Asia-Pacific Instant Coffee Market Size (2024-2030)

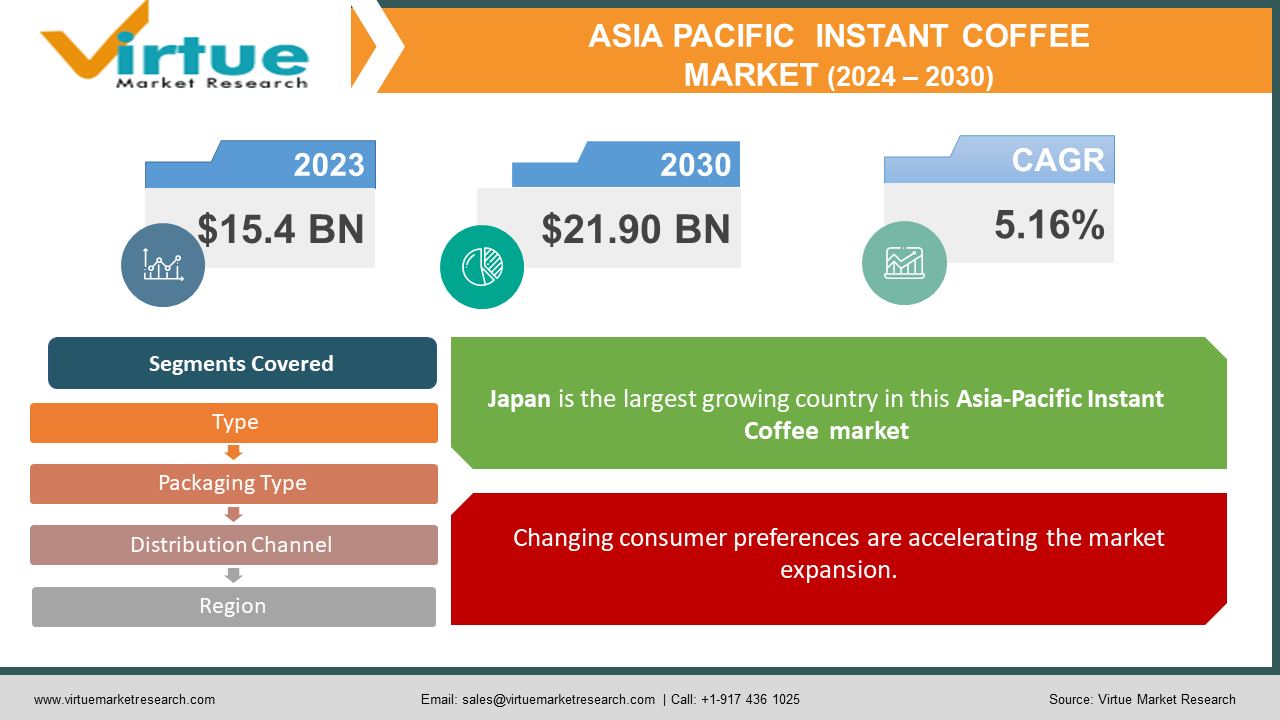

The Asia-Pacific Instant Coffee Market was valued at USD 15.4 billion and is projected to reach a market size of USD 21.90 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.16%.

When hot water or milk is added to powdered or crystallized coffee solids, instant coffee, a beverage manufactured from coffee beans, is brewed. Typically, Robusta coffee beans of inferior quality are roasted and coarsely crushed to make instant coffee. After being brewed, the beans' water content is removed, leaving behind an extract. In the past, the market has experienced an upsurge because of the demand and easy availability. Presently, with economic growth, global operations have been made possible, thereby increasing sales. In the future, with a growing focus on healthier choices, this market is set to see rapid growth. During the forecast period, a considerable boost is anticipated.

Key Market Insights:

With a market share of more than 40%, Asia-Pacific is the biggest market for instant coffee.

More than 75% of the retail-brewed coffee consumed in Australia and New Zealand comes from instant sources.

Up to twice as much acrylamide can be found in instant coffee as in freshly roasted coffee (20, 22). Overexposure to acrylamide raises the risk of cancer and damages the neurological system. To resolve this, organizations have been working towards improving the roasting methods to reduce the acrylamide content. Additionally, studies are being conducted to understand the factors that contribute to this increased content

Asia-Pacific Instant Coffee Market Drivers:

Changing consumer preferences are accelerating the market expansion.

Over the years, there have been a lot of developments in the standard of living. This is mainly because of urbanization, increasing disposable income, and the rising middle class. The economic stability has helped with the growth of companies, thereby promoting more launches and collaborations. Besides, coffee has been a popular beverage in Asian countries, having historical and cultural significance. With the increasing population, demand has seen a drastic elevation. Moreover, dual income is becoming more prevalent in households. As such, a greater percentage of the population can afford and access a wide range of products. Furthermore, with busy schedules, instant coffee has become a go-to option because of its convenience. This is often associated with saving time without compromising on taste or quality. Apart from this, the growing acceptance by many individuals has been a boon for the market.

The benefits associated with instant coffee have been responsible for the growth.

This beverage is an apt choice for health-conscious individuals as it has very few calories. Additionally, it has important minerals like potassium and magnesium, along with vitamins like B12. These compounds are essential for the healthy functioning of the human body and for maintaining immunity. Secondly, because instant coffee is less acidic than brewed coffee, it may be preferable for those who have heartburn or upset stomachs after consuming brewed coffee. Thirdly, according to studies, instant coffee has higher levels of polyphenols and chlorogenic acid, two of the most significant antioxidants. These antioxidants help in maintaining blood pressure, controlling blood sugar, reducing inflammation, improving digestion, and helping with healthy weight loss. Moreover, a few studies indicate that consuming two to three cups of normal or instant coffee per day lowers the risk of cardiovascular disease and death. Furthermore, instant coffee has less caffeine content than regular ones. High amounts of caffeine lead to mood swings, dizziness, headaches, and anxiety.

Asia-Pacific Instant Coffee Market Restraints and Challenges:

Health concerns and competition are the main issues that are currently being faced by the market.

Growing health perceptions can be a potential barrier for the market. Instant coffee contains excessive sugar content, additives, and preservatives. This can contribute to the incidence of chronic illnesses. Additionally, this has higher levels of acrylamide. The neurotoxic acrylamide can induce reduced feeling in the hands and feet, muscular weakness, and difficulty walking. Acrylamide is a carcinogen that also interacts with RNA, DNA, and biological functions. It can induce various malignancies, like pancreatic cancer, in humans. Moreover, it is a strong neurotoxic substance that can harm male reproduction and result in birth abnormalities. Secondly, this beverage is subjected to heavy competition from well-known brands in the industry. Besides, many customers prefer freshly brewed coffee instead of the instant variety. This can cause losses for the market.

Asia-Pacific Instant Coffee Market Opportunities:

Product diversity has been providing the market with an ample number of possibilities. Many popular companies constantly release new flavors and choices for commercialization. The increasing number of coffee shops and cafes has been another major reason for the increase in revenue. These outlets are well maintained and have good ambiance, aesthetics, and options available, which attracts a broader consumer base. Thirdly, digital platforms have been facilitating the development. Through e-commerce, sales are rising locally and internationally. Shopkeepers and owners have been working towards having a good virtual presence for better profits.

ASIA-PACIFIC INSTANT COFFEE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

5.16% |

|

Segments Covered |

By Type, Packaging Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Australia & New Zealand, Rest of Asia-Pacific |

|

Key Companies Profiled |

Nestlé, Jacobs Douwe Egberts (JDE), Strauss Group, Tata Consumer Products, The J.M. Smucker Company, Unilever, Keurig Dr Pepper, Olam International, DE Master Blenders 1753, Starbucks Corporation, Tchibo Coffee International Ltd. |

Asia-Pacific Instant Coffee Market Segmentation:

Asia-Pacific Instant Coffee Market Segmentation: By Type:

- Spray-Dried

- Freeze-Dried

Based on type, the spray-dried segment is the most dominant segment in the market. It holds a share exceeding 55% in 2023. The primary reason for this is cost-effectiveness. Hence, a greater percentage of the population tends to choose this flavor. Secondly, it is easily accessible. This category is commonly found in business retail stores. Thirdly, the production process is simpler, allowing a larger and bulkier manufacturing process. However, the freeze-dried category is the fastest-growing. The primary reason for this is that this method usually retains the original flavor without any alterations. Moreover, it has a longer shelf life, making the storage process easier. Additionally, this segment has been gaining recognition because of its premium quality and straight-forward procedure for preparation.

Asia-Pacific Instant Coffee Market Segmentation: By Packaging Type:

- Sachets

- Pouches

- Jars

Based on packaging type, the jars segment is the largest, holding a share exceeding 40% in 2023. This is mainly because of the space it offers. As such, higher coffee content is loaded into these containers, attracting more customers. Besides, these containers preserve the quality and flavor of the coffee for a longer duration since they are tightly closed, avoiding any sort of contamination. The pouch category is the fastest-growing owing to the ease of transportation. Shipping through these is easier. Furthermore, individuals while traveling prefer options that are lightweight and take up less space, making pouches an ideal choice.

Asia-Pacific Instant Coffee Market Segmentation: By Distribution Channels:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

With a combined share of more than 50% in 2023, supermarkets and hypermarkets represent the largest category of distribution channels. This is a result of its historical prevalence. Customers may more readily obtain the necessary beverages they need because there are more of these stores in each community. This enables direct contact between the customer and the retailer in addition to a visual evaluation of the products to verify their contents, expiration dates, and other important details. In addition, a large number of individuals who are unaware of using the internet opt to purchase their goods in person. The distribution channel in this industry, which is expanding at the fastest rate, is online retail. This is primarily due to convenience. Food items are brought to the residences of the customers. In addition, individuals have easier access to a wider range of flavors, both local and international. Furthermore, online orders also provide discounts and free deliveries to their users.

Asia-Pacific Instant Coffee Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

Based on region, Japan is the largest growing country in this market, holding a rough share of 30% in 2023. This beverage holds cultural significance in this country and therefore has a lot of customers. To keep up with this, many significant companies in Japan are involved in the bulk manufacturing and production processes. Nestle, Key Coffee Inc., Kirin Beverage Company, and UCC Ueshima Coffee Co., Ltd. are the notable players with a global presence. Many flavors and innovations are released regularly for better income generation. Furthermore, the growing population has been contributing to the success. China is the fastest-growing region, with an approximate share of 25%. The increasing coffee culture has been a major factor in boosting the expansion. As a result, a greater percentage of the population has been consuming instant coffee. Besides this, busy lifestyles are facilitating the growth of the market as people have been looking for convenient options. Apart from this, online retail is helping with enormous revenue generation. The global base is achieved because of this channel. Many prominent companies in China, which include Nestle, Uni-President Enterprises Corporation, and Xiamen International Trade Group Corporation (XITGC), have been pioneers in global operations as well as maintaining their digital channels.

COVID-19 Impact Analysis on the Asia-Pacific Instant Coffee Market:

The outbreak of the virus had a mixed impact on the market. This caused disruptions in the supply chain, transportation, and logistics. Import-export trade activities were affected by this. An economic downfall was observed. Most of the funding was shifted toward healthcare applications. This delayed or postponed the launches, collaborations, and investments for instant coffee. However, on the other hand, working from home became very common. People started to increase their consumption of these beverages to stay more active. Besides, this option was widely preferred because of its low calories. Furthermore, online retail provided opportunities for more revenue. People were able to order products from the comfort of their homes. As per a report by the Times of India, Levista, a popular coffee brand in the market, posted that its top line grew by 50% during this period. Post-pandemic, the market has continued to grow owing to the relaxation of rules and the upliftment of guidelines.

Latest Trends/ Developments:

The companies in this industry are motivated to increase their market share by utilizing a range of strategies, such as joint ventures, acquisitions, and investments. Businesses are also spending a lot of money to improve existing formulations while maintaining competitive rates. This has resulted in an even larger expansion.

Coffee brands have been prioritizing sustainability. To achieve this, ethical and local sourcing is being emphasized. Organic farming of leaves that have no pesticides is being given prominence. Additionally, few brands have been seeking certifications from agencies to ensure that the environmental standards are met. Furthermore, eco-friendly packaging techniques have gained attention to reduce the footprint and minimize waste generation.

Key Players:

- Nestlé

- Jacobs Douwe Egberts (JDE)

- Strauss Group

- Tata Consumer Products

- The J.M. Smucker Company

- Unilever

- Keurig Dr Pepper

- Olam International

- DE Master Blenders 1753

- Starbucks Corporation

- Tchibo Coffee International Ltd.

- In July 2023, Kraft Heinz announced its plan for a new instant iced latte with foam aimed at revitalizing the Maxwell House brand. With their new Iced Latte with Foam, Maxwell House intends to close that disparity and attract more clients. Kraft Heinz claims that this fast beverage, which only needs one packet, a cup of cold water, and a spoon, is the first of its type. With this launch, the company seeks to attract more youngsters for consumption.

- In April 2023, Nescafé Ice Roast, a chilled instant coffee beverage, was introduced by Nestlé in China and Mexico. According to the multinational conglomerate, this beverage is Nescafé's first soluble coffee meant to be drank cold. It goes well with milk or water. According to the food and drink industry, 15% of coffee is now consumed cold worldwide, and demand for goods that enable consumers to replicate café-style cold coffee experiences at home is growing. With the introduction, it aims to draw in younger drinkers to the category.

- In January 2023, Tata Coffee Grand Premium, a premium instant coffee mix made entirely of coffee and featuring flavor-locked decoction crystals, was announced by Tata Consumer Products. The product was introduced with consideration for the tastes of customers in non-Southern areas, who often like a 100% coffee mix over a coffee: chicory blend (which is more popular in the South). The goal was to become a major player in the coffee market and provide relevant, high-quality products to increase the market share in the Indian coffee market.

Chapter 1. Asia-Pacific Instant Coffee Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Distribution Channels s

1.5. Secondary Distribution Channels s

Chapter 2. Asia-Pacific Instant Coffee Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Instant Coffee Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Instant Coffee Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Instant Coffee Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Instant Coffee Market– By Type

6.1. Introduction/Key Findings

6.2. Spray-Dried

6.3. Freeze-Dried

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Asia-Pacific Instant Coffee Market– By Packaging Type

7.1. Introduction/Key Findings

7.2. Sachets

7.3. Pouches

7.4. Jars

7.5. Y-O-Y Growth trend Analysis By Packaging Type

7.6. Absolute $ Opportunity Analysis By Packaging Type , 2024-2030

Chapter 8. Asia-Pacific Instant Coffee Market– By Distribution Channels

8.1. Introduction/Key Findings

8.2. Supermarkets and Hypermarkets

8.3. Specialty Stores

8.4. Convenience Stores

8.5. Online Retail

8.6. Y-O-Y Growth trend Analysis Distribution Channels

8.7. Absolute $ Opportunity Analysis Distribution Channels , 2024-2030

Chapter 9. Asia-Pacific Instant Coffee Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Type

9.1.3. By Packaging Type

9.1.4. By Distribution Channels

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia-Pacific Instant Coffee Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestlé

10.2. Jacobs Douwe Egberts (JDE)

10.3. Strauss Group

10.4. Tata Consumer Products

10.5. The J.M. Smucker Company

10.6. Unilever

10.7. Keurig Dr Pepper

10.8. Olam International

10.9. DE Master Blenders 1753

10.10. Starbucks Corporation

10.11. Tchibo Coffee International Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia-Pacific Instant Coffee Market was valued at USD 15.4 billion and is projected to reach a market size of USD 21.90 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.16%.

Changing consumer preferences and associated benefits are the main factors propelling the Asia-Pacific Instant Coffee Market

Based on Distribution Channels, the Asia-Pacific Instant Coffee Market is segmented into Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, and Online Retail.

Japan is the most dominant region for the Asia-Pacific Instant Coffee Market.

Nestlé, Jacobs Douwe Egberts (JDE), and Strauss Group are the key players operating in the Asia-Pacific Instant Coffee Market