Diabetes Digital Therapeutics Market Size (2024 – 2030)

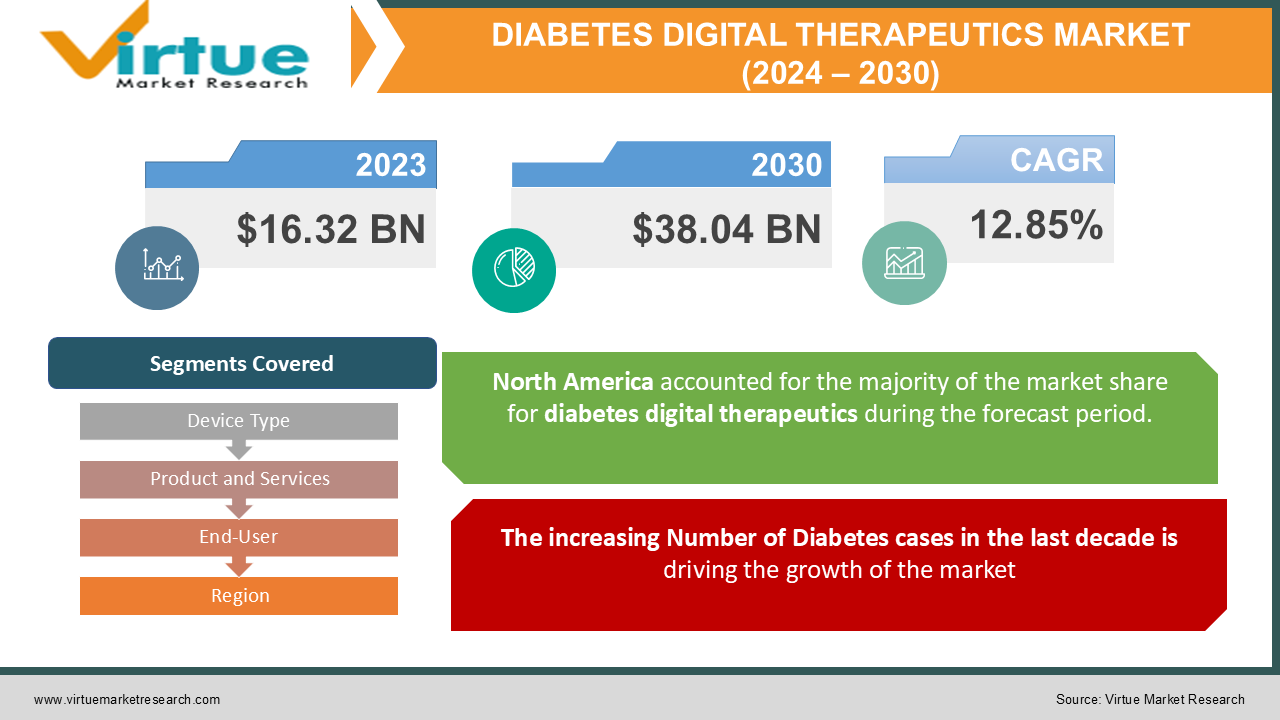

As per our research report, the Global Diabetes Digital Therapeutics Market was valued at USD 16.32 Billion and is projected to reach a market size of USD 38.04 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.85%. The rising prevalence of diabetes has increased the focus on the development and adoption of better solutions for diabetes care. Also, advancements in technologies The increasing adoption of cloud-based enterprise solutions, and the growing use of connected devices and apps are majorly driving the growth of the industry.

Industry Overview:

Digital Therapeutic (DTx) providers provide patients with evidence-based therapeutic interventions driven by high-quality software programs to prevent, manage, or treat medical disorders or illnesses. Diabetes DTx providers offer digital diabetes prevention programs along with tools for managing chronic diabetes.

Diabetes is reaching an epidemic rate, and digital health companies are fighting back with innovative solutions. About 1 in 11 adults worldwide has diabetes, accounting for 425 million people worldwide. With the increasing number of cases of diabetes, the digital diabetes market is also growing. In recent years, the market for digital diabetes treatment has grown significantly. If these trends continue, by 2045, 693 million people in 1899 or 629 million people in 2079 will have diabetes. Globally, diabetes brings the USD 727 billion to medical costs, which is equivalent to one in $ 8 of medical costs.

Therefore, as the number of diabetics around the world grows and the demand for better ways to treat illness increases, the acceptance of patients with innovative diabetes devices, software, and apps will be promoted over the next few years.This is expected to drive the growth of the digital diabetes market. Digital diabetes management systems help patients improve self-management and control their condition. Lowering and keeping blood sugar low is one of the major challenges in the treatment of diabetes and increases the acceptance of these systems. Digital engagement can play an important role in providing adequate care for patients with type 1 and type 2 diabetes. Digital diabetes devices consist of diabetes monitoring hardware, mobile software, and big data cloud computing infrastructure. Smart Glucose Monitor refers to a wireless glucose meter that helps you measure your blood glucose data and provide it to your iOS or Android mobile device.

MARKET DRIVERS:

The increasing Number of Diabetes cases in the last decade is driving the growth of the market

Diabetes is expected to be the seventh leading cause of death by 2030, according to the WHO. The main risk factors for diabetes include stress, lack of exercise, an unhealthy diet, and obesity. Age-related physiological changes also have a significant impact on the risk of diabetes. For example, according to the International Diabetes Federation, the prevalence of diabetes increases with age. Therefore, the highest estimated prevalence is in people over the age of 65. Therefore, the growing elderly population, coupled with increased population exposure to key risk factors, is expected to drive demand for digital diabetes management solutions in key markets.

Technological Advancements in the Mobile software are also driving the growth of the Market

Over the past decade, the medical device industry has seen significant technological advancements in diabetes care, including the emergence of sensor-based CGM technology, device management implantable digital diabetes, closed-loop systems, and wearable smartphone-based diabetes management devices. Advanced technology systems have improved diabetes management and achieved tight control while providing a more flexible diet and schedule for patients, children, and their families. surname. Several digital diabetes management solutions are now available that rival their conventional solutions, such as prefilled syringes, blood glucose analogs, test strips, and insulin pumps. Combined and integrated approaches to diabetes monitoring and management are increasingly common, in addition to device-independent approaches. These devices can not only provide remote monitoring, but also help deliver targeted, modular, and persistently connected care. In addition, smart contact lenses with integrated biosensors and drug delivery materials are being studied for use in CGM, as well as in the treatment of diabetic retinopathy.

MARKET RESTRAINTS:

Lack of Knowledge of Devices and High cost of applications is restraining the growth of the market

Self-monitoring digital blood glucose meters cost around $15-20. Due to the high initial cost and frequent use of accompanying consumables (requiring multiple purchases), this prevents a large portion of end-users from accessing advanced devices, especially people in developing countries with adverse return situations.

In developed countries, most commercial health plans cover the cost of devices that are marketed; In developing countries, disparities in reimbursement policies lead to non-compliance with treatment. Diabetics have to bear the full cost of their glucose meters, insulin, integrated CGM systems, and maintenance in China and India. The high costs and lack of reimbursement in developing countries are therefore expected to limit the adoption of digital diabetes management solutions in the coming years.

Diabetes Digital Therapeutics Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

12.85% |

|

Segments Covered |

By Device Type, Product and Services, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Companies like Medtronic (Ireland), B. Braun Melsungen AG (Germany), Dexcom, Inc. (US), Abbott Laboratories (US), F. Hoffmann-La Roche (Switzerland), Insulet Corporation (US), Tandem Diabetes Care (US), Ascensia Diabetes Care Holdings AG (Switzerland), LifeScan, Inc. (US), Tidepool (US), AgaMatrix (US), Glooko, Inc. (the US), DarioHealth Corporation (Israel), One Drop (US), Dottli (Finland), Ypsomed Holding AG (Switzerland), ARKRAY (Japan), ACON Laboratories, Inc. (US), Care Innovations, LLC (US), Health2Sync (Taiwan), Emperra GmbH E-Health Technologies (Germany), Azumio (US), Decide Clinical Software GmbH (Austria), Pendiq GmbH (Germany), and BeatO (India) are playing a pivotal role in the market. |

This research report on the Diabetes Digital Therapeutics Market has been segmented and sub-segmented based on Device type, products and services, end-user, and region.

Diabetes Digital Therapeutics Market - By Device Type:

- Handheld Devices

- Wearable Devices

Based on the Device Type, The digital diabetes management device market is segmented into wearable and wearable devices. Wearable devices hold the largest market share with 60.3% of the digital diabetes management device market in 2021. These devices include CGM systems, smart insulin pumps, and smart insulin patches bright. Raise awareness about blood glucose monitoring; there is increasing regulatory approval for CGM systems; Technological advancements such as closed-loop pumping systems, smart insulin patches, and other tubing devices are some of the key factors driving the demand for wearables for diabetes management. In addition, connected devices provide instant access to blood glucose readings at regular intervals, allow dose management and logging, and allow patients to upload data online at home.

Diabetes Digital Therapeutics Market – By Product and Services:

- Devices

- Applications

- Data Management Software and platforms

- Services

Based on Product And Services, “The continuous glucose monitoring (CGM) systems segment is expected to grow at the highest CAGR over the forecast period.”

The different products and services considered in the digital diabetes management market are devices, applications, software, and data management platforms, and services. The Devices segment includes smart blood glucose meters, continuous blood glucose monitoring (CGM) systems, smart insulin pens, smart insulin pumps/closed-loop systems, and smart insulin patches. Likewise, the app segment is further categorized into diabetes and blood glucose monitoring apps and obesity and diet management apps. The Continuous Glucose Monitoring Systems market is expected to grow at the highest CAGR during the forecast period. This is mainly because these systems are minimally invasive compared to conventional blood glucose meters.

Diabetes Digital Therapeutics Market - By End-User:

- Self/Home Healthcare

- Hospitals And Speciality Diabetes Clinics

- Academic And research institutes

Based on End-User, The primary end-users of the digital diabetes management market are self-help/home healthcare, diabetes hospitals and clinics, and research and academic institutions. The home healthcare segment is expected to grow at a peak CAGR of 13.2% during the forecast period. Technological advancements in digital diabetes management systems and personal and home care platforms have made them more accurate, minimally invasive, and easy to use. The advent of CGM systems, insulin pump therapy, applications, and services has increased the demand for non-invasive or minimally invasive systems in-home care.

Diabetes Digital Therapeutics Market - By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East

- Africa

Geographically, North America holds the largest market share with 41.4%, followed by Europe with 29.0%. In addition, the United States holds the largest share with 91.8% of the North American digital diabetes management market in 2021. This is attributed to the increasing prevalence of diabetes, technological advancements technology in digital diabetes management solutions, increasing number of smartphone users in the country, high penetration of digital platforms, increasing adoption of enterprise solutions based on the cloud for diabetes management, increasingly using connected devices and apps for diabetes management, and increasingly focused on improving the quality of patient care.

Asia-Pacific is expected to record the fastest growth during the forecast period. Several factors, such as the high prevalence of diabetes, rising healthcare spending, and the growing focus of key players in this region are expected to drive growth. of this market. Rising disposable income and growing awareness about diabetes and related diseases are expected to drive the growth of this regional segment. Favorable reimbursement policies and government initiatives in the field of digital health are expected to create market opportunities. Europe is expected to witness significant growth during the forecast period due to the emergence of startups in the region. With the increasing prevalence of diabetes in emerging countries like India and China, it is expected to boost the market opportunity in Asia-Pacific.

Diabetes Digital Therapeutics Market Share by company

- Medtronic (Ireland)

- B. Braun Melsungen AG (Germany)

- Dexcom, Inc. (US)

- Abbott Laboratories (US)

- F. Hoffmann-La Roche (Switzerland)

- Insulet Corporation (US)

- Tandem Diabetes Care (US)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- LifeScan, Inc. (US)

- Tidepool (US)

- AgaMatrix (US)

- Glooko, Inc. (US)

- DarioHealth Corporation (Israel)

- One Drop (US)

- Dottli (Finland)

- Ypsomed Holding AG (Switzerland)

- ARKRAY (Japan)

- ACON Laboratories, Inc. (US)

- Care Innovations, LLC (US)

- Health2Sync (Taiwan)

- Emperra GmbH E-Health Technologies (Germany)

- Azumio (US)

- Decide Clinical Software GmbH (Austria)

- Pendiq GmbH (Germany)

- BeatO (India)

Recently Glooko's universal diabetes software products provide insights to improve outcomes for people with diabetes and their care teams. Glooko's system synchronizes data from over 190 diabetes devices and activity monitors and provides integrated, timely, and useful patient data, including blood glucose levels, blood pressure, weight, food, insulin, and medication.

One Drop is a consumer digital health company developed One Drop.

Omada Health is a digital behavioral medicine company that helps people change habits that put them at risk for serious but largely preventable chronic diseases like heart disease and type 2 diabetes. The company provides behavioral counseling services to anyone with an Internet connection, using information from social networks, gaming and behavioral science, and more.

Suppliers invest in research and development to develop technologically advanced systems that give them a competitive advantage over other providers and provide an economic benefit to the industry. The industry is expected to see several mergers and acquisitions over the next few years. Companies are taking proactive steps to gain market share and provide a diversified product portfolio.

NOTABLE HAPPENINGS IN THE DIABETES DIGITAL THERAPEUTICS MARKET IN THE RECENT PAST:

- Product Launch - In April 2022 Dexcom launched Dexcom ONE device. The company launched the new Dexcom ONE Continuous Glucose Monitoring System in the UK.

- Collaboration - In April 2020, DreaMed Diabetes Ltd and DexCom Inc., signed a partnership agreement to transfer DexCom's continuous glucose monitoring (CGM) into DreaMed's advisor. This platform will assist healthcare professionals to optimize patient-specific therapy.

- Product Launch - In early 2020, Roche Diagnostics (Switzerland) launched a remote patient monitoring solution, which is a new element of the RocheDiabetes Care Platform and uses its pattern detection feature.

COVD-19 impact on Diabetes Digital Therapeutics Market

In an optimistic scenario, the COVID 19 pandemic is expected to have a long-term positive impact on the entire digital diabetes management market. The digital diabetes management market was initially adversely affected by the COVID 19 pandemic. This is because, in many parts of the world, blockades and quarantine restrictions closed most hospitals, specialized diabetes clinics, and academic research institutes in early 2020. This has postponed all non-required procedures. During this period, the number of outpatients decreased sigificantly. After the blockade and quarantine measures have been lifted in most parts of the world, most people are hesitant to engage in close contact treatment, resulting in less patient flow. However, in most regions, especially North America and Europe, recovery is seen as services return to normal. The Asia Pacific market is slowly recovering, especially in China and India. However, there are still drivers that have driven the digital diabetes market, such as increased digitalization and expansion of healthcare infrastructure. This has the potential to boost market growth from 2021 to 2022. In optimistic scenarios, the need for smoother workflows and faster turnaround times can drive market growth. In a pessimistic scenario, the economic impact of the COVID 19 pandemic on the market could hinder the adoption of digital diabetes management due to the high cost of capital and operating costs. However, this is unlikely, as market recovery is already seen in most regions.

In a realistic scenario, the long-term impact of the COVID 19 pandemic on the digital diabetes management market is neutral and is expected to grow slowly from Q3 2020 and return to pre-COVID conditions from Q1 2021.

Chapter 1. DIABETES DIGITAL THERAPEUTICS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DIABETES DIGITAL THERAPEUTICS MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. DIABETES DIGITAL THERAPEUTICS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. DIABETES DIGITAL THERAPEUTICS MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.DIABETES DIGITAL THERAPEUTICS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DIABETES DIGITAL THERAPEUTICS MARKET – By Device Type

6.1. Handheld Devices

6.2. Wearable Devices

Chapter 7. DIABETES DIGITAL THERAPEUTICS MARKET – By Product and Services

7.1. Devices

7.2. Applications

7.3. Data Management Software and platforms

7.4. Services

Chapter 8. DIABETES DIGITAL THERAPEUTICS MARKET – By End-User:

8.1. Self/Home Healthcare

8.2. Hospitals And Speciality Diabetes Clinics

8.3. Academic And research institutes

Chapter 9. DIABETES DIGITAL THERAPEUTICS MARKET – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. DIABETES DIGITAL THERAPEUTICS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Medtronic (Ireland)

10.2. B. Braun Melsungen AG (Germany)

10.3. Dexcom, Inc. (US)

10.4. Abbott Laboratories (US)

10.5. F. Hoffmann-La Roche (Switzerland),

10.6. Insulet Corporation (US)

10.7. Tandem Diabetes Care (US),

10.8. Ascensia Diabetes Care Holdings AG (Switzerland)

10.9. LifeScan, Inc. (US)

10.10. Tidepool (US)

10.11. AgaMatrix (US)

10.12. Glooko, Inc. (the US)

10.13. DarioHealth Corporation (Israel)

10.14. One Drop (US)

10.15. Dottli (Finland)

10.16. ARKRAY (Japan)

10.17. Ypsomed Holding AG (Switzerland)

10.18. ACON Laboratories

10.19. Inc. (US)

10.20. Care Innovations, LLC (US)

10.21. Health2Sync (Taiwan)

10.22. Emperra GmbH E-Health Technologies (Germany)

10.23. Azumio (US)

10.24. Decide Clinical Software GmbH (Austria)

10.25. Pendiq GmbH (Germany)

10.26. BeatO (India)

Download Sample

Choose License Type

2500

4250

5250

6900