Button Mushroom Market Size (2024 – 2030)

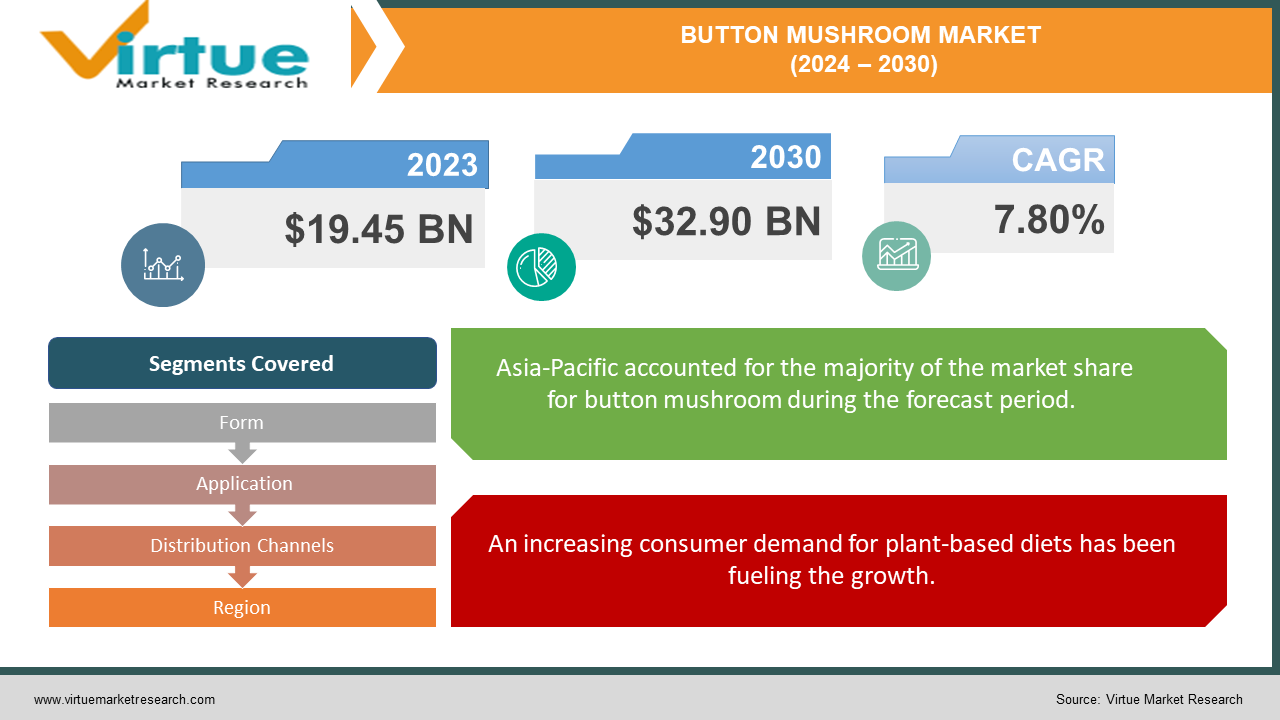

The global button mushroom market was valued at USD 19.45 billion and is projected to reach a market size of USD 32.90 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.80%.

The smooth-capped, firm-yet-tender button mushrooms are little, pale white mushrooms. The least developed stage of the mushroom species is button mushrooms. The stem is thin and white when young, and the crown is smooth and white. The cap may turn brown or tan as they get older, although they still seem light overall. Typically, whether hemispherical or convex, the caps progressively flatten as the mushrooms get bigger. The market was mainly prevalent in countries in North America, Europe, and China. However, their use and applications were limited. It was consumed as a diet during the mid-to late-20th century. Presently, the market has witnessed scope due to advancements in packaging and transportation to restore freshness. In the future, with diverse applications in the food & beverage industry and consumer awareness, a notable acceleration is anticipated.

Key Market Insights:

An estimated 94,676 metric tons of white button mushrooms were produced in India in 2022; 9% of those were from seasonal producing units in Punjab and Haryana.

An estimated 50,000 tons of mushrooms are produced nationally each year, with button mushrooms accounting for 85% of the total.

In Norway, white button mushrooms brought in 235 million Norwegian kroner in sales in 2022.

According to data from the German Federal Statistical Office (Destatis), 76,100 tons of button mushrooms were harvested in 2022.

Agaritine, a water-soluble toxin that may be a mild carcinogen in mice, is another ingredient found in button mushrooms. Human statistics are unavailable; however, the estimated lifetime excess cancer risk is around 10–5. To be safe, people should avoid eating button mushrooms that are fresh, dry, uncooked, or improperly prepared.

Button Mushroom Market Drivers:

An increasing consumer demand for plant-based diets has been fueling the growth.

Over the years, veganism has gained immense popularity. This is the practice of incorporating plant-based foods. Roughly 1.1% of the global population, or 88 million individuals, identified as vegans as of January 2023. This statistic is predicted to increase over the forecast period. This is because people are becoming more aware of the realities faced by the animal industry for their yield. Since mushrooms are fungi that thrive on deadwood and organic debris instead of animals, they are typically considered vegan. Due to their meaty texture, they are a common component in vegetarian and vegan cuisines all over the world and are frequently substituted for meat in dishes. When chopped or sliced, white button mushrooms give meals a meaty mouthfeel. They work well in tofu scrambles, bolognese sauces, and vegan stews. Additionally, they are well suited as a side dish or as a topping for pizzas and burgers. They also work well in stir-fries, omelets, salads, soups, and sauces.

The health benefits of button mushrooms have been facilitating the expansion.

Button mushrooms are rich in selenium, a mineral that functions as an antioxidant and supports healthy immunological function. They also include fiber, protein, B-complex vitamins, and polysaccharides, which stimulate cells in the immune system. Secondly, ergocalciferol, a type of vitamin D found in button mushrooms, is necessary for the formation of bones and the metabolism of calcium. Thirdly, they have a high potassium content and a low salt content, which are helpful for heart health because they help control blood pressure and encourage muscular contractions. Moreover, mushrooms include vitamin B6, which aids in regulating the body's internal clock, a process critical to brain growth and function. It may also improve mood. In addition to potentially improving memory retention and recall, the antioxidant chemicals found in mushrooms may help shield the brain from free radical damage, which can cause cognitive decline. Besides this, they potentially prevent brain degeneration by enhancing general brain growth and health. Furthermore, because of their high fiber and protein content, button mushrooms are a low-calorie but satisfying snack that can help with weight reduction. Sliced white button mushrooms in a stir-fry with 2 grams of fiber, nearly 4 grams of protein, and 28 calories per cup. All these advantages help attract a broader consumer base.

Button Mushroom Market Restraints and Challenges:

Short shelf life, pest & disease management, and intense competition are the main issues that the market is currently facing.

Button mushrooms have a high moisture content. This makes them more prone to microbial contamination. A lot of yield is damaged during harvest due to improper handling. While transporting these fungi, it is necessary to use cold storage logistics for longer distances to keep them fresh. As such, manufacturers need to invest in these solutions to avoid this problem. Secondly, they are vulnerable to attacks from bacteria and mycoviruses. This can rot the crop and lead to adverse effects if consumed by humans. Suitable pest management plans need to be implemented by farmers to prevent crop losses. Thirdly, the market is very competitive. People like other varieties like oysters, portobello, and shiitake. These mushroom alternatives have a good taste and flavor and are affordable. Businesses need to stand out in the industry to widen their customer base.

Button Mushroom Market Opportunities:

Expanding into emerging markets in Asia, Latin America, and the Middle East can provide the market with an ample number of possibilities. These countries have seen tremendous economic progress, leading to better funding. Companies can launch and collaborate in these regions. Besides, a greater number of restaurants have been offering diversity on their menus. Button mushrooms are included in exotic and authentic cuisines. People who are constantly looking for experimentation with their foods find these varieties to be an appealing option. Secondly, innovations in button mushrooms are being commercialized. This includes pre-sliced, dried, powdered, and ready-to-cook options. People who are looking for convenient choices can choose from these alternatives, contributing to higher revenue. Additionally, the trend to replace meat with substitutes is leading to greater profits. Apart from this, technological advancements are beneficial. This includes AI, ML, and data analytics. These fields can be used in agricultural equipment to reduce errors, streamline operations, optimize performance, and enhance productivity. They even help with harvesting, crop management, and climate control. Vertical farming methods can be used to maximize space and provide a controlled environment.

BUTTON MUSHROOM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.80% |

|

Segments Covered |

By Form, Application, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Monterey Mushrooms, Inc., Costa Group, Bonduelle Fresh Europe, Okechamp S.A., Lutece Holdings B.V., Monaghan Mushrooms, The Mushroom Company, Smithy Mushrooms Ltd., Scelta Mushrooms B.V., Highline Mushrooms |

Button Mushroom Market Segmentation: By Form

-

Fresh

-

Processed

The fresh form is the largest and fastest-growing segment, with a share of around 63%. Due to increased global R&D efforts in the food sector, which uses fresh mushrooms to create a range of products, the fresh mushroom market is anticipated to expand at a notable rate. The fresh mushroom industry was the most prominent due to the increase in food output in emerging nations like South Korea, India, the United States, and China. Furthermore, the cost-effective factor encourages a greater number of customers to buy the fresh category.

Button Mushroom Market Segmentation: By Application

-

Food & Beverage

-

Pharmaceutical

-

Cosmetics & Personal Care

-

Industrial

-

Others

The food & beverage industry is the largest growing application. Because button mushrooms are high in nutrients and low in calories, fat, and cholesterol, they are employed in the food and beverage sector. In addition, they are a wonderful source of antioxidants, fiber, protein, and vitamins and minerals. Ninety percent of the mushrooms consumed in the United States are button mushrooms, the most commonly consumed kind. They take on the characteristics of the food they are cooked with, but they are also the least costly and have a moderate flavor. A variety of items, such as mushroom chips, biscuits, soup powder, and nuggets, include button mushrooms. Furthermore, they cook up with a fibrous texture similar to meat and a distinct taste, due to which they are employed as meat replacements. Businesses such as Beyond Meat and Impossible Foods have enhanced the taste and texture of their plant-based burgers by adding mushrooms. The pharmaceutical industry is the fastest-growing application. Bioactive substances found in button mushrooms, such as antioxidants, anti-inflammatory agents, and immune-stimulating qualities, may have positive effects on health. As a result, functional foods and dietary supplements targeted at customers who are health-conscious now contain them. This market is expanding quickly because of improvements in biotechnology and pharmaceutical research, as well as growing consumer awareness of natural and health-promoting goods.

Button Mushroom Market Segmentation: By Distribution Channels

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online Retail

-

Others

Supermarkets and hypermarkets are the largest growing market segments. Accessibility is a key factor influencing this category as well. Since these businesses are often located in every municipality, the necessity has grown. Consumers may interact with the companies, ask questions, and do visual evaluations of the products. By negotiating over the goods, they may even alter the price. Furthermore, some people who find it difficult to use the Internet perform well in in-person interactions. The category with the fastest pace of growth is online retail. The increasing tendency toward digitalization has been credited with contributing to the sector's growth. Convenience is the reason why customers make this choice. Online shoppers may order products and have them delivered right to their homes. They will also have easier access to a greater selection of domestic and foreign items. Online merchants may also help their clients by providing discounts and free shipping.

Button Mushroom Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest growing market. This is because of the region's dense population, button mushroom consumption, and rising health consciousness in developing nations. China, Australia, Japan, India, South Korea, and Southeast Asia are the prominent regions. These regions have extensive cultivation and production of these fungi. Besides, they are involved in the import and export trade, contributing to its success. Europe is the fastest-growing market. Countries like France, Poland, Germany, and the Netherlands are at the forefront. In Europe, there is a rising inclination among consumers to choose organic and sustainably farmed mushrooms. Growing public knowledge of environmental problems and the advantages of eating organic food is what is driving this trend. To accommodate this need, European farmers are investing in organic agricultural methods and earning organic certificates. Biotechnology research and development is also assisting in the creation of novel mushroom strains that are more disease-resistant and have higher yields.

COVID-19 Impact Analysis on the Global Button Mushroom Market:

The pandemic had a positive impact on the market. The epidemic raised awareness of the need to maintain good mental and physical health. People then started to look for healthier alternatives. Furthermore, immunity-building was essential for protecting the body against the illness. The market grew swiftly due to demand. Veganism gained significant attention. Many people started to explore cooking activities due to boredom. Mushrooms are an excellent source of protein. A diet high in protein could aid in the healing of damaged bodily tissues and muscle loss brought on by the COVID-19 infection. According to a report by Down to Earth, two white button strains that were released were anticipated to generate a 15% increase in yield. Post-pandemic, the market has continued to grow owing to demand and health & wellness trends.

Latest Trends/ Developments:

Customers who care about the environment can be drawn in by highlighting ecologically friendly farming methods and minimizing environmental effects. This covers the use of biodegradable packaging, water recycling systems, and renewable energy sources. There is a growing market for organic food products. By investing in organic mushroom farming, businesses can satisfy the rising demand for organic and non-GMO foods from consumers in this niche market and offer a high-quality product.

Key Players:

-

Monterey Mushrooms, Inc.

-

Costa Group

-

Bonduelle Fresh Europe

-

Okechamp S.A.

-

Lutece Holdings B.V.

-

Monaghan Mushrooms

-

The Mushroom Company

-

Smithy Mushrooms Ltd.

-

Scelta Mushrooms B.V.

-

Highline Mushrooms

-

In September 2023, Mistercap's, a grow-your-own mushroom company, was introduced by Wiz Khalifa. Oyster, shitake, and lion's mane mushroom ready-to-eat mushrooms were available by purchasing the $27.95 grow-your-own mushroom kits. The company's mission is to create more ways for people to incorporate mushrooms into their lives, nutrition, and well-being to increase interest in the health benefits of mushrooms.

-

In June 2023, a $1 million button mushroom-producing business debuted in Rwanda's Northern Province's Musanze area. It is anticipated that the factory will yield 250 metric tons of button mushrooms per year, which will be marketed in East African markets as well as locally. Also, the plant will generate compost that nearby farmers may use to cultivate oyster mushrooms.

-

In May 2023, in collaboration with Mission Samriddhi, a social impact organization, Rang De, the country's first peer-to-peer social investment platform, introduced the Mushroom Fund. The goal of this specialty investment fund is to help Tamil Nadu's marginalized farmers cultivate mushrooms as a long-term source of income.

Chapter 1. Button Mushroom Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Button Mushroom Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Button Mushroom Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Button Mushroom Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Button Mushroom Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Button Mushroom Market – By Form

6.1 Introduction/Key Findings

6.2 Fresh

6.3 Processed

6.4 Y-O-Y Growth trend Analysis By Form

6.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Button Mushroom Market – By Distribution Channels

7.1 Introduction/Key Findings

7.2 Supermarkets & Hypermarkets

7.3 Convenience Stores

7.4 Online Retail

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Distribution Channels

7.7 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 8. Button Mushroom Market – By Application

8.1 Introduction/Key Findings

8.2 Food & Beverage

8.3 Pharmaceutical

8.4 Cosmetics & Personal Care

8.5 Industrial

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Button Mushroom Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Form

9.1.3 By Distribution Channels

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Form

9.2.3 By Distribution Channels

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Form

9.3.3 By Distribution Channels

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Form

9.4.3 By Distribution Channels

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Form

9.5.3 By Distribution Channels

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Button Mushroom Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Monterey Mushrooms, Inc.

10.2 Costa Group

10.3 Bonduelle Fresh Europe

10.4 Okechamp S.A.

10.5 Lutece Holdings B.V.

10.6 Monaghan Mushrooms

10.7 The Mushroom Company

10.8 Smithy Mushrooms Ltd.

10.9 Scelta Mushrooms B.V.

10.10 Highline Mushrooms

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global button mushroom market was valued at USD 19.45 billion and is projected to reach a market size of USD 32.90 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.80%.

Increasing consumer demand for plant-based diets and health benefits are the main factors propelling the global button mushroom market.

Based on form, the global button mushroom market is segmented into fresh and processed.

Asia-Pacific is the most dominant region for the global button mushroom market.

Monterey Mushrooms, Inc., Costa Group, and Bonduelle Fresh Europe are the key players operating in the global button mushroom market.