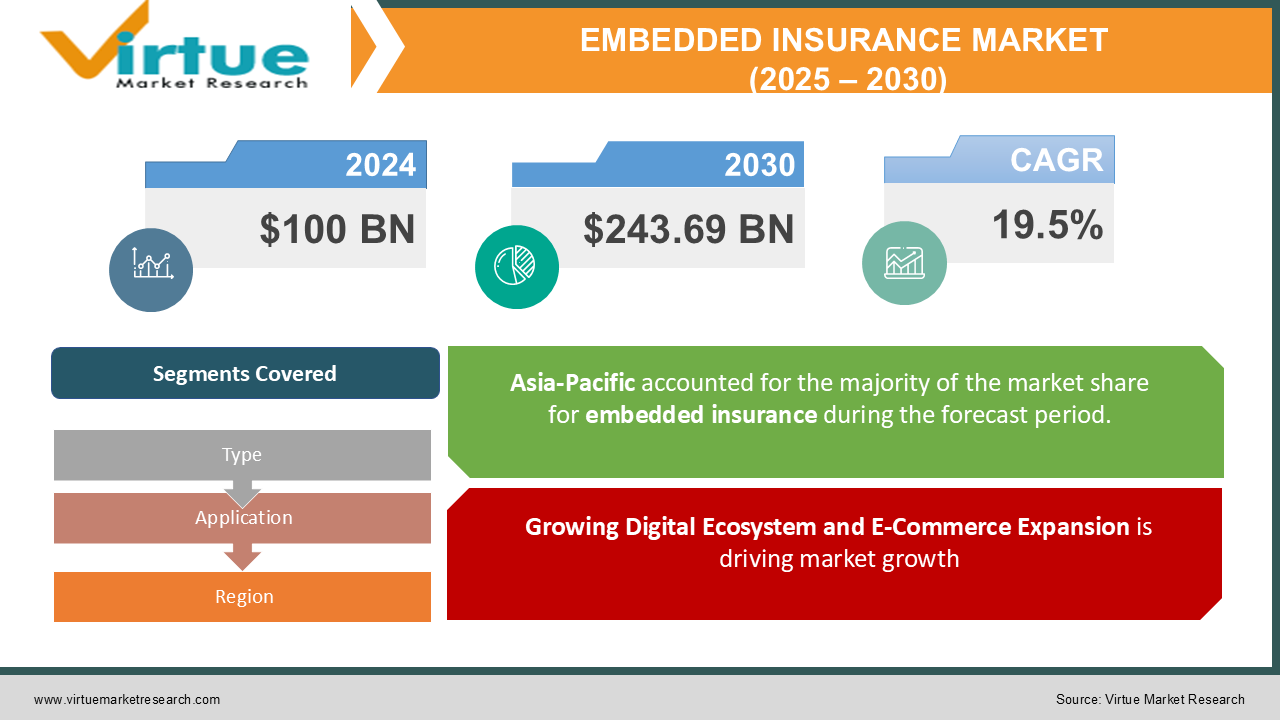

Embedded Insurance Market Size (2025 – 2030)

The Global Embedded Insurance Market was valued at USD 100 billion in 2024 and is expected to grow at a CAGR of 19.5% from 2025 to 2030. The market is projected to reach USD 243.69 billion by 2030.

Embedded insurance refers to the integration of insurance products within the purchase process of various goods and services, such as electronics, travel, automobiles, and financial services. It enables customers to buy insurance seamlessly at the point of sale, eliminating the need for a separate transaction. The market growth is fueled by the rising adoption of digital platforms, increasing e-commerce sales, and consumer preference for simplified insurance solutions. With advancements in AI and machine learning, embedded insurance is becoming more personalized, efficient, and accessible, enhancing the overall customer experience.

Key Market Insights:

-

In 2024, over 60% of digital transactions in retail and automotive sectors included an embedded insurance offer, increasing convenience for customers.

-

The automotive sector dominates the embedded insurance market, accounting for approximately 30% of total revenue in 2024, as car manufacturers and dealers offer insurance at the point of vehicle purchase.

-

Bancassurance and fintech partnerships are driving the market forward, with over 70% of embedded insurance policies now being sold via financial institutions and digital banking services.

-

The Asia-Pacific region is expected to witness the fastest growth, with a CAGR of 22% from 2025 to 2030, due to rising smartphone penetration, expanding digital payments, and regulatory support for InsurTech solutions.

-

Usage-based and on-demand insurance models are becoming increasingly popular, particularly in sectors like health, travel, and automotive, offering flexible and affordable coverage. AI and blockchain technologies are playing a crucial role in fraud prevention and claim automation, increasing efficiency and reducing operational costs.

Global Embedded Insurance Market Drivers:

Growing Digital Ecosystem and E-Commerce Expansion is driving market growth:

The digital revolution has fundamentally reshaped the insurance landscape, and embedded insurance is at the forefront of this transformation. With the proliferation of e-commerce platforms, digital banking, and online transactions, insurers have new opportunities to integrate their offerings seamlessly into everyday purchases. Companies like Amazon, Tesla, and Uber have already incorporated embedded insurance solutions, allowing customers to buy insurance effortlessly as part of their purchasing journey. The ease of use and accessibility drive higher adoption rates, particularly among younger consumers who prefer digital interactions over traditional insurance processes. The growing popularity of BNPL (Buy Now, Pay Later) services further strengthens the demand for embedded insurance, as these platforms often integrate coverage options like payment protection and extended warranties.

Rising Demand for Seamless Customer Experiences is driving market growth:

Consumers today demand convenience and seamless experiences in every aspect of their financial and commercial transactions. Traditional insurance models, which involve lengthy applications and complex paperwork, fail to meet these evolving expectations. Embedded insurance provides a frictionless experience, allowing customers to purchase coverage in just a few clicks, often without even realizing they are buying insurance. This transformation benefits both businesses and consumers—companies improve customer retention and satisfaction, while customers gain instant access to relevant, affordable insurance policies. Fintech startups and InsurTech firms are playing a significant role in this shift by leveraging APIs and AI-driven automation to embed insurance directly into digital products and services.

Advancements in AI and Data Analytics is driving market growth:

The integration of artificial intelligence and data analytics is revolutionizing the embedded insurance market by enabling personalized policies, risk assessment, and real-time underwriting. AI-powered chatbots and virtual assistants guide customers through the insurance selection process, while machine learning algorithms analyze user behavior to offer tailored coverage options. Moreover, predictive analytics enhance fraud detection and claims management, reducing operational costs for insurers. The ability to use IoT (Internet of Things) devices, such as smart home sensors and connected cars, further enhances embedded insurance offerings by providing real-time risk assessment and usage-based pricing models, ultimately leading to better consumer engagement and satisfaction.

Global Embedded Insurance Market Challenges and Restraints:

Regulatory and Compliance Challenges is restricting market growth:

The embedded insurance market operates in a highly regulated environment, with different countries imposing varying levels of restrictions and compliance requirements. Unlike traditional insurance, which follows well-established legal frameworks, embedded insurance faces regulatory ambiguity in many regions. Data privacy concerns, cross-border compliance issues, and evolving consumer protection laws create challenges for companies trying to scale their embedded insurance offerings globally. For example, the European Union's General Data Protection Regulation (GDPR) imposes strict rules on data collection and sharing, which can hinder the seamless integration of insurance into digital platforms. Insurers and technology providers must navigate these complex regulatory landscapes while ensuring transparency and adherence to compliance standards.

Consumer Awareness and Trust Issues is restricting market growth:

While embedded insurance is gaining popularity, many consumers remain unaware of its benefits or skeptical about its value. A significant portion of potential buyers hesitate to opt for embedded insurance due to a lack of understanding, concerns over hidden costs, or doubts about claim settlements. Additionally, since embedded insurance is often bundled with purchases, some customers perceive it as an unnecessary add-on rather than a crucial protection measure. Overcoming these trust issues requires greater consumer education, transparency in policy terms, and proactive communication from insurers and merchants. Companies must invest in marketing and customer engagement strategies to build awareness and highlight the tangible benefits of embedded insurance in daily transactions.

Market Opportunities:

The Global Embedded Insurance Market presents lucrative opportunities for insurers, technology providers, and e-commerce companies. The expansion of digital financial services, coupled with increasing internet penetration, has created a fertile ground for embedded insurance adoption. The rise of subscription-based business models is a key opportunity, as industries like mobility, health, and electronics increasingly offer insurance as part of their service packages. Additionally, parametric insurance models, which provide automated payouts based on predefined conditions, are gaining traction in travel and agriculture sectors, opening new revenue streams for insurers. Strategic collaborations between insurers and digital payment platforms, such as PayPal and Stripe, are expected to further drive market growth, ensuring seamless coverage integration within everyday financial transactions. As AI-driven risk assessment and IoT-enabled usage-based insurance models mature, embedded insurance is set to become a standard feature across diverse industries, significantly enhancing customer engagement and business profitability

EMBEDDED INSURANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

19.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cover Genius, Qover, Trov, Zego, Swiss Re, Allianz Partners, Amodo, Slice Labs, Wrisk, bolttech |

Embedded Insurance Market Segmentation: By Type

-

Life Insurance

-

Health Insurance

-

Travel Insurance

-

Automotive Insurance

-

Product Warranty & Protection Insurance

-

Others

The automotive insurance segment leads the market, driven by the increasing adoption of digital car purchases and connected vehicle technologies. Embedded insurance within vehicle sales, ride-sharing apps, and leasing services is witnessing significant demand, ensuring seamless protection for consumers.

Embedded Insurance Market Segmentation: By Application

-

Retail & E-Commerce

-

BFSI (Banking, Financial Services, and Insurance)

-

Travel & Hospitality

-

Automotive

-

Healthcare

-

Others

Retail and e-commerce dominate embedded insurance applications, as major online platforms integrate protection plans, return insurance, and extended warranties directly into their checkout processes. The increasing trend of digital-first insurance solutions continues to boost this segment.

Embedded Insurance Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the fastest-growing region in the embedded insurance market, with increasing smartphone adoption, digital payment expansion, and rising InsurTech investments. Countries like China and India lead in digital insurance adoption due to government support for financial inclusion and innovative insurance models tailored for low-income populations.

COVID-19 Impact Analysis on the Embedded Insurance Market:

The COVID-19 pandemic played a pivotal role in accelerating the transition toward digital transactions and online purchases, significantly increasing the demand for embedded insurance solutions. As consumers increasingly relied on e-commerce, digital banking, and telehealth services during the pandemic, the need for integrated insurance within these platforms became essential rather than optional. The crisis also raised awareness about the importance of health and travel insurance, causing a surge in demand for embedded coverage in these sectors. As a result, InsurTech companies seized the opportunity to innovate by developing AI-powered underwriting models, which streamlined the policy approval process and improved the efficiency of claims management. This technology-driven approach not only enhanced the customer experience but also provided insurers with the ability to offer faster, more personalized coverage to a broader audience. In the post-pandemic world, the trend toward embedded insurance remains strong, with an ongoing focus on digital convenience, security, and customer-centric solutions. Consumers now expect seamless, integrated insurance options that are easy to access and manage within the digital platforms they use daily. This shift has redefined the insurance industry, pushing companies to adapt to new demands for instant, user-friendly coverage while leveraging advanced technology to meet evolving consumer needs. As the landscape continues to evolve, embedded insurance is positioned to play a key role in shaping the future of the industry, ensuring that consumers have greater access to the coverage they need, when they need it.

Latest Trends/Developments:

The embedded insurance market is currently experiencing significant shifts, driven by several emerging trends. One of the most notable is the rise of microinsurance models, which cater to specific, smaller coverage needs, making insurance more accessible to a broader audience. Additionally, blockchain-based smart contracts are gaining traction, offering enhanced transparency, security, and efficiency in policy management and claims processing. The integration of insurance through APIs is also transforming the industry, allowing seamless embedding of insurance services into digital platforms and applications. Key industry players are forming strategic partnerships with fintech firms and digital platforms to expand their offerings and reach new customer segments. This collaboration is fueling the adoption of innovative insurance models, as companies look to tap into the growing demand for digital-first solutions. The increasing popularity of usage-based insurance in mobility services, such as ride-sharing and car rentals, is also reshaping how consumers access coverage. This model allows for more personalized and flexible pricing based on individual usage patterns. Another significant trend is the expansion of embedded health coverage within telemedicine platforms. With healthcare increasingly being delivered remotely, there is a growing need for integrated insurance solutions to provide patients with streamlined access to care and coverage. Finally, the rise of AI-powered automated claims processing is enhancing the customer experience by speeding up claim approvals and reducing manual intervention. These advancements are collectively shaping the future of the embedded insurance market, making it more efficient, accessible, and tailored to modern consumer needs.

Key Players:

-

Cover Genius

-

Qover

-

Trov

-

Zego

-

Swiss Re

-

Allianz Partners

-

Amodo

-

Slice Labs

-

Wrisk

-

bolttech

Chapter 1. Embedded Insurance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Embedded Insurance Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Embedded Insurance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Embedded Insurance Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Embedded Insurance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Embedded Insurance Market – By Type

6.1 Introduction/Key Findings

6.2 Life Insurance

6.3 Health Insurance

6.4 Travel Insurance

6.5 Automotive Insurance

6.6 Product Warranty & Protection Insurance

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Embedded Insurance Market – By Application

7.1 Introduction/Key Findings

7.2 Retail & E-Commerce

7.3 BFSI (Banking, Financial Services, and Insurance)

7.4 Travel & Hospitality

7.5 Automotive

7.6 Healthcare

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Embedded Insurance Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Embedded Insurance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cover Genius

9.2 Qover

9.3 Trov

9.4 Zego

9.5 Swiss Re

9.6 Allianz Partners

9.7 Amodo

9.8 Slice Labs

9.9 Wrisk

9.10 bolttech

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Embedded Insurance Market was valued at USD 100 billion in 2024 and is expected to grow at a CAGR of 19.5% from 2025 to 2030. The market is projected to reach USD 243.69 billion by 2030.

The market is driven by the rise of digital platforms, AI-driven underwriting, and seamless customer experiences.

The market is segmented by type (Life, Health, Automotive, etc.) and application (Retail, BFSI, Travel, etc.).

Asia-Pacific is the fastest-growing region, driven by digital insurance adoption.

Some key players include Cover Genius, Trov, Qover, Zego, and Swiss Re.