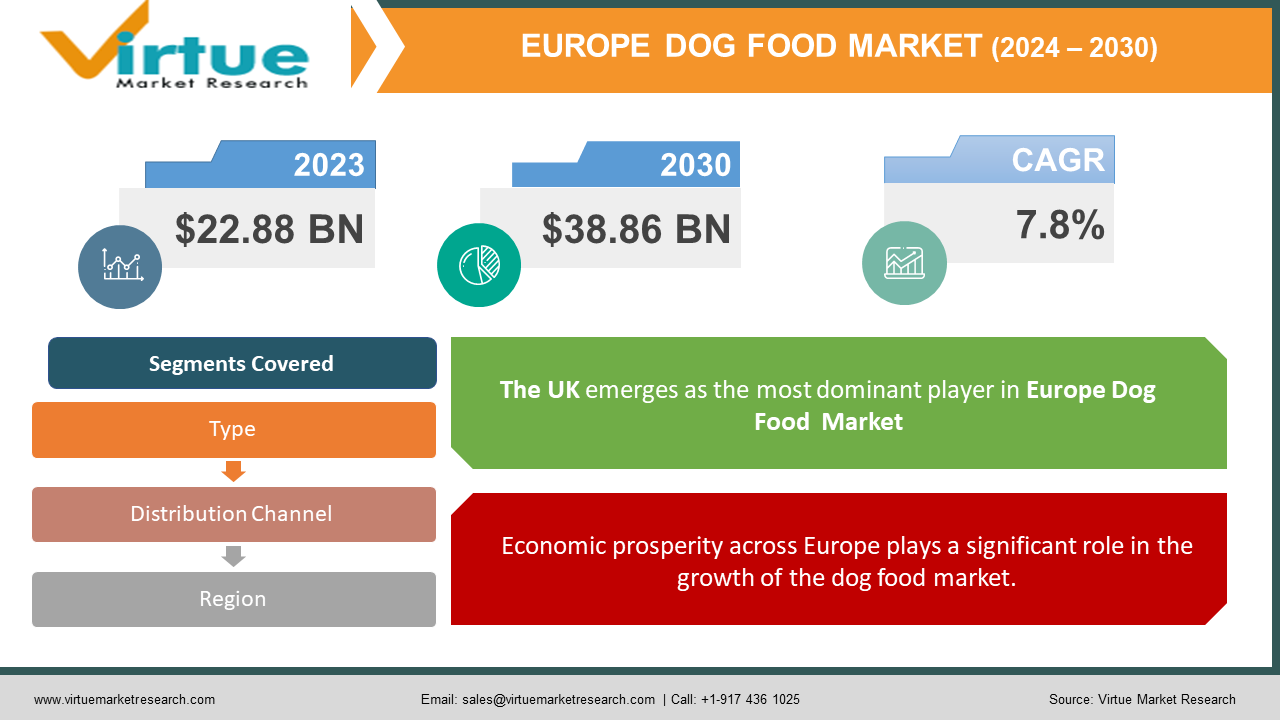

Europe Dog Food Market Size (2024-2030)

The Europe Dog Food Market was valued at USD 22.88 Billion in 2023 and is projected to reach a market size of USD 38.86 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.8%.

Europe is seeing a steady rise in dog ownership due to the burgeoning pet humanization movement. More and more people view dogs as important members of the family, and they are prepared to make financial investments in their health, such as buying high-quality food. Premium dog food options that meet particular nutritional requirements, breed sizes, and activity levels are becoming more and more popular among consumers. Due to this trend, grain-free recipes, organic ingredients, and dog diets tailored to senior citizens or puppies are becoming more and more common. Consumers are increasingly concerned about the environmental impact of pet food production. This is driving demand for dog food made with sustainable ingredients and eco-friendly packaging.

Key Market Insights:

- In the European market, the need for dog food products with enhanced nutritional analysis and personalisation is projected to reach $920 million by 2024.

- By the end of 2024, the market for dog food products with improved palatability and texture variation is projected to have grown to $2.4 billion, with a compound annual growth rate (CAGR) of 5.4% from 2019 to 2024.

- By 2024, it's expected that the market for dog food products with cutting-edge packaging options that increase shelf life would be worth $1.3 billion.

- By the end of 2024, the market for dog food products with cutting-edge portion control and feeding systems is expected to have grown to $880 million, with a compound annual growth rate (CAGR) of 6.3% from 2019 to 2024.

- In the European market, the need for dog food products with improved supply chain traceability and transparency is expected to be valued at $1.1 billion.

- By the end of 2024, it is projected that the market for dog food products made for active and working dogs would have grown to $980 million at a compound annual growth rate of 5.9%.

- It is anticipated that there would be a $3.2 billion market for dog food items made using sophisticated manufacturing techniques like baking, cold-pressing, and extrusion.

- As environmental effect becomes more and more of a concern, the market for dog food products with enhanced sustainability and eco-friendly techniques is expected to reach $1.6 billion in 2024.

Europe Dog Food Market Drivers:

Across Europe, a heartwarming trend is unfolding – the humanization of pets. Dogs are no longer simply seen as guard animals or working companions; they are increasingly viewed as valued members of the family.

The humanization trend manifests in various ways. Dog owners are more likely to celebrate their dog's birthdays, purchase them stylish accessories, and even include them in family outings and vacations. This desire to "spoil" their canine companions extends to their diet, leading to a surge in demand for premium dog food options. With dogs occupying a more prominent role in families, pet owners are becoming more educated about their nutritional needs. They are moving away from generic dog food options and seeking out formulations that address specific health concerns, breed requirements, and even activity levels. This focus on specialized nutrition fuels the premiumization trend in the European dog food market. Consumers are increasingly willing to pay a premium for dog food containing high-quality protein sources, functional ingredients like probiotics or glucosamine, and grain-free or limited-ingredient formulas catering to dogs with allergies or sensitivities.

Economic prosperity across Europe plays a significant role in the growth of the dog food market.

When a pet owner's basic needs—such as food and shelter—are satisfied, they are more inclined to spend money on extras that pertain to their dog's wellbeing. This entails looking for high-quality dog food options, signing up for dog training programmes, and making use of pet care services like walking or grooming. Busy lifestyles across Europe are driving the demand for convenient pet food solutions. Pre-portioned single-serve packs, subscription services delivering dog food directly to homes, and the rise of online pet food retailers all cater to this need for convenience. The increasing disposable income and busy lifestyles are also impacting how Europeans shop for dog food. Online retailers are gaining traction, offering a wider selection of brands and convenient home delivery options. However, pet specialty stores with knowledgeable staff remain a crucial resource for personalized advice and building brand loyalty.

Europe Dog Food Market Restraints and Challenges:

Not all pet owners in Europe have unlimited budgets for their dogs. Price sensitivity, particularly in regions with slower economic growth, can be a significant barrier to entry for premium dog food brands. Consumers may opt for economy dog food options that prioritize affordability over premium ingredients or specialized formulations. Even pet owners willing to spend on their dogs are likely to seek value for money. This translates to a demand for dog food brands that offer a clear differentiation and justify their premium price points through superior quality ingredients, demonstrable health benefits, or strong brand reputation. Supermarkets and hypermarkets often offer private label dog food options at competitive prices. These can be attractive to budget-conscious consumers, putting pressure on established brands to maintain competitive pricing strategies for their entry-level or mid-range products. Regulatory requirements regarding dog food labeling are constantly evolving. Manufacturers need to stay updated on these changes to ensure their labels comply with current regulations and provide accurate information to consumers.

Europe Dog Food Market Opportunities:

Formulations specifically designed for puppies, senior dogs, or adult dogs with varying activity levels can cater to the unique nutritional requirements of each life stage. Dog food containing ingredients like glucosamine for joint health, probiotics for gut health, or omega-3 fatty acids for cognitive function can appeal to owners concerned about specific health issues. The rise of personalized pet care solutions could extend to dog food. DNA testing or online tools could help determine a dog's unique dietary needs, leading to customized food formulations. Sourcing ingredients like ethically raised meat from sustainable farms or utilizing insect protein as an alternative protein source can resonate with environmentally conscious consumers. Online pet food retailers are rapidly expanding their market share, offering a vast selection of dog food brands and convenient delivery options.

EUROPE DOG FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

7.8% |

||

|

Segments Covered |

By Type, Distribution Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Nestlé Purina PetCare , Mars Petcare, Butcher's Pet Care, Hill's Pet Nutrition, Versele-Laga, Agrando GmbH, Bozita Naturals |

Europe Dog Food Market Segmentation:

Europe Dog Food Market Segmentation: By Type:

- Dry Dog Food

- Wet Dog Food

- Treats and Snacks

Dry dog food, also known as kibble, reigns supreme in the European market. Dry dog food offers unmatched convenience for pet owners. It has a longer shelf life compared to wet food, requires minimal preparation, and is easy to store. Busy lifestyles across Europe make convenience a key factor for pet owners. Portion control is essential for dogs to maintain a healthy weight, and dry dog food makes it easier to do so. To further help with portion control, kibble is available in several kibble sizes to accommodate different breeds and age groups. A large range of formulations are available in dry dog food to meet different demands.

The segment of treats and snacks for dogs is witnessing the most dynamic growth in the European dog food market. With dogs increasingly viewed as family members, pet owners are more likely to indulge them with treats and snacks. These treats can serve various purposes, from rewarding good behaviour to providing mental stimulation or supplementing their diet. Treats are no longer just about indulgence. The market is witnessing a rise in functional treats that offer specific benefits like dental health support, joint care, or improved digestion.

Europe Dog Food Market Segmentation: By Distribution Channel:

- Pet Specialty Stores

- Supermarkets and Hypermarkets

- Online Retailers

Supermarkets and hypermarkets remain the leading distribution channel for dog food in Europe. These one-stop shopping destinations offer a wide variety of dog food brands, including economy and some premium options, alongside other pet care products. Busy pet owners can conveniently pick up dog food while doing their regular grocery shopping. Many established dog food brands have strong shelf presence in supermarkets and hypermarkets, making them familiar choices for consumers.

The way dog food is distributed in Europe is fast changing due to the influence of online shops. Online retailers provide a huge assortment of dog food brands, easy-to-order home delivery choices, and subscription services that send out pre-portioned dog food on a regular basis. This serves pet owners who are busy and appreciate ease of use. Due to their lack of physical shelf space constraints, online sellers are able to carry a far greater selection of dog food brands, including specialised and niche products that might not be easily found in supermarkets.

Europe Dog Food Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

With a roughly 16% market share, the UK has long been a leader in the European dog food industry. Numerous variables, such as the prevalence of well-known pet food brands, a high degree of pet ownership, and a focus on pet nutrition and wellness, all contribute to this dominance. The growing humanization of pets, especially dogs, is one of the main factors contributing to the UK's market supremacy. The growing trend of British pet owners considering their dogs as part of the family has increased demand for premium and high-quality dog food products.

In the European dog food market, Spain accounts for about 8% of the total market share. Despite historically being a more cat-friendly country, dog ownership has been increasingly common in recent years, which has helped the dog food industry expand. Because they want to provide their dogs the best nutrition possible, Spanish pet owners are starting to embrace the trend of premium and specialty dog food products. Further driving market expansion is the ease with which Spanish customers can now acquire a greater variety of dog food options thanks to the emergence of e-commerce and online pet food businesses.

COVID-19 Impact Analysis on the Europe Dog Food Market:

With more dogs joining European households, the demand for dog food naturally rose. This growth was particularly significant in the puppy food segment, as new dog owners welcomed adorable canine companions. The emotional connection with their new furry family members led many pet owners to prioritize quality. This resulted in a shift towards premium dog food options, with higher-quality ingredients and targeted formulations gaining traction. With restrictions on movement and a heightened focus on online shopping, e-commerce platforms emerged as the favoured channel for dog food purchases. The convenience of home delivery and access to a wider range of brands further fueled this trend. Global disruptions in logistics and transportation networks created temporary shortages of certain dog food ingredients and packaging materials. This led to price fluctuations and, in some cases, limited availability of specific brands. As pandemic restrictions eased and life returned to a semblance of normalcy, some consumers shifted their spending priorities. This could potentially lead to a moderation in the demand for premium dog food, although the overall pet ownership trend is expected to remain positive.

Latest Trends/ Developments:

Dog food created especially for adult dogs with different activity levels, pups, or senior dogs is becoming more and more popular. Each life stage has different nutritional needs, which are met by these formulas, which maintain joint health and cognitive function in senior dogs, encourage optimal growth and development in puppies, and provide energetic adult dogs just the appropriate amount of energy. More and more dog foods are being made with specific components, such as omega-3 fatty acids to support cognitive function, probiotics to support digestive health, and glucosamine to support joint health. Pet owners can now treat some health issues that their furry pals may have. Dog food is becoming more and more individualised. In order to ascertain a dog's specific nutritional requirements, DNA testing or internet resources may be employed more frequently. This could result in food formulations that are specially blended to meet each dog's demands and breed-specific requirements.

Key Players:

- Nestlé Purina PetCare

- Mars Petcare

- Butcher's Pet Care

- Hill's Pet Nutrition

- Versele-Laga

- Agrando GmbH

- Bozita Naturals

Chapter 1. Europe Dog Food Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Dog Food Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Dog Food Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Dog Food Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Dog Food Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Dog Food Market– By Type

6.1. Introduction/Key Findings

6.2. Dry Dog Food

6.3. Wet Dog Food

6.4. Treats and Snacks

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Dog Food Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Pet Specialty Stores

7.3. Supermarkets and Hypermarkets

7.4. Online Retailers

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Dog Food Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Dog Food Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Nestlé Purina PetCare

9.2. Mars Petcare

9.3. Butcher's Pet Care

9.4. Hill's Pet Nutrition

9.5. Versele-Laga

9.6. Agrando GmbH

9.7. Bozita Naturals

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The number of dog owners in Europe is steadily increasing. This translates to a larger consumer base and a higher demand for dog food. The perception of dogs is shifting from companions to cherished family members. This leads to pet owners spending more on their furry friends, including higher-quality dog food.

Concerns exist regarding the transparency of ingredient sourcing and the potential presence of contaminants like mycotoxins or heavy metals in dog food, particularly in economy or private label brands

Nestlé Purina PetCare, Mars Petcare, Butcher's Pet Care, Hill's Pet Nutrition, Versele-Laga, Agrando GmbH, Bozita Naturals

The UK has long been a frontrunner in the European dog food market, with a market share of approximately 16%.

Spain holds a market share of around 8% in the European dog food market. The popularity of dog ownership has been on the rise in recent years, contributing to the growth of the dog food market.