Embedded Finance Market Size (2024 - 2030)

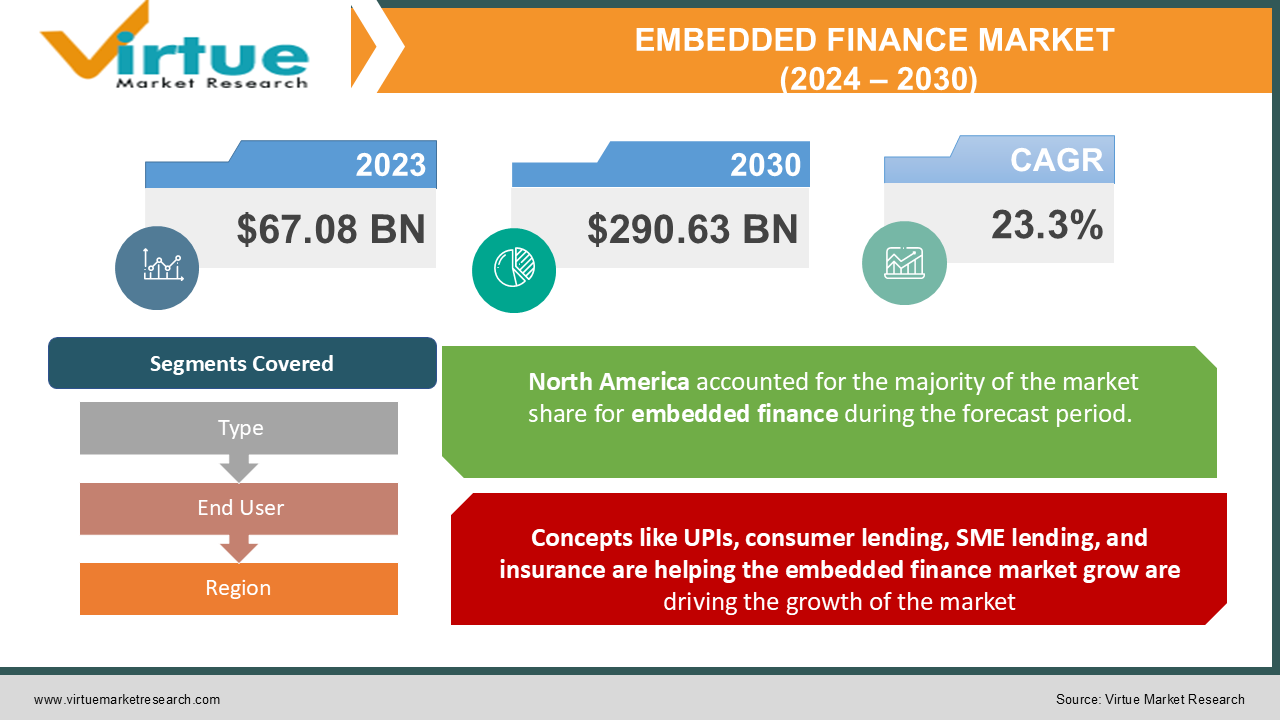

The Global Embedded Finance Market was valued at USD 67.08 Billion and is projected to reach a market size of USD 290.63 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 23.3%. The rising number of fintech brands expanding their roots in the insurance market, enhancing innovative platforms building contextual insurance products and services are the major factors that are driving the growth of the industry.

Industry Overview:

Embedded finance is the integration of economic services or equipment – traditionally bought by a financial institution – within the products or offerings of a non-financial organization. Think of an online store providing temporary loans in the structure of BNPL, or the digital pockets on your smartphone enabling on-the-spot contactless payments. But this is simply the beginning. An instance of this is when payment technology is built-in inside the infrastructure of an app or e-commerce site, which means that customers don’t have to enter their credit card important points for each transaction.

Digital wallets that allow contactless mobile transactions and on-the-spot online purchases are an additional form of embedded payments which have ended up wildly famous in view that the launch of Apple Pay in 2014. Embedded finance has already commenced streamlining economic processes in both customer and business commerce through decreasing boundaries to entry for a number of products and services. Previously, a customer may need to go to a physical bank to get a mortgage for a big purchase, or a business customer may also spend hours on cumbersome forms in order to get entry to exchange credit. Now, these offerings are being made on hand effortlessly at the factor of purchase. Rising wide variety of fintech manufacturers increasing their roots in the insurance plan market, bettering the progressive systems constructing contextual insurance plan products and services. This quickens the boom of the embedded finance market in new market spaces.

COVID-19 impact on the Embedded Finance Market

Covid-19 has impacted more than one international market with the aid of rearranging the supply chains due to the fact of market restrictions and logistics bans brought by governments around the world. Yet there have been some markets that had solely a moderate impact from the pandemic. The embedded finance market flourished and multiplied in new areas due to the unfolding of covid-19. People are now extra involved in their health, which leads to the demand for embedded finance solutions. Spreading focus on the rising fitness concerns and new persistent illnesses is forcing firms to undertake embedded finance solutions, improving and securing one’s healthcare rights.

Uncertainty in many sectors caused by covid-19 has led to the collaboration between fintech, large tech firms, and banks to pace up the strategies and structure techniques to get better from the harm done. This leads to excessive sales of embedded finance options while carriers focus on making these options greater bendy so that they can be built in with different contemporary technologies. This raises the demand for embedded finance options worldwide.

Cashless transactions have skyrocketed in India due to covid-19 and demonetization. The UPI repayments are now used largely, integrating with a couple of structures like Paytm, Google Pay, and Phone Pay. Low-value EMIs is another thing that drives the sales of customer lending. This consists of buying now pay for later. The B2B operations combine with fintech services to improve economic management, growing the income of embedded finance solutions. Another principal thing that pushes the market boom is the excessive penetration of the net and 4G/5G offerings in developed and growing regions.

MARKET DRIVERS:

Concepts like UPIs, consumer lending, SME lending, and insurance are helping the embedded finance market grow are driving the growth of the market

The modern trends in the market provide an explanation for the upward style in the market as a consequence of multiple technological developments and organizations setting up embedded finance services because of the fast digitization, boom of corporates, and demand for better capital flow. The embedded finance solution providers are integrating their services and making them greater customized for the end users. This consists of AI integration to the lending platforms, machine learning for embedded investment packages, and internet of things (IoT) integration with embedded payment options. These aspects beautify the end consumer ride and consistently radically change the market trend. The use of cloud-based systems to smoothen up more than one complicated operation is additionally forcing sectors to undertake embedded monetary practices, fueling the income of embedded economic services.

MARKET RESTRAINTS:

The unavailability of the internet, including the incompetency of the workforce, is restraining the growth of the market

One of the main things which hinder the growth of the market is the unavailability of the internet in the market. Also, the incompetency of the workforce in the payment sector is also restraining the growth of the market. New risks involving payment transactions that lead up to fraud and malicious activities are also hindering the growth of the embedded finance market. The Covid-19 pandemic has also affected the payment market during the forecast period.

EMBEDDED FINANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

23.3% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bankable, Banxware, Cross River, Finix, Flywire, Marqeta, RailsBank, Openpayd, Plaid, and Q2., |

Embedded Finance Market - By Type

-

-

Embedded Banking

-

Embedded Insurance

-

Embedded Investments

-

Embedded Lending

-

Embedded Payment

-

Based on Type, the embedded banking section has the very best sales manageable through 2030. The adoption of embedded is probably to develop at a CAGR of 16.2% throughout the forecast period. Its boom is attributed to the fast digitization of banking services and non-public banks, bettering and reworking the consumer experience.

In the future, the income of embedded banking offerings is estimated to develop in share to the want for effortless procedures and clean transactions. This pushes the income of embedded finance structures in the new markets.

Embedded Finance Market - By End User

-

Loans Associations

-

Investment Banks & Investment Companies

-

Brokerage Firms

-

Insurance Companies

-

Mortgage Companies

Based on the End- User, the investment banks & investment businesses phase is the largest section in the embedded finance market and is predicted to maintain the greatest element in the forecast period. The section is thriving at a sturdy CAGR of 16.2%. The things behind the increase in this section are rising startups and demand for excessive investments. The improved consumption from these funding services and the integration of embedded fintech offerings are growing the income of embedded finance solutions.

Embedded Finance Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, The North American section of the embedded finance market is predicted to develop significantly over the forecast period 2023 - 2030, especially due to the presence of more than one vendor, making significant investments in market innovations. The largest market is the United States, thriving at a CAGR of 16.2% between 2023 - 2030.

the region is anticipated to preserve a market income of USD 89.1 Bn with the aid of the stop of 2030. Factors such as the excessive income of embedded finance options and services in this region are an extended investment, payment, and mortgage digitization.

Apart from this, the Asia-Pacific market is estimated to rise during the forecast period, China is the second absolute best developing market for embedded finance market, thriving at a CAGR of 15.8% and will maintain a value of USD 17 Bn by using 2030.

Japan region will maintain USD 13.8 Bn by using the quilt of 2030 as it prospers on a promising CAGR of 14.8% between 2023 - 2030. The UK additionally grows alongside with Japan the forecasted cost of USD 10.5 Bn (2030) at a CAGR of 15.4% between 2023 - 2030.

Embedded Finance Market Share by Company

-

Bankable

-

Banxware

-

Cross River

-

Finix

-

Flywire

-

Marqeta

-

RailsBank

-

Openpayd

-

Plaid, and Q2.

Recently, Bankable has introduced its series of virtual ledger managers, payment card programs, digital banking, and e-wallet. This pushes the sales of embedded finance services. Also, India-based finance and investments company IIFL partnered with FinBox, an Indian fintech. Through this partnership, IIFL will offer digital credit avenues to its merchants, B2B e-commerce traders, using FinBox's embedded buy now, pay later (BNPL) and working capital credit products.

The competitive market of embedded finance is different and makes the market extra unique for new players. Companies additionally collaborate and merge with different companies, which enhances operability. The carriers focus on increasing their grant chain and distribution channels.

Almost all financial establishments have commenced imparting embedded services alongside the devoted embedded finance fintech groups that have made the world embedded financial market especially aggressive than ever before.

Some of the main strategies adopted by the pinnacle players in the market consist of the provision of modern services such as embedded lending at the point of sale (PoS) for attracting retail customers. In current years inclusion of embedded insurance, and plan premiums have created superb possibilities for the market boom of embedded finance service providers. The estimated value of insurance plan premiums contributed to the market through embedded monetary services was once around USD 3.8 Bn in the year 2021. Integration of such new services is anticipated to raise the world embedded finance market.

NOTABLE HAPPENINGS IN THE GLOBAL EMBEDDED FINANCE MARKET IN THE RECENT PAST:

-

Product Launch - In June 2021, Crossriver introduced its multiple embedded finance services like payment, lending, banking, traditional banking, and compliance. This fuel the sales of embedded finance services.

-

Product Launch - In September 2021, India-based fintech player FinBox launched Account Aggregator (AA). FinBox would be able to access and onboard approximately one million new applicants more accurately, resulting in improved operations.

Chapter 1.EMBEDDED FINANCE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.EMBEDDED FINANCE MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.EMBEDDED FINANCE MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.EMBEDDED FINANCE MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. EMBEDDED FINANCE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.EMBEDDED FINANCE MARKET - By Type

6.1 Embedded Banking

6.2. Embedded Insurance

6.3. Embedded Investments

6.4. Embedded Lending

6.5. Embedded Payment

Chapter 7.EMBEDDED FINANCE MARKET – By End User

7.1. Loans Associations

7.2. Investment Banks & Investment Companies

7.3. Brokerage Firms

7.4. Insurance Companies

7.5. Mortgage Companies

Chapter 8.EMBEDDED FINANCE MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Embedded Finance Market – Key Players

9.1. Bankable

9.2. Banxware

9.3. Cross River

9.4. Finix

9.5. Flywire

9.6. Marqeta

9.7. RailsBank

9.8. Openpayd

9.9. Plaid, and Q2

Download Sample

Choose License Type

2500

4250

5250

6900