Europe Automotive Aftermarket Market Size (2024-2030)

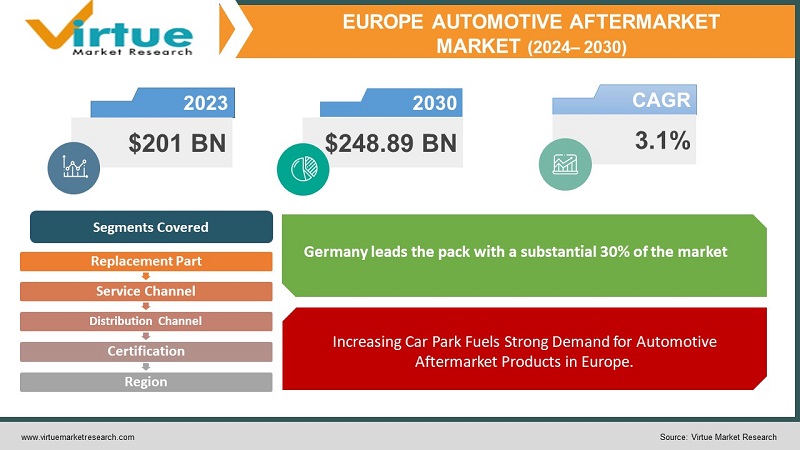

The Europe Automotive Aftermarket Market is expanding quickly; it was estimated to be worth USD 201 billion in 2023 and is expected to increase to USD 248.89 billion by 2030, with a projected compound annual growth rate (CAGR) of 3.1% from 2024 to 2030.

The Europe Automotive Aftermarket Market is a thriving and robust market, with a diverse range of enterprises catering to the evolving needs of the automotive industry and automobile owners. Recent studies indicate that the sector has expanded rapidly, with estimates putting its value at $201 billion in 2023. The increasing number of automobiles on the road, the rising demand from consumers for customisation and performance enhancements, and the thriving e-commerce sector are all seen to be significant causes of this rise. The market is segmented into multiple areas, ranging from providing replacement parts and components to providing specialty services such as upkeep, repairs, and customisation.

The automotive aftermarket in Europe is expanding due to a number of factors, including technological advancements, the emergence of eco-friendly practices like remanufacturing, a robust network of conventional brick-and-mortar stores, and a growing internet presence. As the automotive environment continues to develop, innovation, evolving consumer preferences, and a strong aftermarket ecosystem are projected to fuel additional growth in the Europe automotive aftermarket industry.

Key Market Insights:

Significant market insights into the European car aftermarket reveal a dynamic landscape with observable patterns and impacts. Based on the latest available data, the market has demonstrated a robust growth trajectory and is anticipated to attain a noteworthy magnitude of $201 billion by 2023. One of the main drivers of this increase is the growing need for aftermarket parts and services brought on by the expanding number of automobiles on the road. Technological developments, especially in the fields of automotive electronics and connectivity, have propelled the market's growth and increased demand for state-of-the-art accessories and parts. Thanks to the growth of e-commerce as a significant distribution channel, consumers may now easily source automotive aftermarket components.

In keeping with the industry's broader tendency towards ecologically friendly solutions, remanufacturing practices and other sustainability initiatives have also grown in popularity. The companies' strategic focus on product innovation, online presence, and service excellence to obtain a piece of this rising market is indicative of the competitive nature of the European automobile aftermarket industry. As the industry grows, it is expected that market players will overcome challenges and grab new opportunities, further shaping the trajectory of the European automotive aftermarket.

Europe Automotive Aftermarket Market Drivers:

Increasing Car Park Fuels Strong Demand for Automotive Aftermarket Products in Europe.

The region's automotive aftermarket is seeing significant growth, largely due to the rapid increase in Europe's vehicle fleet. Because there are more and more cars on European roads, there is a continuous demand for maintenance services, new accessories, and replacement parts. The need for a steady supply of aftermarket solutions is fueled by the ageing car demographic, which is fueling this expanding industry trend. The automotive aftermarket sector is vital to the industry's continuous growth because it meets the evolving needs of customers who want to prolong the life of their cars.

The dominance of e-commerce is changing the automotive aftermarket landscape in Europe.

In the digital age, the European car aftermarket is radically changing as e-commerce takes centre stage in determining market dynamics. Because it offers clients unrivalled convenience, a wide selection of items, and competitive pricing, online purchasing for aftermarket parts has entyrely transformed the industry. The expansion of e-commerce not only facilitates transactions but also increases market accessibility, enabling consumers to make informed decisions. The shift to internet platforms is one notable factor that is affecting the present and future direction of Europe's automobile aftermarket.

Sustainable Remanufacturing Practices Become the Main Event.

Amidst the increasing emphasis on sustainability worldwide, remanufacturing methods have emerged in Europe's automobile aftermarket, marking a significant shift. This environmentally friendly approach addresses the growing trend of consumers choosing eco-friendly items as well as environmental challenges. In keeping with the ideas of a circular economy, the aftermarket industry's commitment to remanufacturing prolongs the life cycle of automotive components and decreases waste. With regulations becoming more stringent and public awareness of environmental issues growing, the focus on sustainable practices is a revolutionary force shaping the growth of the European automobile aftermarket.

Europe Automotive Aftermarket Market Restraints and Challenges:

Complying with Regulatory Requirements and Their Complexities Burden.

The complicated and constantly evolving emission, safety, and waste disposal requirements pose a challenge to Europe's automobile aftermarket industry. To comply with and amend these regulations, a significant amount of resources must be devoted to testing, research and development, and conformity assurance. Smaller market players may find it particularly challenging to keep up with the regulatory landscape, which might lead to increased compliance costs and potential barriers to entry.

Technological Upheavals and Barriers to Integration.

The rapid advancement of automotive technology poses two obstacles for aftermarket organisations. On the one hand, there is a growing need for cutting-edge aftermarket components that seamlessly integrate with complex automotive systems. However, the speed at which technology is developing demands constant adaptation and upskilling. Smaller rivals might find it difficult to make the investments in knowledge and technology required to stay competitive, which could lead to a technological slide behind their more astute and larger rivals.

The spread of fake parts and problems with consumer trust.

Because counterfeit auto parts are so widely available, the European automotive aftermarket faces many difficulties. Counterfeit parts not only jeopardise vehicle performance and safety, but they also erode consumer trust in the aftermarket industry. In order to detect and halt the sale of counterfeit goods, law enforcement organisations, trade associations, and government authorities must collaborate. Educating consumers about the risks posed by fake components is essential to preserving the integrity of the aftermarket market.

Europe Automotive Aftermarket Market Market Opportunities:

Growth in Hybrid and Electric Vehicles Carves Out Niche Markets.

Europe's increasing use of electric and hybrid cars has led to a growing demand for aftermarket parts and services designed specifically for these green vehicles. Businesses that specialise in software solutions, battery repairs, charging infrastructure, and electric vehicle (EV) components have a plethora of business options. It is possible to increase the overall sustainability of the automotive aftermarket by carefully placing companies to meet the unique demands of the developing electric vehicle industry.

Solutions for Digitalization and Connectivity to Improve Customer Experience.

The digitalization of the automotive aftermarket provides businesses with an opportunity to enhance both customer happiness and operational effectiveness. By leveraging technologies such as the Internet of Things, artificial intelligence, and data analytics, aftermarket companies may offer state-of-the-art solutions for car diagnostics, preventive maintenance, and tailored services. Investing in digital platforms, smartphone apps, and connected car technologies presents a significant opportunity to create a seamless and engaging aftermarket experience that will boost customer satisfaction and loyalty.

Concentrate on Sustainable Practices and the Circular Economy.

There is potential for aftermarket companies to implement circular economy methods because of the growing emphasis on sustainability. Remanufacturing, recycling, and refurbishing automotive components provide environmentally favourable alternatives. Companies can promote recycling initiatives, utilise eco-friendly packaging, and find ways to produce and market remanufactured parts. Businesses that embrace sustainability gain from having more environmentally conscious consumers and from adhering to international environmental standards.

EUROPE AUTOMOTIVE AFTERMARKET MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.1% |

|

Segments Covered |

By Replacement part,service channel, certification, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, and Rest of Europe |

|

Key Companies Profiled |

Continental A.G. , Mahle Gmbh, Delphi Tech, Valeo Group, Gestamp, Magna International Inc., Lear Corp, Faurecia, Thyssennkrup AG |

Market Segmentation of Europe Automotive Aftermarket Market:

Europe Automotive Aftermarket Market Segmentation: By Replacement Part:

- Battery

- Tyre

- Filters

- Brake Parts

- Turbochargers

- Body Parts

- Wheels

The highly fragmented Europe Automotive Aftermarket is made up of a wide range of components, of which replacement parts are just one that are required for vehicle maintenance and performance enhancement. This sector includes vital components like batteries, wheels, brake components, tyres, filters, and turbochargers. Electrical systems require batteries; tyres provide optimal traction and safety; filters aid in engine efficiency; brake components are vital for safety; turbochargers boost engine power; body components maintain structural integrity and aesthetics; and wheels are essential to the vehicle's overall dynamics. This section demonstrates the aftermarket's breadth in satisfying different car owners' needs and preserving a robust ecology of replacement parts.

In the European car aftermarket, tyres are one of the most significant and prosperous replacement component segments. The performance, safety, and fuel efficiency of an automobile is significantly influenced by its tyres. There is a constant requirement for aftermarket tyre products because wear and tear require regular replacements regularly. Consumer preferences for specific tyre types, such as performance, eco-friendly, or all-season tyres, are another factor driving the industry. Innovations in tyre technology, such as run-flat tyres and smart tyre systems, have an impact on the aftermarket tyre industry's popularity. As a result, the market for new tyres is a vibrant, constantly changing sector that involves a lot of consumer interaction and has a significant impact on the operation of entyre cars.

Europe Automotive Aftermarket Market Segmentation: By Service Channel:

- DIFM (Do it for Me)

- DIY (Do it Yourself)

- OE (Delegating to OEMs)

The Europe Automotive Aftermarket is logically segmented into service channels to meet a broad range of consumer needs and preferences. This division is divided into three categories: Do it Yourself (DIY), which allows enthusiasts to handle vehicle maintenance and modifications on their own; Original Equipment (OE), which contracts out services to Original Equipment Manufacturers (OEMs) and authorised service centres; and Do it for Me (DIFM), where customers rely on professional services for repairs and maintenance. The DIY market targets do-it-yourself enthusiasts looking for a more involved car experience, whereas the DIFM segment targets people looking for simplicity of use and professional expertise. On the other hand, the OEM channel places a strong emphasis on brand-specific expertise to ensure that auto customers trust OEMs with maintenance. This segmentation shows the market's adaptability to a broad range of consumer preferences by offering specific solutions for every type of car maintenance.

The DIFM (Do it for Me) segment is one of the most effective and well-liked service channels in the European automotive aftermarket. This channel serves customers who seek convenience and knowledgeable assistance with auto maintenance and repairs. Many clients now choose the expertise of trained technicians and service providers due to the complexities of modern cars and their integration of cutting-edge technologies. DIFM services are particularly effective for intricate tasks, diagnostics, and repairs requiring specific tools and expertise. The DIFM technique ensures that automobile owners can rely on experienced professionals, which makes the process hassle-free and fosters confidence in the aftermarket repair industry.

Europe Automotive Aftermarket Market Segmentation: By Distribution Channel

- Wholesalers & Distributors

- Retailers (OEMs and Repair Shops)

In the dynamic European auto aftermarket sector, market segmentation based on distribution channels is critical to enhancing accessibility and the overall efficacy of the supply chain. As intermediaries, distributors, and wholesalers are crucial because they consolidate goods from many manufacturers and distribute them to retailers more effectively. This centralises the availability of a large range of automotive components and accessories for retailers, including original equipment manufacturers (OEMs) and repair shops.

By making large purchases and prudent inventory management, wholesalers and distributors not only help to maintain a steady flow of goods but also contribute to cost savings. This distribution approach makes merchants more competitive, enables them to meet the wide range of needs of their clientele, and keeps them abreast of the rapidly evolving aftermarket automotive trends by providing them with access to a large inventory of auto components. The collaboration of distributors, retailers, and wholesalers also fosters a flexible and responsive market by ensuring quick product availability and quick response to emerging market demands. This cooperative distribution approach is extremely effective in the European auto aftermarket, where it creates a smooth supply chain that ultimately benefits businesses and consumers.

Europe Automotive Aftermarket Market Segmentation: By Certification

- Certified Parts

- Genuine Parts

- Uncertified Parts

In the automotive industry, market segmentation based on certification status—dividing car parts into certified, genuine, and uncertified categories—has shown to be a very effective strategy for ensuring product quality, dependability, and customer satisfaction. Since certified components pass rigorous testing and follow industry standards, their performance and compatibility with vehicles are guaranteed. The manufacturer's authenticity stamp on genuine parts attests to their compliance with the strictest quality requirements. Usually, they are bought directly from the original equipment manufacturer (OEM).

Because it enables customers to make well-informed decisions based on their preferences and financial limits, this segmentation is more successful. Those who value their car's longevity and performance above all else may choose certified or original parts if they want a higher level of quality assurance. Budget-conscious buyers, however, may consider non-certified parts if they are aware of the trade-off between price and benefits and possible quality variances. By providing clarity to the automotive aftermarket market, this segmentation strategy empowers customers to make well-informed decisions on the parts they purchase. It also allows manufacturers and retailers to tailor their marketing strategies, ensuring that the relevant information reaches the right audience.

Europe Automotive Aftermarket Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The major regions of Europe account for a varied portion of the Europe Automotive Aftermarket Market; notable contributors include the UK, Germany, France, Italy, and Spain. Germany leads the pack with a substantial 30% of the market, largely attributable to its strong automotive sector and extensive aftermarket presence. With a notable 23%, the UK comes in second, demonstrating its significant impact on the growth of the European aftermarket landscape. Taken together, France, Italy, and Spain make up 32% of the market, with each country making a distinct contribution. The remaining 15% of Europe is made up of several nations, each of which influences the dynamics of the aftermarket. The distribution shown here demonstrates the regional variations in client preferences, legal,

COVID-19 Impact Analysis on the Europe Automotive Aftermarket Market :

The COVID-19 epidemic presents opportunities and problems for the European automotive aftermarket business. The epidemic's effects on supply chains, lockdowns, and economic instability have decreased vehicle utilisation, which has had an impact on the aftermarket goods and services sector. Consumer purchase behaviour has been impacted by decreased mobility and financial uncertainty; necessary maintenance and repair services may now take precedence over discretionary upgrades.

Positively, the pandemic has accelerated the development of e-commerce channels in the automotive aftermarket, as an increasing number of individuals choose to shop for parts and accessories online. The focus on health and safety has also increased demand for contactless and remote auto repair services. Furthermore, extending the lifespan of existing automobiles is becoming more and more important, which raises the need for replacement parts and repair services as long as travel restrictions and unstable economic conditions persist.

Producers and suppliers in the European Automotive Aftermarket are adapting to these changes by increasing their online presence, optimising their supply chains, and expanding their product lines to better satisfy their customers' evolving needs. The flexibility and development of the sector are exemplified.

Latest Trends/ Developments:

The automotive aftermarket industry in Europe is changing due to several noteworthy developments. One noteworthy development is the increasing use of cutting-edge technologies like artificial intelligence (AI) and machine learning in product creation, inventory control, and customer assistance. This digital revolution makes it possible for clients to receive more customised services and faster reaction times by increasing operational efficiency. Another significant development is the growing trend in the aftermarket towards electric vehicle components, charging infrastructure, and maintenance services, which is in line with the growing demand for electric vehicles (EVs). With consumers and governments placing an increasing emphasis on sustainability, the aftermarket is evolving to fulfil the needs of the electric car market.

Predictive maintenance and data analytics are also growing in significance in the aftermarket sector. Data-driven insights facilitate proactive maintenance, which enhances overall vehicle performance by reducing downtime. This pattern aligns well with the industry's broader focus on providing comprehensive and preventive vehicle care solutions. The growth of e-commerce and online marketplaces for auto parts and accessories is also transforming the aftermarket retail landscape. Established retailers are under pressure to enhance their online presence and streamline their supply chain processes as an increasing number of consumers make product comparisons, research, and purchases through online channels.

Key Players:

- Continental A.G.

- Mahle Gmbh

- Delphi Tech

- Valeo Group

- Gestamp

- Magna International Inc.

- Lear Corp

- Faurecia

- Thyssennkrup AG

Key players in the automotive aftermarket shape it by fostering innovation, setting benchmarks for the sector, and meeting a variety of customer needs. Of these major companies, Continental A.G. stands out as a global pioneer in automotive technology, well-known for its cutting-edge tyre, interior electronics, and safety system technologies. Mahle GmbH's emphasis on sustainability and efficiency provides a significant contribution to the aftermarket industry. Mahle GmbH is an expert in filtering systems and engine parts. Leading provider of automobile propulsion systems, Delphi systems, guarantees advancements in powertrain and electronics. Valeo Group is an expert in automotive technology, with a focus on enhancing vehicle electrification, comfort, and visibility.

The industry's manufacturing landscape is shaped in part by companies such as Gestamp, a recognised provider of assembly solutions and metal forming expertise, and Magna International Inc., a broad automotive supplier. Lear Corp., a firm known for its innovation in automotive seating and electronics, and Faurecia, a company that specialises in vehicle interiors, seating, and clean mobility solutions, play a major role in enabling enhanced in-car experiences. Thyssenkrupp AG, a large industrial company, contributes with its material and component knowledge and influences the automotive aftermarket by providing vital components required for car manufacturing. As the backbone of the automotive aftermarket, these significant players collaborate to advance sustainability, customer-centric solutions, and technological advancements.

Chapter 1. Europe Automotive Aftermarket Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Automotive Aftermarket Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Automotive Aftermarket Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Automotive Aftermarket Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Automotive Aftermarket Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Automotive Aftermarket Market – By Replacement Part

6.1. Introduction/Key Findings

6.2. Battery

6.3. Tyre

6.4. Filters

6.5. Brake Parts

6.6. Turbochargers

6.7. Body Parts

6.8. Wheels

6.9. Y-O-Y Growth trend Analysis By Replacement Part

6.10. Absolute $ Opportunity Analysis By Replacement Part , 2024-2030

Chapter 7. Europe Automotive Aftermarket Market – By Service Channel

7.1. Introduction/Key Findings

7.2 DIFM (Do it for Me)

7.3. DIY (Do it Yourself)

7.4. OE (Delegating to OEMs)

7.5. Y-O-Y Growth trend Analysis By Service Channel

7.6. Absolute $ Opportunity Analysis By Service Channel , 2024-2030

Chapter 8. Europe Automotive Aftermarket Market – By Distribution Channel

8.1. Introduction/Key Findings

8.2 Wholesalers & Distributors

8.3. Retailers (OEMs and Repair Shops)

8.4. Y-O-Y Growth trend Analysis Distribution Channel

8.5. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Automotive Aftermarket Market – By Certification

9.1. Introduction/Key Findings

9.2 Certified Parts

9.3. Genuine Parts

9.4. Uncertified Parts

9.5. Y-O-Y Growth trend Analysis Certification

9.6. Absolute $ Opportunity Analysis Certification , 2024-2030

Chapter 10. Europe Automotive Aftermarket Market , By Geography – Market Size, Forecast, Trends & Insights

10.1. Europe

10.1.1. By Country

10.1.1.1. U.K.

10.1.1.2. Germany

10.1.1.3. France

10.1.1.4. Italy

10.1.1.5. Spain

10.1.1.6. Rest of Europe

10.1.2. By Replacement Part

10.1.3. By Distribution Channel

10.1.4. By Service Channel

10.1.5. Certification

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Europe Automotive Aftermarket Market – Company Profiles – (Overview, Replacement Part Portfolio, Financials, Strategies & Developments)

11.1 Continental A.G.

11.2. Mahle Gmbh

11.3. Delphi Tech

11.4. Valeo Group

11.5. Gestamp

11.6. Magna International Inc.

11.7. Lear Corp

11.8. Faurecia

11.9. Thyssennkrup AG

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Europe Automotive Aftermarket Market is expanding quickly; it was estimated to be worth USD 201 billion in 2023 and is expected to increase to USD 248.89 billion by 2030, with a projected compound annual growth rate (CAGR) of 3.1% from 2024 to 2030.

The primary drivers of the European automotive aftermarket market are the expanding number of vehicles on the road, technological advancements, and the growing demand for aftermarket services and accessories

The Europe Automotive Aftermarket Market is confronted with several formidable challenges, including the prevalence of counterfeit components that undermine consumer confidence, flexibility, and compliance, and rapid technological advancements

In 2023, Germany held the largest share of the Europe Automotive Market

The Main Players are: Gehle Gmbh, Delphi Tech, Valeo Group, Gestamp, Magna International Inc., Lear Corp, Fauria, and Thyssennkrup AG