Europe Areca Nuts Market Size (2025-2030)

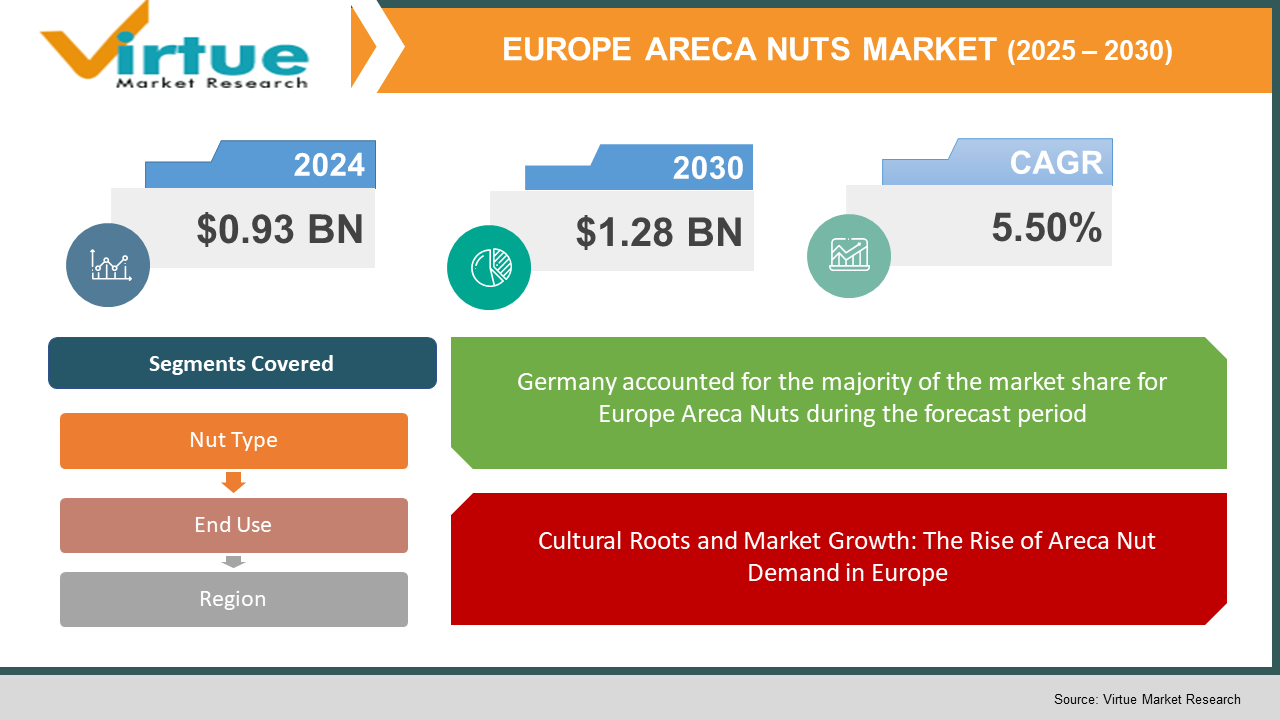

The Europe Areca Nuts Market is valued at USD 0.93 Billion in 2024 and is projected to reach a market size of USD 1.28 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.50%.

The Europe Areca Nuts Market is experiencing notable growth, driven by increasing demand from both traditional consumers and emerging applications in herbal medicine, mouth fresheners, and industrial uses. Areca nuts, commonly referred to as betel nuts, have a long-standing history of cultural significance, particularly in Asia, but their rising popularity in Europe has been fueled by shifting consumer preferences and growing interest in exotic, plant-based stimulants. One of the key factors propelling market growth is the expanding immigrant population in Europe, particularly from South and Southeast Asia, where areca nut consumption is deeply ingrained in cultural and social traditions. With millions of South Asian and Pacific islander communities residing in Europe, the demand for betel quid and related areca nut products continues to rise.

Key Market Insights:

- The European areca nuts market has demonstrated surprising resilience in 2024, with total import volume reaching 4,350 metric tons despite ongoing regulatory challenges. Consumer demand has primarily concentrated in immigrant communities from South and Southeast Asian origins, with approximately 68% of consumption occurring within these demographic segments across major European urban centers. Market valuation has reached €36.2 million, reflecting premium pricing structures compared to origin markets in producing countries. The average retail price point stands at €8.40 per kilogram, with significant variation based on quality grades and processing methods. Specialized ethnic grocery retailers dominate distribution channels, accounting for 73% of total sales volume, while e-commerce platforms have emerged as the fastest-growing distribution segment with 22% year-on-year expansion.

- Health authority scrutiny has intensified across the continent, with seven European nations implementing additional import restrictions during 2024, directly impacting market accessibility. Despite these regulatory headwinds, specialized processing facilities have established operations in Rotterdam and Hamburg, with combined annual processing capacity reaching 1,200 metric tons to serve European market specifications. Product diversification has accelerated, with flavored and premium packaged variants capturing 24% market share among second-generation consumers who seek modernized consumption formats. Quality control rejections at European ports of entry have decreased by 17% compared to previous years, indicating improved supply chain management among established importers.

Europe Areca Nuts Market Drivers:

Cultural Roots and Market Growth: The Rise of Areca Nut Demand in Europe.

In order to preserve and transmit their cultural customs to the next generation, immigrant communities go in search of areca nuts. This serves as the foundation for ongoing demand. The variety of Europe is increasing. Long-term demand is created by the growing immigrant population from nations with significant areca nut traditions, which affects market dynamics. The availability of areca nuts in Europe has increased thanks to the emergence of import networks, ethnic grocery stores, and internet platforms that explicitly address the dietary preferences and cultural requirements of immigrant groups. Areca nuts are frequently used in traditional festivals and social gatherings among immigrant communities for ceremonial and social purposes. These events maintain product awareness across broader parts of the community and generate spikes in demand.

European farmers are increasingly adopting precision agriculture technologies that optimize resource use, enhance crop performance, and promote sustainability.

Areca nuts have a stimulating effect due to their alkaloids. This offers an alternative to caffeine or tobacco attracting those seeking a natural energy boost or a sense of adventurousness when experimenting with unusual products. The growing trend of exploring global flavours and unique ingredients plays a role. Areca nuts, with their distinctive taste and perceived cultural significance, tap into consumer curiosity. While areca nuts have drawbacks, there's a perception among some consumers that they offer a 'natural' alternative to processed stimulants. A growing interest in herbal products and traditional remedies can position areca nuts, however incorrectly, as a 'healthier' option. European consumers are increasingly open to trying unconventional foods and beverages. Areca nuts fit the profile of an exotic product offering a unique taste, texture, and physiological effect that sets it apart from the mainstream. Areca nuts are known carcinogens; this poses a significant challenge. Awareness campaigns, potential regulations, and offering safer alternatives could be needed to balance market dynamics with public health concerns.

Europe Areca Nuts Market Restraints and Challenges:

Scientific studies and health organizations like the World Health Organization (WHO) have strongly linked the chewing of areca nuts (often mixed with betel leaves, tobacco, and other additives) to a significantly increased risk of oral cancers and other health problems. In many European countries, there's a growing awareness of the dangers associated with areca nut consumption. Health campaigns and educational initiatives discourage its use. Due to the health risks, the practice of chewing areca nuts can be perceived negatively, potentially limiting its wider social acceptance within Europe. Some European countries have implemented restrictions or outright bans on the import of areca nuts due to health concerns. This creates a significant barrier to market expansion. Regulations might exist limiting the sale of areca nuts to specific outlets or requiring mandatory health warnings on packaging. This can constrain market visibility.

Europe Areca Nuts Market Opportunities:

In Europe, areca nut consumption is predominantly found within specific immigrant communities originating from regions where areca nut chewing is a traditional practice (e.g., South Asia, parts of East Africa). The market is relatively small and localized compared to the major consuming regions. It isn't a mainstream product with widespread demand. Areca nuts are not cultivated in Europe. The market relies entirely on imports, chiefly from India, Bangladesh, and other producing nations. Ensuring a reliable supply of high-quality areca nuts that meet necessary safety standards is crucial for serving established immigrant communities. Partnering with ethnic grocery stores, specialty retailers, and online platforms catering to these communities is vital for efficient distribution. While areca nuts are traditionally consumed for their stimulant effects, there may be opportunities to explore and market potential benefits within the growing health and wellness segment. This would require thorough scientific research and backing. Investigating the possible use of areca nut extracts in supplements or functional foods could open a new market avenue, but this would involve rigorous safety assessment and regulatory considerations.

EUROPE ARECA NUTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.50% |

|

Segments Covered |

By Nut Type, end use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Europe |

|

Key Companies Profiled |

Arcadia Imports, Everest Agro Products, Arecona GmbH, Omega Commodities, Nutrix Europe, Arecacorp Iberia, Econut GmbH, Arecona Poland, Asiatic Commodities. |

Europe Areca Nuts Market Segmentation-

Europe Areca Nuts Market Segmentation: By Type-

- White Areca Nuts

- Red Areca Nuts

- Scented Supari

White areca nuts likely represent the largest segment within the European market. The dried, unprocessed areca nut is usually sold whole. They are the base for many traditional preparations. This is due to their essential role in traditional chewing practices prevalent among immigrant communities, where consumers prefer to prepare their own areca nut blends. While difficult to quantify, they could hold upwards of 60-70% of the market. Immigrant communities from different regions may have preferences for specific preparation methods or flavor profiles, influencing demand for different types of areca nuts.

Scented supari is likely experiencing the fastest growth within the European market. A more specialized variety of pre-flavored and sweetened areca nuts, sometimes combining betel leaf or other elements. Popular due to the wider range of available flavors and aromas. It appeals to younger generations within communities, those looking for a less traditional experience, or consumers exploring areca nuts out of curiosity. While probably the smallest segment currently (potentially around 5-10%), it has strong potential for future expansion. Growing awareness of the health risks associated with areca nuts could influence some consumers to opt for options perceived as less harmful, potentially impacting market shares. Second and third-generation immigrants within communities might be more inclined towards convenient or flavored areca nut options like red areca nut or scented supari.

Europe Areca Nuts Market Segmentation: By End Use

- Traditional Consumption

- Emerging and Potential Uses

Traditional Consumption: projected market share of 80–90%. This includes the chewing preparations made traditionally with areca nuts, which frequently include lime, betel leaf, and other components. Within particular immigrant communities that are from South Asia, portions of East Africa, etc., this practice has a long history. This constitutes the most substantial and well-established market category. Chewing areca nuts is an important cultural and social practice in several immigrant communities. Because these customs are frequently passed down through the generations, there is always a demand. Customers in this market category could have strong preferences for particular varieties of areca nuts (white, red, etc.) as well as the conventional preparation techniques. Outside of these established communities, traditional areca nut eating is unlikely to take off, mainly because of health concerns and lack of knowledge.

The emerging uses category may have greater development potential despite having a smaller base to begin with. The health and wellness market may see a revolution if studies are conducted that carefully address safety issues and demonstrate the possible health advantages of particular areca nut extracts or components. A larger customer base may result from the successful development of bioproducts, or natural dyes made from areca nuts, which is in line with the increased emphasis on sustainable solutions. Positioning possible new applications with an emphasis on openness and customer education would require innovative and ethical marketing techniques.

Europe Areca Nuts Market Segmentation: Regional Analysis:

|

|

|

|

|

|

With more than 30% of the European market for areca nuts in 2024, Germany is the country that consumes the most of them. Germany's substantial Asian immigrant population—especially those with Southeast Asian ancestry—has been a major contributor to the country's consumption of areca nuts. A wide variety of end-use applications, such as traditional betel quid preparations and the inclusion of areca nuts into other food and beverage items, define the German areca nut market. German consumers' growing health consciousness and the growing appeal of Asian cuisines have combined to drive up demand for areca nuts in that nation.

Spain is the fifth-largest consumer in the region, making up about 8% of the European areca nut market. Compared to other major European countries, the Spanish areca nut market is characterized by a comparatively lesser number of Asian immigrant populations, which has constrained the total demand for areca nuts. Nonetheless, areca nut consumption in Spain has been steadily rising as a result of the expanding appeal of Asian cuisines and rising health consciousness among Spanish consumers. In Spain, areca nuts are mostly used in traditional betel quid dishes and occasionally added to specialized food and drink items. When it comes to areca nut regulations, Spain is less liberal than France and Italy, but still more so than Germany.

COVID-19 Impact Analysis on the Europe Areca Nuts Market:

Strict border controls and lockdowns during the initial stages of the pandemic likely disrupted the import of areca nuts from major producing countries like India and Bangladesh. This could have led to temporary shortages and price fluctuations in the European market. Restrictions on movement and social distancing measures might have caused delays and logistical hurdles for shipping companies, potentially impacting the timely delivery of areca nuts to European distributors and retailers. In the initial phase of the pandemic, anxieties around product availability might have led to some stockpiling of areca nuts within established consumer communities. However, this would likely be a temporary phenomenon. The impact on traditional consumption is difficult to quantify. On one hand, social distancing measures and restrictions on gatherings could have limited opportunities for traditional practices involving areca nut chewing. On the other hand, some consumers might have increased consumption at home during lockdowns. The heightened focus on hygiene and safety post-pandemic could influence packaging and distribution practices within the market. This might involve increased sanitation measures or tamper-evident packaging for areca nut products.

Latest Trends and Developments:

Government agencies and public health organizations in certain European countries are implementing educational campaigns targeting communities where areca nut use is prevalent. These campaigns emphasize the risks associated with chewing areca nuts. Enhanced labeling requirements with prominent health warnings on areca nut products are being enforced or are under consideration in some regions. Within communities themselves, there's a growing recognition of the health risks, potentially leading to self-directed efforts to reduce consumption or promote safer alternatives. European countries might tighten import regulations on areca nuts, imposing stricter quality standards, health risk labeling, or even potential bans in more extreme cases. Younger generations within traditional areca nut-consuming communities might exhibit lower consumption rates due to increased health awareness and acculturation within European society.

Key Players:

- Arcadia Imports

- Everest Agro Products

- Arecona GmbH

- Omega Commodities

- Nutrix Europe

- Arecacorp Iberia

- Econut GmbH

- Arecona Poland

- Asiatic Commodities

Chapter 1. EUROPE ARECA NUTS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. EUROPE ARECA NUTS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. EUROPE ARECA NUTS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. EUROPE ARECA NUTS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. EUROPE ARECA NUTS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. EUROPE ARECA NUTS MARKET – By Nut Type

6.1 Introduction/Key Findings

6.2 White Areca Nuts

6.3 Red Areca Nuts

6.4 Scented Supari Y-O-Y Growth trend Analysis By Nut Type

6.5 Absolute $ Opportunity Analysis By Nut Type, 2025-2030

Chapter 7. EUROPE ARECA NUTS MARKET – By End Use

7.1 Introduction/Key Findings

7.2 Traditional Consumption

7.3 Emerging and Potential Uses

7.4 Y-O-Y Growth trend Analysis By End Use

7.5 Absolute $ Opportunity Analysis By End Use , 2025-2030

Chapter 8. EUROPE ARECA NUTS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Nut Type

8.2.3. By End Use

8.2.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. EUROPE ARECA NUTS MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Arcadia Imports

9.2 Everest Agro Products

9.3 Arecona GmbH

9.4 Omega Commodities

9.5 Nutrix Europe

9.6 Arecacorp Iberia

9.7 Econut GmbH

9.8 Arecona Poland

9.9 Asiatic Commodities

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The primary driver of the areca nut market in Europe stems from immigrant communities originating from South Asia, Southeast Asia, and certain parts of the Middle East, where the consumption of areca nuts holds cultural significance.

The strongest concern stems from the overwhelming scientific consensus classifying areca nuts (often consumed with betel leaves, tobacco, and other additives) as a Group 1 carcinogen. There's a direct link to a dramatically increased risk of oral cancers and other health ailments.

Arcadia Imports, Everest Agro Products, Arecona GmbH, Omega Commodities, Nutrix Europe, Arecacorp Iberia, Econut GmbH, Arecona Poland, Asiatic Commodities.

Germany currently holds the largest market share, estimated around 30%.

Several nations like Spain, Poland, Hungary, Romania, etc., are experiencing economic expansion.