Europe Bakery Ingredients Market Size (2024-2030)

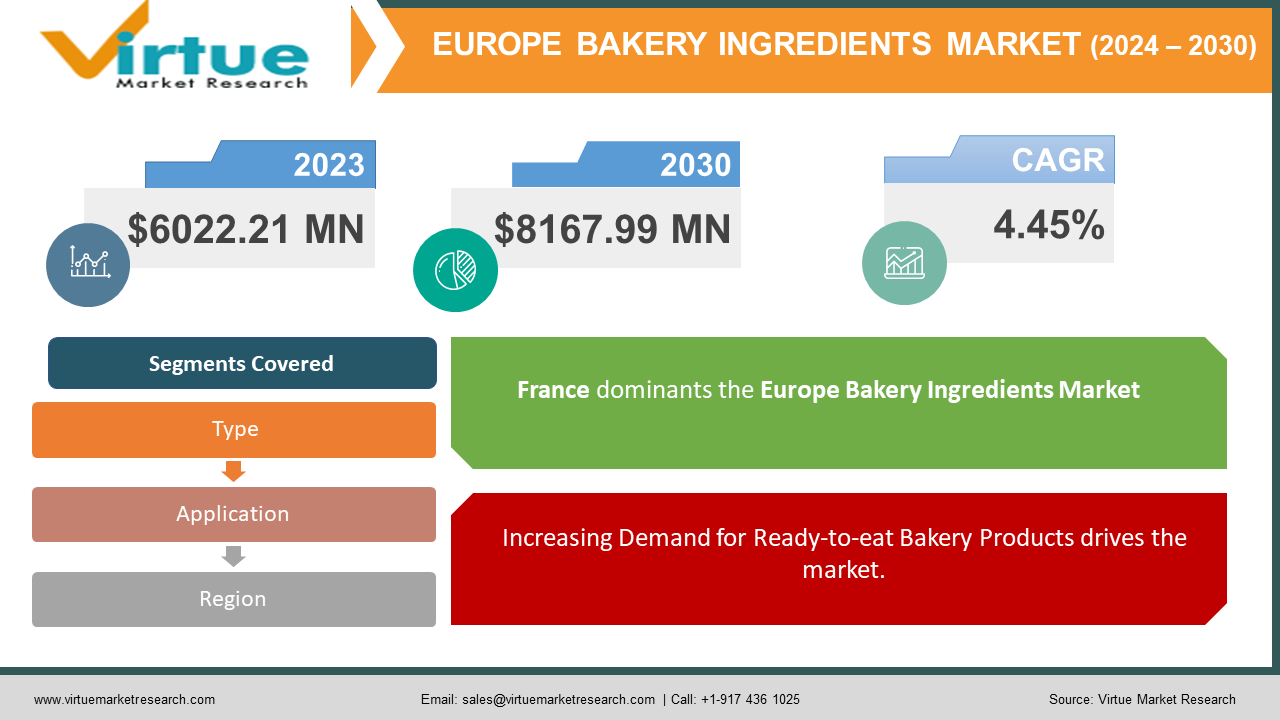

The Europe Bakery Ingredients Market was valued at USD 6022.21 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 8167.99 million by 2030, growing at a CAGR of 4.45%.

Key Market Insights:

Bakery ingredients, essential components utilized in the production of various baked goods such as bread, cookies, biscuits, rolls, pies, cakes, and pastries, among others, are pivotal to the bakery sector. This industry is currently witnessing a surge driven by a growing emphasis on healthy dietary habits and an escalating demand for convenient food products. Major industry players and established corporations are actively engaging in the production of these ingredients to align with evolving consumer preferences and expand their market presence. Bakery ingredients serve as food additives that play a crucial role in preserving the freshness, texture, and flavor of baked items, while also prolonging their shelf life and enhancing protein content. These ingredients are available in diverse flavors and are widely recognized as fundamental sources of nutrition for consumers. The primary catalysts propelling the growth of this industry include the increasing emphasis on healthy eating habits and the escalating demand for convenience-oriented products. Market leaders and large corporations are strategically focusing on product diversification and market expansion to secure a larger market share. Moreover, the utilization of bakery ingredients is anticipated to witness a notable upsurge in the foreseeable future, primarily driven by the expansion of the frozen baked goods market. The rising adoption of frozen bakery products can be attributed to their inherent advantages such as convenience, rapid preparation, widespread availability, and cost-effectiveness.

Europe Bakery Ingredients Market Drivers:

Increasing Demand for Ready-to-eat Bakery Products drives the market.

The market is experiencing a notable transition in consumer preferences towards ready-to-eat products, primarily influenced by the busy lifestyles and hectic schedules of working individuals. This shift in consumer behavior is anticipated to significantly bolster the market studied during the forecast period. Ready-to-eat products are widely regarded as the most convenient alternative to traditional meals, offering consumption flexibility at any time. The escalating demand for baked foods is closely linked to the burgeoning trend of convenience-oriented food options.

In developed nations such as the United States and the United Kingdom, a proliferation of local bakery enterprises, cafes, and supermarkets has emerged in recent years to meet the escalating demand for both fresh and frozen bakery products, as well as a diverse range of bakery ingredients. The increasing preference for ready-to-eat food items is poised to propel the bakery ingredients market forward.

Moreover, the transition from traditional home-cooked meals to convenient food options has also fueled the demand for bakery ingredients in emerging markets. Factors such as the adoption of a Westernized lifestyle, the prevalence of double-income households, a growing emphasis on healthier living, heightened nutritional awareness, and an increase in disposable income are key drivers behind the rising expenditure on bakery products and the expansion of the baked foods industry. Consequently, this trend is expected to drive the demand for bakery ingredient manufacturers.

Furthermore, the growing consumer demand for baked goods with enhanced nutritional profiles, characterized by reduced sugar content, inclusion of whole grains, and zero trans-fat per serving, is further fueling the demand for bakery products.

Europe Bakery Ingredients Market Restraints and Challenges:

The variability in the cost of essential ingredients such as flour, sugar, and dairy can significantly impact the profitability of bakery enterprises. Fluctuations in commodity markets can pose challenges in maintaining consistent pricing strategies.

Furthermore, the growing awareness of health issues such as diabetes and obesity has spurred consumer demand for healthier bakery offerings. This trend presents challenges for ingredient suppliers, who are tasked with developing and sourcing ingredients that align with health-conscious preferences.

Europe Bakery Ingredients Market Opportunities:

The bakery ingredient market exhibits a high level of fragmentation, characterized by the entry of numerous medium-sized and large enterprises in recent years. Additionally, small bakeries, artisanal bakeries, and home-based bakeries contribute to the diversity of offerings within the market. In urban regions, there is a growing preference for large and international bakeries, while domestic and local bakeries remain favored in rural areas. This significant fragmentation and disparate market conduct are expected to impede the expansion of the European bread ingredients market.

The consumption of bakery items and bread has been steadily rising across the region, positioning Europe as one of the prominent markets for bakery products, driven notably by increasing per capita consumption in key countries such as the United Kingdom, Germany, France, Italy, the Netherlands, and Spain. Notably, approximately 65 percent of the flour produced in the United Kingdom is utilized for bread production, while the remaining 35 percent caters to a diverse array of culinary products, offering ample opportunities within the market.

Moreover, the convergence of factors such as escalating disposable income levels and rapid urbanization is expected to present attractive prospects for the region's primary stakeholders.

EUROPE BAKERY INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.45% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Germany, France, Italy, UK, Spain, Rest of Europe |

|

Key Companies Profiled |

Archer-Daniels-Midland Company, Monginis Food Pvt. Ltd., Associated British Foods plc., BreadTalk Co., Ltd., Aryzta AG, Goodman Fielder, Finsbury Food Group, Britannia Industries Ltd., Flower Foods Inc, Angel Yeast Co., DuPont, Bakels Group |

Europe Bakery Ingredients Market Segmentation

Europe Bakery Ingredients Market Segmentation By Application:

- Bread

- Cookies and Biscuits

- Rolls and Pies

- Cakes and Pastries

Various types of bakery products, including bread, cookies, biscuits, rolls, pies, cakes, and pastries, comprise the diverse range of bakery ingredients available in the market. Among these, the bread application category stands out as the dominant segment. Bread, a staple baked food item, holds significant cultural and religious significance worldwide, particularly in Western societies.

Over time, bread has evolved beyond its traditional role as a breakfast staple, increasingly finding its way into artisanal sweet creations. The growing consumption of bread in the food industry can be attributed to factors such as rising disposable income, urbanization, and evolving consumer preferences. While white bread remains popular, health-conscious consumers are shifting towards brown and other nutritionally enriched varieties.

Following closely behind bread, cookies and biscuits represent the second-largest market segment. These products are gaining popularity, especially among younger demographics. Continuous product innovations aimed at enhancing taste, texture, and health benefits are driving the demand for cookies and biscuits. Manufacturers are focusing on introducing new flavors and packaging options to cater to consumer preferences. Additionally, cookies, biscuits, and other confectionery items like chocolates are popular choices for gift-giving. The rising demand for low-calorie variants is further fueling growth in the bakery ingredients sector, particularly among health-conscious consumers.

Europe Bakery Ingredients Market Segmentation By Type:

- Enzymes

- Starch

- Fiber

- Colors

- Flavors

- Emulsifier

- Antimicrobials

- Fats

- Dry baking mix

- Others

Dry baking mixes are offered in various forms such as granular, powder, flake, and crystal, tailored to their diverse applications in the food industry. These mixes serve to enhance the visual appeal of dishes while also contributing to improved digestion, weight management, metabolism regulation, and blood pressure reduction, among other benefits.

The surge in demand for ready-to-eat foods and the proliferation of quick-service restaurants (QSRs) in both developed and developing nations have significantly boosted the demand for dry baking mixes across regions. Additionally, consumer inclination towards experimentation with novel flavors, textures, and cuisines has further propelled the demand for these mixes.

Moreover, the bakery ingredients industry has experienced substantial expansion, driven by the availability of dry baking mixes through online sales channels and modern trade outlets such as supermarkets and hypermarkets. Rising health consciousness among consumers has led to increased demand for gluten-free bakery products like cakes, pastries, bread, and muffins, thereby driving growth in the baking mix and enzyme industry. Notably, enzymes serve as effective substitutes for potassium bromate, a banned substance in many regions, leading to the enzyme category's projected fastest Compound Annual Growth Rate (CAGR) over the forecast period.

Europe Bakery Ingredients Market Segmentation- by Region

- Germany

- France

- Italy

- UK

- Spain

- Rest of Europe

In France, bakery products that offer a blend of healthfulness, convenience, and nutrition are considered essential dietary components, driving the significant market growth. The country's thriving tourism industry has played a crucial role, enabling roadside establishments to offer bakery items that are easy to vend and transport, leading to lower selling and storage expenses. These factors collectively contribute to the expansion of the French bakery ingredients sector.

Meanwhile, Germany boasts the highest bread consumption rates, serving as a primary catalyst for market growth. Within the European baked goods market, Germany holds a prominent position as a market leader. German consumers are increasingly gravitating towards low-calorie bakery options that offer the same level of taste and satisfaction as their traditional counterparts. Bread and rolls emerge as the most favored category, with a growing demand for ingredient-level enhancements, value-added products, and gluten-free alternatives.

COVID-19 Pandemic: Impact Analysis

Latest Trends/ Developments:

- In October 2023, McKee Foods is slated to introduce an enticing addition to its esteemed Little Debbie line of confectionery delights and bakery offerings: the Big Pack Cookies and Creme Brownies. These generously sized brownies, individually wrapped for freshness, come packaged in crates of 12, each adorned with a luscious topping of white icing and chocolate cookie crumbs. The Big Pack Cookies and Creme Brownies present a mouthwatering fusion, seamlessly blending the indulgent, fudgy texture of Little Debbie brownies with the delightful crunchiness and creaminess of cookies and creme. This harmonious combination yields an elegant flavor profile and luxurious textural contrast that will cater to the preferences of every member of the household. Moreover, the designation "big pack" reflects not only the substantial size of each brownie but also the generous number of servings per carton, making them an ideal choice for convenient snacking or for sharing with friends and family.

- In May 2023, at the Bakery China event, Angel Yeast unveiled a high-protein mixed-grain bread boasting an impressive protein content of 12 grams per 100 grams of bread. This breakthrough simplifies the process of infusing bread with delightful flavors while ensuring the long-lasting stability of those flavors.

Key Players:

These are the top 10 players in the Europe Bakery Ingredients Market: -

- Archer-Daniels-Midland Company

- Monginis Food Pvt. Ltd.

- Associated British Foods plc.

- BreadTalk Co., Ltd.

- Aryzta AG

- Goodman Fielder

- Finsbury Food Group

- Britannia Industries Ltd.

- Flower Foods Inc

- Angel Yeast Co.

- DuPont

- Bakels Group

Chapter 1. Europe Bakery Ingredients Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type of Material s

1.5. Secondary Product Type of Material s

Chapter 2. Europe Bakery Ingredients Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Bakery Ingredients Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Bakery Ingredients Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Bakery Ingredients Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Bakery Ingredients Market– By Type

6.1. Introduction/Key Findings

6.2. Enzymes

6.3. Starch

6.4. Fiber

6.5. Colors

6.6. Flavors

6.7. Emulsifier

6.8. Antimicrobials

6.9. Fats

6.10. Dry baking mix

6.11. Others

6.12. Y-O-Y Growth trend Analysis By Type

6.13. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Bakery Ingredients Market– By Application

7.1. Introduction/Key Findings

7.2 Bread

7.3. Cookies and Biscuits

7.4. Rolls and Pies

7.5. Cakes and Pastries

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Bakery Ingredients Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Bakery Ingredients Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Archer-Daniels-Midland Company

9.2. Monginis Food Pvt. Ltd.

9.3. Associated British Foods plc.

9.4. BreadTalk Co., Ltd.

9.5. Aryzta AG

9.6. Goodman Fielder

9.7. Finsbury Food Group

9.8. Britannia Industries Ltd.

9.9. Flower Foods Inc

9.10. Angel Yeast Co.

9.11. DuPont

9.12. Bakels Group

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The market is experiencing a notable transition in consumer preferences towards ready-to-eat products, primarily influenced by the busy lifestyles and hectic schedules of working individuals

The top players operating in the Europe Bakery Ingredients Market are - Archer-Daniels-Midland Company, Monginis Food Pvt. Ltd., and Associated British Foods plc.

The consumption of bakery items and bread has been steadily rising across the region, positioning Europe as one of the prominent markets for bakery products, driven notably by increasing per capita consumption in key countries such as the United Kingdom, Germany, France, Italy, the Netherlands, and Spain

Germany boasts the highest bread consumption rates, serving as a primary catalyst for market growth.