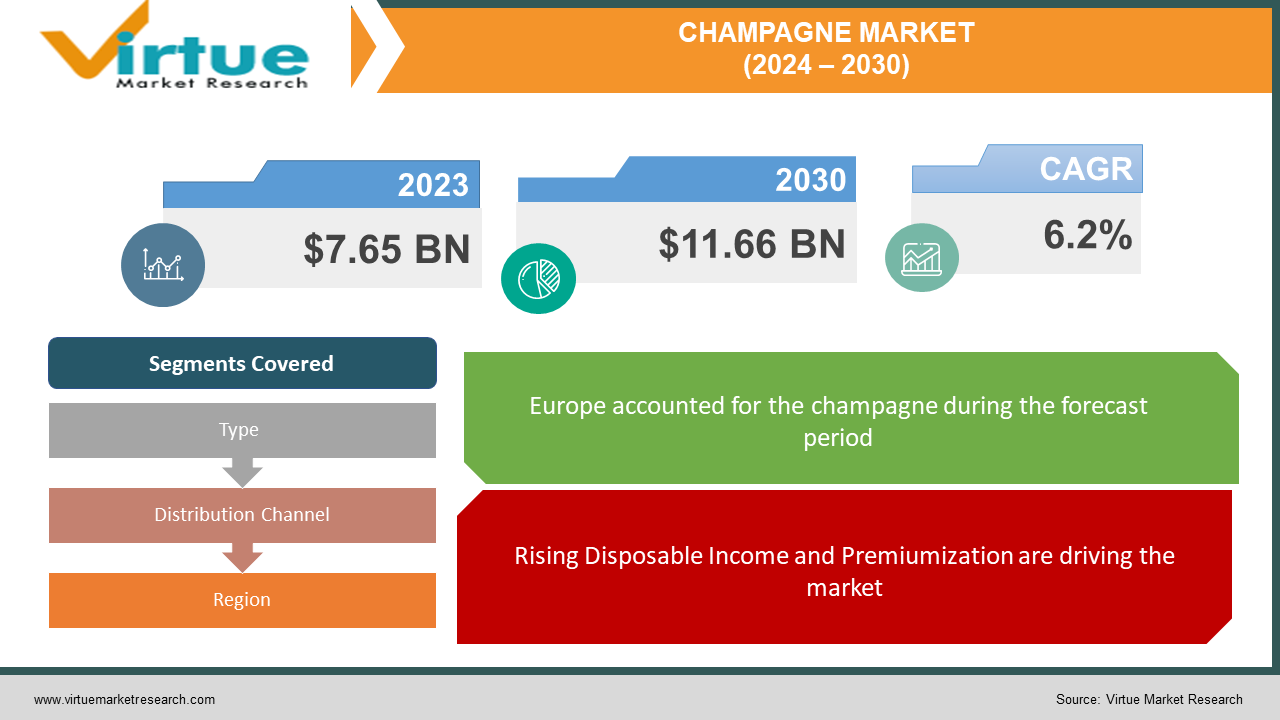

Champagne Market Size (2024 – 2030)

The Global Champagne Market was valued at USD 7.65 billion in 2023 and will grow at a CAGR of 6.2% from 2024 to 2030. The market is expected to reach USD 11.66 billion by 2030.

Champagne, synonymous with celebration and luxury, is a sparkling wine produced exclusively in the Champagne region of northeastern France. Made primarily from Chardonnay, Pinot Noir, and Pinot Meunier grapes, it undergoes a specific double fermentation process called "méthode champenoise" which creates its signature bubbles. Champagne boasts a range of styles, from dry and crisp "brut" to sweeter "demi-sec," each offering a unique flavor profile. Its production is strictly regulated, ensuring quality and contributing to its premium status enjoyed worldwide.

Key Market Insights:

The champagne market, synonymous with luxury and celebration, is experiencing steady growth, driven by several key factors. Firstly, a growing appreciation for premium beverages and increasing disposable income in emerging economies like China is fueling demand. Secondly, the diverse range of styles, from dry "brut" to sweeter "demi-sec," caters to various palates and occasions, offering options beyond traditional celebrations. Additionally, innovative marketing strategies by major champagne houses are targeting younger demographics and promoting champagne as a lifestyle choice, expanding its reach beyond its elite image. However, the market also faces challenges, such as rising production costs, stricter regulations, and potential disruptions in global supply chains. Furthermore, replicating the unique characteristics of genuine Champagne can be difficult, leading to competition from sparkling wines produced in other regions. Despite these challenges, the champagne market is expected to maintain its upward trajectory, fueled by its distinct brand identity, evolving consumer preferences, and ongoing marketing efforts to position it as a sophisticated and versatile beverage.

Global Champagne Market Drivers:

Rising Disposable Income and Premiumization are driving the market

The rise of the global middle class, particularly in booming economies like China and India, is creating a prime market for champagne. As disposable income increases, consumers are seeking to elevate their lifestyles and indulge in premium goods. Champagne, steeped in tradition and synonymous with exclusivity and sophistication, perfectly aligns with these aspirations. This growing demand is fueled by the perception of champagne as a celebratory beverage for special occasions, a luxurious reward for hard work, and a symbol of refined taste. This trend presents a significant opportunity for champagne producers to expand their reach beyond traditional markets and tap into a new generation of discerning consumers with a growing appreciation for premium experiences.

Evolving Consumer Preferences is driving the market

Gone are the days of champagne being solely reserved for popping corks at weddings. Today's consumers are on a quest for unique and diverse experiences, and the champagne world is responding with a delightful array of styles. The traditional "brut," known for its dry and crisp character, remains a popular choice. However, a growing appreciation exists for the full spectrum of champagne styles. Sweeter options like "demi-sec" offer a more approachable experience, perfect for pairing with desserts or lighter fare. Additionally, rosé champagnes, bursting with vibrant fruit flavors, are gaining traction, particularly among younger demographics. This newfound appreciation for diversity extends beyond taste. Consumers are exploring different bottle sizes, perfect for smaller gatherings or personal enjoyment. The versatility of champagne is further emphasized by innovative food pairings, taking it beyond celebratory toasts and into the realm of fine dining experiences. This shift in consumer preference is a boon for the champagne market, creating a broader appeal and ensuring there's a perfect bubbly option for every palate and occasion.

The growing popularity of Sparkling Wines is driving the market

The worldwide popularity of sparkling wines is creating a delightful ripple effect for the champagne market. As consumers explore the world of bubbly beverages, they become more accustomed to celebrating with fizzy options. This initial foray into sparkling wines can act as a gateway to the unique world of genuine champagne.

Several factors make champagne stand out from the crowd. Firstly, its distinct characteristics, arising from the specific grape varietals, traditional "méthode champenoise" production process, and unique terroir, create a complex and nuanced flavor profile unmatched by many sparkling wines. Secondly, its protected designation of origin (PDO) status guarantees that the grapes are sourced and the entire production process takes place within the designated Champagne region of France, ensuring authenticity and quality. This combination of distinct taste and guaranteed origin positions genuine champagne as the pinnacle of sparkling wine experiences, potentially enticing consumers who have enjoyed other bubbly options to explore its unique qualities. This spillover effect from the broader sparkling wine market, coupled with the irreplaceable characteristics of genuine champagne, presents a promising opportunity for continued growth and brand recognition in the global beverage landscape.

Global Champagne Market challenges and restraints:

Rising Production Costs are restricting market growth

The production of champagne isn't just about popping some grapes in a bottle. It's a labor of love, requiring skilled workers for tasks like hand-picking grapes and manually riddling bottles. This, coupled with strict regulations governing every step of the process, from grape varietals to production methods, drives up the cost compared to other sparkling wines.

The situation is further compounded by external factors. Climate change wreaks havoc on grape yields, sometimes leading to shortages and driving up prices. Additionally, rising minimum wages, a positive development for workers, also contributes to increased production costs. These factors squeeze profit margins for champagne producers, forcing them to navigate a delicate balance between maintaining qualities, adhering to regulations, and ensuring their business remains profitable.

Economic Fluctuations and Geopolitical Instability are restricting market growth

The champagne market isn't immune to external economic pressures. When economic downturns hit, consumers tighten their belts, leading to a decrease in spending on luxury goods like champagne. This can cause a significant dip in overall market growth. Furthermore, geopolitical instability throws a wrench into the smooth operations of the global champagne market. Disruptions in global supply chains and trade routes caused by international conflicts can hinder the flow of champagne internationally. This can lead to shortages in certain regions, price fluctuations, and ultimately, dampen consumer enthusiasm for the celebratory bubbly. To navigate these challenges, champagne producers need to be adaptable, potentially exploring new markets or implementing cost-saving measures to ensure the continued allure of champagne even in uncertain times

Market Opportunities:

The champagne market presents several exciting opportunities for growth and expansion. The burgeoning middle class in emerging economies like China and India, with their increasing disposable income and growing taste for premium beverages, offers a significant potential consumer base. Champagne houses can tap into this market by tailoring marketing strategies and potentially introducing entry-level options that cater to price sensitivity while maintaining brand identity. Furthermore, the evolving consumer preference for diverse experiences opens doors for exploring new champagne styles and flavors. Experimenting with grape varietals, fermentation techniques, and blending could lead to unique offerings that attract a wider range of palates and expand beyond traditional celebratory occasions. Additionally, strategic partnerships with restaurants and bars can create dedicated champagne pairing menus or events, educating consumers about food pairings and showcasing the versatility of champagne beyond celebratory toasts. The growing online retail market presents another opportunity. By developing e-commerce platforms and engaging in targeted online marketing, champagne houses can reach a wider audience and overcome geographical limitations. Additionally, leveraging social media effectively to create engaging content, showcase the champagne-making process, and connect with potential consumers can foster brand loyalty and build a strong online presence, particularly among younger demographics.

Environmental Concerns and Sustainability is restricting the market growth

The world is going green, and the champagne industry is taking note. Consumers are increasingly environmentally conscious, raising concerns about the sustainability of champagne production practices. This scrutiny extends to various aspects, including vineyard management (pesticide use, water conservation), energy consumption throughout the production process, and waste disposal associated with packaging and byproducts. Ignoring these concerns can alienate environmentally responsible consumers, potentially damaging brand image and market share.

Therefore, champagne producers are actively addressing these concerns by implementing sustainable practices like adopting organic or biodynamic viticulture, utilizing renewable energy sources, and minimizing waste through recyclable packaging and responsible disposal methods. By embracing environmental responsibility, champagne producers can not only attract a wider audience but also contribute to a greener future for the industry and the planet.

CHAMPAGNE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

LVMH Moët Hennessy Louis Vuitton SE, Champagne Lanson-BCC, Laurent-Perrier, Vranken Pommery Monopole, Nicolas Feuillatte, Rémy Cointreau, Bollinger, Taittinger, Pol Roger, Champagne Ayala |

Champagne Market segmentation - by type

-

Brut champagne

-

Rosé champagne

-

Blanc de Blancs

-

Blanc de Noirs

-

Demi-sec

The global champagne market offers a diverse range of types catering to various preferences. Brut champagne, known for its dryness and versatility, is the most popular and widely consumed. In contrast, Doux champagne, the sweetest type, is less common and typically enjoyed as a dessert wine. Additionally, Blanc de Blancs champagne, crafted solely from white grapes, and Blanc de Noirs champagne, made exclusively from black grapes, are considered premium options due to their unique flavor profiles and are less frequently encountered compared to non-vintage champagnes, which blend grapes from different years for a consistent style.

Champagne Market segmentation - By Distribution Channel

-

On-trade

-

Off-trade

Traditionally, on-trade sales, occurring in restaurants, bars, and hotels, have been the dominant channel for champagne, linked to its celebratory nature. However, the off-trade segment, encompassing retail stores and online platforms, is experiencing significant growth. This shift is driven by changing consumer behavior, favoring in-home celebrations and the convenience of online shopping. Understanding this evolving landscape is crucial for champagne producers to adapt their strategies and reach consumers through the most prevailing channels.

Champagne Market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Geographically, the global Champagne market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa. Europe remains the dominant region, driven by a strong cultural affinity and established markets like France, Germany, and the UK. However, the fastest growing region is Asia Pacific, fueled by booming economies in China and India, where rising middle classes and increasing disposable income are creating a new generation of Champagne enthusiasts.

COVID-19 Impact Analysis on the Global Champagne Market

The COVID-19 pandemic significantly impacted the global Champagne market, causing a nearly 20% plunge in annual sales. Disrupted supply chains, lockdowns in key markets like France and Australia that shuttered restaurants and bars (major champagne consumption channels), and a general economic downturn affecting luxury goods purchases all contributed to the decline. However, the Champagne industry showed resilience. E-commerce sales boomed as consumers shifted their habits online, with producers establishing direct-to-consumer platforms to meet this demand. Additionally, with economic recovery and a return to celebratory gatherings, champagne sales rebounded swiftly, suggesting a positive future for the industry. The pandemic also accelerated pre-existing trends like online sales and diversification into new markets, which could position the Champagne market for long-term growth.

Latest trends/Developments

The global Champagne market is experiencing a bubbly revival, driven by a shift towards more casual consumption and growing demand in emerging economies. While traditionally reserved for celebrations, Champagne is increasingly enjoyed at restaurants, bars, and even at home. Economic growth in countries like China and India fuels this trend, while established markets benefit from rising tourism. Consumers are also driving change, seeking Champagnes with health-conscious attributes and unique flavor profiles. Despite challenges like overconsumption and global disruptions, the Champagne market outlook is bright, with innovation and diverse consumer preferences shaping its future.

Key Players:

-

LVMH Moët Hennessy Louis Vuitton SE

-

Champagne Lanson-BCC

-

Laurent-Perrier

-

Vranken Pommery Monopole

-

Nicolas Feuillatte

-

Rémy Cointreau

-

Bollinger

-

Taittinger

-

Pol Roger

-

Champagne Ayala

Chapter 1. Champagne Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Champagne Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Champagne Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Champagne Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Champagne Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Champagne Market – By type

6.1 Introduction/Key Findings

6.2 Brut champagne

6.3 Rosé champagne

6.4 Blanc de Blancs

6.5 Blanc de Noirs

6.6 Demi-sec

6.7 Y-O-Y Growth trend Analysis By type

6.8 Absolute $ Opportunity Analysis By type, 2024-2030

Chapter 7. Champagne Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 On-trade

7.3 Off-trade

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Champagne Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Champagne Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 LVMH Moët Hennessy Louis Vuitton SE

9.2 Champagne Lanson-BCC

9.3 Laurent-Perrier

9.4 Vranken Pommery Monopole

9.5 Nicolas Feuillatte

9.6 Rémy Cointreau

9.7 Bollinger

9.8 Taittinger

9.9 Pol Roger

10 Champagne Ayala

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Champagne Market was valued at USD 7.65 billion in 2023 and will grow at a CAGR of 6.2% from 2024 to 2030. The market is expected to reach USD 11.66 billion by 2030.

Rising Disposable Income and Premiumization and growing Popularity of Sparkling Wines are the reasons which are driving the market.

Based on the distribution channel it is divided into two segments – on-trade, off-trade

Europe is the most dominant region for the Champagne Market.

LVMH Moët Hennessy Louis Vuitton SE, Champagne Lanson-BCC, Laurent-Perrier, Vranken Pommery Monopole