E-Mobility Market Size (2024 – 2030)

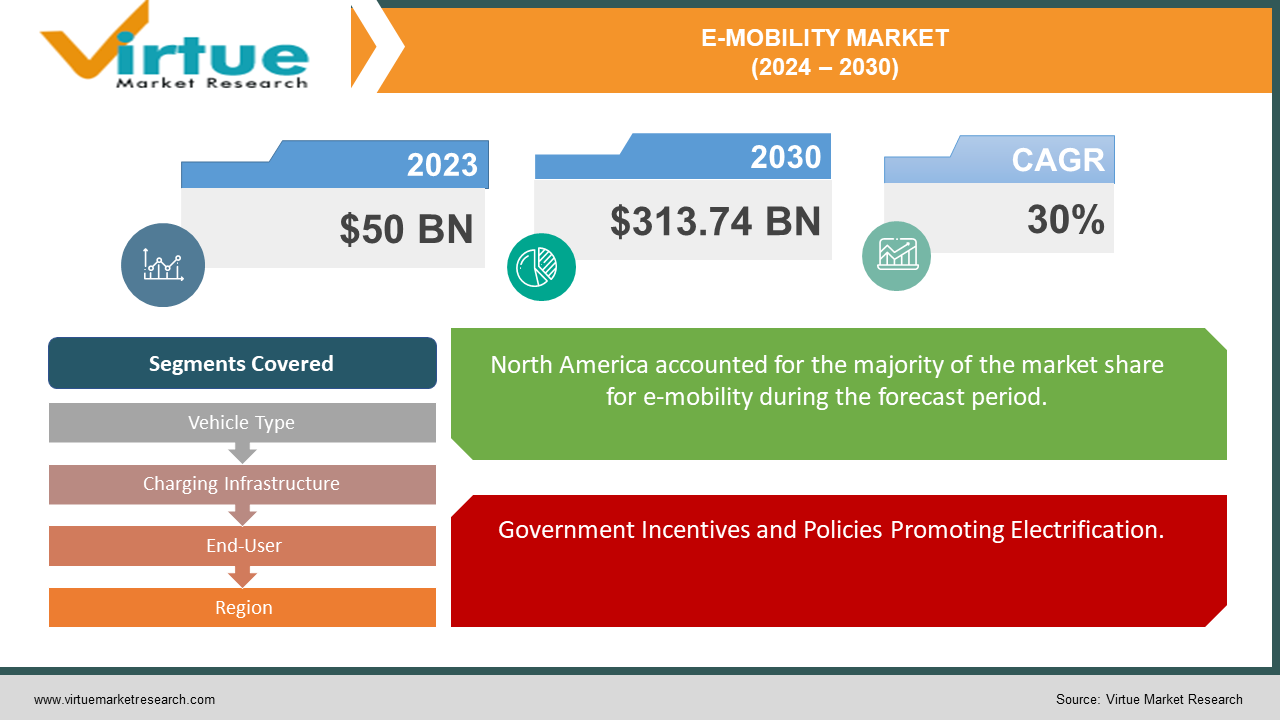

The market for e-mobility was estimated to be worth USD 50 billion in 2023 and is expected to increase to USD 313.74 billion by 2030, with a projected compound annual growth rate (CAGR) of 30% from 2024 to 2030.

The e-mobility market, characterized by the adoption of electric vehicles (EVs) and associated infrastructure, has witnessed remarkable growth and transformation in recent years. Fueled by a convergence of technological advancements, environmental consciousness, and government initiatives aimed at reducing carbon emissions, the market has emerged as a pivotal force in the transportation sector. Electric cars, bikes, scooters, buses, and trucks have become increasingly prevalent, offering consumers and businesses viable alternatives to traditional fossil fuel-powered vehicles. This transition is underpinned by improvements in battery technology, driving range, and charging infrastructure, enhancing the feasibility and appeal of electric mobility solutions. Moreover, the rising consumer awareness of sustainability, coupled with supportive policies and incentives, continues to accelerate the adoption of e-mobility worldwide. As the market continues to evolve and expand, stakeholders across industries are poised to capitalize on the opportunities presented by the electrification of transportation, driving innovation, and shaping the future of mobility.

Key Insights:

Electric vehicle (EV) sales reached a record high of 4 million units globally in 2022, marking a 43% increase compared to the previous year, signaling a significant shift towards electrification in the automotive industry.

The charging infrastructure for EVs is expanding rapidly, with the number of public charging stations worldwide surpassing 1.75 million in 2023, providing consumers with greater accessibility and convenience for electric vehicle charging.

Despite the growth of the e-mobility market, range anxiety remains a concern for consumers, with surveys indicating that over 60% of potential EV buyers are worried about the limited driving range of electric vehicles. Implementing widespread deployment of fast-charging stations and improving battery technology are critical solutions to address this challenge and alleviate range anxiety among consumers.

Global E-Mobility Market Drivers:

Government Incentives and Policies Promoting Electrification.

Governments around the world are implementing various incentives and policies to accelerate the adoption of electric vehicles (EVs) and promote the growth of the e-mobility market. Measures such as subsidies, tax incentives, and rebates for EV purchases, as well as stringent emissions regulations and targets, are driving both consumers and automakers toward electric mobility solutions. By incentivizing the transition to cleaner transportation alternatives, governments are playing a crucial role in reducing greenhouse gas emissions and mitigating the impact of climate change.

Technological Advancements in Battery Technology.

Significant advancements in battery technology, particularly in terms of energy density, charging speed, and cost reduction, are driving the growth of the e-mobility market. Breakthroughs in lithium-ion battery chemistry, as well as the development of solid-state and next-generation battery technologies, are enabling longer driving ranges, faster charging times, and increased affordability of electric vehicles. These technological innovations are enhancing the appeal and viability of EVs, making them more competitive with traditional internal combustion engine vehicles.

Growing Consumer Awareness and Environmental Concerns.

Increasing awareness of environmental issues and the desire for sustainable transportation options are driving consumer interest and demand for electric vehicles. Concerns over air pollution, climate change, and dependence on fossil fuels are prompting individuals to seek cleaner and greener alternatives for their daily commuting and transportation needs. As a result, there is a rising preference for electric vehicles among environmentally-conscious consumers, contributing to the expansion of the e-mobility market and the transition towards a more sustainable transportation ecosystem.

Global E-Mobility Market Restraints and Challenges:

Range Anxiety and Infrastructure Limitations.

One of the significant challenges facing the global e-mobility market is range anxiety, which refers to the fear of running out of battery charge while driving. Despite improvements in battery technology, EVs still have limited driving ranges compared to traditional vehicles, leading to concerns among consumers about finding charging stations, especially on long journeys. Additionally, the availability and accessibility of charging infrastructure remain inconsistent, particularly in rural and remote areas, posing a barrier to widespread EV adoption.

High Initial Cost and Affordability Concerns.

The upfront cost of electric vehicles continues to be a significant barrier for many consumers, as EVs generally have higher purchase prices compared to conventional gasoline-powered cars. Although the total cost of ownership over the vehicle's lifespan may be lower due to savings on fuel and maintenance, the initial investment remains a deterrent for some buyers. Affordability concerns, coupled with limited access to financing options and incentives, can hinder the mass-market adoption of electric vehicles, particularly in emerging economies where purchasing power is lower.

Charging Infrastructure Deployment Challenges.

The expansion of charging infrastructure, including both public and private charging stations, is crucial for supporting the widespread adoption of electric vehicles. However, deploying charging infrastructure faces various challenges, including high installation costs, regulatory hurdles, and complex permitting processes. Moreover, the integration of charging infrastructure with the existing power grid poses technical challenges, such as grid capacity constraints and demand management issues. Addressing these challenges and accelerating the deployment of charging infrastructure is essential to alleviate range anxiety and facilitate the transition to electric mobility.

Global E-Mobility Market Opportunities:

Government Support and Investment in E-Mobility Infrastructure.

Governments worldwide are increasingly prioritizing investments in e-mobility infrastructure, including charging networks and incentives for electric vehicle adoption. These initiatives present significant opportunities for market players to collaborate with governments and leverage public-private partnerships to expand the charging infrastructure and promote the adoption of electric vehicles. Additionally, government funding and subsidies for research and development in battery technology and electric vehicle manufacturing create opportunities for innovation and market growth.

Technological Innovation and Advancements in Battery Technology.

Continued advancements in battery technology, such as improvements in energy density, charging speed, and cost reduction, present significant opportunities for innovation and market expansion in the e-mobility sector. Breakthroughs in battery chemistry, as well as the development of solid-state and next-generation battery technologies, have the potential to enhance the performance and affordability of electric vehicles, making them more competitive with traditional combustion engine vehicles. Market players can capitalize on these technological advancements to develop innovative products and solutions that address consumer needs and preferences.

Rise of Electric Mobility Ecosystem and Integration with Renewable Energy.

The transition to electric mobility is driving the emergence of an interconnected ecosystem comprising electric vehicles, charging infrastructure, renewable energy sources, and energy storage systems. This integration presents opportunities for market players to develop holistic solutions that optimize energy use, reduce carbon emissions, and enhance sustainability. For example, vehicle-to-grid (V2G) technology enables electric vehicles to serve as mobile energy storage units, providing grid stabilization and demand response services. Additionally, the integration of electric vehicles with renewable energy sources, such as solar and wind power, enables clean and sustainable transportation solutions while reducing reliance on fossil fuels.

E-MOBILITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

30% |

|

Segments Covered |

By Vehicle Type, Charging Infrastructure, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tesla. Inc., BYD Company Limited, Nissan Motor Corporation, BMW Group, Volkswagen Group, General Motors Company, Ford Motor Company, Daimler AG (Mercedes-Benz), Audi AG, Rivian Automotive, Inc., Lucid Motors Inc., NIO Inc. |

E-Mobility Market Segmentation: By Vehicle Type

-

Electric Cars

-

Electric Bicycles

-

Electric Scooters

-

Electric Motorcycles

-

Electric Buses

-

Electric Trucks

Among the various segments in the global e-mobility market, electric cars stand out as one of the most effective and impactful segments. Electric cars have gained significant traction in recent years due to their potential to revolutionize the automotive industry and address environmental concerns. With advancements in battery technology, electric cars offer comparable performance to traditional internal combustion engine vehicles while producing zero tailpipe emissions, contributing to cleaner air and reduced greenhouse gas emissions. Additionally, electric cars cater to a wide range of consumer preferences and needs, from compact city cars to luxury SUVs, making them suitable for diverse market segments. The growing availability of charging infrastructure and government incentives further bolster the appeal and adoption of electric cars. As a result, electric cars are poised to play a central role in shaping the future of transportation, driving sustainability, and reducing dependence on fossil fuels.

E-Mobility Market Segmentation: By Charging Infrastructure

-

Home Charging Stations

-

Public Charging Stations

-

Workplace Charging Stations

Among the segments of charging infrastructure in the global e-mobility market, home charging stations emerge as one of the most effective solutions. Home charging stations offer convenience and accessibility for electric vehicle (EV) owners, allowing them to recharge their vehicles overnight while parked at home. This level of convenience eliminates the need for frequent visits to public charging stations, making it particularly appealing for EV owners with predictable commuting patterns and access to private parking spaces. Moreover, home charging stations provide EV owners with greater control over their charging schedules, allowing them to take advantage of off-peak electricity rates and optimize their charging costs. With the rise in the adoption of electric vehicles and the increasing number of residential properties equipped with dedicated parking spaces, home charging stations are poised to play a crucial role in supporting the widespread adoption of electric mobility and facilitating the transition to a sustainable transportation ecosystems.

E-Mobility Market Segmentation: By End-User

-

Personal Use

-

Commercial Use

-

Shared Mobility Services

Among the segments of end-users in the global e-mobility market, shared mobility services stand out as one of the most effective and transformative segments. Shared mobility services, including ride-hailing, car-sharing, and bike-sharing, offer a convenient and cost-effective alternative to traditional car ownership, particularly in urban areas where congestion and pollution are prevalent concerns. By leveraging electric vehicles (EVs) for shared mobility services, operators can significantly reduce emissions and contribute to cleaner air quality in densely populated cities. Moreover, shared electric mobility services cater to a wide range of consumer demographics, including millennials, urban professionals, and environmentally conscious individuals, who prioritize convenience, affordability, and sustainability. The scalability and flexibility of shared mobility models enable operators to optimize fleet utilization and adapt to changing consumer preferences and mobility trends. With the growing popularity of shared electric mobility services and advancements in technology, such as autonomous driving and mobility-as-a-service platforms, this segment is poised for continued growth and innovation, shaping the future of urban transportation.

E-Mobility Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The e-mobility market exhibits a diverse distribution of market share across different regions, with North America emerging as the frontrunner, capturing the largest share at 36%. This dominance is attributed to factors such as strong government support, robust charging infrastructure, and a high level of consumer awareness and adoption of electric vehicles (EVs). Following closely behind is Europe, claiming a substantial 22% market share, driven by stringent emissions regulations, generous incentives for EV adoption, and a growing network of public charging stations. The Asia-Pacific region commands a significant 21% market share, propelled by rapid urbanization, increasing urban congestion, and ambitious clean energy targets set by governments. South America the Middle East and Africa regions hold smaller yet notable market shares of 12% and 9%, respectively. While these regions are comparatively nascent in terms of e-mobility adoption, they present untapped potential for market growth due to evolving regulatory frameworks, rising environmental consciousness, and the expansion of charging infrastructure. Overall, the distribution of market share by region underscores the global momentum towards electrification of transportation, with each region contributing uniquely to the advancement of e-mobility on a worldwide scale.

COVID-19 Impact Analysis on the Global E-Mobility Market:

The COVID-19 pandemic has had a significant impact on the global e-mobility market, causing disruptions across the supply chain, manufacturing operations, and consumer demand. In the initial stages of the pandemic, widespread lockdowns and restrictions led to a slowdown in automotive production and sales, including electric vehicles (EVs). Supply chain disruptions, labor shortages, and temporary factory closures resulted in delays in EV production and delivery timelines. Furthermore, the economic uncertainty and financial strain caused by the pandemic led to a decline in consumer spending and investment in new vehicles, dampening demand for EVs. However, as the world gradually adapts to the new normal and economies reopen, interest and demand have been resurgent for e-mobility solutions. The pandemic has underscored the importance of sustainable transportation and resilience against future crises, driving governments and businesses to prioritize investments in e-mobility infrastructure and technology. Additionally, the shift towards remote work and changes in commuting patterns have accelerated the adoption of electric vehicles for personal mobility and last-mile delivery services. As the global economy continues to recover, the e-mobility market is poised for growth, with opportunities for innovation, collaboration, and the advancement of sustainable transportation solutions.

Latest Trends/ Developments:

The global e-mobility market is witnessing several latest trends and developments that are shaping the future of transportation. One notable trend is the increasing adoption of electric vehicles (EVs) across various segments, fueled by advancements in battery technology, improved charging infrastructure, and growing environmental consciousness among consumers. Additionally, there is a growing emphasis on electrification in the commercial transportation sector, with companies investing in electric buses, trucks, and delivery vans to reduce emissions and operating costs. Another significant trend is the integration of renewable energy sources, such as solar and wind power, with e-mobility solutions, enabling cleaner and more sustainable transportation ecosystems. Furthermore, the rise of smart mobility solutions, including connected EVs, autonomous vehicles, and mobility-as-a-service platforms, is transforming the way people move and access transportation services. These trends underscore the ongoing shift towards electrification and innovation in the e-mobility market, with opportunities for stakeholders to collaborate, innovate, and drive positive change in the transportation industry.

Key Players:

-

Tesla. Inc.

-

BYD Company Limited

-

Nissan Motor Corporation

-

BMW Group

-

Volkswagen Group

-

General Motors Company

-

Ford Motor Company

-

Daimler AG (Mercedes-Benz)

-

Audi AG

-

Rivian Automotive, Inc.

-

Lucid Motors Inc.

-

NIO Inc.

Chapter 1. E-Mobility Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. E-Mobility Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. E-Mobility Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. E-Mobility Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. E-Mobility Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. E-Mobility Market – By Vehicle Type

6.1 Introduction/Key Findings

6.2 Electric Cars

6.3 Electric Bicycles

6.4 Electric Scooters

6.5 Electric Motorcycles

6.6 Electric Buses

6.7 Electric Trucks

6.8 Y-O-Y Growth trend Analysis By Vehicle Type

6.9 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 7. E-Mobility Market – By Charging Infrastructure

7.1 Introduction/Key Findings

7.2 Home Charging Stations

7.3 Public Charging Stations

7.4 Workplace Charging Stations

7.5 Y-O-Y Growth trend Analysis By Charging Infrastructure

7.6 Absolute $ Opportunity Analysis By Charging Infrastructure, 2024-2030

Chapter 8. E-Mobility Market – By End-User

8.1 Introduction/Key Findings

8.2 Personal Use

8.3 Commercial Use

8.4 Shared Mobility Services

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. E-Mobility Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Vehicle Type

9.1.3 By Charging Infrastructure

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Vehicle Type

9.2.3 By Charging Infrastructure

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Vehicle Type

9.3.3 By Charging Infrastructure

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Vehicle Type

9.4.3 By Charging Infrastructure

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Vehicle Type

9.5.3 By Charging Infrastructure

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. E-Mobility Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Tesla. Inc.

10.2 BYD Company Limited

10.3 Nissan Motor Corporation

10.4 BMW Group

10.5 Volkswagen Group

10.6 General Motors Company

10.7 Ford Motor Company

10.8 Daimler AG (Mercedes-Benz)

10.9 Audi AG

10.10 Rivian Automotive, Inc.

10.11 Lucid Motors Inc.

10.12 NIO Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for e-mobility was estimated to be worth USD 50 billion in 2023 and is expected to increase to USD 313.74 billion by 2030, with a projected compound annual growth rate (CAGR) of 30% from 2024 to 2030.

The primary drivers of the global smart e-mobility market include technological advancements in electric vehicles, supportive government policies, and increasing environmental awareness among consumers.

The key challenges facing the global e-mobility market include range anxiety, high initial costs, and the need for extensive charging infrastructure development.

In 2023, North America held the largest share of the global e-mobility market.

Tesla, Inc., BYD Company Limited, Nissan Motor Corporation, BMW Group, Volkswagen Group, General Motors Company, Ford Motor Company, Daimler AG (Mercedes-Benz), Audi AG, Rivian Automotive, Inc., Lucid Motors Inc., NIO Inc. are the main players.