Disaster Recovery Software Market Size (2024 – 2030)

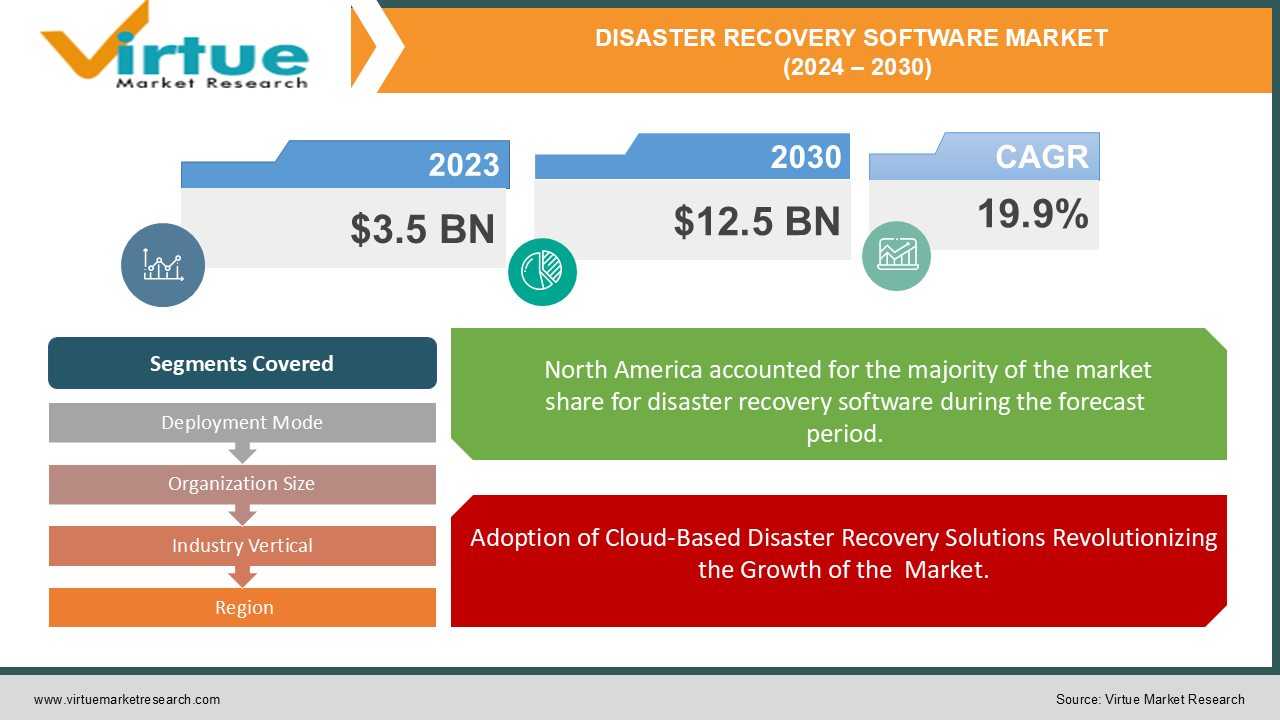

The Global Disaster Recovery Software Market was valued at USD 3.5 billion in 2023 and is projected to reach a market size of USD 12.5 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 19.9% between 2024 and 2030.

The Global Disaster Recovery Software Market is a critical component in the IT infrastructure landscape, enabling businesses to protect their data and maintain operational continuity in the face of unexpected disruptions. Disaster recovery software is designed to restore vital systems and data after incidents like cyberattacks, hardware failures, natural disasters, or human errors. With the rise of cloud-based solutions, this market is witnessing rapid growth as companies increasingly rely on automated and scalable disaster recovery services to minimize downtime and ensure business continuity. Additionally, the proliferation of digital transformation initiatives, coupled with the growing frequency of cyberattacks, has intensified the demand for robust disaster recovery solutions. Key drivers of this market include increasing reliance on data for business operations, regulatory requirements mandating data protection, and advancements in recovery technologies like virtualization and automation. Cloud-based disaster recovery is gaining significant traction due to its cost-effectiveness and flexibility, allowing businesses of all sizes to implement comprehensive recovery plans. As more organizations prioritize data protection and business resilience, the demand for advanced disaster recovery software solutions is expected to grow, making it a vital aspect of future IT strategies across industries.

Key Market Insights:

-

Over 40% of businesses experience data loss due to disasters annually.

-

90% of companies without disaster recovery software fail within a year after a disaster.

-

Cloud-based disaster recovery solutions account for more than 55% of the market.

-

50% of organizations consider disaster recovery software critical to their IT strategy.

-

70% of data breaches are caused by human error, emphasizing the need for automated recovery solutions.

-

By 2027, 75% of enterprises are projected to use disaster recovery as a service (DRaaS).

Global Disaster Recovery Software Market Drivers:

Rising Frequency of Cyberattacks and Data Breaches Driving the Growth of the Global Disaster Recovery Software Market.

One of the key drivers for the Global Disaster Recovery Software Market is the increasing frequency of cyberattacks and data breaches. As businesses become more reliant on digital infrastructure, the vulnerability to cyber threats such as ransomware, phishing attacks, and data breaches has grown significantly. In many cases, these attacks can cripple operations, causing prolonged downtime and significant financial losses. Disaster recovery software plays a critical role in helping organizations respond quickly by restoring compromised data and systems. The growing sophistication of cyberattacks has made it essential for businesses to have comprehensive disaster recovery plans in place to safeguard their sensitive information and minimize operational disruptions. The need for automated, real-time data recovery solutions is further amplified by stringent data protection regulations, which mandate businesses to ensure data integrity and availability in the event of a cyber incident. As a result, organizations across industries, especially in finance, healthcare, and government sectors, are increasingly adopting disaster recovery software to mitigate the risks posed by cyber threats and maintain business continuity. This has positioned the market as a crucial aspect of modern IT infrastructure planning.

Adoption of Cloud-Based Disaster Recovery Solutions Revolutionizing the Growth of the Market.

The widespread adoption of cloud-based disaster recovery solutions is another significant driver of the Global Disaster Recovery Software Market. Traditional disaster recovery solutions often required substantial investments in physical infrastructure, which made them inaccessible for small and medium-sized enterprises (SMEs). However, the advent of cloud technology has revolutionized the disaster recovery landscape by offering cost-effective, scalable, and flexible solutions. Cloud-based disaster recovery software eliminates the need for expensive on-site hardware, allowing businesses to store critical data and applications securely in the cloud. In the event of a disaster, these solutions enable faster recovery times with minimal manual intervention, ensuring that businesses can quickly resume operations. Moreover, cloud-based solutions offer pay-as-you-go models, making disaster recovery more accessible for organizations of all sizes. The flexibility of cloud deployment also allows businesses to customize their recovery plans based on specific requirements, whether for data backup, system restoration, or application continuity. With the increasing shift toward cloud adoption and digital transformation initiatives, cloud-based disaster recovery solutions are becoming a preferred choice for businesses seeking to enhance their resilience and safeguard their critical operations against potential threats.

Global Disaster Recovery Software Market Restraints and Challenges:

The Global Disaster Recovery Software Market faces several restraints and challenges, despite its growing importance in safeguarding business continuity. One significant challenge is the high cost associated with implementing advanced disaster recovery solutions, especially for small and medium-sized enterprises (SMEs). Although cloud-based options have reduced some of the financial burdens, the overall investment in infrastructure, regular updates, and skilled personnel to manage disaster recovery systems remains substantial. Additionally, the complexity of integrating disaster recovery software with existing IT systems can be daunting for businesses, leading to potential disruptions during implementation. Data security and privacy concerns also pose challenges, as companies are often hesitant to fully embrace cloud-based recovery solutions due to fears of sensitive data being compromised. Another key restraint is the lack of awareness and preparedness among businesses, particularly in developing regions, where organizations may underestimate the importance of having a robust disaster recovery plan. Moreover, the rapid evolution of cyber threats requires constant software updates and adaptability, which can strain the resources of companies that are not fully equipped to handle such changes. These factors, combined with the challenge of ensuring seamless recovery across increasingly complex IT environments, pose significant obstacles to the broader adoption of disaster recovery software.

Global Disaster Recovery Software Market Opportunities:

The Global Disaster Recovery Software Market presents significant opportunities, driven by technological advancements and the growing digital transformation across industries. One of the primary opportunities lies in the increasing adoption of cloud computing and Disaster Recovery as a Service (DRaaS). Cloud-based solutions offer scalability, flexibility, and cost-efficiency, making them highly appealing for businesses of all sizes, particularly small and medium-sized enterprises (SMEs) that previously struggled with the high costs of traditional disaster recovery systems. As more organizations migrate their operations to the cloud, the demand for cloud-based disaster recovery solutions is expected to rise significantly. Additionally, the growing focus on automation and artificial intelligence (AI) in disaster recovery processes presents another key opportunity. AI-driven disaster recovery solutions can enable predictive analytics, early detection of potential failures, and faster recovery times, ensuring minimal disruption to business operations. The market also has potential growth opportunities in emerging markets, where the adoption of disaster recovery software is still in its infancy. As businesses in these regions become increasingly aware of the need for data protection and regulatory compliance, the demand for disaster recovery solutions is expected to grow. Vendors that offer affordable, flexible, and secure solutions are well-positioned to capture this expanding market share.

DISASTER RECOVERY SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

19.9% |

|

Segments Covered |

By Deployment Mode, Organization Size, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Microsoft Corporation, IBM Corporation, VMware, Inc.,Oracle Corporation, Cisco Systems, Inc., Amazon Web Services (AWS), Acronis International GmbH, Zerto Ltd., Commvault Systems, Inc., Veeam Software |

Global Disaster Recovery Software Market Segmentation: By Deployment Mode

-

On-Premise

-

Cloud-Based

In 2023, based on market segmentation by Deployment Mode, Cloud-Based had the highest share of the Global Disaster Recovery Software Market. Cloud-based disaster recovery (DR) solutions are gaining traction due to several compelling advantages and market trends. Scalability is a key benefit, as cloud providers offer virtually unlimited computing resources, enabling businesses to quickly adjust their DR infrastructure according to fluctuating needs. This approach is cost-effective, eliminating the need for significant upfront investments in hardware and software, thereby making DR accessible for organizations of all sizes. Flexibility further enhances the appeal of cloud-based DR, allowing businesses to select from various services, including backup and recovery, replication, and disaster recovery as a service (DRaaS). Rapid deployment is another crucial advantage, with many solutions being implementable within days or even hours. Additionally, cloud providers typically incorporate robust security measures to protect data and infrastructure from emerging threats. Market trends also support the shift toward cloud-based DR, notably the increasing frequency and severity of disasters, including natural events and cyberattacks, which heighten the demand for reliable recovery solutions. As more businesses migrate their workloads to the cloud, awareness of the importance of business continuity grows, compelling organizations to prioritize robust DR plans to minimize downtime and financial losses in times of crisis.

Global Disaster Recovery Software Market Segmentation: By Organization Size

-

Small and Medium-Sized Enterprises (SMEs)

-

Large Enterprises

In 2023, based on market segmentation by Organization Size, Large Enterprises had the highest share of the Global Disaster Recovery Software Market. Large enterprises face unique challenges that drive their need for robust disaster recovery solutions. With complex IT infrastructures and critical business operations, these organizations prioritize minimizing downtime and data loss to maintain operational continuity. The significance of regulatory compliance further compels large enterprises, particularly in highly regulated industries such as finance and healthcare, to invest in comprehensive disaster recovery measures to adhere to stringent data security and business continuity standards. The potential impact of disruptions on their vast operations elevates risk management to a top priority, prompting these companies to adopt proactive disaster recovery strategies. Additionally, large enterprises possess the financial resources to invest in advanced disaster recovery technologies and solutions that can address their specific needs. While small and medium-sized enterprises (SMEs) are increasingly recognizing the importance of disaster recovery, the scale and complexity of large enterprises often necessitate more sophisticated and tailored solutions. This disparity highlights the critical nature of effective disaster recovery planning in safeguarding the substantial investments and operational integrity of large organizations, ensuring they are prepared to respond to unexpected events and maintain resilience in the face of challenges.

Global Disaster Recovery Software Market Segmentation: By Industry Vertical

-

Banking, Financial Services, and Insurance (BFSI)

-

Healthcare

-

IT and Telecommunications

-

Government

-

Retail

-

Manufacturing

-

Media and Entertainment

-

Education

In 2023, based on market segmentation by Industry Vertical, IT and Telecommunications had the highest share of the Global Disaster Recovery Software Market. The IT and telecommunications sectors are critical to the functioning of numerous industries, necessitating a strong emphasis on disaster recovery to ensure business continuity and minimize downtime. Disruptions in these foundational sectors can lead to cascading effects throughout the economy, making it imperative for companies to have comprehensive disaster recovery plans in place. Additionally, these industries manage vast amounts of sensitive data, elevating data protection and recovery to a top priority. As a result, organizations in IT and telecommunications are vigilant about implementing robust solutions to safeguard their data assets against potential threats. Regulatory compliance is another significant factor driving disaster recovery investments, as many companies in these sectors operate under stringent regulations that mandate the establishment of effective recovery protocols. Furthermore, the nature of the industry often positions IT and telecommunications firms as early adopters of advanced technologies, including innovative disaster recovery solutions. This proactive approach allows them to leverage the latest advancements in technology, enhancing their resilience against disruptions. By prioritizing disaster recovery, these industries not only protect their operations but also contribute to the stability and reliability of the broader economy.

Global Disaster Recovery Software Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Disaster Recovery Software Market. North America is a key region for the Global Disaster Recovery Software Market, driven by several compelling factors. The area boasts a strong culture of technological innovation and early adoption, which extends to the implementation of advanced disaster recovery solutions. This forward-thinking approach is crucial as organizations seek to enhance their resilience against potential disruptions. Additionally, strict data privacy and security regulations, such as HIPAA and GDPR, further fuel the demand for robust disaster recovery measures, compelling businesses to ensure compliance while protecting sensitive information. The region's relatively stable economy and well-developed infrastructure create an attractive environment for businesses, resulting in a higher concentration of organizations that require effective disaster recovery solutions to maintain operational continuity. Furthermore, the competitive landscape in North America is notable, featuring numerous established players alongside innovative startups, all offering a diverse range of disaster recovery options. This competition drives continuous improvements and advancements in technology, enabling businesses to choose from a wide array of solutions tailored to their specific needs. Together, these factors position North America as a leading market for disaster recovery software, essential for organizations aiming to safeguard their operations in an increasingly complex digital landscape.

COVID-19 Impact Analysis on the Global Disaster Recovery Software Market.

The COVID-19 pandemic had a significant impact on the Global Disaster Recovery Software Market, driving a surge in demand as businesses worldwide faced unprecedented operational challenges. With widespread lockdowns, remote work mandates, and disruptions to supply chains, many organizations experienced vulnerabilities in their IT infrastructure, highlighting the critical need for robust disaster recovery solutions. The pandemic accelerated digital transformation, with businesses rapidly adopting cloud technologies to ensure business continuity in a remote work environment. As a result, there was a notable increase in the adoption of cloud-based disaster recovery solutions, particularly among small and medium-sized enterprises (SMEs) that needed cost-effective and scalable options. The heightened risk of cyberattacks during the pandemic also underscored the importance of having reliable disaster recovery plans in place, as companies became more reliant on digital platforms for daily operations. Furthermore, the shift to remote work exposed gaps in traditional recovery strategies, leading businesses to invest in automated and AI-driven solutions to ensure faster recovery times and reduce manual intervention. Overall, the COVID-19 pandemic acted as a catalyst for the disaster recovery software market, pushing organizations to prioritize data protection and system resilience, which is expected to drive sustained growth in the post-pandemic period.

Latest trends / Developments:

The Global Disaster Recovery Software Market is witnessing several key trends and developments that are shaping its future growth. One of the most notable trends is the increasing adoption of Disaster Recovery as a Service (DRaaS), driven by the growing shift toward cloud-based solutions. DRaaS offers flexible, scalable, and cost-effective recovery options, allowing businesses to implement comprehensive disaster recovery strategies without the need for heavy investments in physical infrastructure. Another significant development is the integration of artificial intelligence (AI) and machine learning (ML) into disaster recovery software. AI-driven solutions enhance the speed and accuracy of recovery processes by predicting system failures, identifying potential threats, and automating recovery tasks. Additionally, businesses are increasingly focusing on adopting automated disaster recovery testing, which ensures that recovery plans are effective without manual intervention. There is also a growing emphasis on multi-cloud disaster recovery strategies, as companies leverage multiple cloud providers to enhance data redundancy and reduce the risk of single-point failures. As cybersecurity threats continue to evolve, companies are investing in more sophisticated disaster recovery solutions that integrate security features like encryption and threat detection. These trends indicate a broader move toward more resilient, intelligent, and automated disaster recovery solutions that can meet the complex needs of modern IT environments.

Key Players:

-

Microsoft Corporation

-

IBM Corporation

-

VMware, Inc.

-

Oracle Corporation

-

Cisco Systems, Inc.

-

Amazon Web Services (AWS)

-

Acronis International GmbH

-

Zerto Ltd.

-

Commvault Systems, Inc.

-

Veeam Software

Chapter 1. Disaster Recovery Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Disaster Recovery Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Disaster Recovery Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Disaster Recovery Software Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Disaster Recovery Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Disaster Recovery Software Market – By Deployment Mode

6.1 Introduction/Key Findings

6.2 On-Premise

6.3 Cloud-Based

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. Disaster Recovery Software Market – By Organization Size

7.1 Introduction/Key Findings

7.2 Small and Medium-Sized Enterprises (SMEs)

7.3 Large Enterprises

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. Disaster Recovery Software Market – By Industry Vertical

8.1 Introduction/Key Findings

8.2 Banking, Financial Services, and Insurance (BFSI)

8.3 Healthcare

8.4 IT and Telecommunications

8.5 Government

8.6 Retail

8.7 Manufacturing

8.8 Media and Entertainment

8.9 Education

8.10 Y-O-Y Growth trend Analysis By Industry Vertical

8.11 Absolute $ Opportunity Analysis By Industry Vertical, 2024-2030

Chapter 9. Disaster Recovery Software Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Deployment Mode

9.1.3 By Organization Size

9.1.4 By Industry Vertical

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Deployment Mode

9.2.3 By Organization Size

9.2.4 By Industry Vertical

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Deployment Mode

9.3.3 By Organization Size

9.3.4 By Industry Vertical

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Deployment Mode

9.4.3 By Organization Size

9.4.4 By Industry Vertical

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Deployment Mode

9.5.3 By Organization Size

9.5.4 By Industry Vertical

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Disaster Recovery Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Microsoft Corporation

10.2 IBM Corporation

10.3 VMware, Inc.

10.4 Oracle Corporation

10.5 Cisco Systems, Inc.

10.6 Amazon Web Services (AWS)

10.7 Acronis International GmbH

10.8 Zerto Ltd.

10.9 Commvault Systems, Inc.

10.10 Veeam Software

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Disaster Recovery Software market is expected to be valued at US$ 3.2 billion.

Through 2030, the Global Disaster Recovery Software market is expected to grow at a CAGR of 19.9%.

By 2030, the Global Disaster Recovery Software Market is expected to grow to a value of US$ 12.5 billion.

North America is predicted to lead the Global Disaster Recovery Software market.

The Global Disaster Recovery Software Market has segments By Deployment Mode, Organization Size, Industry Vertical, and Region.