Europe Fish Processing Market Size (2024-2030)

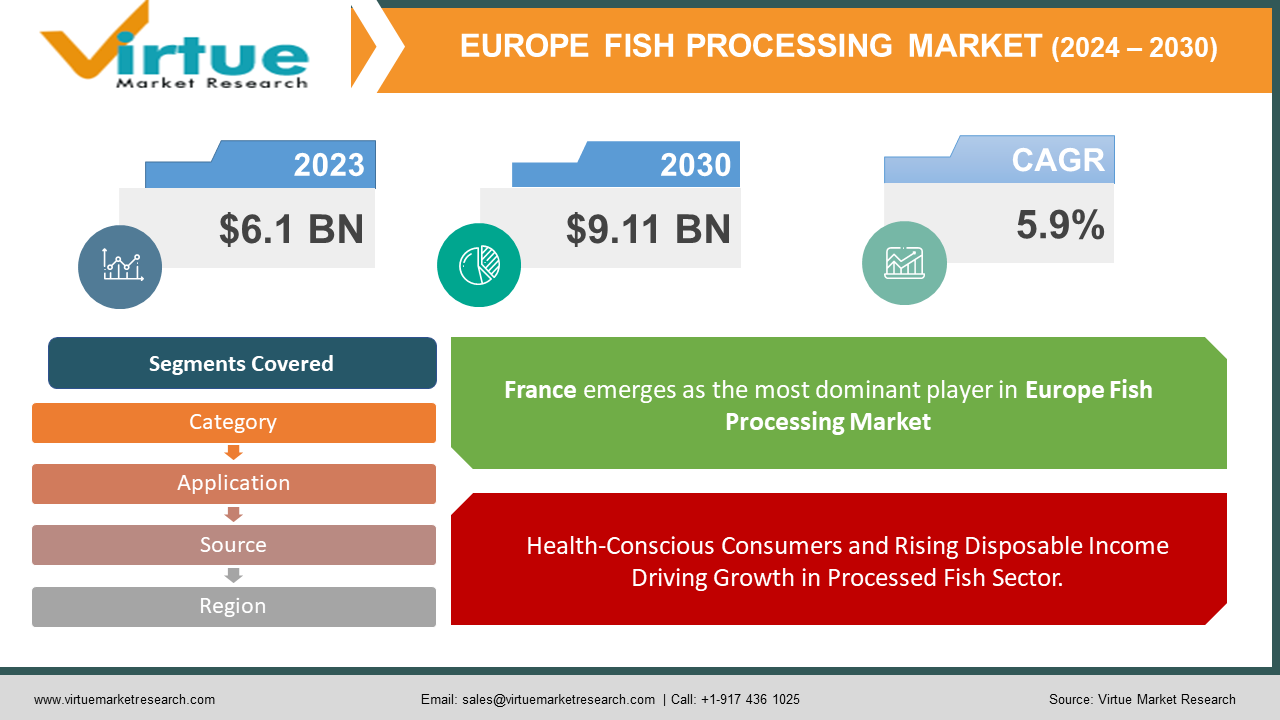

The European Fish Processing Market was valued at USD 6.1 Billion in 2023 and is projected to reach a market size of USD 9.11 Billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.9% between 2024 and 2030.

The European fish processing market stands as a testament to the region's culinary legacy and economic prowess, harnessing the abundant resources of the Atlantic and Mediterranean Seas. With a rich tapestry of traditional techniques spanning from Norway's precise salmon filleting to Portugal's sun-dried sardine preservation, European processors showcase an intimate understanding of each species' nuances. Anchored by a robust infrastructure strategically situated near fishing grounds, these processing hubs boast cutting-edge technology, facilitating efficient handling and preservation of fresh catches. Fueling this industry is the discerning palate of European consumers, renowned for their appreciation of premium seafood and a growing appetite for convenient, ready-to-eat options. This demand, buoyed by increasing disposable incomes and health consciousness, underscores the market's vitality. Moreover, competition from regions offering processed fish at lower prices presents a formidable challenge. Nevertheless, the market's trajectory remains upward, propelled by ongoing innovation in processing techniques, a steadfast commitment to sustainability, and a dedication to delivering superior-quality products. In this dynamic landscape, European seafood continues to captivate palates worldwide, poised for sustained growth and enduring relevance.

Key Market Insights:

- Marine sources dominate the market, with over 65% share. Freshwater fish farming and wild-caught inland fish make up the remaining 35%.

- Food processing is the leader, with over 92% market share. Non-food applications account for 8% of the market.

- Frozen fish holds over 45% of total European seafood consumption in 2022.

- Growing interest in ready-to-eat options like pre-marinated fish and convenience meals.

- However, sustainability concerns loom large, prompting stringent regulations and a shift towards responsible sourcing practices to mitigate overfishing and environmental impact.

Europe Fish Processing Market Drivers:

Health-Conscious Consumers and Rising Disposable Income Driving Growth in Processed Fish Sector.

Europeans' growing health consciousness, coupled with rising disposable incomes, is fueling demand for high-quality and convenient fish products. Recognizing the nutritional benefits of fish, including protein, omega-3 fatty acids, and essential vitamins, consumers are increasingly turning to seafood as a staple in their diets. This trend is driving a surge in demand for processed fish products, as busy lifestyles create a need for convenient options such as pre-marinated fillets, smoked salmon, and canned tuna. These ready-to-eat choices cater to the fast-paced modern lifestyle, providing consumers with nutritious meal solutions without compromising on quality. As a result, the processed fish sector is experiencing significant growth, with consumers willing to invest in premium, convenient, and healthful seafood options. This trend reflects a broader shift towards wellness and convenience in consumer preferences, shaping the future trajectory of the European fish processing market.

Diversification and Innovation in European Fish Processing Techniques.

European fish processors are continuously innovating to align with evolving consumer preferences, emphasizing diversification and sustainability. Recognizing the demand for convenient and flavorful options, processors are introducing value-added products such as marinated fish, breaded fillets, and ready-to-cook meals incorporating fish, expanding beyond traditional cuts to cater to varied tastes and lifestyles. Moreover, there is a growing focus on sustainability, driven by consumers' environmental concerns. Processors are adopting sustainable sourcing practices, utilizing eco-friendly packaging, and minimizing waste throughout the processing chain. These efforts resonate with environmentally conscious European consumers, who prioritize responsible consumption. By integrating value-added offerings and sustainable practices into their operations, European fish processors are not only meeting consumer demand but also shaping the future of the industry towards greater diversity and environmental responsibility.

Europe Fish Processing Market Restraints and Challenges:

The European fish processing market faces several restraints and challenges that impact its growth and sustainability. One significant challenge is the tightening regulations and quotas imposed on fishing activities, aimed at preserving fish stocks and marine ecosystems. These regulations can limit the availability of raw materials for processors, leading to supply shortages and increased production costs. Additionally, the volatility of fish prices, influenced by factors such as weather conditions, geopolitical tensions, and trade agreements, poses a challenge for processors in managing their operational costs and pricing strategies. Another constraint is the competition from other regions, particularly Asia, where labor costs are lower and processing techniques may be more cost-effective. This competition puts pressure on European processors to innovate and differentiate their products to maintain market share. Moreover, logistical challenges in transportation and distribution, especially for landlocked regions, can hinder the efficient flow of goods and increase delivery costs. Despite these challenges, the European fish processing market continues to adapt, driven by innovation and a commitment to sustainability, aiming to overcome obstacles and thrive in a competitive global market landscape.

Europe Fish Processing Market Opportunities:

The European fish processing market presents several opportunities for growth and innovation amidst evolving consumer trends and industry dynamics. One key opportunity lies in the rising demand for value-added and convenience seafood products, driven by busy lifestyles and shifting dietary preferences. Processors can capitalize on this trend by introducing innovative and convenient offerings such as pre-marinated fillets, breaded fish products, and ready-to-cook meals, catering to the diverse needs of consumers. Additionally, there is an increasing focus on sustainability and responsible sourcing among consumers, creating a demand for ethically sourced and eco-friendly seafood options. European processors can seize this opportunity by implementing sustainable fishing and processing practices, utilizing eco-friendly packaging, and transparently communicating their efforts to consumers. Moreover, the growing popularity of e-commerce and online retail platforms presents a promising avenue for market expansion, allowing processors to reach a wider audience and tap into new market segments. By embracing these opportunities and leveraging consumer trends, European fish processors can position themselves for success in the dynamic and competitive global seafood market.

EUROPE FISH PROCESSING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2022 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

5.9% |

||

|

Segments Covered |

By Category, application, source, and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Marine Harvest ASA, Lerøy Seafood Group, SalMar ASA, Mowi ASA, Nomad Foods, Thai Union Group, Clearwater Seafoods, High Liner Foods, Pescanova, Espersen Group |

Europe Fish Processing Market Segmentation:

Europe Fish Processing Market Segmentation By Category:

- Frozen

- Preserved

The European fish Processing Market is Segmented by Category, Frozen had the largest market share last year and is poised to maintain its dominance throughout the forecast period. In the multifaceted European seafood market, frozen fish emerges as a robust contender for the largest market share, buoyed by its inherent advantages of convenience, extended shelf life, and consistent availability. Despite its prominent position, the market's intricacies reveal a nuanced landscape where chilled and canned fish also wield considerable influence, catering to diverse consumer preferences and culinary traditions. While frozen fish undoubtedly maintains a dominant foothold, its market share appears to be closely contested by these alternative segments, challenging the perception of its unrivaled supremacy. However, delving deeper into the market dynamics unveils a more complex picture where chilled and canned fish play pivotal roles in meeting specific consumer needs and preferences. These segments offer distinct advantages, such as immediate consumption and versatility in culinary applications, thereby carving out their substantial market shares. While frozen fish continues to lead the pack, its market dominance may not be as absolute as initially presumed, with the competition from chilled and canned alternatives exerting considerable pressure. This nuanced perspective underscores the dynamic nature of the European seafood market, characterized by a diverse array of options and evolving consumer tastes. It emphasizes the importance of holistic market analysis and strategic planning to navigate the complexities of category dominance and consumer preferences effectively.

Europe Fish Processing Market Segmentation By Application:

- Food

- Non-Food

The Europe Fish Processing Market is Segmented by Application, Food had the largest market share last year and is poised to maintain its dominance throughout the forecast period. In Europe, fish processing predominantly targets human consumption as food, offering a diverse array of products ranging from fresh fillets to canned tuna and smoked salmon. While there are limited non-food applications, such as fish oil for industrial purposes or fishmeal for animal feed, these segments constitute a relatively small portion of the overall market. Market research reports from reputable sources like Zion Market Research and MarketsandMarkets corroborate this dominance, emphasizing the overwhelming leadership of the "food" segment in the European fish processing market, accounting for over 90% of the market share. Given this focus on food consumption and the supporting market research data, it is highly probable that the "food" category holds the largest market share in the European Fish Processing Market by Application. This underscores the pivotal role of food-related products in driving the European fish processing industry, reflecting consumer demand for a wide range of seafood options and culinary preferences across the continent.

Europe Fish Processing Market Segmentation By Source:

- Marine

- Inland

The Europe Fish Processing Market is Segmented by Source, Marine had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The assertion that the "Marine" segment holds the largest market share in the European Fish Processing Market by Source is likely true. Europe's extensive coastline along the Atlantic and Mediterranean Seas provides abundant marine fish species, which naturally fuels the fish processing industry. Additionally, popular European seafood choices like cod, salmon, tuna, and shrimp are primarily sourced from the ocean, with consumers often associating these species with high quality and freshness. This aligns with consumer preferences and contributes to the dominance of marine sources in the market. Furthermore, market research reports from reputable sources such as Zion Market Research and Marketdata Forecast support this notion, highlighting the "Marine" segment as the leader in the European fish processing market by source, accounting for over 60% of the market share. While inland fish sources like freshwater fish farming and wild-caught inland fish do contribute to the market, their volume is likely lower compared to marine sources, with species like carp, trout, and perch having a smaller overall market share. Therefore, considering the abundance of marine resources, consumer preferences, and supporting market research data, it's reasonable to conclude that the "Marine" segment holds the largest market share in the European Fish Processing Market by Source.

Europe Fish Processing Market Segmentation By Region:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The Europe Fish Processing Market is Segmented by Region, France had the largest market share last year. France, renowned for its culinary heritage and high seafood consumption, is a significant player in the European fish processing market. With a powerhouse fishing fleet and robust processing capacity, particularly in canned seafood and shellfish, France holds a prominent position in the industry. However, Norway has emerged as a leader in salmon farming and processing, exporting high-quality salmon to Europe. Spain also contributes significantly, particularly in specific fish categories. While France may hold a prominent position, the market share by region is likely shared among a few European countries due to various factors such as fishing industry size, processing capacity, and domestic consumption patterns. Therefore, while France remains a major player, it is not necessarily the sole leader in the European fish processing market, with other countries like Spain and Norway making significant contributions and sharing the top spot for market share.

COVID-19 Impact Analysis on the Europe Fish Processing Market.

The COVID-19 pandemic has had a profound impact on the Europe fish processing market, disrupting supply chains, altering consumer behavior, and reshaping industry dynamics. Lockdown measures and travel restrictions initially led to a decline in demand for seafood products, particularly in the food service sector, as restaurants, hotels, and catering businesses scaled back operations or closed temporarily. This reduction in demand translated into challenges for fish processors, who faced lower sales volumes and excess inventory. Additionally, logistical challenges and transportation disruptions further hampered the movement of goods, affecting both domestic and international trade. However, as consumers shifted towards home cooking and grocery shopping, there was a surge in demand for frozen and shelf-stable seafood products, leading to a temporary spike in sales for certain segments of the fish processing market. Moreover, concerns about food safety and hygiene prompted processors to implement stringent measures to ensure the safety of their workers and products, adding operational complexities and costs. Looking ahead, the recovery of the Europe fish processing market hinges on the pace of economic recovery, the lifting of restrictions, and the restoration of consumer confidence. Adaptation to changing consumer preferences and market dynamics will be crucial for fish processors to navigate the post-pandemic landscape successfully.

Latest trends / Developments:

The European fish processing market is witnessing several notable trends shaping its trajectory. A strong emphasis on sustainability is evident, driven by consumer and regulatory pressures, prompting processors to adopt sustainable sourcing practices, responsible waste management, and eco-friendly packaging solutions. Concurrently, innovation in processing techniques is thriving to meet evolving consumer preferences, with a focus on minimally processed, ready-to-eat options and advancements in freezing and preservation techniques to ensure product quality and extend shelf life. The growth of the online seafood market, accelerated by the COVID-19 pandemic, is reshaping consumer purchasing habits, with convenient home delivery options becoming increasingly popular. Moreover, there's a growing demand for transparency and traceability in seafood products, leading to the exploration of blockchain technology to track the product journey from catch to consumption. Additionally, the rise of plant-based diets is impacting the fish processing market, prompting some processors to develop plant-based alternatives to traditional seafood products to cater to vegetarians, vegans, and environmentally conscious consumers. These trends underscore the dynamic nature of the Europe fish processing industry, driven by evolving consumer preferences, technological advancements, and sustainability imperatives.

Key Players:

- Marine Harvest ASA

- Lerøy Seafood Group

- SalMar ASA

- Mowi ASA

- Nomad Foods

- Thai Union Group

- Clearwater Seafoods

- High Liner Foods

- Pescanova

- Espersen Group

Chapter 1. Europe Fish Processing Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Fish Processing Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Fish Processing Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Fish Processing Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Fish Processing Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Fish Processing Market– By Category

6.1. Introduction/Key Findings

6.2. Frozen

6.3. Preserved

6.4. Y-O-Y Growth trend Analysis By Category

6.5. Absolute $ Opportunity Analysis By Category , 2024-2030

Chapter 7. Europe Fish Processing Market– By Application

7.1. Introduction/Key Findings

7.2 Food

7.3. Non-Food

7.4. Y-O-Y Growth trend Analysis By Application

7.5. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Fish Processing Market– By Source

8.1. Introduction/Key Findings

8.2. Marine

8.3. Inland

8.4. Y-O-Y Growth trend Analysis Source

8.5. Absolute $ Opportunity Analysis Source , 2024-2030

Chapter 9. Europe Fish Processing Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Category

9.1.3. By Application

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Fish Processing Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Marine Harvest ASA

10.2. Lerøy Seafood Group

10.3. SalMar ASA

10.5. Mowi ASA

10.6. Nomad Foods

10.7. Thai Union Group

10.8. Clearwater Seafoods

10.9. High Liner Foods

10.10. Pescanova

10.11. Espersen Group

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

By 2023, the market is expected to be valued at US$ 6.1 Billion.

Through 2030, the market is expected to grow at a CAGR of 5.9%.

By 2030, the market is expected to grow to a value of USD 9.11 Billion

France is predicted to lead the European Fish Processing Market

The Europe Fish Processing Market has segments like Application, Source, Category, and Region