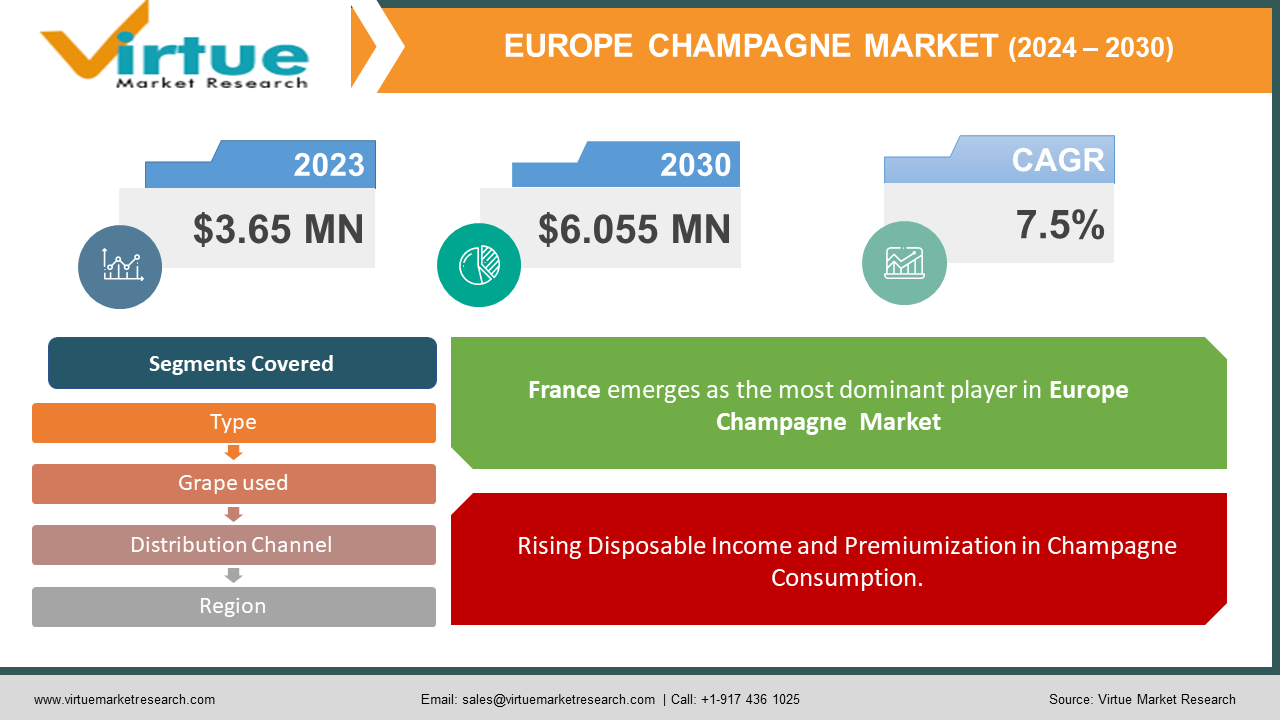

Europe Champagne Market Size (2024-2030)

The Europe Champagne Market was valued at USD 3.65 Million in 2023 and is projected to reach a market size of USD 6.055 Million by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 7.5% between 2024 and 2030.

Champagne, the epitome of sparkling wine, is crafted through the meticulous méthode champenoise, involving secondary fermentation in the bottle, a hallmark of its authenticity and luxury. This prestigious beverage hails from the Champagne region in France, where specific grape varieties—predominantly Pinot Noir, Chardonnay, and Pinot Meunier—thrive in its approved vineyards. The result is a sophisticated flavor profile characterized by crisp lemony notes, creamy textures, and toasted nuances, all contributing to its elegance and grace.

Key Market Insights:

- Champagne holds 85% of the global sparkling wine market, making it the top choice for celebrations.

- France dominates Champagne exports with a 70% share worldwide, highlighting its significant influence in the industry.

- While "Brut" Champagne remains the most popular, "Rosé" Champagne is gaining traction, now representing 20% of the market.

- Sustainability is a growing focus in the European Champagne market, with over 70% of vineyards adopting sustainable viticulture practices.

Europe Champagne Market Drivers:

Rising Disposable Income and Premiumization in Champagne Consumption.

Economic growth in Europe has significantly increased disposable income, leading consumers to spend more on premium products, including champagne. This surge in purchasing power has shifted consumer behavior, with people now buying champagne more frequently and not just reserving it for special occasions. The luxurious image of champagne plays a crucial role in this trend, as individuals are drawn to the prestige and exclusivity associated with renowned champagne brands. As a result, there is a growing willingness to pay higher prices for these premium labels, reflecting a broader trend of premiumization in the market. This shift not only underscores the appeal of champagne's sophisticated and elegant profile but also highlights how economic prosperity can drive demand for high-end products. Consequently, champagne is becoming a more common indulgence in everyday life, celebrated for its association with luxury and refined taste, further entrenching its status as a symbol of affluence and celebration in contemporary European culture.

Tourism and Hospitality Industry Boosts Champagne Market.

The flourishing tourism sector in Europe significantly benefits the champagne market, as international visitors seek to indulge in luxury champagnes in their region of origin. This attraction to authentic experiences drives tourists to vineyards and local establishments, enhancing their travel with the prestige of tasting champagne where it is produced. Furthermore, the expansion of hotels, restaurants, bars, and pubs across Europe creates a robust demand for champagne within the hospitality industry. These venues cater to both tourists and locals who desire premium beverages, contributing to a steady increase in champagne consumption. The allure of enjoying champagne in upscale settings, coupled with the hospitality sector's commitment to offering high-quality experiences, strengthens the market for this esteemed sparkling wine. As a result, the interconnection between tourism and the hospitality industry fosters a thriving environment for champagne sales, reinforcing its status as a symbol of luxury and celebration, and ensuring its continued popularity among discerning consumers.

Europe Champagne Market Restraints and Challenges:

Despite its robust appeal, the European champagne market faces several restraints and challenges. One significant challenge is the stringent regulations governing the production and labeling of champagne, which can limit flexibility and innovation within the industry. Additionally, climate change poses a threat to the Champagne region, impacting grape yields and quality, which could affect supply and increase production costs. The market also faces competition from other sparkling wines and premium beverages, which offer consumers a broader range of choices at varying price points. Economic fluctuations and political uncertainties, such as those resulting from Brexit, can disrupt trade and affect consumer spending power, further challenging the market. Additionally, the growing trend towards health consciousness and moderation in alcohol consumption may reduce demand, as consumers increasingly seek healthier lifestyle choices. These factors collectively pose significant obstacles to the sustained growth and profitability of the champagne market in Europe, necessitating strategic adaptation and resilience from producers and marketers to maintain their competitive edge and market share.

Europe Champagne Market Opportunities:

The European champagne market presents numerous opportunities for growth and innovation. One key opportunity lies in expanding global exports, particularly to emerging markets in Asia and Latin America, where rising disposable incomes and a growing appreciation for luxury goods are driving demand for premium beverages. Additionally, the increasing trend of experiential tourism offers a unique avenue for growth, as tourists seek immersive experiences, such as vineyard tours and tasting sessions in the Champagne region, enhancing brand loyalty and awareness. The growing popularity of online retail and direct-to-consumer sales channels also provides a significant opportunity for champagne producers to reach a broader audience, particularly younger consumers who are more inclined to shop online. Furthermore, the market can capitalize on the trend towards sustainability by adopting eco-friendly practices in production and packaging, appealing to environmentally conscious consumers. Innovations in product offerings, such as organic and low-alcohol champagnes, can also attract health-conscious buyers. By leveraging these opportunities, champagne producers can not only expand their market presence but also reinforce their brand's prestige and adaptability in a dynamic market landscape.

EUROPE CHAMPAGNE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Type, Grape used, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

Europe Champagne Market Segmentation:

Europe Champagne Market Segmentation By Grape Used:

- Pinot Noir

- Pinot Meunier

- Chardonnay

The Europe Champagne Market Segmented by Grape Used, Pinot Noir had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Champagne production is governed by strict regulations that permit the use of only three grape varietals: Chardonnay, Pinot Noir, and Pinot Meunier. Among these, Chardonnay is particularly esteemed for its ability to impart finesse and elegance to the final product. Pinot Noir, while valued for adding body and structure, is typically used in lesser quantities to achieve the classic balance and style that define Champagne. Market research and production trends suggest that Chardonnay holds the largest market share in Champagne, primarily due to its contribution to the wine's desired characteristics. Producers often prioritize Chardonnay to create a refined and sophisticated flavor profile that meets consumer expectations for quality and consistency. This strategic preference for Chardonnay not only aligns with the regulatory framework but also caters to the market's demand for premium, elegant Champagnes. Consequently, Chardonnay's prominence in the blend underscores its critical role in maintaining the prestigious image and superior taste of Champagne, ensuring that it continues to be the preferred choice among discerning consumers worldwide.

Europe Champagne Market Segmentation Type:

- Prestige Cuvee

- Blanc De Noirs

- Blanc De Blancs

- Rosé Champagne

The Europe Champagne Market Segmented by Type, Prestige Cuvee had the largest market share last year and is poised to maintain its dominance throughout the forecast period. This segment, representing the highest quality tier in Champagne production, consists of the finest blends made from the best grapes, often aged longer to achieve exceptional complexity and depth. Prestige Cuvée Champagnes, such as Dom Pérignon and Cristal, are renowned for their superior craftsmanship, exclusivity, and unparalleled taste, which command premium prices and appeal to affluent consumers. The enduring dominance of Prestige Cuvée is driven by several factors. Firstly, the rising disposable income and trend toward premiumization mean that more consumers are willing to spend on high-end products, including top-tier Champagnes. Secondly, the association of Prestige Cuvée with luxury and celebration reinforces its appeal, particularly for special occasions and gifting. Additionally, the growth of the tourism and hospitality industry, with its emphasis on offering premium experiences, further boosts the demand for these exquisite Champagnes. Given these dynamics, Prestige Cuvée is well-positioned to continue leading the market, benefitting from its strong brand reputation and the ongoing consumer preference for luxurious and high-quality beverages.

Europe Champagne Market Segmentation Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Stores

The Europe Champagne Market Segmented by Distribution Channel, Supermarkets/Hypermarkets had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Their extensive accessibility and convenience make them a preferred choice for consumers, who appreciate the ability to purchase Champagne alongside regular groceries. The significant purchasing power of these large retail chains allows them to negotiate better pricing with producers, resulting in competitive prices that encourage higher consumption rates. Furthermore, these stores often feature dedicated sections for premium alcoholic beverages, including Champagne, enhancing product visibility and appeal. In-store promotions, loyalty programs, and discounts drive impulse purchases and foster customer loyalty, contributing to sustained sales growth. The convenience of one-stop shopping combined with the variety of Champagne brands available, from budget-friendly to high-end options, ensures broad consumer appeal. The strategic placement of Champagne within these stores and the customer-centric approach of Supermarkets and Hypermarkets solidify their role as the leading distribution channel. This broad reach and ability to cater to diverse consumer needs ensure that Supermarkets and Hypermarkets will continue to dominate the Champagne market, leveraging their advantages to sustain their market leadership.

Europe Champagne Market Segmentation By Region:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The Europe Champagne Market Segmented by Region, France had the largest market share last year and is poised to maintain its dominance throughout the forecast period. This dominance is deeply rooted in the historical and geographical significance of the Champagne region within France. As the birthplace of Champagne production, France benefits from a rich heritage and expertise in crafting this esteemed sparkling wine. Additionally, France's strong cultural affinity for Champagne further reinforces its market leadership. The French people have a long-standing tradition of celebrating special occasions with Champagne, contributing to consistent domestic consumption. Moreover, France's status as a major exporter of Champagne allows it to maintain a strong presence in international markets, catering to diverse consumer preferences worldwide. This entrenched position is further supported by stringent regulations that protect the authenticity and quality of Champagne produced in France, bolstering consumer confidence in the product's origin and integrity. Given these factors, France is well-positioned to continue leading the European Champagne market by region, leveraging its heritage, cultural significance, and commitment to quality to sustain its dominance in the years to come.

COVID-19 Impact Analysis on the Europe Champagne Market.

The COVID-19 pandemic has had a significant impact on the European Champagne market, disrupting both production and consumption dynamics. Lockdown measures and restrictions on social gatherings led to a decline in celebratory events and hospitality activities, reducing demand for Champagne. With weddings, parties, and other festivities postponed or scaled-down, consumers shifted towards more essential purchases, dampening overall sales. Additionally, the closure of bars, restaurants, and entertainment venues further constrained the on-trade channel, which traditionally accounts for a substantial portion of Champagne sales. On the production side, logistical challenges, labor shortages, and safety protocols disrupted supply chains and vineyard operations, impacting harvests and bottling schedules. Despite these challenges, there were pockets of resilience, as some consumers sought comfort in premium indulgences during periods of isolation, leading to increased sales of Champagne through retail channels. Looking ahead, the recovery of the Europe Champagne market hinges on the pace of economic recovery, the easing of restrictions, and consumer confidence restoration. Adaptation to changing consumer behaviors, such as the rise of e-commerce and home consumption trends, will be crucial for Champagne producers to navigate the evolving landscape and emerge stronger from the crisis.

Latest trends / Developments:

In the ever-evolving landscape of the Europe Champagne market, several trends and developments have emerged, shaping consumer preferences and industry dynamics. One prominent trend is the increasing demand for organic and sustainable Champagne options, reflecting a broader shift towards eco-conscious consumption. Champagne producers are responding to this demand by implementing environmentally friendly practices in vineyard management and production processes, as well as obtaining organic certifications to appeal to discerning consumers. Another notable development is the rising popularity of low-alcohol and zero-alcohol Champagnes, driven by health-conscious consumers seeking lighter beverage options without compromising on taste or quality. This trend aligns with the broader movement towards wellness and moderation, presenting opportunities for Champagne producers to innovate and diversify their product offerings. Additionally, the COVID-19 pandemic has accelerated the digital transformation of the Champagne market, with an increased focus on e-commerce platforms and virtual tasting experiences to reach consumers directly. Leveraging social media and digital marketing strategies has become essential for engaging with customers and building brand loyalty in an increasingly competitive market landscape. Overall, these trends underscore the dynamic nature of the European Champagne market and the importance of adaptation and innovation for industry players to thrive in the face of evolving consumer preferences and market challenges.

Key Players:

- Moët & Chandon

- Veuve Clicquot

- Dom Pérignon

- Louis Roederer

- Taittinger

- Krug

- Laurent-Perrier

- Piper-Heidsieck

- Ruinart

- Bollinger

Chapter 1. Europe Champagne Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Champagne Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Champagne Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Champagne Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Champagne Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Champagne Market– By Grape Used

6.1. Introduction/Key Findings

6.2. Pinot Noir

6.3. Pinot Meunier

6.4. Chardonnay

6.5. Y-O-Y Growth trend Analysis By Grape Used

6.6. Absolute $ Opportunity Analysis By Grape Used, 2024-2030

Chapter 7. Europe Champagne Market– By Type

7.1. Introduction/Key Findings

7.2 Prestige Cuvee

7.3. Blanc De Noirs

7.4. Blanc De Blancs

7.5. Rosé Champagne

7.6. Y-O-Y Growth trend Analysis By Type

7.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 8. Europe Champagne Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Specialty Stores

8.4. Online Retail

8.5. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Champagne Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Distribution Channel

9.1.3. By Type

9.1.4. By Grape Used

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Champagne Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Moët & Chandon

10.2. Veuve Clicquot

10.3. Dom Pérignon

10.4. Louis Roederer

10.5. Taittinger

10.6. Krug

10.7. Laurent-Perrier

10.8. Piper-Heidsieck

10.9. Ruinart

10.10. Bollinger

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

By 2023, the Europe Champagne market is expected to be valued at US$ 3.65 Million

Through 2030, the Europe Champagne market is expected to grow at a CAGR of 7.5%.

By 2030, the Europe Champagne Market is expected to grow to a value of US$ 6.055 Million

. North America is predicted to lead the Europe Champagne market.

The Europe Champagne has segments like Grape Used, Type, Distribution Channel, and Region