Europe Instant Coffee Market Size (2024-2030)

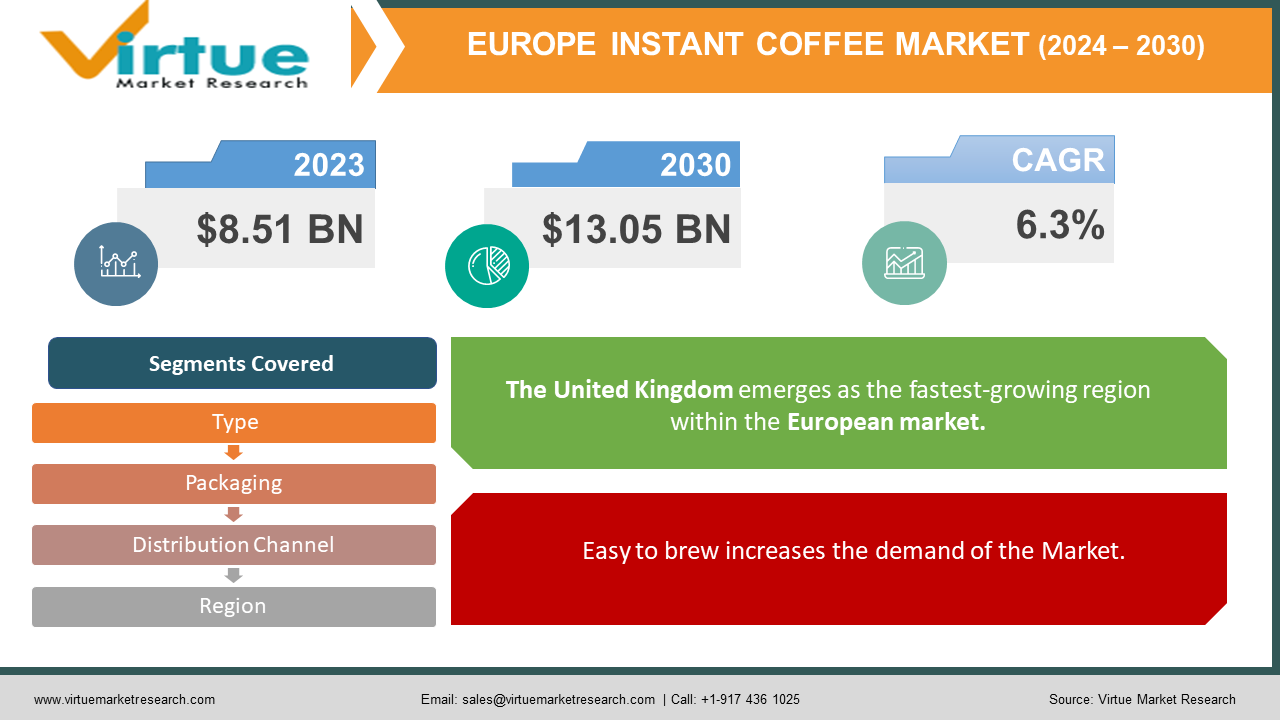

The Europe Instant Coffee Market was valued at USD 8.51 Billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 13.05 Billion by 2030, growing at a CAGR of 6.3%.

A blended beverage known as coffee is crafted from roasted coffee beans and the seeds of berries sourced from specific coffee species. The seeds undergo isolation to yield a consistent, unroasted green coffee in its raw form. Following this, a roasting process is employed, transforming the seeds into a consumable compound known as roasted coffee. Subsequently, the roasted coffee is finely ground, and the resulting particles are typically infused with boiling water to produce the final coffee product.

Characterized by its dark hue, bitter taste, slight acidity, and caffeine content, coffee stands as one of the most renowned beverages globally, with diverse preparation and presentation methods. While it is commonly served hot, chilled or iced variations are also prevalent. To mitigate the bitter notes or enhance the flavor profile, sugar, sugar substitutes, milk, or cream are frequently incorporated.

Key Market Insights:

The coffee market in Europe holds significant prominence, representing approximately one-third of the global consumption share. Despite the anticipation of consumption stabilizing in the long term, Europe continues to allure coffee exporters, remaining an appealing market. Particularly noteworthy are the opportunities presented by the burgeoning specialty coffee segment within Europe.

Europe Instant Coffee Market Drivers:

Easy to brew increases the demand of the Market.

Instant coffee, as its name implies, can be swiftly prepared by combining hot or cold water or milk with the powdered or crystallized granules of coffee. The contemporary fast-paced lifestyle embraced by the populace has heightened the demand and popularity of conveniently consumable products. The on-the-go nature of individuals further positions instant coffee as the optimal beverage choice. Beyond its role as a beverage, instant coffee finds utility in enhancing the flavor of various desserts such as ice creams, ice pops, gelatos, milkshakes, and smoothies, among an array of other delights.

The growing consciousness among consumers regarding making health-conscious choices for long-term advantages is duly considered in the production of these products.

Instant coffee is not only a flavorful addition but also a source of numerous nutrients and antioxidants, contributing to benefits such as metabolism boost, improved liver and mental health, longevity promotion, and enhanced cognitive function.

Europe Instant Coffee Market Restraints and Challenges:

High amounts of acrylamide present in the coffee hamper the market.

The potential impediment to the growth of the instant coffee market lies in the high concentration of acrylamide found in larger quantities in instant coffee as compared to freshly brewed coffee. Acrylamide, a detrimental substance formed during the roasting of coffee beans, poses risks to the nervous system and is associated with an increased likelihood of cancer when consumed in elevated amounts.

Rising concerns about the effects of excessive coffee drinking affect the market negatively.

Concerns are mounting regarding the adverse effects of excessive coffee consumption in the fast-paced contemporary world. The prevalent trend of consuming coffee 4-5 times daily to navigate through demanding schedules, meetings, and important tasks without sufficient sleep has adversely affected many individuals. Excessive coffee intake can lead to various issues such as insomnia, headaches, rapid heart rate, anxiety, dehydration, restlessness, and shakiness. The growing apprehension about the negative impacts of excessive coffee consumption poses a challenge to the market's growth. Additionally, the perception of coffee as an addictive substance prompts some consumers to steer clear of it. The market also faces competition from the increasing preference for alternative beverages like flavored tea, green tea, and others.

While instant coffee, when consumed in moderate quantities, does not exhibit significant adverse effects, this essential fact is sometimes overlooked by consumers. The lack of proper communication by market players regarding the composition and benefits of instant coffee contributes to this ignorance, posing a potential hindrance to the market's growth.

Europe Instant Coffee Market Opportunities:

In recent years, the surge in the working population has correspondingly led to an increase in coffee consumption. The evolution of the instant coffee market has enticed a multitude of market players into the coffee industry, resulting in a highly fragmented landscape. The saturation observed in the instant coffee market has intensified competition among players, compelling them to vie for new consumers and retain existing ones through innovative products, diverse flavors, unique packaging, and other strategic marketing approaches.

To stand out in this competitive environment, market participants have introduced a spectrum of new flavors, including Macha, hazelnut, mint, caramel, Italian roast, green bean, and French vanilla. Additionally, small sachets have been introduced to enhance the affordability of instant coffee. Innovative marketing strategies have significantly contributed to the burgeoning popularity of premium, high-quality coffee. Coffee makers are tailoring their offerings to align with local tastes and preferences, further fueling the appeal of instant coffee due to its ease of preparation, quick availability, affordability, and a diverse range of flavors.

The incorporation of antioxidants in instant coffee, contributing to consumer health benefits, serves as a catalyst for market growth. Such strategic initiatives not only widen the consumer market but also present lucrative opportunities for industry players.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

6.3% |

||

|

Segments Covered |

By Type, Packaging, Distribution Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Nestle S.A, JAB Holding Company, Starbucks Corporation, Strauss Group Ltd, Tchibo Coffee, Tata Global Beverages, Jacobs Douwe Egberts, The Kraft Heinz Company, Matthew Algies Company ltd, Unilever Plc |

Market Segmentation:

Europe Instant Coffee Market Segmentation By Type:

- Spray-Dried

- Freeze-Dried

The market is predominantly led by the spray-dried segment, which utilizes the process of spraying liquid coffee droplets into extremely hot and dry air. This method facilitates the evaporation of the liquid, resulting in the formation of fine coffee particles as the final product. Spray-dried instant coffee holds widespread popularity, attributed to its uncomplicated production process and cost-effectiveness in comparison to freeze-dried instant coffee.

The economic viability of spray-dried coffee renders it an affordable choice for a majority of consumers, thereby enhancing its profitability for producers. Ongoing technological advancements that simplify, ensure continuity, and align with compatible processes in spray-drying are anticipated to drive the growth of this segment in the future.

Europe Instant Coffee Market Segmentation By Packaging:

- Sachet

- Pouch

- Jar

- Others

The pouch segment is poised to achieve the highest Compound Annual Growth Rate (CAGR) at 8.29%. Pouches emerge as the optimal packaging solution for instant coffee, owing to their ease of storage, break-resistant nature (in contrast to glass jars), and availability in diverse quantities. Pouches offer exceptional flexibility, being lightweight and easily transportable, making them a preferred choice for on-the-go consumers. Moreover, their cost-effectiveness, contributing to their pocket-friendly nature, propels their demand in the market.

As sustainability gains prominence across industries, the adoption of eco-friendly, green, and sustainable packaging materials is on the rise. Instant coffee pouches can align with this trend, incorporating environmentally conscious materials in their manufacturing process. This environmentally friendly aspect positions them as a popular choice in today's climate-conscious world.

Europe Instant Coffee Market Segmentation By Distribution Channel:

- supermarkets/hypermarkets

- online

- business-to-business

- convenience stores

- others

The supermarkets/hypermarkets segment has asserted its dominance in the market. These large, extensively distributed retail spaces boast a higher consumer reach compared to other outlets. The prevalence of consumer preferences for one-stop shopping, where various brands and their products are conveniently available in a single location, is a key factor driving the segment's dominance. The ongoing trend of urbanization, coupled with the expansion of retail chains, is expected to further propel the growth of this segment.

Brands are capitalizing on the extensive foot traffic in supermarkets/hypermarkets by offering product demonstrations to attract consumers. This marketing strategy is anticipated to provide additional momentum to the growth of the supermarkets/hypermarkets segment.

Europe Instant Coffee Market Segmentation- by region

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

Presently, Europe stands as the predominant force in the instant coffee market, holding the highest per capita coffee consumption globally. The dominance of Europe in the instant coffee market is closely linked to the substantial per capita income of several developed economies within the region. The presence of a sizable coffee roasting industry and numerous coffee suppliers further contributes to the saturation of the European coffee market.

The regional market is witnessing a surge in demand for high-quality, unique, and innovative instant coffee, which is expected to bolster its growth. Notably, in Italy, the instant coffee market is characterized by the dominance of renowned brands such as Lavazza and Illy, celebrated for their rich and aromatic blends. Among European nations, Germany takes the lead in the instant coffee market, while the United Kingdom emerges as the fastest-growing region within the European market.

COVID-19 Pandemic: Impact Analysis

The year 2020 witnessed a decreased demand for specialty coffee throughout Europe, attributed to the impact of the COVID-19 pandemic. Social distancing measures and heightened consumer health concerns led to a notable decline in out-of-home consumption, despite the growth observed in online sales. Nevertheless, even amid these challenges, the interest in high-quality coffees persisted strongly across Europe.

Latest Trends/ Developments:

- In January 2022, Sleepy Owl, the instant coffee company, expanded its product portfolio by introducing a line of premium instant coffee, enhancing brand accessibility. The new offerings include three flavors: Original, French Vanilla, and Hazelnut, all of which are free from artificial flavors or preservatives.

- Similarly, in March 2022, Melbourne-based coffee roaster Beat Coffee unveiled a specialty instant coffee that seamlessly integrates convenience, taste, and quality in individual sachets. Utilizing the freeze-drying technique, the coffee roaster aims to preserve the coffee's vitality and maintain its distinctive notes of caramel and honey flavor.

Key Players:

These are top 10 players in the Europe Instant Coffee Market: -

- Nestle S.A

- JAB Holding Company

- Starbucks Corporation

- Strauss Group Ltd.

- Tchibo Coffee

- Tata Global Beverages

- Jacobs Douwe Egberts

- The Kraft Heinz Company

- Matthew Algies Company ltd

- Unilever Plc

Chapter 1. Europe Instant Coffee Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Instant Coffee Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Instant Coffee Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Instant Coffee Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Instant Coffee Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Instant Coffee Market– By Type

6.1. Introduction/Key Findings

6.2. Spray-Dried

6.3. Freeze-Dried

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Instant Coffee Market– By Packaging

7.1. Introduction/Key Findings

7.2 Sachet

7.3. Pouch

7.4. Jar

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Packaging

7.7. Absolute $ Opportunity Analysis By Packaging , 2024-2030

Chapter 8. Europe Instant Coffee Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. supermarkets/hypermarkets

8.3. online

8.4. business-to-business

8.5. convenience stores

8.6. others

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.8. Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 9. Europe Instant Coffee Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By type

9.1.3. By packaging

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Instant Coffee Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestle S.A

10.2. JAB Holding Company

10.3. Starbucks Corporation

10.4. Strauss Group Ltd.

10.5. Tchibo Coffee

10.6. Tata Global Beverages

10.7. Jacobs Douwe Egberts

10.8. The Kraft Heinz Company

10.9. Matthew Algies Company ltd

10.10. Unilever Plc

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The contemporary fast-paced lifestyle embraced by the populace has heightened the demand and popularity of conveniently consumable products.

Top Players operating in the Europe Instant Coffee Market are - Nestle S.A, JAB Holding Company, Starbucks Corporation, Strauss Group Ltd., Tchibo Coffee, Tata Global Beverages, Jacobs Douwe Egberts.

The year 2020 witnessed a decreased demand for specialty coffee throughout Europe, attributed to the impact of the COVID-19 pandemic.

In January 2022, Sleepy Owl, the instant coffee company, expanded its product portfolio by introducing a line of premium instant coffee, enhancing brand accessibility. The new offerings include three flavors: Original, French Vanilla, and Hazelnut, all of which are free from artificial flavors or preservatives

The United Kingdom emerges as the fastest-growing region within the European market.