Digital Therapeutics Market Size (2024 – 2030)

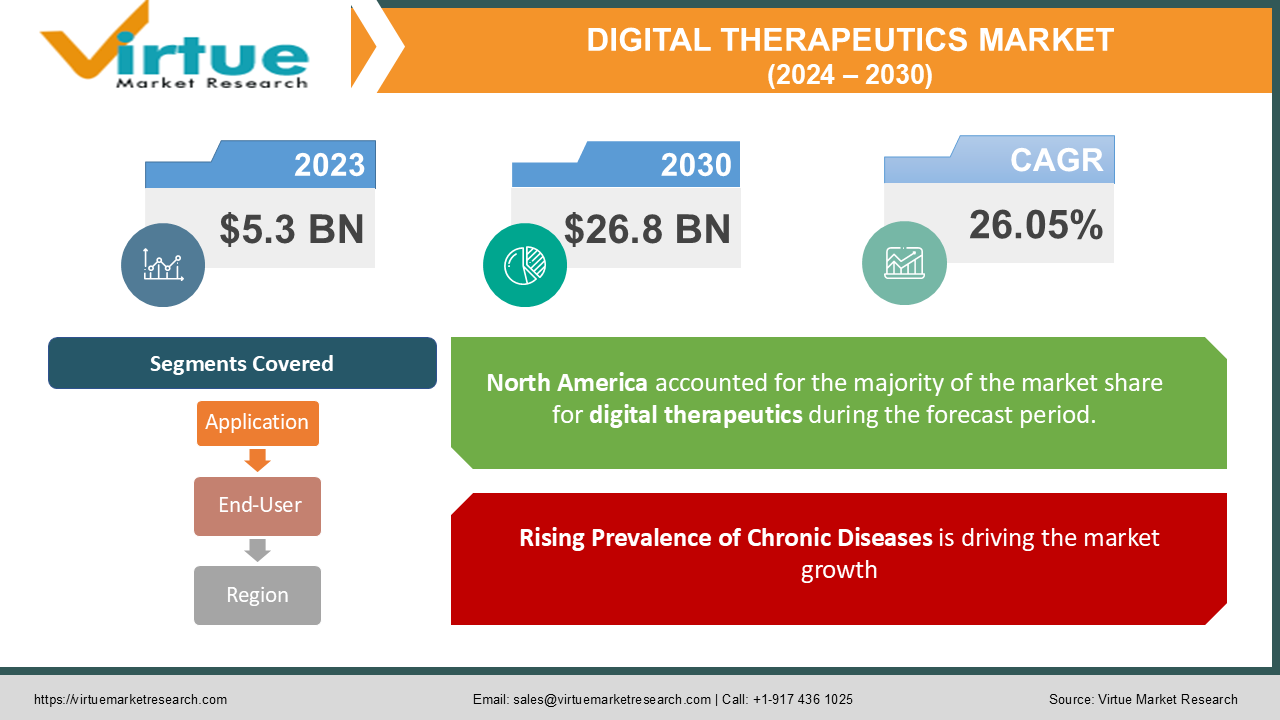

The Global Digital Therapeutics Market was valued at USD 5.3 billion in 2023 and is expected to grow at a remarkable CAGR of 26.05% from 2024 to 2030, reaching a market size of USD 26.8 billion by 2030.

Digital therapeutics are evidence-based therapeutic interventions delivered via software programs that help prevent, manage, or treat medical disorders or diseases. These therapies are often delivered through apps, wearable devices, or online platforms, targeting chronic conditions such as diabetes, obesity, mental health issues, and cardiovascular diseases. The market is experiencing rapid growth due to advancements in technology, increasing demand for remote healthcare solutions, and the growing burden of chronic diseases worldwide.

Key Market Insights:

The diabetes segment dominates the application market, accounting for over 30% of the market in 2023, driven by the increasing prevalence of type 2 diabetes globally and the demand for digital diabetes management tools.

The mental health application segment is also experiencing strong growth, driven by the rising demand for digital solutions to manage depression, anxiety, and other mental health disorders.

North America holds the largest market share, with over 40% in 2023, due to the presence of key digital therapeutic companies, advanced healthcare infrastructure, and strong regulatory support for digital health solutions.

The increasing adoption of digital therapeutics by healthcare providers, payers, and employers is driving market growth, with corporate wellness programs emerging as a key trend in the sector.

The rising prevalence of chronic diseases, especially in aging populations, is fueling demand for effective, scalable, and personalized digital health solutions.

Global Digital Therapeutics Market Drivers:

Rising Prevalence of Chronic Diseases is driving the market growth

The global rise in chronic diseases, particularly diabetes, cardiovascular diseases, obesity, and mental health conditions, is a significant driver of the digital therapeutics market. As populations age and lifestyles become more sedentary, the burden of chronic diseases has increased, creating a need for innovative, scalable solutions to manage and treat these conditions. Digital therapeutics offer patients accessible and personalized tools to monitor their health, adhere to treatment plans, and prevent disease progression. For example, digital solutions for diabetes management, such as apps that track blood glucose levels, diet, and physical activity, are gaining widespread adoption. These tools allow patients to manage their condition more effectively and help healthcare providers monitor patient progress in real time. In addition to diabetes, digital therapeutics are being used to manage cardiovascular diseases, hypertension, and mental health disorders, providing tailored interventions that improve health outcomes and reduce healthcare costs. As the global burden of chronic diseases continues to rise, the demand for digital therapeutics is expected to grow exponentially, driving market growth.

Technological Advancements in Healthcare are driving the market growth

Advancements in technology, particularly in artificial intelligence (AI), machine learning, and data analytics, are revolutionizing the digital therapeutics market. These technologies enable the development of highly personalized and adaptive therapeutic solutions that can monitor patient behavior, provide real-time feedback, and adjust treatment plans based on individual needs. AI-powered digital therapeutics can analyze vast amounts of patient data to identify patterns, predict disease progression, and recommend personalized interventions. For example, AI algorithms can be used to develop mental health apps that provide real-time cognitive behavioral therapy (CBT) interventions, or they can be applied to diabetes management platforms that offer personalized recommendations for insulin dosing. Machine learning models also improve over time as they analyze more data, making digital therapeutics increasingly effective at delivering long-term health benefits. Wearable devices and sensors also play a crucial role in the digital therapeutics ecosystem. These devices allow continuous monitoring of vital signs such as heart rate, blood pressure, and physical activity, providing valuable insights into patient health. The integration of wearable data with digital therapeutics platforms enhances the ability to track patient progress, detect early signs of deterioration, and provide timely interventions. These technological advancements are transforming the way chronic diseases are managed, making digital therapeutics a key component of modern healthcare.

Increasing Demand for Remote Healthcare Solutions is driving the market growth

The growing demand for remote healthcare solutions, accelerated by the COVID-19 pandemic, is another key driver of the digital therapeutics market. As healthcare systems around the world adapted to the challenges of the pandemic, the need for remote patient monitoring, virtual care, and telehealth solutions became paramount. Digital therapeutics offer a convenient and effective way to deliver care remotely, allowing patients to manage their conditions from the comfort of their homes.

Digital therapeutics are particularly beneficial for managing chronic diseases, where continuous monitoring and adherence to treatment plans are crucial for long-term success. By providing real-time feedback, reminders, and educational content, digital therapeutics help patients stay engaged with their treatment and improve outcomes. Remote healthcare solutions also reduce the burden on healthcare providers by enabling them to monitor patient progress without the need for in-person visits.

Moreover, the pandemic highlighted the importance of mental health, leading to increased demand for digital mental health solutions. Apps and platforms offering cognitive behavioral therapy (CBT), mindfulness training, and stress management tools have become essential for addressing the mental health challenges posed by isolation, anxiety, and stress. As remote healthcare becomes an integral part of healthcare delivery, the demand for digital therapeutics is expected to continue growing, driving market expansion.

Global Digital Therapeutics Market Challenges and Restraints:

Regulatory and Reimbursement Challenges are restricting the market growth

One of the major challenges facing the digital therapeutics market is the regulatory and reimbursement landscape. Unlike traditional pharmaceuticals or medical devices, digital therapeutics fall into a relatively new category of healthcare products, which has led to uncertainties in regulatory approval processes and reimbursement policies. While some countries, such as the U.S. and Germany, have made significant progress in establishing regulatory frameworks for digital therapeutics, others are still in the process of developing clear guidelines. In the U.S., the Food and Drug Administration (FDA) has implemented the Digital Health Innovation Action Plan, which provides a regulatory framework for digital therapeutics. However, obtaining FDA approval can be a lengthy and costly process, which may discourage smaller companies from entering the market. In Europe, the European Medicines Agency (EMA) and national regulatory bodies are working to establish consistent guidelines, but the regulatory landscape remains fragmented.

Data Privacy and Security Concerns is restricting the market growth

As digital therapeutics rely heavily on the collection and analysis of patient data, concerns about data privacy and security are significant challenges for the market. Digital therapeutics platforms often collect sensitive health information, including medical histories, treatment plans, and real-time health data from wearable devices. Ensuring the privacy and security of this data is critical to maintaining patient trust and complying with regulatory requirements. Data breaches, cyberattacks, and unauthorized access to patient data can have serious consequences for both patients and companies. In recent years, healthcare organizations have been targeted by cyberattacks, highlighting the vulnerability of digital health platforms to security threats. To address these concerns, digital therapeutics companies must invest in robust cybersecurity measures, including encryption, secure data storage, and compliance with data protection regulations such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the U.S.

Market Opportunities:

The digital therapeutics market presents significant opportunities for growth, driven by several key trends and developments. One of the most promising opportunities is the integration of digital therapeutics into healthcare systems as part of a broader shift toward value-based care. Value-based care focuses on improving patient outcomes and reducing healthcare costs by promoting prevention, early intervention, and personalized treatment. Digital therapeutics are well-suited to support these goals, as they offer scalable, cost-effective solutions for managing chronic diseases and improving patient adherence to treatment plans. By providing real-time feedback, monitoring, and personalized interventions, digital therapeutics can help prevent disease progression, reduce hospitalizations, and improve overall health outcomes. As healthcare systems around the world continue to shift toward value-based care, digital therapeutics are expected to play a central role in delivering high-quality, cost-effective care. Another key opportunity lies in the expansion of digital therapeutics for mental health applications. Mental health disorders, including depression, anxiety, and stress-related conditions, are increasingly recognized as significant public health challenges. The COVID-19 pandemic has further exacerbated the demand for mental health services, as individuals faced increased stress, isolation, and anxiety during lockdowns. Digital therapeutics offer a convenient and accessible way to deliver mental health interventions, including cognitive behavioral therapy (CBT), mindfulness training, and stress management tools. The mental health segment of the digital therapeutics market is expected to grow rapidly as more patients and healthcare providers turn to digital solutions to address mental health needs. Additionally, the growing adoption of digital therapeutics by employers and payers presents a significant opportunity for market growth. Many employers are integrating digital therapeutics into their corporate wellness programs to promote employee health and reduce healthcare costs. By offering digital therapeutics for chronic disease management, mental health support, and preventive care, employers can improve employee well-being, reduce absenteeism, and lower healthcare expenditures. Payers, including insurance companies and government healthcare programs, are also recognizing the value of digital therapeutics in improving health outcomes and reducing costs. As more payers integrate digital therapeutics into their coverage plans, the market is expected to expand, making these therapies more accessible to a broader population.

DIGITAL THERAPEUTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

26.05% |

|

Segments Covered |

By Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Omada Health, Pear Therapeutics, Livongo Health, Propeller Health, Akili Interactive Labs, Biofourmis, Happify Health, Kaia Health, Click Therapeutics, Noom |

Digital Therapeutics Market Segmentation: By Application

-

Diabetes

-

Obesity

-

Cardiovascular Diseases

-

Respiratory Diseases

-

Mental Health

The diabetes segment is the dominant application in the digital therapeutics market, accounting for over 30% of the market share in 2023. Digital therapeutics for diabetes management, including apps and platforms that monitor blood glucose levels, diet, and physical activity, are widely used to improve patient outcomes and prevent complications. With the increasing prevalence of type 2 diabetes globally, the demand for digital solutions that support diabetes self-management is expected to continue growing, driving further expansion of this segment.

Digital Therapeutics Market Segmentation: By End-User

-

Patients

-

Providers

-

Payers

The patients segment is the largest end-user segment, accounting for over 45% of the market in 2023. Patients are increasingly adopting digital therapeutics to manage chronic conditions, improve adherence to treatment plans, and access personalized health interventions. The convenience and accessibility of digital therapeutics, combined with their ability to provide real-time feedback and support, make them highly appealing to patients, particularly those managing chronic diseases.

Digital Therapeutics Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is the dominant region in the global digital therapeutics market, accounting for over 40% of the market share in 2023. The U.S. leads the region, driven by strong regulatory support for digital health solutions, the presence of key market players, and a robust healthcare infrastructure. The growing adoption of digital therapeutics by healthcare providers, employers, and insurers in the U.S. has fueled market growth, and this trend is expected to continue over the forecast period.

COVID-19 Impact Analysis on the Global Digital Therapeutics Market:

The COVID-19 pandemic has had a profound impact on the global digital therapeutics market, accelerating the adoption of remote healthcare solutions and highlighting the importance of digital health tools in managing chronic diseases. During the pandemic, healthcare systems worldwide faced significant challenges, including overwhelmed hospitals, delayed non-urgent medical procedures, and limited access to in-person care. As a result, the demand for digital health solutions, including digital therapeutics, surged. Digital therapeutics played a critical role in helping patients manage chronic conditions remotely during the pandemic. Patients with diabetes, cardiovascular diseases, and mental health disorders were able to use digital therapeutics to monitor their health, receive personalized treatment plans, and access real-time support from healthcare providers. This shift toward remote care not only helped alleviate the burden on healthcare systems but also demonstrated the effectiveness of digital therapeutics in improving patient outcomes. The pandemic also highlighted the growing importance of mental health, with digital therapeutics for mental health disorders experiencing increased demand. Lockdowns, social isolation, and anxiety about the pandemic contributed to a rise in mental health issues, leading to a surge in the use of digital mental health apps and platforms. These tools provided patients with access to cognitive behavioral therapy (CBT), mindfulness training, and stress management resources, helping them cope with the psychological effects of the pandemic. In the post-pandemic era, the adoption of digital therapeutics is expected to continue growing as healthcare systems embrace telehealth and remote care solutions. The pandemic has accelerated the integration of digital therapeutics into mainstream healthcare, and this trend is likely to persist in the long term.

Latest Trends/Developments:

Several key trends are shaping the future of the digital therapeutics market. One of the most significant trends is the increasing use of artificial intelligence (AI) and machine learning to enhance the capabilities of digital therapeutics. AI-powered digital therapeutics can analyze vast amounts of patient data to provide personalized treatment plans, predict disease progression, and offer real-time feedback. This technology is transforming the way chronic diseases are managed, making digital therapeutics more effective and personalized.

Another key trend is the rise of wearable devices and sensors that integrate with digital therapeutics platforms. These devices provide continuous monitoring of vital signs, such as heart rate, blood pressure, and physical activity, offering valuable insights into patient health. The integration of wearable data with digital therapeutics enhances the ability to track patient progress and deliver timely interventions. The mental health segment of the digital therapeutics market is also experiencing rapid growth, driven by increased awareness of mental health issues and the rising demand for digital solutions to manage conditions such as depression, anxiety, and stress. Mental health apps and platforms offering cognitive behavioral therapy (CBT) and mindfulness training are becoming increasingly popular, particularly in the wake of the COVID-19 pandemic.

Finally, the growing adoption of digital therapeutics by employers and payers is shaping the future of the market. Employers are integrating digital therapeutics into corporate wellness programs to promote employee health and reduce healthcare costs, while payers are recognizing the value of these solutions in improving patient outcomes and reducing hospitalizations.

Key Players:

-

Omada Health

-

Pear Therapeutics

-

Livongo Health

-

Propeller Health

-

Akili Interactive Labs

-

Biofourmis

-

Happify Health

-

Kaia Health

-

Click Therapeutics

-

Noom

Chapter 1. Digital Therapeutics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Therapeutics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Therapeutics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Therapeutics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Therapeutics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Therapeutics Market – By End-User

6.1 Introduction/Key Findings

6.2 Patients

6.3 Providers

6.4 Payers

6.5 Y-O-Y Growth trend Analysis By End-User

6.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 7. Digital Therapeutics Market – By Application

7.1 Introduction/Key Findings

7.2 Diabetes

7.3 Obesity

7.4 Cardiovascular Diseases

7.5 Respiratory Diseases

7.6 Mental Health

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Digital Therapeutics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-User

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-User

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-User

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-User

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-User

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Digital Therapeutics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Omada Health

9.2 Pear Therapeutics

9.3 Livongo Health

9.4 Propeller Health

9.5 Akili Interactive Labs

9.6 Biofourmis

9.7 Happify Health

9.8 Kaia Health

9.9 Click Therapeutics

9.10 Noom

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Digital Therapeutics Market was valued at USD 5.3 billion in 2023 and is expected to reach USD 26.8 billion by 2030, growing at a CAGR of 26.05%.

The key drivers include the rising prevalence of chronic diseases, technological advancements in healthcare, and increasing demand for remote healthcare solutions.

The market is segmented by application (diabetes, obesity, cardiovascular diseases, respiratory diseases, mental health) and by end-users (patients, providers, payers).

North America is the dominant region, accounting for over 40% of the market share in 2023, driven by strong regulatory support and the presence of key market players.

Leading players include Omada Health, Pear Therapeutics, Livongo Health, Propeller Health, and Akili Interactive Labs.