Europe Biofertilizers Market Size (2023-2030)

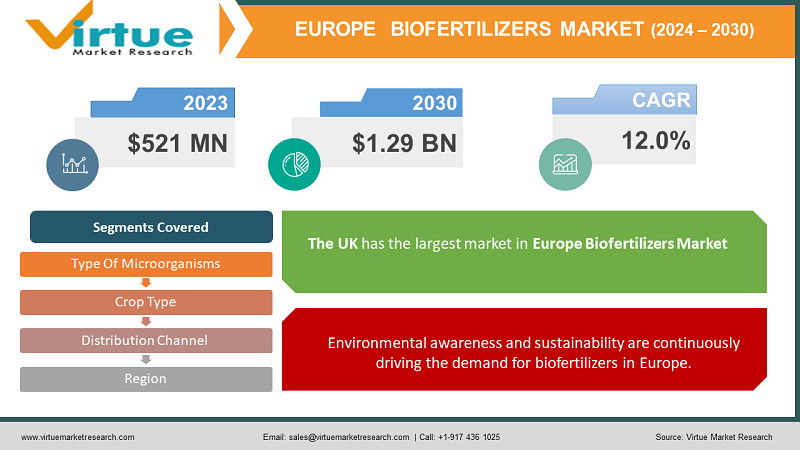

Europe Biofertilizers Market was estimated to be worth USD 521 Million in 2022 and is projected to reach a value of USD 1.29 Billion by 2030, growing at a CAGR of 12.0% during the forecast period 2023-2030.

The European biofertilizers market is gaining growth as sustainable agriculture becomes a priority to address environmental concerns and enhance crop yield and productivity. Biofertilizers are made with the help of living microorganisms like bacteria, fungi, and algae that enhance soil fertility and assist in plant growth. Biofertilizers act as an eco-friendly alternative to chemical fertilizers, which are harmful to the environment. Europe's diverse agricultural landscape and growing emphasis on organic farming practices have driven the demand for biofertilizers across the region.

Europe Biofertilizers Market Drivers:

Environmental awareness and sustainability are continuously driving the demand for biofertilizers in Europe.

Environmental consciousness is increasing among farmers and consumers which has driven the demand for sustainable and environment-friendly farming practices. Biofertilizers align well with these values by reducing soil and water pollution and limiting the release of greenhouse gases and chemicals. Biofertilizers reduce the use of synthetic fertilizers helping in mitigating climate change. Due to these benefits and rising environmental concerns, biofertilizers are high in demand and will continue to be in the future.

Organic farming trends along with the need to manage soil health and nutrients are accelerating the need for biofertilizers in Europe.

As consumers increasingly demand organic products, the demand for organic farming also rises in Europe. Biofertilizers are an excellent fit for organic farming because they sit well with organic certification requirements and contribute positively to the overall sustainability of the farming process. Biofertilizers enhance soil fertility as well, which improves nutrient retention and provides enhanced availability of nutrients to plants. Farmers are continuously appealing to biofertilizers because of their potential to increase crop yield and productivity. As farmers seek to optimize nutrient management and maintain long-term soil health, biofertilizers become a valuable tool in achieving these goals, driving their demand in the market.

Europe Biofertilizers Market Challenges:

Limited Awareness and Education pose a significant challenge to Europe's Biofertilizers market.

Lack of awareness and education regarding the proper use and benefits of biofertilizers among farmers is one of the biggest challenges for this market. Traditional chemical fertilizers are widely utilized and well-established among farmers and convincing them to switch to biofertilizers requires spreading education about their efficacy and benefits in comparison to chemical alternatives. Education, training, support, and outreach efforts are crucial to communicating the advantages of biofertilizers in farming and guiding their application.

High production costs and variable efficacy could hinder the growth of the European biofertilizer market.

The production costs involved with biofertilizers could be high as compared to traditional chemical fertilizers, which can limit some farmers, especially small farmers with limited financial resources, from adopting biofertilizers. Since biofertilizers are made using living organisms, their efficacy could vary depending on many factors like crop variety, climate, and soil type. To achieve consistent and effective results across various environmental conditions, tailored solutions and expertise are required which could be challenging.

COVID-19 Impact on the Europe Biofertilizers Market:

In the early stages of the pandemic, many industries experienced disruptions in supply chains due to lockdowns, travel restrictions, and workforce shortages. The biofertilizer market was also affected, with potential delays in the production and distribution of biofertilizer products. The biofertilizer market's performance is closely tied to the agriculture sector. During the pandemic, there were shifts in demand for various agricultural products due to changes in consumer behavior and export patterns. Governments in Europe implemented various measures to support businesses and industries affected by the pandemic. Depending on the level of support provided to the agriculture sector, there might have been financial incentives or assistance programs that influenced farmers' choices regarding fertilizers, including biofertilizers. Biofertilizers are often associated with sustainable agricultural practices. The pandemic highlighted the importance of resilient and sustainable food systems. This renewed focus on sustainability could have led to increased interest in biofertilizers and other environmentally friendly agricultural practices.

The pandemic's economic impact influenced investment decisions and research priorities in the agricultural sector. The limitations on physical interactions accelerated the adoption of online platforms for purchasing agricultural inputs, including biofertilizers. This shift opened up new distribution channels for biofertilizer manufacturers. Depending on the severity of labor shortages in agriculture due to pandemic-related factors, there were changes in farming practices, which had implications for fertilizer use.

Europe Biofertilizers Market Recent Developments:

- In April 2023, Rooteco, a Spanish biotech start-up that produces and sells biofertilizers and bio-stimulants raised EUR 300,000 in funding. It aims to expand its business throughout Europe in 2024, and beyond Europe in 2025.

- In June 2022, Novozymes, a leading European biotech company got into a partnership with AgroFresh, a global leader in post-harvest freshness solutions. They are forming a research and commercialization partnership to develop better biological solutions that can improve post-harvest quality and minimize waste.

EUROPE BIOFERTILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Type of microorganisms, crop type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Europe, U.K., Germany, France, Italy, Spain, Rest Of Europe |

|

Key Companies Profiled |

BioFert Manufacturing Ltd., Symborg, Novozymes A/S, Lallemand Inc., Biomax Naturals Ltd., EMNZ - Effective Microorganisms New Zealand, Rizobacter, Madras Fertilizers Limited, Agri Life, Italpollina S.p.A. |

Europe Biofertilizers Market Segmentation:

Europe Biofertilizers Market Segmentation: By Type of Microorganisms

- Nitrogen-Fixing Biofertilizers

- Phosphate-Solubilizing Biofertilizers

- Potassium-Mobilizing Biofertilizers

- Micronutrient-Solubilizing Biofertilizers

- Sulfur-Fixing Biofertilizers

Nitrogen-fixing biofertilizers have the largest market share. These biofertilizers contain nitrogen-fixing bacteria, such as species of Rhizobium, Bradyrhizobium, and Azotobacter which establish symbiotic relationships with leguminous plants, enabling them to convert atmospheric nitrogen into a form that plants can use for growth, reducing the need for synthetic nitrogen fertilizers. Phosphate-solubilizing biofertilizers contain microorganisms, often phosphate-solubilizing bacteria (PSB) and fungi, that help solubilize bound phosphorus in the soil, making it more accessible to plants, making it the fastest-growing segment. Potassium-mobilizing microorganisms, such as bacteria and fungi, enhance the availability of potassium in the soil. These microorganisms break down complex minerals containing potassium, releasing them into a form that plants can absorb. Micronutrient-solubilizing biofertilizers focus on enhancing the availability of essential micronutrients like zinc, iron, and copper. Sulfur-fixing biofertilizers contain sulfur-fixing microorganisms which help to make sulfur compounds in the soil more accessible to plants, contributing to their overall health and productivity.

Europe Biofertilizers Market Segmentation: By Crop Type

- Cereals

- Fruits & Vegetables

- Legumes

- Oilseeds

Cereal crops are staple foods and major components of many diets, which is why this is the largest segment in this market. Biofertilizers that enhance nutrient uptake, particularly nitrogen, can significantly impact cereal yields. Fruits and vegetables are high-value crops that often require well-balanced nutrient management for optimal growth and quality, which can be improved by biofertilizers to increase soil fertility, nutrient availability, and overall plant health, resulting in increased yields and better-tasting produce. This is the fastest-growing segment in this market due to the increasing demand for organic and sustainable produce. Leguminous crops have a unique ability to form symbiotic relationships with nitrogen-fixing bacteria called rhizobia. Biofertilizers containing these bacteria can enhance nitrogen availability in the soil, benefiting both the legumes and subsequent crops in rotation. Oilseed crops like sunflower, soybean, and canola require adequate nutrient levels for oil production. Phosphate-solubilizing biofertilizers can help release bound phosphates in the soil, making them available to oilseed plants and promoting better oil yield.

Europe Biofertilizers Market Segmentation: By Distribution Channel

- Direct Sales

- Agricultural Cooperatives

- Retail Outlets

- Online Platforms

- Distributors and Wholesalers

Manufacturers or distributors sell biofertilizer products directly to individual farmers making direct sales. This channel allows for personalized communication, product recommendations, and direct feedback from customers. Agricultural cooperatives act as intermediates between manufacturers and farmers. They aggregate demand from multiple farmers and purchase biofertilizers in bulk, often negotiating better prices, and comprise the largest segment in the market. Biofertilizer products can be sold through traditional retail channels, such as agricultural supply stores, garden centers, and agrochemical retailers. With the rise of e-commerce, biofertilizer products are increasingly available on online platforms and marketplaces. Farmers can conveniently browse and purchase products online, and manufacturers can reach a broader customer base beyond geographical boundaries, which is why this is the fastest-growing segment. Distributors and wholesalers buy biofertilizer products from manufacturers in bulk and then supply them to various retail outlets, cooperatives, and other resellers. They play a crucial role in ensuring products reach different regions efficiently.

Europe Biofertilizers Market Segmentation: By Region

- U.K.

- Germany

- France

- Italy

- Spain

- Rest Of Europe

The United Kingdom, as a significant agricultural nation, plays a role in shaping the biofertilizer market in Europe. Germany is known for its advanced agricultural practices and focus on sustainable farming. The biofertilizer market in Germany could be driven by the country's robust organic farming movement, stringent environmental regulations, and the promotion of integrated nutrient management. France's diverse agricultural landscape, including vineyards, cereal fields, and orchards, impacts the biofertilizer market a lot, and of which this is the largest segment in this market. The biofertilizer market in Italy could be influenced by the country's focus on organic and sustainable practices in both conventional and niche agricultural segments. Spain's diverse climate zones and agriculture make it a potential market for biofertilizers. The "Rest of Europe" category includes countries like Scandinavia, Poland Hungary, and Greece.

Europe Biofertilizers Market Key Players:

- BioFert Manufacturing Ltd.

- Symborg

- Novozymes A/S

- Lallemand Inc.

- Biomax Naturals Ltd.

- EMNZ - Effective Microorganisms New Zealand

- Rizobacter

- Madras Fertilizers Limited

- Agri Life

- Italpollina S.p.A.

Chapter 1. Europe Biofertilizers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Biofertilizers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Biofertilizers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Biofertilizers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Biofertilizers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Biofertilizers Market– By Type of Microorganisms

6.1. Introduction/Key Findings

6.2. Nitrogen-Fixing Biofertilizers

6.3. Phosphate-Solubilizing Biofertilizers

6.4. Potassium-Mobilizing Biofertilizers

6.5. Micronutrient-Solubilizing Biofertilizers

6.6. Sulfur-Fixing Biofertilizers

6.7. Y-O-Y Growth trend Analysis By Type of Microorganisms

6.8. Absolute $ Opportunity Analysis By Type of Microorganisms, 2023-2030

Chapter 7. Europe Biofertilizers Market– By Crop Type

7.1. Introduction/Key Findings

7.2. Cereals

7.3.Fruits & Vegetables

7.4.Legumes

7.5.Oilseeds

7.6. Y-O-Y Growth trend Analysis By Crop Type

7.7. Absolute $ Opportunity Analysis By Crop Type, 2023-2030

Chapter 8. Europe Biofertilizers Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Direct Sales

8.3.Agricultural Cooperatives

8.4. Retail Outlets

8.5. Online Platforms

8.6. Distributors and Wholesalers

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.8. Absolute $ Opportunity Analysis Distribution Channel, 2023-2030

Chapter 9. Europe Biofertilizers Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Crop Type

9.1.3. By Type of Microorganisms

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Biofertilizers Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BioFert Manufacturing Ltd.

10.2. Symborg

10.3. Novozymes A/S

10.4. Lallemand Inc.

10.5. Biomax Naturals Ltd.

10.6. EMNZ - Effective Microorganisms New Zealand

10.7. Rizobacter

10.8. Madras Fertilizers Limited

10.9. Agri Life

10.10. Italpollina S.p.A.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Europe Biofertilizers Market is estimated to be worth USD 521 Million in 2022 and is projected to reach a value of USD 1.29 Billion by 2030, growing at a CAGR of 12.0% during the forecast period 2023-2030

The European biofertilizers Market Drivers are Environmental awareness and sustainability and Organic farming trends along with the need to manage soil health and nutrients.

. Based on the Product type, the Europe Biofertilizers Market is segmented into Cereals, Fruits and vegetables, Legumes, and Oilseeds

France is the most dominating in the Europe Biofertilizers Market.

BioFert Manufacturing Ltd., Symborg, Novozymes A/S, and Lallemand Inc. are a few of the leading players in the Europe Biofertilizers Market.