End-of-Line Packaging Machines Market Size (2024 – 2030)

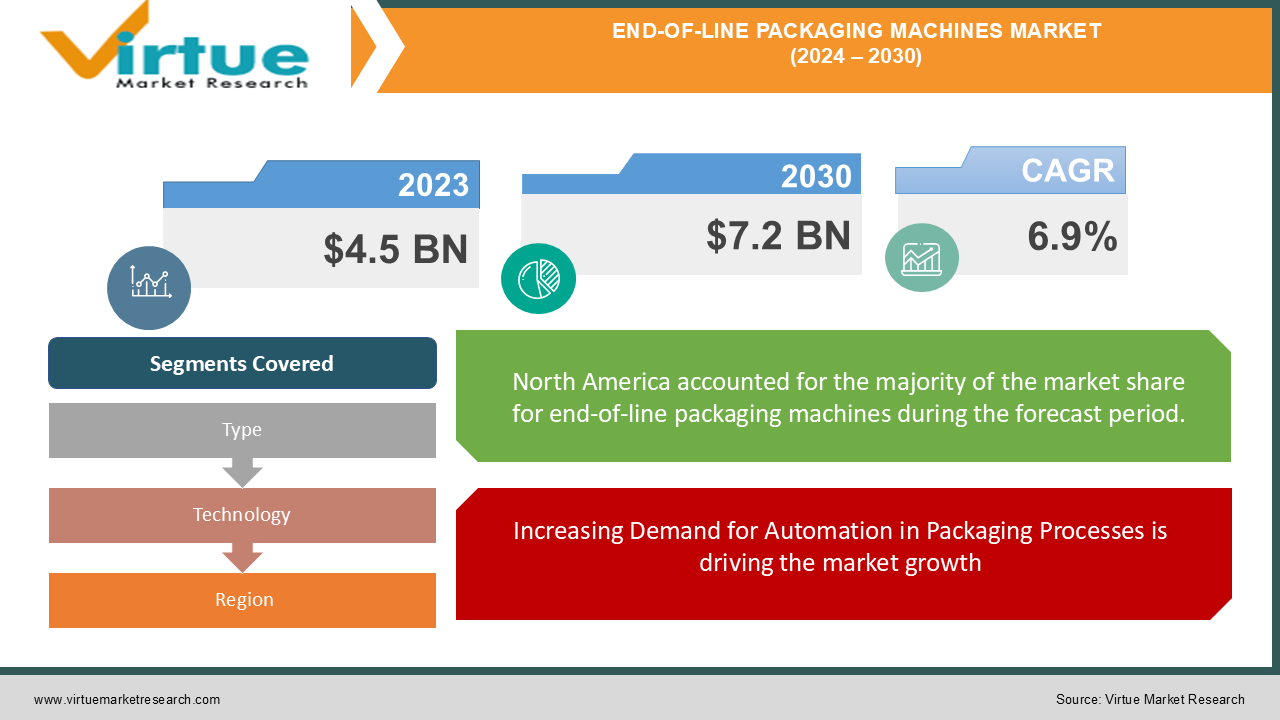

The Global End-of-Line Packaging Machines Market was valued at USD 4.5 billion in 2023 and is expected to reach USD 7.2 billion by 2030, growing at a CAGR of 6.9% during the forecast period.

End-of-line packaging machines are crucial in automating the final stages of the packaging process, including sealing, labeling, palletizing, and wrapping. These machines enhance efficiency, reduce labor costs, and improve the overall quality of packaging, making them vital for industries like food & beverage, pharmaceuticals, consumer goods, and electronics.

Key Market Insights:

Automatic end-of-line packaging machines dominate the market, accounting for more than 60% of the market share in 2023.

North America is the largest market, followed by Europe and Asia-Pacific.

The growing demand for automation in the packaging industry is a significant driver of market growth.

Global End-of-Line Packaging Machines Market Drivers:

Increasing Demand for Automation in Packaging Processes is driving the market growth

The growing demand for automation in packaging processes is a key driver of the Global End-of-Line Packaging Machines Market. Industries such as food & beverage, pharmaceuticals, and consumer goods are increasingly adopting automation to enhance operational efficiency, reduce labor costs, and minimize human errors. End-of-line packaging machines play a crucial role in automating tasks such as sealing, labeling, palletizing, and wrapping, which are essential for maintaining product quality and meeting high production demands. The shift towards automated packaging solutions is further accelerated by the need to comply with stringent regulations, improve product safety, and meet the demands of e-commerce, which requires efficient and reliable packaging systems. As companies continue to invest in automation to stay competitive, the demand for end-of-line packaging machines is expected to grow significantly.

Rising Adoption of Smart Packaging Solutions is driving the market growth

The adoption of smart packaging solutions is another major driver of the Global End-of-Line Packaging Machines Market. Smart packaging incorporates advanced technologies such as sensors, RFID tags, and IoT connectivity to enhance the functionality and performance of packaging. End-of-line packaging machines are increasingly being integrated with smart technologies to enable real-time monitoring, predictive maintenance, and data-driven decision-making. These smart packaging solutions offer several benefits, including improved traceability, enhanced product safety, and increased efficiency in the supply chain. The growing demand for smart packaging, driven by factors such as consumer preferences for convenience, the need for longer shelf life, and the rise of e-commerce, is boosting the adoption of end-of-line packaging machines that can support these advanced technologies.

Growth of the E-Commerce Industry is driving the market growth

The rapid growth of the e-commerce industry is driving the demand for efficient and reliable end-of-line packaging machines. E-commerce companies require packaging solutions that can handle a high volume of orders, ensure product safety during transit, and provide a positive unboxing experience for customers. End-of-line packaging machines are essential in automating the final stages of the packaging process, enabling e-commerce businesses to meet the demands of fast and accurate order fulfillment. Additionally, the rise of e-commerce has led to increased demand for customized packaging, which requires flexible and adaptable packaging machines. As the e-commerce industry continues to expand globally, the demand for end-of-line packaging machines is expected to grow, driving market growth.

Global End-of-Line Packaging Machines Market Challenges and Restraints:

High Initial Investment and Maintenance Costs are restricting the market growth

The high initial investment and maintenance costs associated with end-of-line packaging machines are significant challenges for the market. These machines require substantial capital investment for purchasing, installing, and integrating into existing production lines. Additionally, the cost of maintaining and servicing these machines can be high, particularly for advanced and automated systems. For small and medium-sized enterprises (SMEs), the high costs can be a barrier to adopting end-of-line packaging machines, limiting market growth. To overcome this challenge, manufacturers are offering flexible financing options, leasing models, and scalable solutions that cater to the needs of SMEs. However, the cost factor remains a key restraint, particularly in price-sensitive markets.

Complexity of Machine Integration with Existing Systems is restricting the market growth

Integrating end-of-line packaging machines with existing production and packaging systems can be complex and challenging. The machines need to be compatible with other equipment, such as filling machines, conveyors, and quality control systems, to ensure seamless operation. Additionally, the integration process requires careful planning, customization, and technical expertise to minimize disruptions and avoid production downtime. The complexity of integration can be a barrier to adoption, particularly for companies with older or incompatible systems. To address this challenge, manufacturers are focusing on developing modular and flexible machines that can be easily integrated with existing systems. However, the complexity of integration remains a challenge, particularly for companies looking to upgrade or retrofit their packaging lines.

Market Opportunities:

The Global End-of-Line Packaging Machines Market presents significant growth opportunities, driven by the increasing adoption of automation, smart packaging solutions, and the expansion of the e-commerce industry. One of the key opportunities lies in the development of modular and customizable packaging machines that can cater to the diverse needs of different industries. These machines offer flexibility and scalability, allowing companies to adapt to changing production requirements and market demands. Additionally, the integration of advanced technologies such as AI, machine learning, and IoT into end-of-line packaging machines offers opportunities for manufacturers to enhance the performance, efficiency, and reliability of their machines. These technologies enable predictive maintenance, real-time monitoring, and data-driven decision-making, providing companies with valuable insights into their packaging processes. Furthermore, the growing focus on sustainability and the need to reduce packaging waste presents opportunities for manufacturers to develop eco-friendly packaging machines that can support the use of recyclable materials and reduce environmental impact. As the market continues to evolve, manufacturers that can offer innovative, flexible, and sustainable packaging solutions are expected to benefit from significant growth opportunities.

END-OF-LINE PACKAGING MACHINES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.9% |

|

Segments Covered |

By Type, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Krones AG, Bosch Packaging Technology, ProMach Inc., IMA Group, Coesia S.p.A., Sidel Group, Barry-Wehmiller Companies, Marchesini Group S.p.A., Tetra Pak International S.A., Aetna Group S.p.A. |

End-of-Line Packaging Machines Market Segmentation: By Type

-

Case Packers

-

Palletizers

-

Wrapping Machines

-

Labeling Machines

-

Others

The case packers segment is the most dominant type in the end-of-line packaging machines market. These machines are widely used in industries such as food & beverage, pharmaceuticals, and consumer goods for efficiently packing products into cases or boxes, ensuring product safety and optimizing storage space.

End-of-Line Packaging Machines Market Segmentation: By Technology

-

Automatic

-

Semi-Automatic

-

Manual

Automatic end-of-line packaging machines dominate the market, accounting for more than 60% of the market share in 2023. These machines offer high efficiency, consistency, and speed, making them ideal for high-volume production lines.

End-of-Line Packaging Machines Market Segmentation: by Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is the most dominant region in the Global End-of-Line Packaging Machines Market. The region's strong industrial base, high adoption of automation, and the presence of leading packaging machine manufacturers contribute to its dominance. The U.S. is the largest market in North America, driven by the demand for efficient packaging solutions in industries such as food & beverage, pharmaceuticals, and consumer goods.

COVID-19 Impact Analysis on the End-of-Line Packaging Machines Market:

The COVID-19 pandemic had a mixed impact on the Global End-of-Line Packaging Machines Market. During the initial stages of the pandemic, disruptions in supply chains, lockdowns, and restrictions on manufacturing activities led to a slowdown in market growth. Many companies postponed or canceled their investment plans for new packaging machines due to economic uncertainty and the need to conserve cash. However, the pandemic also highlighted the importance of automation and efficient packaging processes, particularly in the food & beverage, pharmaceuticals, and e-commerce sectors. The increased demand for packaged goods, driven by the shift towards online shopping and the need for contactless deliveries, led to a surge in demand for end-of-line packaging machines. Additionally, the focus on hygiene and safety during the pandemic accelerated the adoption of automated packaging solutions that minimize human contact. As a result, the market witnessed a recovery in the latter half of 2020 and is expected to continue growing as companies invest in automation to enhance their resilience and efficiency in the post-pandemic era.

Latest Trends/Developments:

The Global End-of-Line Packaging Machines Market is witnessing several key trends and developments that are shaping its growth. One notable trend is the increasing adoption of robotic automation in end-of-line packaging processes. Robotic systems are being integrated into packaging machines to perform tasks such as palletizing, depalletizing, and case packing with high precision and speed. These robotic systems offer flexibility, scalability, and the ability to handle a wide range of products, making them ideal for industries with diverse packaging needs. Another trend is the growing focus on sustainability in packaging. Companies are increasingly seeking packaging machines that can support the use of eco-friendly materials, reduce packaging waste, and minimize energy consumption. Manufacturers are responding to this demand by developing machines that are more energy-efficient and capable of handling recyclable and biodegradable materials. Additionally, the integration of IoT and Industry 4.0 technologies into packaging machines is gaining traction. These technologies enable real-time monitoring, predictive maintenance, and data-driven decision-making, helping companies optimize their packaging processes and improve overall efficiency. The trend towards modular and customizable packaging machines is also gaining momentum, as companies seek solutions that can be easily adapted to changing production requirements and market demands.

Key Players:

-

Krones AG

-

Bosch Packaging Technology

-

ProMach Inc.

-

IMA Group

-

Coesia S.p.A.

-

Sidel Group

-

Barry-Wehmiller Companies

-

Marchesini Group S.p.A.

-

Tetra Pak International S.A.

-

Aetna Group S.p.A.

Chapter 1. End-of-Line Packaging Machines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. End-of-Line Packaging Machines Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. End-of-Line Packaging Machines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. End-of-Line Packaging Machines Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. End-of-Line Packaging Machines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. End-of-Line Packaging Machines Market – By Type

6.1 Introduction/Key Findings

6.2 Case Packers

6.3 Palletizers

6.4 Wrapping Machines

6.5 Labeling Machines

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. End-of-Line Packaging Machines Market – By Technology

7.1 Introduction/Key Findings

7.2 Automatic

7.3 Semi-Automatic

7.4 Manual

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. End-of-Line Packaging Machines Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Technology

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Technology

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Technology

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Technology

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Technology

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. End-of-Line Packaging Machines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Krones AG

9.2 Bosch Packaging Technology

9.3 ProMach Inc.

9.4 IMA Group

9.5 Coesia S.p.A.

9.6 Sidel Group

9.7 Barry-Wehmiller Companies

9.8 Marchesini Group S.p.A.

9.9 Tetra Pak International S.A.

9.10 Aetna Group S.p.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global End-of-Line Packaging Machines Market was valued at USD 4.5 billion in 2023 and is expected to reach USD 7.2 billion by 2030, growing at a CAGR of 6.9% during the forecast period.

Key drivers of the End-of-Line Packaging Machines Market include increasing demand for efficient packaging solutions in the food and beverage industry, advancements in automation and robotics technologies, and the growing need for sustainable and eco-friendly packaging solutions. These factors contribute to enhanced operational efficiency, reduced packaging costs, and improved product safety.

The End-of-Line Packaging Machines Market is segmented by type into Case Packers, Palletizers, Stretch Wrappers, and Others. By application, it is segmented into Food and Beverage, Pharmaceuticals, Consumer Goods, Electronics, and Others.

North America is the most dominant region for the End-of-Line Packaging Machines Market, driven by advanced manufacturing technologies, high demand from the food and beverage sector, and significant investments in automation solutions.

Leading players in the End-of-Line Packaging Machines Market include Bosch Packaging Technology, KUKA AG, ProMach Inc., Schneider Electric, Sidel Group, Tetra Pak International S.A., Rockwell Automation, Mitsubishi Electric Corporation, ABB Ltd., and Hain Celestial Group.