Backup and Disaster Recovery Market Size (2023 – 2030)

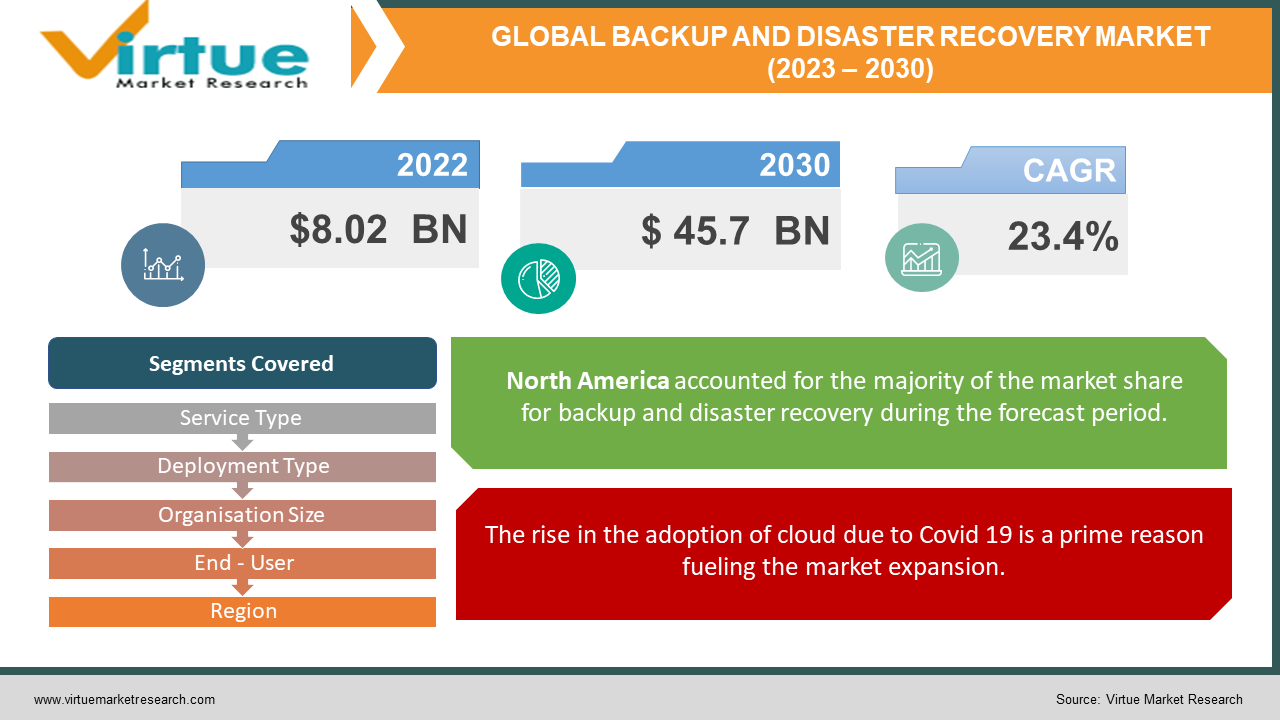

The market value of the Backup and Disaster Recovery Market was worth USD 8.02 billion in 2022 and is projected to reach USD 45.7 billion by 2030, recording a Compound Annual Growth Rate (CAGR) of 23.4% over the forecast period. Following COVID-19, the backup and disaster recovery industry will continue to develop as more businesses across the world aim to shift their IT infrastructure to the cloud, improve business continuity, and streamline IT operations and thus will fuel the market expansion of the Backup and Disaster Recovery Market.

INDUSTRY OVERVIEW:

Backup and disaster recovery refers to a third-party cloud computing and backup service model that replicates and recovers virtual servers and data in the act of any natural or man-made disaster. To safeguard sensitive information of the company, backups are often generated on a public, cloud, virtual private cloud (VPC), or hybrid environment. It provides total network assistance and management during outages, ensuring business continuity by reducing downtime and interruptions. It finds widespread use in the banking, financial services, and insurance (BFSI), healthcare, manufacturing, information technology (IT), and telecommunications industries as a result of these advantages. The interconnected, multi-cloud environment is extremely important in today's society, with the cloud evolving as a vital data security platform. According to IDC research, nearly 90% of businesses are employing data security mechanisms involving cloud infrastructure. Backup and disaster recovery solutions are often used to ensure the security of a certain application, data type, or regulatory obligation. The threat of data loss from natural catastrophes or mechanical failures is increasing, resulting in a surge in demand for backup and disaster recovery solutions. Backup and disaster recovery is a cloud-based technique that allows businesses to back up and restore critical data stored in a third-party cloud.

The expansion of the backup and Disaster recovery industry is fueled by an increase in hostile data breaches. To protect critical information, the BFSI, healthcare, IT, telecommunications, and many other industries are actively using disaster recovery and backup services. One of the important reasons driving the market's growth is the expanding trend of digitalization, as well as the increasing acceptance of cloud-based services across sectors. Backup and disaster recovery solutions are widely used because they reduce the requirement for a separate facility and allow for quick data recovery with fewer complications. Moreover, growing awareness of cloud-based backup and recovery advantages across small and medium-sized businesses is boosting the market growth. Backup and disaster recovery solutions are routinely used by these firms to evaluate and implement an effective disaster recovery plan. Several technical improvements, such as the advent of intelligent data duplication, virtual machine inventory, and automated testing, are also helping to drive the industry forward. Apart from that, the ability to reduce downtime, lower operating costs, increase profit, and manage resources effectively are all factors driving demand for Backup and Disaster recovery solutions. The vendors of Backup and Disaster recovery solutions are always working to improve the DR (Disaster Recovery) planning solution to make it easier to install and lower operational costs. As a result, the backup and disaster recovery market is fast developing all over the world, assisting enterprises in addressing existential threats and recovering data loss.

COVID-19 IMPACT ON BACKUP AND DISASTER RECOVERY MARKET:

The pandemic's occurrence has had a favorable impact on the backup and disaster recovery sector. The epidemic hastened the acceptance and use of digital services, with many individuals using app-based services for professional and personal purposes. Organizations had to switch to work from home mode to protect the safety of their employees and preserve operational efficiency as a result of the worldwide lockdown, causing a rise in demand for cloud-based solutions. Furthermore, demand for stronger security of hidden business assets surged as a result of an unanticipated spike in cyber-criminal activity that targeted numerous organizations and their consumers, fueling market development. The need for backup and disaster recovery solutions will continue to grow as more businesses opt for cloud-based solutions to improve their IT infrastructure.

MARKET DRIVERS:

The rise in the adoption of cloud due to Covid 19 is a prime reason fueling the market expansion:

COVID-19 has impacted the dynamics of company operations all around the world. Though the COVID-19 outbreak has exposed flaws in business models across industries, it has also provided various chances for Backup and Disaster recovery companies to develop their business across organizations, since cloud usage has surged as a result of the COVID-19 lockdown. Many businesses are minimizing their IT investment in 2020 as a result of the lockdown. Organizations are turning to the public cloud for backup and disaster recovery solutions to achieve these aims and minimize capital investment in these challenging times which is acting as a positive influence on the Backup and Disaster Recovery market growth.

The emergence of AI and ML in backup and disaster recovery solutions to strengthen the data recovery strategies of enterprises:

Software solution providers have been looking at developing cutting-edge technologies like Artificial Intelligence (AI) and Machine Learning to support the development of novel solutions. Over time, AI use has risen substantially, and the technology now provides meaningful value to clients while also assisting solution providers in increasing revenue. AI in backup and disaster recovery can help secure and recover data in a variety of ways. Because data is a company's most valuable asset, it can't afford to lose it, thus companies are investing in finding out new technologies and ways to back their data which is consequently fueling the Backup and Disaster Recovery market growth.

MARKET RESTRAINTS:

The reluctance of enterprises toward the adoption of cloud-based solutions over traditional methods is a major factor hampering the growth:

Enterprises are hesitant to adopt new technology. For a long time, it has been the most significant obstacle for solution providers. Security concerns, ignorance, misunderstandings about technology and pricing structures, and obstinate views to stick with traditional systems for backup and disaster recovery techniques are all reasons why businesses are hesitant to adopt cloud and cloud-based recovery solutions. Organizations do not trust cloud environments because they are prone to data breaches and cyber-attacks. These barriers stand in the way of vendors informing clients about the possible business benefits of well-designed and personalized backup and disaster recovery solutions.

Difficulty in achieving security and compliance in cloud environments is hampering the market growth:

Even though large enterprises and SMEs are rapidly adopting backup and disaster recovery solutions, one of the main difficulties faced by backup and disaster recovery providers and consumers is the security of the data. Organizations must ensure that recovery and backup sites have the same degree of protection as primary sites. Maintaining and demonstrating compliance in cloud settings can be more complicated since firms must interact with several providers and service-level agreements. When it comes to data storage on cloud-based systems, businesses are extremely cautious. Any data disruption would have a huge impact on the firm. As a result, many businesses are hesitant to employ backup and disaster recovery solutions.

BACKUP AND DISASTER RECOVERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

23.4% |

|

Segments Covered |

By Service Type, By Deployment Type, By Organisation Size, By End - User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Microsoft, IBM, VMware, iland, Recovery Point, Sungard Availability Services, InterVision, AWS, TierPoint, Infrascale, Acronis Axcient, BIOS Middle East, C&W Communications, Carbonite, Daisy, Databarracks, Datto, Evolve IP, Expedient, Flexential, Geminare, NTT, Quorum, SorageCraft, Unitrends, RackWare, Druva, Optum, DARZ Zettagrid, and PhoenixNAP |

This research report on the Backup and Disaster Recovery Market has been segmented and sub-segmented based on Service Type, By Deployment Type, By Organisation Size, By End - User, and By Region.

BACKUP AND DISASTER RECOVERY MARKET– BY SERVICE TYPE

-

Real-time Replication

-

Backup and Restore

-

Data Protection

Based on Service Type, the backup and disaster recovery market is segmented into Real-time Replication, Backup and Restore, and Data Protection. Among these, the Backup and Restore segment will contribute significantly to the backup and disaster recovery market development. In a cloud computing context, backup is the process of duplicating data. It allows for the recovery of duplicate sets in the event of data loss due to downtime or failures, such as power outages, human mistakes, or natural disasters. In the case of a disaster, restore refers to the retrieval of lost or corrupted files from storage media. The data restore procedure refers to the process of recovering specific data that has become unavailable due to logical or physical damage to the storage devices. As the volume of data grows, so does the demand for backup. Enterprises benefit from backup for a variety of reasons, including higher agility, data retention, cheaper costs, faster deployments, and better data security. It offers solutions that are cost-effective, automated, dependable, secure, and scalable. In the case of a crisis, these technologies assure company continuity. Enterprises with limited resources can outsource their data and applications to backup and disaster recovery suppliers, who offer specialized backup and restore services while reducing CAPEX.

BACKUP AND DISASTER RECOVERY MARKET– BY DEPLOYMENT TYPE

-

Public Cloud

-

Private Cloud

Based on Deployment Type, the backup and disaster recovery market is segmented into Public Cloud and Private Cloud. Among these, the Public Cloud segment dominated the market share for the backup and disaster recovery market in 2021 and is projected to continue with this trend over the forecast period. The public cloud deployment platform is based on the cloud computing concept, which enables service providers to create applications and make them available to the general public over the web. Public cloud services are provided for free or on a pay-per-use basis, depending on the needs of end customers. The public cloud deployment method is best suited for web servers or system designs where security and compliance aren't a big concern. The public cloud allows for easier access and quicker deployments. These reasons lead to the widespread use of disaster recovery services. Scalability, dependability, flexibility, and remote access are all advantages of the public cloud deployment which are motivating the business to opt for backup and disaster recovery solutions.

BACKUP AND DISASTER RECOVERY MARKET– BY ORGANISATION SIZE

-

Small and Medium-sized Enterprises (SMEs)

-

Large Enterprises

Based on Organisation Size, the backup and disaster recovery market is segmented into Small and Medium Enterprises and Large Enterprises. Among these two, the large enterprises hold the major market share in the backup and disaster recovery market in 2021. Big companies and enterprises are now heavily relying on big data to devise analytical information which is aiding them in identifying opportunities, making critical business decisions, and helping improve business performance. The organizations are restructuring their security policy and are heavily relying on backup and disaster recovery solutions and security mechanisms in safeguarding important assets from diverse cyber-attacks or any natural or man-made disaster thus contributing to the market growth.

BACKUP AND DISASTER RECOVERY MARKET– BY END-USER

-

Banking, Financial Services, and Insurance (BFSI)

-

Telecommunications

-

IT and ITeS

-

Government and Public Sector

-

Retail and Consumer Goods

-

Manufacturing

-

Energy and Utilities

-

Media and Entertainment

-

Healthcare and Life Sciences

-

Others

Based on application, the back and disaster recovery solutions are widely used in industries Banking, Financial Services, and Insurance (BFSI), Telecommunications, IT and ITeS, Government and Public Sector, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Media and Entertainment and Healthcare and Life Sciences among others. The BFSI sector dominated the market share. As financial institutions such as commercial banks and credit unions establish their credentials on their ability to offer constant and continuous service to their clients, the BFSI industry is widely and rapidly embracing backup and disaster recovery solutions. Any system outage might harm these companies' reputations and lead to losses of clients. Critical industries, such as banking, are likely to progressively use cloud-based services and solutions as data, applications, and systems might be recovered instantly in case of any disruptions. Most cloud recovery and backup suppliers that cater to financial institutions evaluate and enhance their infrastructure to verify that compliance, auditing, and financial sector standards are fulfilled. Smaller institutions that cannot devote staff time to meeting compliance standards would benefit from these regulatory changes. Both commercial and governmental businesses are increasingly focusing on deploying the newer technologies to avoid cyber threats to safeguard their IT processes and systems, secure consumer-sensitive data, and comply with regulatory requirements. Financial firms are also being driven to take a proactive approach to security as a result of rising consumer expectations, technical capabilities, and regulatory constraints which are subsequently influencing the backup and disaster recovery market positively.

BACKUP AND DISASTER RECOVERY MARKET– BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

Based on region, the backup and disaster recovery market are grouped into North America, Europe, Asia Pacific, Latin America, The Middle East, and Africa. Because of the presence of internationally leading businesses and major players in the area, North America is projected to occupy a considerable proportion of the backup and disaster recovery market. The high need for data security and data recovery solutions for securing vital and private information is a major driver propelling market expansion in North America. Furthermore, the proliferation of small enterprises and start-up organizations is expected to fuel the expansion of the backup and disaster recovery industry. The growing number of cyber-attacks and security breaches across the area is driving demand for cloud-based security solutions. The growth of e-commerce platforms is also boosting the market in US and Canada.

The European market is also projected to grow significantly owing to factors such as increasing investment related to data security projects. Europe is also projected to see significant market expansion in the next years as a result of stringent data privacy and security rules. The European General Data Protection Regulation (GDPR) requires businesses to use a variety of safeguards to protect their sensitive data against cyberattacks and natural catastrophes.

The Asia-Pacific region is projected to emerge as the most promising market for backup and disaster recovery services. The major aspect driving considerable market expansion throughout Asian countries is rapidly increasing IT infrastructure. Government data protection legislation is also anticipated to encourage the adoption of backup and disaster recovery services in China, Japan, and India. Natural catastrophes, which occur regularly in some Asian countries such as Japan and India, are also expected to spur widespread usage of services. As a result, the Asia-Pacific backup and disaster recovery services market is expected to increase significantly in the coming years.

BACKUP AND DISASTER RECOVERY MARKET– BY COMPANIES:

Some of the major key players in the backup and disaster recovery market are

-

Sungard Availability Services

-

InterVision

-

AWS

-

TierPoint

-

Infrascale

-

Acronis Axcient

-

BIOS Middle East

-

C&W Communications

-

Carbonite

-

Daisy

-

Databarracks

-

Datto

-

Evolve IP

-

Expedient

-

Flexential

-

Geminare

-

NTT

-

Quorum

-

SorageCraft

-

Unitrends

-

RackWare

-

Druva

-

Optum

-

DARZ Zettagrid

-

PhoenixNAP

There are numerous prominent companies in the backup and disaster recovery sector, which is somewhat competitive. Few companies presently dominate the industry in terms of market share. Companies are extending their market presence by gaining new deals and reaching newer markets due to developments in data storage and security technologies.

NOTABLE HAPPENING IN BACKUP AND DISASTER RECOVERY MARKET:

-

ACQUISITION- In July 2021, in a transaction estimated at USD 374 million, Hewlett Packard Enterprise agreed to buy Zerto, a leading cloud data management, and protection company.

-

PRODUCT LAUNCH- In May 2021, At KubeCon + CloudNativeCon Europe 2021, Wanclouds, a multi-cloud SaaS and managed service provider, unveiled its Multi-Cloud Disaster Recovery as a Service. As extreme weather and cybercrime threats increasingly threaten business operations, the company's backup and disaster recovery solution minimizes the financial investment and technological challenges that typically prevent or delay enterprises from putting up disaster recovery defenses

-

PRODUCT LAUNCH- in October 2020, Sungard Availability Services (Sungard AS), one of North America's and Europe's leading suppliers of highly available, cloud-connected infrastructure, introduced a new Private Cloud solution as the centerpiece of its end-to-end Connected Cloud platform. As businesses look for ways to accelerate digitalization across their processes, Sungard AS Private Cloud provides a solution designed to evolve with them at the pace they ought to develop, with flexibility minimal commitment, and on-demand scalability.

Chapter 1. Backup and Disaster Recovery Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Backup and Disaster Recovery Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Backup and Disaster Recovery Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Backup and Disaster Recovery Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Backup and Disaster Recovery Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Backup and Disaster Recovery Market – By Service Type

6.1. Real-time Replication

6.2. Backup and Restore

6.3. Data Protection

Chapter 7. Backup and Disaster Recovery Market – By Deployment Type

7.1. Public Cloud

7.2. Private Cloud

Chapter 8. Backup and Disaster Recovery Market – By Organisation Size

8.1. Small and Medium-sized Enterprises (SMEs)

8.2. Large Enterprises

Chapter 9. Backup and Disaster Recovery Market – By End-User

9.1. Banking, Financial Services, and Insurance (BFSI)

9.2. Telecommunications

9.3. IT and ITeS

9.4. Government and Public Sector

9.5. Retail and Consumer Goods

9.6. Manufacturing

9.7. Energy and Utilities

9.8. Media and Entertainment

9.9. Healthcare and Life Sciences

9.10. Others

Chapter10. Backup and Disaster Recovery Market- By Region

10.1. North America

10.2. Europe

10.3. Asia-Pacific

10.4. Latin America

10.5. The Middle East

10.6. Africa

Chapter 11. Backup and Disaster Recovery Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1 Microsoft

11.2 IBM

11.3 VMware

11.4 iland

11.5 Recovery Point

11.6 Sungard Availability Services

11.7 InterVision

11.8 AWS

11.9 TierPoint

11.10 Infrascale

11.11 Acronis Axcient

11.12 BIOS Middle East

11.13 C&W Communications

11.14 Carbonite

11.15 Daisy

11.16 Databarracks

11.17 Datto

11.18 Evolve IP

11.19 Expedient

11.20 Flexential

11.21 Geminare

11.22 NTT

11.23 Quorum

11.24 SorageCraft

11.25 Unitrends

11.26 RackWare

11.27 Druva

11.28 Optum

11.29 DARZ Zettagrid

11.30 PhoenixNAP

Download Sample

Choose License Type

2500

4250

5250

6900