplier of mushrooms to both domestic and international markets. Statistics indicate that the Netherlands produces over 350,000 tons of mushrooms annually, solidifying its position as a leading player in the European mushroom cultivation market.

Poland is the fastest-growing segment in the European mushroom cultivation market. This growth is attributed to several factors, including favorable climate conditions, a robust agricultural sector, and increasing investment in mushroom cultivation. Poland's strategic location in Europe facilitates exports to neighboring countries, further boosting its mushroom production. Statistics indicate that Poland produces around 330,000 tons of mushrooms annually, making it a significant contributor to the European market.

COVID-19 Impact Analysis on the Europe Mushroom Cultivation Market:

The COVID-19 pandemic significantly impacted the European mushroom Cultivation Market, presenting a complex set of challenges and opportunities. On one hand, the increased consumer focus on health and immunity bolstered demand for mushrooms, given their recognized nutritional benefits. However, lockdowns, disruptions in the supply chain, and shifts in consumer purchasing behavior posed operational challenges to growers. The pandemic also highlighted the need for enhanced food safety measures within the industry. Mushroom cultivation faced labor shortages and increased production costs due to health and safety protocols. Moving forward, the industry is expected to continue adapting to these changes by investing in automation, sustainable practices, and diversification of product offerings to meet evolving consumer preferences in the post-pandemic era.

Latest Trends/ Developments:

Many European companies are prioritizing sustainability in mushroom cultivation. They are adopting environmentally friendly practices such as using renewable energy sources, reducing water usage, and implementing waste-reduction techniques. Additionally, the recycling of agricultural byproducts, such as straw or sawdust, as substrate materials for mushroom growth is becoming more common. These initiatives not only align with consumer demands for eco-conscious products but also help reduce production costs and enhance long-term viability in the market.

To cater to a broader consumer base and expand market reach, companies are diversifying their mushroom product offerings. This includes the development of specialty mushroom varieties like shiitake, oyster, and maitake, which are gaining popularity for their unique flavors and potential health benefits. Furthermore, businesses are exploring value-added products such as mushroom extracts, powders, and snacks, capitalizing on the growing interest in functional foods and dietary supplements. These strategies enable companies to tap into new segments of the market and increase their competitiveness in the evolving culinary and wellness landscapes.

Key Players:

- Monaghan Mushrooms Ltd

- Bonduelle Group

- Okechamp S.A.

- Scelta Mushrooms BV

- Prochamp BV

- Italspwan Group

- Banken Champignons

- Flemming Dreisig A/S

- Hughes Mushrooms Ltd

- Monalisa SpA

In November 2022, Scelta Inside, a subsidiary of the Scelta Mushrooms Group, entered into a distribution partnership with MBio, the innovation division of the Monaghan Group. This collaboration aims to expand the worldwide market for natural food ingredients by providing vitamins sourced from mushrooms.

In March 2022, Cornerstone Investment Management, previously known as Cornerstone Partners, a private equity investment manager, teamed up with Kartesia, a specialized European financing provider, and OKECHAMP S.A., a Polish mushroom producer, to form a prominent global player in the mushroom production industry.

Chapter 1. Europe Mushroom Cultivation Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Mushroom Cultivation Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Mushroom Cultivation Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Mushroom Cultivation Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Mushroom Cultivation Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Mushroom Cultivation Market– By Cultivation Method

6.1. Introduction/Key Findings

6.2. Conventional Cultivation

6.3. Organic Cultivation

6.4. Hydroponic Cultivation

6.5. Y-O-Y Growth trend Analysis By Cultivation Method

6.6. Absolute $ Opportunity Analysis By Cultivation Method, 2024-2030

Chapter 7. Europe Mushroom Cultivation Market– By Mushroom Type

7.1. Introduction/Key Findings

7.2 Button Mushroom

7.3. Shiitake Mushroom

7.4. Oyster Mushroom

7.5. Portobello Mushroom

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Mushroom Type

7.8. Absolute $ Opportunity Analysis By Mushroom Type, 2024-2030

Chapter 8. Europe Mushroom Cultivation Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets

8.3. Specialty Stores

8.4. Online Retail

8.5. Wholesalers

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 9. Europe Mushroom Cultivation Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Cultivation Method

9.1.3. By Mushroom Type

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Mushroom Cultivation Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Monaghan Mushrooms Ltd

10.2. Bonduelle Group

10.3. Okechamp S.A.

10.4. Scelta Mushrooms BV

10.5. Prochamp BV

10.6. Italspwan Group

10.7. Banken Champignons

10.8. Flemming Dreisig A/S

10.9. Hughes Mushrooms Ltd

10.10. Monalisa SpA

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The European mushroom Cultivation Market was valued at USD 81.78 Million and is projected to reach a market size of USD 119.76 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%.

Health and Wellness Trends among consumers along with Sustainability and Environmental Concerns are expanding the Europe Mushroom Cultivation market globally

Based on the cultivation method, Europe's Mushroom Cultivation market is divided into Conventional Cultivation, Organic Cultivation, and Hydroponic Cultivation.

The Netherlands is the most dominant region for the European mushroom Cultivation Market.

Monaghan Mushrooms Ltd, Bonduelle Group, Okechamp S.A., and Scelta Mushrooms BV. are a few of the key players operating in the Europe Mushroom Cultivation Market.