Areca Nuts Market Size (2023 – 2030)

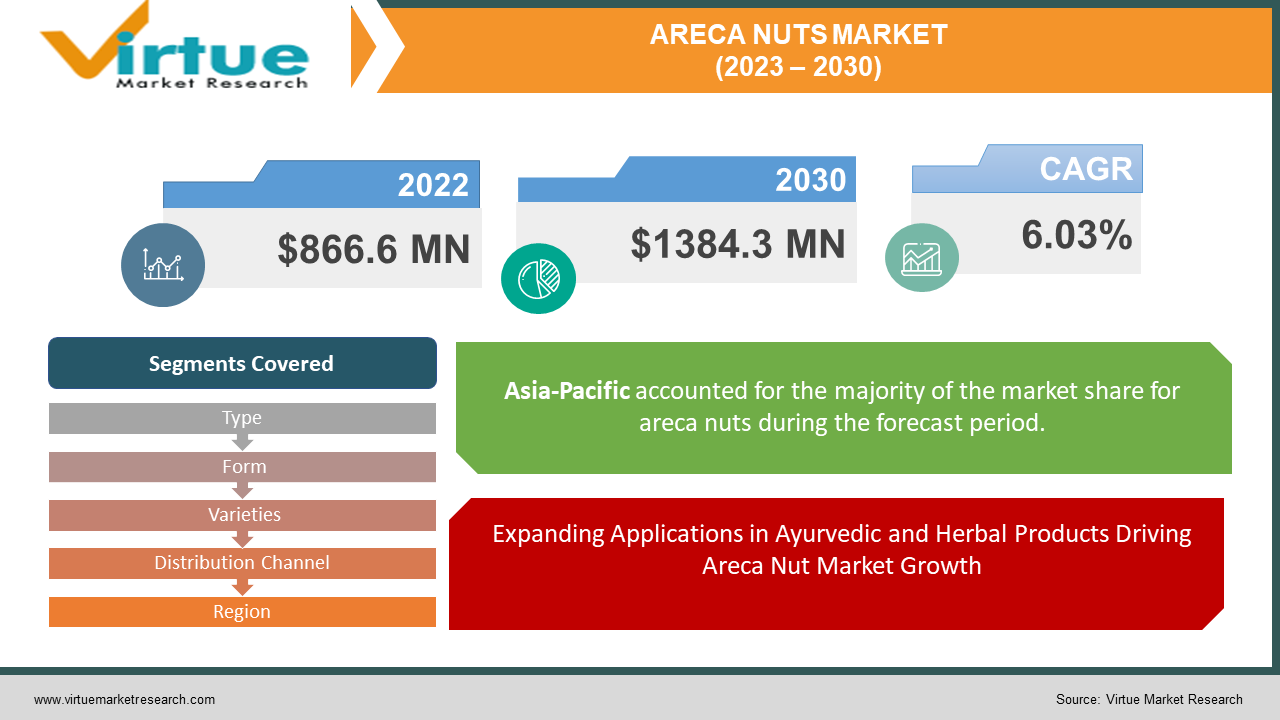

The Global Areca Nuts Market was valued at USD 866.6 Million in 2023 and is projected to reach a market size of USD 1384.3 Million by the end of 2030. Over the forecast period of 2023-2030, the market is anticipated to grow at a CAGR of 6.03%.

The global Areca Nut market has undergone a significant transformation, becoming a vital industry that blends tradition, agriculture, and commerce. In recent years, this market has witnessed substantial growth, propelled by changing consumer habits, expanding international trade, and advancements in cultivation and processing techniques. The expansion of this market can be attributed to the increasing demand for Areca Nut products, driven by globalization, which has made products from various regions easily accessible to consumers worldwide. As consumers become more health-conscious and seek diverse cultural experiences, the Areca Nut market is likely to adapt, introducing new products and flavors, and ensuring its sustained relevance in the global agricultural landscape.

Key Market Insights:

The Areca Nut market is witnessing noteworthy trends and developments, shaped by a combination of cultural traditions, agricultural practices, and changing consumer preferences. Areca Nut, often referred to as betel nut, holds cultural significance in various parts of Asia, especially in countries like India, Bangladesh, and parts of Southeast Asia. Traditional consumption practices, including chewing betel quid, persist, driving the demand for raw areca nuts. Increasing health consciousness among consumers has led to concerns regarding the health risks associated with areca nut consumption, such as oral cancers and other health issues. The market has witnessed product diversification, with processed areca nut products gaining traction. Areca nut extracts, supari (processed areca nut used in various confectioneries), and other value-added products cater to a broader consumer base, impacting both domestic and international markets.

Furthermore, Agricultural practices related to areca nut cultivation have benefited from technological advancements. Modern farming techniques, irrigation systems, and pest control methods have enhanced crop yield and quality, ensuring a consistent supply to meet market demands.

Areca Nuts Market Drivers:

Expanding Applications in Ayurvedic and Herbal Products Driving Areca Nut Market Growth.

The Areca nut’s integration into Ayurvedic and herbal products is a key factor propelling market growth. Areca nut extracts are being increasingly utilized in traditional medicine and herbal formulations due to their perceived health benefits. Ayurvedic practitioners are exploring the potential medicinal properties of Areca nuts, leading to the development of various wellness products. This diversification into the healthcare sector, driven by the growing awareness of herbal remedies, is creating new avenues for the Areca nut market, further fuelling its expansion.

Cultural Traditions and Social Practices Upholding the Global Areca Nut Market:

Cultural traditions and social practices continue to play a pivotal role in upholding the global Areca nut market. Areca nut chewing holds immense cultural significance in various regions, especially in parts of Asia where it is deeply rooted in social and ceremonial practices. These cultural ties bolster the demand for Areca nuts, especially during festivals, weddings, and other significant events. Such cultural traditions ensure a steady demand, providing a stable market base for Areca nut producers and sellers.

Areca Nuts Market Restraints and Challenges:

Fluctuating Prices of Areca Nut are Causing Market Volatility.

The areca nut market is highly susceptible to price fluctuations, primarily due to varying crop yields influenced by factors like climate conditions and pest outbreaks. These unpredictable fluctuations in prices create market volatility, making it challenging for both producers and consumers to plan budgets effectively. The uncertainty in pricing adds financial instability to the industry, making long-term investments and planning difficult for stakeholders.

Shifting Consumer Preferences towards Healthier Alternatives Restraining Areca Nut Market

Changing consumer lifestyles and a growing emphasis on health and wellness have led to a shift in preferences towards healthier snack options. As consumers become more health-conscious, they tend to avoid products associated with potential health risks, such as areca nuts. This change in consumer behavior has resulted in a decreased demand for areca nut products, posing a significant challenge for market players who struggle to align their offerings with evolving consumer demands.

Areca Nuts Market Opportunities:

Rising Demand for Ethnic and Exotic Flavors Expands Areca Nut Market Horizons

The global culinary landscape is witnessing a surge in the demand for ethnic and exotic flavors, presenting exciting opportunities in the Areca nut market. Areca nuts, with their unique taste and texture, are finding applications in gourmet and ethnic cuisines, adding distinctive flavors to various dishes and snacks. As food enthusiasts and chefs experiment with diverse ingredients, Areca nuts are gaining popularity as a novel culinary ingredient. This demand for exotic flavors not only opens doors for Areca nut producers to collaborate with chefs and food manufacturers but also encourages the development of innovative Areca nut-based food products, catering to the evolving tastes of consumers worldwide.

Manufacturers are Exploring Areca Nut's Potential in the Cosmetic and Pharmaceutical Industries

The cosmetic and pharmaceutical industries are increasingly recognizing the potential benefits of Areca nut extracts and compounds. Areca nut extracts are known for their astringent and antimicrobial properties, making them valuable ingredients in skincare and oral care products. Additionally, ongoing research explores Areca nut's potential in pharmaceutical applications, including drug delivery systems and herbal medicine formulations. With advancements in extraction techniques and formulations, Areca nut-based ingredients are becoming key components in cosmetics, oral hygiene products, and pharmaceutical preparations. This diversification into non-traditional markets offers significant growth opportunities for Areca nut producers and processors, encouraging innovation and product development in these sectors.

ARECA NUTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.03% |

|

Segments Covered |

By Type, Form, Varieties, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GM Group, Gokul Group, SSG Group, The CAMPCO Ltd., N.K. Agro Exports, Sri Gurudev Group, B.V. Exports, Viedelta Industries Co, Ltd, Agni Group of Companies, Poorna Nuts |

Areca Nuts Market Segmentation: By Type

-

White Areca Nut

-

Red Areca Nut

In 2023, the Red Areca Nut segment accounted for the largest revenue share in the global Areca Nuts market. This dominance is attributed to the unique properties and applications of Red Areca Nuts, making them highly sought after in various industries. With a distinctive reddish hue, these nuts are favored for their superior quality and rich flavor, appealing to a wide range of consumers. In the culinary world, Red Areca Nuts are prized for their aromatic profile, making them a popular choice for enhancing the taste of dishes and snacks. Moreover, the cosmetic and pharmaceutical sectors have recognized the potential of Red areca nut extracts due to their natural astringent and antimicrobial properties.

The White Areca Nut segment has emerged as the frontrunner in the global Areca Nuts market, marking a remarkable surge in growth with the fastest Compound Annual Growth Rate (CAGR). Their pristine appearance and mild, slightly sweet taste have garnered substantial attention, appealing to a broad consumer base across culinary, medicinal, and cosmetic sectors. In the culinary sphere, chefs and food manufacturers are increasingly incorporating White Areca Nuts into diverse recipes, appreciating their subtle flavor that complements various dishes.

Areca Nuts Market Segmentation: By Form

-

Raw

-

Processed

In 2023, The Raw areca nut segment commands the largest market share in the Areca Nuts market. This dominance is primarily attributed to the versatility and fundamental appeal of raw Areca nuts in various industries. Raw Areca Nuts are prized for their natural purity and unprocessed essence, making them highly sought after for culinary applications. The raw state preserves essential nutrients and properties, rendering them ideal for medicinal purposes. Additionally, their natural state also makes them a preferred choice in herbal and Ayurvedic preparations.

Moreover, the processed areca nut segment is the fastest-growing segment in the Areca Nuts market. Through various processing methods such as roasting, slicing, and flavoring, Areca nuts undergo transformations that enhance their taste, texture, and shelf life. Processed Areca Nuts are favored for their ready-to-consume nature, making them convenient snacks in both urban and rural settings. Moreover, the food industry leverages processed Areca Nuts as ingredients for an array of products, including confectioneries, snacks, and flavored beverages. The processing techniques not only diversify the Areca nut market but also appeal to a broader consumer base seeking innovative, flavored options.

Areca Nuts Market Segmentation: By Varieties

-

Traditional Varieties

-

Hybrid Varieties

-

Organic Areca Nuts

-

Others

In 2023, the Traditional areca nut varieties segment held the largest market share in the global Areca Nuts market. These time-honored varieties, cultivated through generations, carry a heritage of authenticity and natural richness, appealing to a discerning consumer base. Traditional Areca nuts are esteemed for their distinct taste, texture, and aroma, often considered superior by enthusiasts and connoisseurs. Their legacy as a symbol of hospitality and tradition in various cultures further enhances their market appeal.

Moreover, the Organic areca nut segment is the fastest-growing segment in the global Areca Nuts market. Organic Areca nuts, cultivated without the use of synthetic pesticides, chemicals, or genetically modified organisms, offer a natural and eco-friendly alternative. Health-conscious consumers are increasingly opting for organic products, appreciating the absence of harmful chemicals. Moreover, organic farming practices contribute to environmental conservation, further fuelling the appeal of Organic Areca Nuts.

Areca Nuts Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Convenience Stores

-

Online Retail

In 2023, the Supermarkets and Hypermarkets segment dominated the global Areca Nuts market, holding the largest market share. Supermarkets and hypermarkets, with their extensive shelf space and diverse product offerings, allow consumers to explore different Areca nut varieties and brands in one location. Additionally, the strategic placement of Areca nut products within these outlets, combined with promotional activities and discounts, further stimulates sales.

Moreover, The Online retail segment has the fastest-growing CAGR in the global Areca Nuts market. This rapid growth is attributed to the paradigm shift in consumer shopping patterns, as more individuals embrace the digital marketplace for their purchasing needs. Online retail platforms offer a diverse array of Areca nut products, providing consumers with the convenience of exploring various brands, qualities, and packaging options from the comfort of their homes. The ease of comparing prices and reading customer reviews online enhances consumer confidence and aids informed decision-making.

Areca Nuts Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, Asia-Pacific held the largest market share of 52.7% in the global areca nut market. This regional dominance is attributed to the deep-rooted cultural significance of Areca nuts in Asian countries, where they are an integral part of traditional ceremonies, social gatherings, and cultural rituals. Additionally, Asia-Pacific nations have a rich history of Areca nut cultivation, resulting in a diverse range of high-quality products. The widespread consumption of Areca nuts in various forms, including raw, processed, and traditional varieties, further fuels the market in this regionMoreover, North America held the second largest market share of 29.1% in the global areca nut market. The increasing multicultural population, especially in the United States and Canada, has introduced traditional practices and customs from Asian countries, where Areca nuts are widely consumed. Furthermore, the region's vibrant food industry continually experiments with incorporating Areca nuts into a variety of culinary delights, catering to the evolving tastes of the population.

COVID-19 Impact Analysis on the Global Areca Nuts Market:

The global Areca Nuts market experienced a significant impact from the COVID-19 pandemic. The closure of restaurants, hotels, and catering services led to a decrease in demand, particularly in regions heavily reliant on these sectors. Additionally, supply chain disruptions and labor shortages affected the harvesting, processing, and distribution of Areca nuts. However, as the pandemic progressed, there was a notable shift in consumer behavior. The demand for Areca nuts, known for their various health benefits and cultural significance, saw a resurgence. With people spending more time at home, there was an uptick in home cooking and snacking, driving the sales of Areca nuts through online platforms and local stores.

Latest Trends/Developments:

In September 2022, a valid registration certificate issued by the Directorate General of Foreign Trade (DGFT) was issued for the annual import of 17,000 metric tonnes of green areca nuts from Bhutan without minimum import price (MIP) through LCS Jaigaon (INJIGB). In May 2022, CAMPO Ltd. contacted the External Affairs Ministry to prevent the movement of areca nuts at ICP in Manipur due to its negative impacts on the local and domestic market, which significantly distress farmers,

Key Players:

-

GM Group

-

Gokul Group

-

SSG Group

-

The CAMPCO Ltd.

-

N.K. Agro Exports

-

Sri Gurudev Group

-

B.V. Exports

-

Viedelta Industries Co, Ltd

-

Agni Group of Companies

-

Poorna Nuts

Chapter 1. Areca Nuts Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Areca Nuts Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Areca Nuts Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Areca Nuts Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Areca Nuts Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Areca Nuts Market – By Type

6.1 Introduction/Key Findings

6.2 White Areca Nut

6.3 Red Areca Nut

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Areca Nuts Market – By Form

7.1 Introduction/Key Findings

7.2 Raw

7.3 Processed

7.4 Y-O-Y Growth trend Analysis By Form

7.5 Absolute $ Opportunity Analysis By Form, 2023-2030

Chapter 8. Areca Nuts Market – By Varieties

8.1 Introduction/Key Findings

8.2 Traditional Varieties

8.3 Hybrid Varieties

8.4 Organic Areca Nuts

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Varieties

8.7 Absolute $ Opportunity Analysis By Varieties, 2023-2030

Chapter 9. Areca Nuts Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Supermarkets and Hypermarkets

9.3 Specialty Stores

9.4 Convenience Stores

9.5 Online Retail

9.6 Y-O-Y Growth trend Analysis By Distribution Channel

9.7 Absolute $ Opportunity Analysis By Distribution Channel, 2023-2030

Chapter 10. Areca Nuts Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.2.1 By Distribution Channel

10.1.3 By Varieties

10.2 By Form

10.2.1 Countries & Segments - Market Attractiveness Analysis

10.3 Europe

10.3.1 By Country

10.3.1.1 U.K

10.3.1.2 Germany

10.3.1.3 France

10.3.1.4 Italy

10.3.1.5 Spain

10.3.1.6 Rest of Europe

10.3.2 By Type

10.3.3 By Form

10.3.4 By Varieties

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 Asia Pacific

10.4.1 By Country

10.4.1.1 China

10.4.1.2 Japan

10.4.1.3 South Korea

10.4.1.4 India

10.4.1.5 Australia & New Zealand

10.4.1.6 Rest of Asia-Pacific

10.4.2 By Type

10.4.3 By Form

10.4.4 By Varieties

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 South America

10.5.1 By Country

10.5.1.1 Brazil

10.5.1.2 Argentina

10.5.1.3 Colombia

10.5.1.4 Chile

10.5.1.5 Rest of South America

10.5.2 By Type

10.5.3 By Form

10.5.4 By Varieties

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

10.6 Middle East & Africa

10.6.1 By Country

10.6.1.1 United Arab Emirates (UAE)

10.6.1.2 Saudi Arabia

10.6.1.3 Qatar

10.6.1.4 Israel

10.6.1.5 South Africa

10.6.1.6 Nigeria

10.6.1.7 Kenya

10.6.1.8 Egypt

10.6.1.9 Rest of MEA

10.6.2 By Type

10.6.3 By Form

10.6.4 By Varieties

10.6.5 By Distribution Channel

10.6.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Areca Nuts Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 GM Group

11.2 Gokul Group

11.3 SSG Group

11.4 The CAMPCO Ltd.

11.5 N.K. Agro Exports

11.6 Sri Gurudev Group

11.7 B.V. Exports

11.8 Viedelta Industries Co, Ltd

11.9 Agni Group of Companies

11.10 Poorna Nuts

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wine Market was valued at USD 866.6 Million in 2023 and is projected to reach a market size of USD 1384.3 Million by the end of 2030 with a CAGR of 6.03%.

The primary drivers include the expanding applications of ayurvedic and herbal products, cultural traditions, and social practices.

In 2023, the Red Areca Nut segment held the largest market share in the Areca Nuts market.

Asia-Pacific dominated the global Areca nut market with the largest market share of 52.7% in the global Areca Nuts market.

GM Group, Gokul Group, SSG Group, The CAMPCO Ltd., N.K. Agro Exports and Sri Gurudev Group are some of the key players in the Areca Nuts market.