Electric Mobility Scooter Market Size (2025 – 2030)

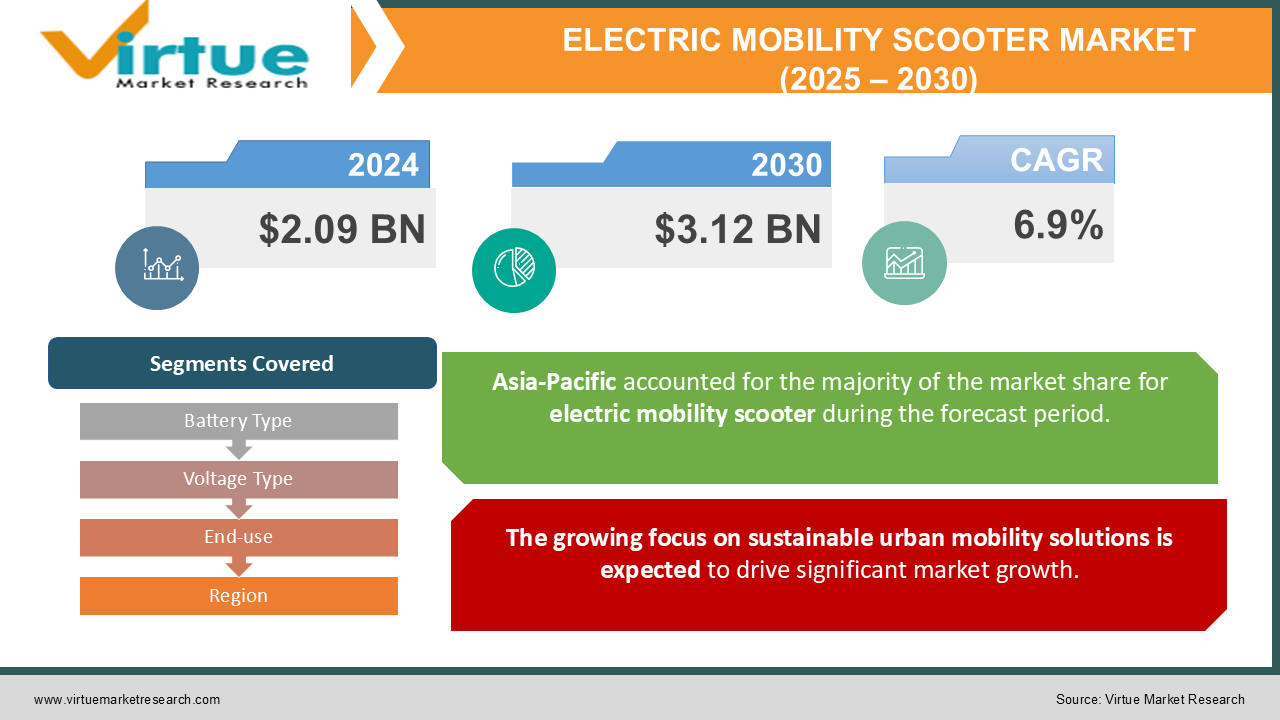

The Electric Mobility Scooter Market was valued at USD 2.09 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 3.12 billion by 2030, growing at a CAGR of 6.9%.

Key Market Insights:

- The rising demand for fuel-efficient transportation options, combined with heightened concerns about greenhouse gas and carbon emissions, is expected to accelerate the adoption of electric scooters (e-scooters) in the coming years.

- Strict emission regulations, such as the greenhouse gas (GHG) emission standards set by the U.S. Environmental Protection Agency (EPA), BS-VI in India, and China VI, are further boosting the electric scooter market.

- Additionally, electric scooters offer superior mechanical efficiency, quieter operation, and require less maintenance compared to traditional models, making them increasingly popular among consumers. Moreover, the integration of electric scooters into shared mobility services and vehicle rental systems is driving further growth in the market.

Electric Mobility Scooter Market Drivers:

The growing focus on sustainable urban mobility solutions is expected to drive significant market growth.

E-scooters are experiencing higher sales compared to e-motorcycles, primarily due to their lower initial costs and the greater variety of models available, offering consumers a wide range of options. The appeal of e-scooters, both as recreational devices and as practical commuting vehicles, is driving their increasing adoption. As a result, numerous startups are launching "rent-by-the-minute" e-scooter services in major metropolitan areas.

Several pilot programs have been implemented to introduce e-scooters gradually, aiming to reduce vehicle emissions in urban environments. The growing popularity of e-scooters is also motivating traditional two-wheeler manufacturers to enter the market. India, in particular, is emerging as a promising market for e-scooters. As a result, numerous Indian two-wheeler manufacturers are gearing up to introduce their models in this segment. For example, in November 2022, Vegh Automobiles launched the VEGH S60, its first high-speed electric scooter in India. This model features a 3 kW battery on a 60V platform, designed to comply with the AIS 56 amendments issued by the Government of India. The scooter can be fully charged in 3 to 4 hours and achieves top speeds of 60 to 70 km/h.

Electric Mobility Scooter Market Restraints and Challenges:

The absence of adequate charging infrastructure may hinder the growth of the electric scooter market.

The absence of sufficient charging infrastructure is poised to be the greatest barrier to the growth of the e-scooter market. A key factor for potential buyers when considering an electric two-wheeler is the convenience of being able to charge the vehicle anywhere, at any time. Unlike developed countries, many emerging economies lack the necessary charging stations to support widespread adoption. As an initial solution, manufacturers are working to establish their own charging networks, particularly in developing nations. However, the involvement of both government entities and private investors is crucial to accelerating the adoption of electric vehicles globally. For the e-scooter industry to thrive, a comprehensive charging infrastructure is essential, enabling users to travel long distances with confidence, without the concern of limited charging options.

Electric Mobility Scooter Market Opportunities:

Advance Technology creates opportunities in the market.

The rise of ride-sharing and rental services has played a significant role in the increasing popularity of electric scooters, broadening their accessibility to a diverse group of users. These services offer a convenient and flexible transportation option for individuals who may not wish to own a scooter or prefer using it for occasional trips. Advancements in battery technology and electric motor efficiency have notably enhanced the performance and range of electric scooters, increasing their appeal to consumers. These improvements make electric scooters more reliable and practical for everyday use, driving greater interest in the market. These technological innovations contribute to longer battery life, faster charging times, and enhanced overall efficiency, further driving the appeal of electric scooters as a practical and sustainable transportation option.

ELECTRIC MOBILITY SCOOTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.9% |

|

Segments Covered |

By Battery Type, Voltage Type, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BMW Motorrad International, Ather Energy, AllCell Technologies LLC, Gogoro, Inc., Honda Motor Co. Ltd., GOVECS, KTM AG, Jiangsu Xinri E-Vehicle Co., Ltd. , Niu International, Mahindra GenZe. |

Electric Mobility Scooter Market Segmentation: By Battery Type

-

Lead Acid

- Li-ion

The Lead-Acid battery segment led the market, driven by its advantages such as durability, damage tolerance, and affordability. However, the adoption of Lead-Acid (SLA) batteries is anticipated to decline in the coming years due to their large size, quick energy depletion, and limited load capacity.

In contrast, the lithium-ion battery segment saw relatively low demand but is expected to gain significant momentum and grow at the highest compound annual growth rate (CAGR) over the forecast period. The lithium-ion battery segment accounted for a notable market share, owing to its superior performance, high charging-discharging efficiency, high charge density, and lightweight characteristics.

Electric Mobility Scooter Market Segmentation: By Voltage Type

-

48-59V

-

60-72V

-

73-96V

-

Above 96V

The 48-59 V segment holds the largest share in the global market and is expected to maintain its dominance throughout the forecast period. These batteries are highly compatible with e-scooters, offering higher power output, which is anticipated to drive further market growth. E-scooters with 48-59 V batteries are typically preferred for short-distance commutes.

The 60-72 V segment is expected to experience strong growth and market penetration in 2023, securing the second-largest market share. This segment is projected to grow during the forecast period as consumers increasingly favor scooters with extended battery range to minimize the need for frequent charging.

The 73-96 V segment is also forecasted to experience positive growth. This segment is expected to grow at a significant rate, driven by consumer preference for high-voltage e-scooters that offer long-range capabilities and reduce the frequency of battery charging.

Electric Mobility Scooter Market Segmentation: By End-use

-

Personal

-

Commercial

The personal use segment holds a dominant share in the electric scooter market. Electric scooters are transforming the personal vehicle landscape due to their eco-friendliness, lightweight design, affordability, low maintenance, and ease of maneuverability. They are increasingly preferred over other electric alternatives, especially by millennials and individuals in low- to middle-income brackets. Additionally, the development of private charging stations or designated charging spots by electric scooter manufacturers is expected to further drive the adoption of e-scooters among consumers.

The commercial segment is projected to experience growth during the forecast period. Electric scooters present an economical and efficient solution for last-mile delivery in commercial settings. In locations such as factories, universities, warehouses, and large industrial sites, e-scooters offer fast and cost-effective transportation. With the increasing popularity of shared mobility services, many vehicle rental companies are expanding their fleets of e-scooters, available for rent by the minute or for specific time durations, contributing to the growth of the commercial segment.

Electric Mobility Scooter Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region is expected to lead the electric scooter market over the forecast period, with key economies such as China, India, South Korea, and Japan playing a significant role in shaping the overall market landscape. These countries are seeing the rise of numerous startups as well as the entry of established and traditional manufacturers.

In 2021, Taiwan introduced subsidies of up to USD 900-1000 for purchasing new electric motorcycles and scooters. As a result of this initiative, electric scooters accounted for 11.9% of the total scooter market in Taiwan, with 94,000 units sold out of the 809,000 scooters sold in the country that year. Notably, Gogoro Inc. sold approximately 79,000 electric scooters in Taiwan in 2021. The Taiwanese government aims to have 70% of new scooter sales’

India, one of the largest two-wheeler markets in the world, is seeing the influx of numerous new startups that are launching innovative models while also expanding their existing product lines and infrastructure. Companies are forming strategic partnerships with global players to enhance their market presence.

North America is expected to experience significant growth during the forecast period, driven by both government initiatives and private sector involvement to expand the regional electric two-wheeler charging station network. Moreover, the promotion of research and development activities focused on high-density batteries is expected to further boost the regional market in the coming years.

The European electric scooter market is also expected to see considerable growth over the forecast period. Increased investments in electric vehicle charging infrastructure and research into innovative high-density batteries are expected to support regional growth. Furthermore, the arrival of international electric scooter manufacturers is intensifying competition, with companies in Europe concentrating on launching a variety of electric scooter models to attract the younger demographic. These strategies are anticipated to fuel the overall growth of the European market.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a considerable adverse effect on the electric scooter and motorcycle market. Global lockdowns resulted in the suspension of production and sales of new vehicles, including electric scooters and motorcycles. Additionally, supply chain disruptions caused shortages in raw materials needed to produce various scooter and motorcycle components, leading to production delays.

However, with the growing global shift towards cleaner mobility, the market is expected to experience an economic recovery post-pandemic. The decline in automotive production and labor shortages further strained the market, but as manufacturers have resumed operations, supported by steadily increasing automobile sales in regions with fewer COVID-19 cases, a market recovery is anticipated during the forecast period. Furthermore, manufacturers are implementing contingency plans to address future uncertainties, ensuring continuity in business operations and maintaining relationships with clients in critical sectors of the automobile industry.

Latest Trends/ Developments:

In December 2023, Gogoro, a leading electric two-wheeler brand from Taiwan, announced plans to launch a new electric scooter model in the Indian market. The upcoming model features a practical and durable design, with prominent body panels, a spacious floorboard, and a split-style, large seat, catering to the needs of Indian consumers.

In the same month, Log9, an advanced battery technology company, and electric motorcycle startup TORK Motors joined forces to establish an interoperable charging network in India through the Bharat Charge Alliance (BCA). As members of the BCA, TORK and Log9 will facilitate the mutual use of their electric vehicle charging networks, ensuring compliance with the interoperable LEV fast-charging standard.

Key Players:

These are top 10 players in the Electric Mobility Scooter Market :-

-

BMW Motorrad International

-

Ather Energy

-

AllCell Technologies LLC

-

Gogoro, Inc.

-

Honda Motor Co. Ltd.

-

GOVECS

-

KTM AG

-

Jiangsu Xinri E-Vehicle Co., Ltd.

-

Niu International

-

Mahindra GenZe.

Chapter 1. Electric Mobility Scooter Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electric Mobility Scooter Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electric Mobility Scooter Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electric Mobility Scooter Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electric Mobility Scooter Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electric Mobility Scooter Market – By Battery Type

6.1 Introduction/Key Findings

6.2 Lead Acid

6.3 Li-ion

6.4 Y-O-Y Growth trend Analysis By Battery Type

6.5 Absolute $ Opportunity Analysis By Battery Type, 2024-2030

Chapter 7. Electric Mobility Scooter Market – By Voltage Type

7.1 Introduction/Key Findings

7.2 48-59V

7.3 60-72V

7.4 73-96V

7.5 Above 96V

7.6 Y-O-Y Growth trend Analysis By Voltage Type

7.7 Absolute $ Opportunity Analysis By Voltage Type, 2024-2030

Chapter 8. Electric Mobility Scooter Market – By End-User

8.1 Introduction/Key Findings

8.2 Personal

8.3 Commercial

8.4 Y-O-Y Growth trend Analysis By End-User

8.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Electric Mobility Scooter Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Battery Type

9.1.3 By Voltage Type

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Battery Type

9.2.3 By Voltage Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Battery Type

9.3.3 By Voltage Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Battery Type

9.4.3 By Voltage Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Battery Type

9.5.3 By Voltage Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Electric Mobility Scooter Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BMW Motorrad International

10.2 Ather Energy

10.3 AllCell Technologies LLC

10.4 Gogoro, Inc.

10.5 Honda Motor Co. Ltd.

10.6 GOVECS

10.7 KTM AG

10.8 Jiangsu Xinri E-Vehicle Co., Ltd.

10.9 Niu International

10.10 Mahindra GenZe.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The rising demand for fuel-efficient transportation options, combined with heightened concerns about greenhouse gas and carbon emissions, is expected to accelerate the adoption of electric scooters (e-scooters) in the coming years.

The top players operating in the Electric Mobility Scooter Market are - Gogoro, Inc., Honda Motor Co. Ltd., GOVECS, KTM AG, Jiangsu Xinri E-Vehicle Co., Ltd. and Niu International.

The COVID-19 pandemic had a considerable adverse effect on the electric scooter and motorcycle market.

In December 2023, Gogoro, a leading electric two-wheeler brand from Taiwan, announced plans to launch a new electric scooter model in the Indian market.

North America is expected to experience significant growth during the forecast period, driven by both government initiatives and private sector involvement to expand the regional electric two-wheeler charging station network.