Automotive Aftermarket Market Size (2024 – 2030)

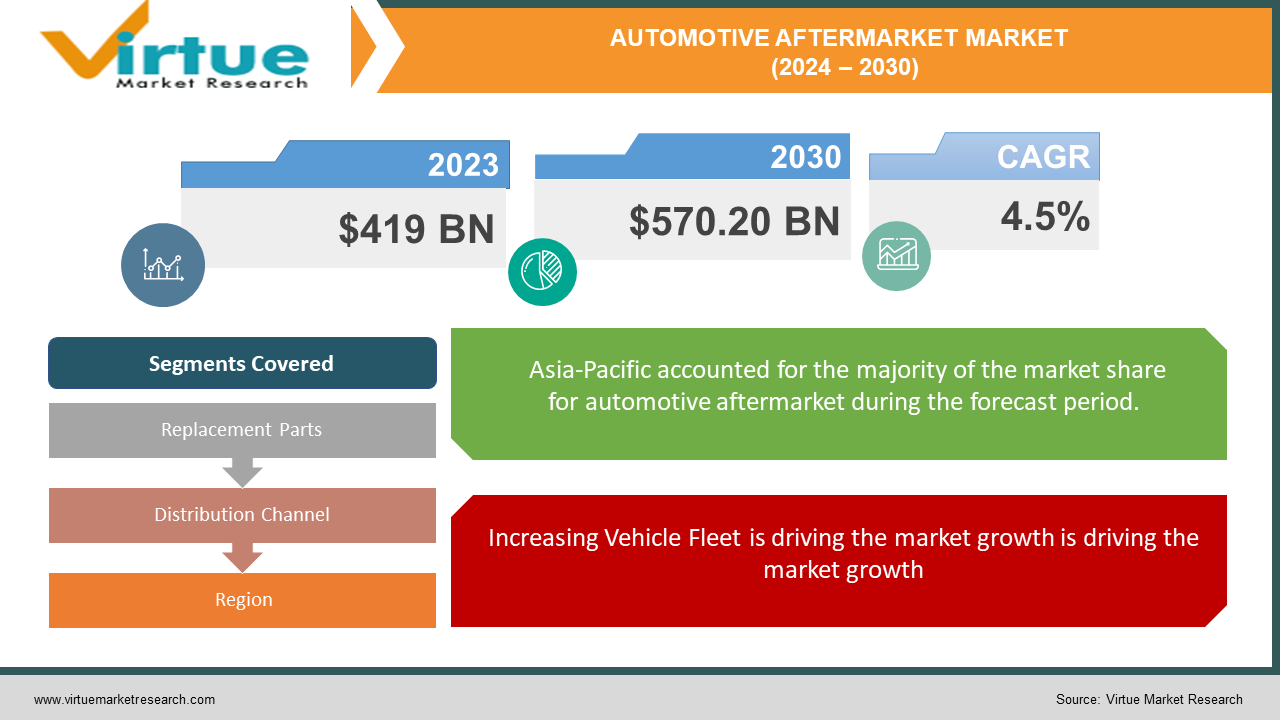

The Global Automotive Aftermarket Market was valued at USD 419 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. The market is expected to reach USD 570.20 billion by 2030.

The automotive aftermarket is a vast industry that deals with all the parts, chemicals, equipment, and accessories for vehicles after they are sold by the original equipment manufacturer (OEM) to consumers. This aftermarket offers a wide variety of choices, including replacement parts, collision parts, appearance parts, and performance parts, at varying qualities and prices for nearly all vehicle makes and models. The increasing number of vehicles on the road, rising consumer awareness regarding vehicle maintenance, and the growing adoption of advanced technologies in automotive parts are driving market growth.

Key Market Insights:

Replacement parts, including tires, batteries, and brake parts, dominate the market due to their high demand.

Online sales channels are gaining traction, offering convenience and a wider range of options to consumers.

Asia-Pacific is the fastest-growing region, driven by the increasing vehicle fleet and rising disposable incomes.

Consumers increasingly seek convenient access to aftermarket parts, with online channels offering competitive prices and vast selection.

Global Automotive Aftermarket Market Drivers:

Increasing Vehicle Fleet is driving the market growth is driving the market growth

The growing number of vehicles on the road is a significant driver for the automotive aftermarket market. With the rising global population and economic growth, the demand for personal and commercial vehicles has increased. This has led to a larger fleet of vehicles that require regular maintenance, repairs, and replacement parts. According to the International Organization of Motor Vehicle Manufacturers (OICA), the global vehicle fleet reached over 1.4 billion units in 2023, with a substantial increase in passenger cars and commercial vehicles. As the number of vehicles continues to grow, the demand for automotive aftermarket products and services, such as replacement parts, accessories, and maintenance services, is expected to rise. Additionally, the increasing average age of vehicles is contributing to the demand for aftermarket products. Older vehicles are more likely to require frequent maintenance and replacement of worn-out parts, driving the growth of the automotive aftermarket market. Furthermore, the rise in vehicle ownership in emerging economies, such as China and India, is boosting the demand for aftermarket products and services, creating significant growth opportunities for market players.

Technological Advancements in Automotive Parts is driving the market growth

Technological advancements in automotive parts are driving the growth of the automotive aftermarket market. The development of advanced and innovative automotive technologies has led to the introduction of high-performance and durable aftermarket products. For example, advancements in tire technology have resulted in the production of tires with improved traction, durability, and fuel efficiency. Similarly, advancements in battery technology have led to the development of longer-lasting and more efficient batteries for vehicles. These technological innovations are attracting consumers to invest in high-quality aftermarket products to enhance the performance and longevity of their vehicles. Additionally, the integration of smart technologies in automotive parts, such as sensors, telematics, and connectivity solutions, is gaining popularity. Smart aftermarket products enable real-time monitoring of vehicle performance, predictive maintenance, and remote diagnostics, enhancing the overall driving experience and reducing the risk of breakdowns. The increasing adoption of electric vehicles (EVs) is also contributing to the demand for advanced aftermarket products. EVs require specialized components, such as battery packs, charging equipment, and electric drivetrains, creating new opportunities for aftermarket manufacturers. The continuous advancements in automotive technology are expected to drive the growth of the automotive aftermarket market in the coming years.

Rising Consumer Awareness and Preference for Vehicle Maintenance is driving the market growth

Rising consumer awareness and preference for vehicle maintenance are significant drivers for the automotive aftermarket market. Consumers are becoming more conscious of the importance of regular vehicle maintenance and the impact it has on vehicle performance, safety, and longevity. As a result, there is an increasing demand for high-quality aftermarket products and services that can help maintain and enhance vehicle performance. According to a survey by the Automotive Aftermarket Suppliers Association (AASA), 70% of vehicle owners in the U.S. prefer to use aftermarket products for their vehicle maintenance and repairs. This growing awareness is driving the demand for replacement parts, accessories, and maintenance services in the aftermarket sector. Additionally, the rise of do-it-yourself (DIY) culture among vehicle owners is contributing to the growth of the aftermarket market. Many consumers prefer to perform basic maintenance and repairs on their own, leading to an increased demand for DIY-friendly aftermarket products and tools. The availability of online tutorials, instructional videos, and repair guides is further encouraging consumers to take up DIY vehicle maintenance. The increasing consumer preference for vehicle maintenance and the rise of DIY culture is expected to drive the growth of the automotive aftermarket market.

Global Automotive Aftermarket Market Challenges and Restraints:

High Competition and Pricing Pressure is restricting the market growth

The automotive aftermarket market is characterized by intense competition and pricing pressure, posing significant challenges for market players. The presence of numerous aftermarket manufacturers, suppliers, and retailers has led to a highly competitive landscape, with companies vying for market share. This intense competition often results in aggressive pricing strategies and discounts, putting pressure on profit margins. Additionally, the availability of counterfeit and substandard aftermarket products at lower prices further intensifies pricing pressure. Counterfeit products not only affect the revenue of genuine aftermarket manufacturers but also pose safety risks to consumers. To overcome these challenges, market players need to focus on product differentiation, quality assurance, and brand reputation. Investing in research and development to introduce innovative and high-performance aftermarket products can help companies gain a competitive edge. Moreover, educating consumers about the risks associated with counterfeit products and the benefits of using genuine aftermarket parts is crucial. Building strong distribution networks and partnerships with authorized retailers can also help mitigate pricing pressure and ensure the availability of genuine products. The high competition and pricing pressure in the automotive aftermarket market necessitate strategic initiatives and continuous efforts to maintain market position and profitability.

Regulatory and Compliance Challenges are restricting the market growth

The automotive aftermarket market faces regulatory and compliance challenges that can impact market growth and operations. Various countries have stringent regulations and standards governing the manufacturing, distribution, and use of aftermarket products. These regulations are aimed at ensuring product quality, safety, and environmental sustainability. Compliance with these regulations requires significant investments in quality control, testing, and certification processes, adding to the operational costs for aftermarket manufacturers. For instance, in the European Union (EU), aftermarket products must comply with the European Emission Standards (Euro standards) and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation. Non-compliance with these regulations can result in penalties, product recalls, and reputational damage. Additionally, the increasing focus on environmental sustainability and the adoption of green initiatives are driving the demand for eco-friendly aftermarket products. Manufacturers need to invest in sustainable materials and production processes to meet the evolving regulatory requirements and consumer preferences. Keeping up with the changing regulatory landscape and ensuring compliance with various standards can be challenging for aftermarket companies. Therefore, staying updated with regulatory changes, investing in compliance initiatives, and adopting sustainable practices are essential for navigating the regulatory and compliance challenges in the automotive aftermarket market.

Market Opportunities:

The automotive aftermarket market presents several significant opportunities for growth and expansion. One of the key opportunities lies in the increasing adoption of digital platforms and e-commerce channels. With the rise of online shopping and the growing preference for convenience, consumers are increasingly turning to online platforms for purchasing aftermarket products. E-commerce provides a wide range of options, competitive pricing, and doorstep delivery, making it an attractive choice for consumers. Aftermarket companies can leverage digital platforms to reach a broader customer base, offer personalized recommendations, and provide a seamless shopping experience. Additionally, the integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), in e-commerce platforms can enhance customer engagement and improve inventory management. For example, AI-powered chatbots can assist customers in finding the right aftermarket products, while ML algorithms can optimize inventory levels and predict demand patterns. Another significant opportunity lies in the growing demand for electric vehicle (EV) aftermarket products. As the adoption of EVs continues to rise, there is a growing need for specialized components, such as battery packs, charging equipment, and electric drivetrains. Aftermarket manufacturers can capitalize on this trend by developing and offering high-quality and compatible EV aftermarket products. Moreover, the increasing focus on vehicle customization and personalization presents opportunities for aftermarket companies. Consumers are looking for unique and personalized aftermarket accessories to enhance the aesthetics and performance of their vehicles. Offering a wide range of customizable aftermarket products, such as interior accessories, performance upgrades, and aesthetic enhancements, can attract consumers and drive market growth. The continuous advancements in technology, changing consumer preferences, and the growing e-commerce landscape create a favorable environment for the growth of the automotive aftermarket market.

AUTOMOTIVE AFTERMARKET MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Replacement Parts, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robert Bosch GmbH, Denso Corporation, Continental AG, Delphi Technologies PLC, 3M Company, ZF Friedrichshafen AG, Valeo SA, Aisin Seiki Co., Ltd., BorgWarner Inc., Magna International Inc. |

Automotive Aftermarket Market Segmentation - by Replacement Parts

-

Tires

-

Batteries

-

Brake Parts

-

Filters

-

Lighting

Tires reign supreme in the replacement parts sector due to the relentless wear and tear they experience from everyday driving. Unlike other essential components that might require periodic replacement, tires are constantly in contact with the road, facing friction, weather elements, and potential road hazards. This constant battle necessitates regular replacement, fueling a market driven by the need for safety and optimal vehicle performance. As a result, tires consistently outpace other replacement parts in terms of demand and market share within the automotive aftermarket industry

Automotive Aftermarket Market Segmentation - by Distribution Channel

-

Online

-

Offline

The offline distribution channel remains the king of the automotive aftermarket. This dominance stems from the extensive network of brick-and-mortar stores, service centers, and repair shops that cater to a customer base not yet fully converted to the online world. These physical locations offer a multitude of advantages. For one, they provide the invaluable service of hands-on assistance. Trained staff can answer questions, diagnose problems, and recommend the correct parts, ensuring customers get exactly what they need. Additionally, the ability to see, touch, and compare parts before purchase is a significant advantage, especially for complex components.

Automotive Aftermarket Market Segmentation - by Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region has emerged as the automotive aftermarket's undisputed heavyweight, claiming the largest market share globally. This dominance is fueled by a confluence of factors. Firstly, a surge in vehicle ownership across the region, particularly in countries like China and India, has created a massive installed base of cars that require regular maintenance and parts replacement. Secondly, rising disposable incomes empower consumers to invest in keeping their vehicles running smoothly.

COVID-19 Impact Analysis on the Automotive Aftermarket Market:

The COVID-19 pandemic had a profound impact on the automotive aftermarket market. The pandemic disrupted global supply chains, leading to shortages of raw materials and components, which in turn affected the production and availability of aftermarket products. Many manufacturing facilities faced temporary closures, and transportation restrictions further hindered the distribution of products. Additionally, the economic uncertainty and financial constraints caused by the pandemic led to a decline in consumer spending on non-essential items, including aftermarket products. However, the pandemic also highlighted the importance of personal mobility and vehicle maintenance, as public transportation options were limited and people relied more on personal vehicles. This shift in consumer behavior created opportunities for the aftermarket market, particularly in segments related to essential vehicle maintenance and repair. Moreover, the accelerated adoption of digital platforms and e-commerce during the pandemic allowed aftermarket companies to reach consumers through online channels. As the world recovers from the pandemic, the automotive aftermarket market is expected to rebound, driven by the pent-up demand for vehicle maintenance and the increasing emphasis on personal mobility and safety.

Latest Trends/Developments:

The automotive aftermarket market is witnessing several notable trends and developments. One of the significant trends is the increasing adoption of digital technologies and data analytics in aftermarket services. Companies are leveraging data analytics to gain insights into consumer behavior, predict demand patterns, and optimize inventory management. This data-driven approach enables aftermarket companies to offer personalized recommendations and targeted marketing strategies, enhancing customer engagement and satisfaction. Another notable trend is the rise of vehicle connectivity and telematics. Connected vehicles equipped with telematics systems provide real-time data on vehicle performance, maintenance needs, and driving behavior. This data can be utilized by aftermarket companies to offer proactive maintenance services, remote diagnostics, and predictive maintenance solutions. Additionally, the growing focus on sustainability and environmental consciousness is driving the demand for eco-friendly aftermarket products. Consumers are increasingly seeking aftermarket products that are made from sustainable materials and have a lower environmental impact. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in aftermarket processes is gaining traction. AI-powered chatbots, virtual assistants, and predictive maintenance systems are enhancing customer experience and operational efficiency. The continuous advancements in technology, changing consumer preferences, and the increasing emphasis on sustainability are shaping the future of the automotive aftermarket market.

Key Players:

-

Robert Bosch GmbH

-

Denso Corporation

-

Continental AG

-

Delphi Technologies PLC

-

3M Company

-

ZF Friedrichshafen AG

-

Valeo SA

-

Aisin Seiki Co., Ltd.

-

BorgWarner Inc.

-

Magna International Inc.

Chapter 1. Automotive Aftermarket Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Aftermarket Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Aftermarket Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Aftermarket Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Aftermarket Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Aftermarket Market – By Replacement Parts

6.1 Introduction/Key Findings

6.2 Tires

6.3 Batteries

6.4 Brake Parts

6.5 Filters

6.6 Lighting

6.7 Y-O-Y Growth trend Analysis By Replacement Parts

6.8 Absolute $ Opportunity Analysis By Replacement Parts, 2024-2030

Chapter 7. Automotive Aftermarket Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online

7.3 Offline

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Automotive Aftermarket Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Replacement Parts

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Replacement Parts

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Replacement Parts

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Replacement Parts

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Replacement Parts

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automotive Aftermarket Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Robert Bosch GmbH

9.2 Denso Corporation

9.3 Continental AG

9.4 Delphi Technologies PLC

9.5 3M Company

9.6 ZF Friedrichshafen AG

9.7 Valeo SA

9.8 Aisin Seiki Co., Ltd.

9.9 BorgWarner Inc.

9.10 Magna International Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Aftermarket Market was valued at USD 419 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. The market is expected to reach USD 570.20 billion by 2030.

The market is driven by the increasing vehicle fleet, technological advancements in automotive parts, and rising consumer awareness and preference for vehicle maintenance.

The market is segmented by replacement parts into tires, batteries, brake parts, filters, and lighting. It is also segmented by distribution channel into online and offline.

Asia-Pacific is the most dominant region due to the significant growth in vehicle ownership, rising disposable incomes, and the expansion of the automotive industry.

Leading players in the market include Robert Bosch GmbH, Denso Corporation, Continental AG, Delphi Technologies PLC, 3M Company, ZF Friedrichshafen AG, Valeo SA, Aisin Seiki Co., Ltd., BorgWarner Inc., and Magna International Inc.