Digital Freight Forwarding Market Size (2025 – 2030)

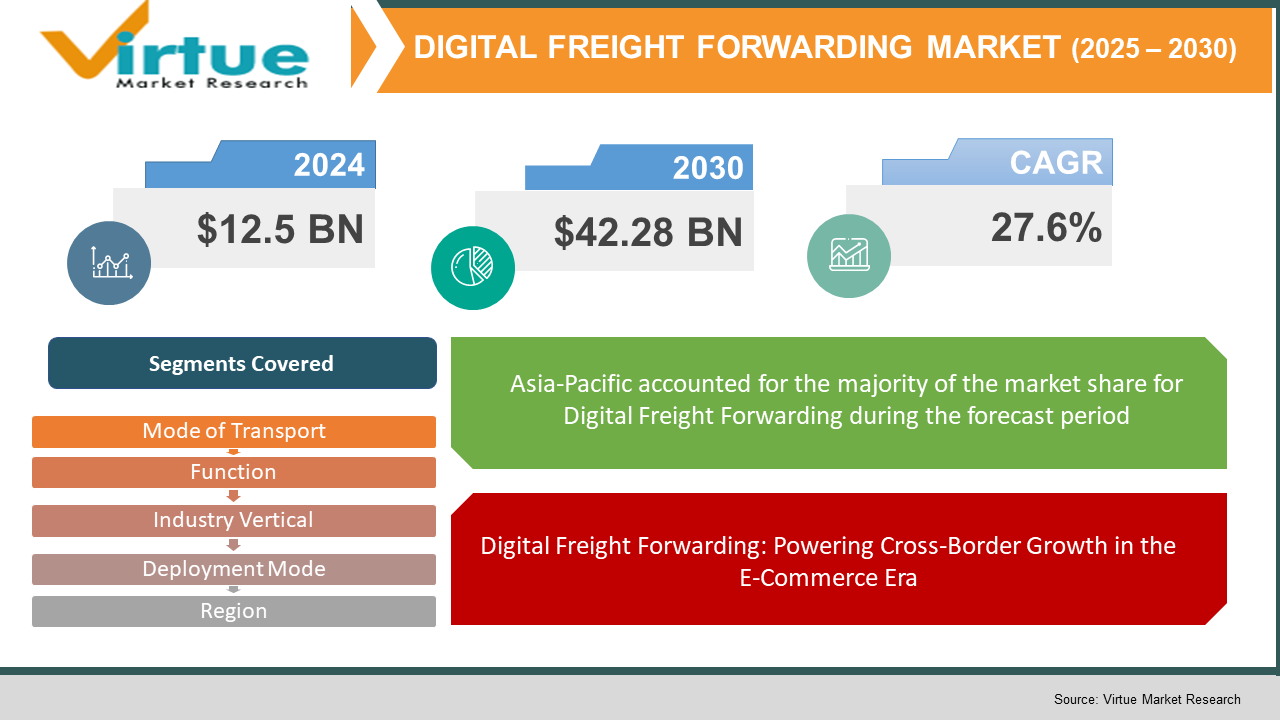

The Digital Freight Forwarding Market was valued at USD 12.5 billion and is projected to reach a market size of USD 42.28 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 27.6%.

Digital freight forwarders rely on sophisticated digital technology to simplify communication between parties, offer quick shipment status updates, and provide a completely open system for comparing costs at several shippers to secure the best deals for customers. By going digital with documentation—creating, uploading, and distributing all required paperwork—they eliminate administrative hurdles and maximize access for everyone involved. The boom of cross-border online shopping has grown dramatically the application of these solutions, with corporations calling for prompter, cleaner, and better freight services. Digital freight platforms allow for instant tracking, autonomous documentation, as well as advanced supply chain traceability, redressing inefficiency in global commerce. As estimated e-commerce spending globally is due to hit a record USD 6.3 trillion in 2024, demand for clever logistics solutions cannot be more exigent. Despite the challenges, market growth is limited by issues such as underdeveloped infrastructure in developing markets, expensive logistics, and strict air freight regulations. Compliance with international trade regulations and customs further increases complexity, mostly leading to delays and higher operating costs. As much as this has been an obstacle, there is huge market growth potential in the wake of direct-to-consumer (DTC) logistics. As businesses look for quicker and cheaper modes of transport, innovations such as multi-modal transport networks that combine land, sea, and air are lowering shipping costs and lead times. One such example is Maersk's launch in March 2025 of a digital freight forwarding platform driven by AI-optimized routes, which has enabled shippers to save up to 15%. The future of digital freight forwarding appears even more promising with the increasing incorporation of AI, blockchain, and IoT which will bring greater transparency, adaptability, and efficiency to global logistics processes.

Key Market Insights:

- Maersk- and IBM-designed blockchain supply chain platform TradeLens realized paperless export of freight from Rotterdam to Singapore in January 2024. Through blockchain and smart contracts, the platform autonomously executed customs clearance and payment settlement and saved 40% processing time, decreasing transaction fees. The feat underlined how blockchain reduces delay, increases transparency, and provides secure and tamper-evident documents in digital freight forwarding.

- The market is characterized by stunning figures, highlighting its growth and development. In 2024, global freight forwarding services will deal with about 100 million TEUs of containerized goods. The air freight segment will transport more than 75 million metric tons of goods. The overall revenue of the industry is anticipated to exceed $250 billion, and digital freight forwarding will account for nearly $50 billion. Sea freight remains the biggest, representing 60% of the market revenue, followed by air freight taking 25%, and road and rail combining for the remaining 15%.

- Freight forwarders control approximately 80% of international trade cargo. The use of blockchain technology for secure documentation is likely to increase by 30%. Electronic booking platforms currently account for 40% of freight forwarding transactions. The investment in green logistics programs by the market is expected to be more than $10 billion. More than 60% of freight forwarders provide end-to-end logistics services. The cold chain logistics sector is increasing at a rate of 12% due to pharmaceutical and perishable items demand. Small and medium enterprises (SMEs) make up 45% of the market's customers. Integrated logistics services are expected to have a 25% growth rate.

Digital Freight Forwarding Market Key Drivers:

Digital Freight Forwarding: Powering Cross-Border Growth in the E-Commerce Era

Cross-Border Growth and E-Commerce Expansion.

The fast expansion of e-commerce has greatly grown the need for effective logistics solutions. With the forecast of worldwide e-commerce revenues growing to USD 6.3 trillion by 2024, companies need dynamic and clear freight services to cater to the high volume of shipments. Electronic freight forwarding websites provide real-time visibility, quick quotes, and seamless documentation, which allow firms to effectively handle greater volumes.

Real-Time Visibility and Transparency.

Supply chains today require real-time visibility to provide on-time delivery and satisfaction to customers. Digital freight forwarders leverage technologies such as IoT and AI to enable real-time tracking, as well as predictive analytics to help companies track shipments and detect probable disruptions. This transparency strengthens decision-making and builds trust among stakeholders.

Technological Advancements Driving Operational Efficiency.

The adoption of new technologies like artificial intelligence, machine learning, and cloud computing has transformed freight forwarding activities. These technologies automate repetitive processes, optimize routes, and eliminate human errors, resulting in higher operational efficiency and cost reduction. For example, AI-based platforms can minimize empty truck miles by as much as 15%, making logistics more sustainable.

Digital Freight Forwarding Market Restraints and Challenges:

Overcoming the Obstacles in the Digital Freight Forwarding Marketplace.

The digital freight forwarding marketplace, though revolutionary, encounters numerous long-standing challenges that impede its smooth adoption and expansion. One of the most important barriers to entry is a dependency on legacy systems, which may not be compatible with contemporary digital alternatives, resulting in inefficiencies and integration challenges. Moreover, the absence of proper infrastructure, especially in developing economies, inhibits the adoption of digital technologies because of factors such as unstable internet connectivity and a lack of technological resources. Cyber threats are another key issue; as freight forwarders go digital, they become vulnerable to cyberattacks, threatening sensitive information breaches and business disruptions. In addition, the sector suffers from a lack of trained staff who are adept at using digital tools, so it is difficult to operate and maintain sophisticated systems efficiently. Compliance with intricate international regulations presents yet another level of complexity, since dealing with differing customs procedures and legal requirements can result in delays and added expense. Finally, the considerable up-front cost of digital transformation, such as the cost of new technology and training, is prohibitive to some, particularly small and medium-sized businesses. These issues combined highlight the importance of strategic investment and planning to truly achieve the full potential of digital freight forwarding.

Digital Freight Forwarding Market Opportunities:

Unlocking Growth and Emerging Opportunities in the Digital Freight Forwarding Market.

The digital freight forwarding market is set to experience substantial growth as a result of multiple emerging opportunities. The growth of e-commerce and direct-to-consumer (DTC) models has increased the need for effective, transparent, and nimble logistics offerings. Digital platforms providing real-time tracking, instant quotes, and simplified documentation are becoming more and more necessary to satisfy these needs. Technological advancements, especially in artificial intelligence (AI), machine learning, and the Internet of Things (IoT), are increasing operational effectiveness by streamlining routes and minimizing empty miles. For example, AI-powered platforms have recorded a decrease of 10–15% in empty truck miles, which results in cost savings and reduced emissions. Moreover, increasing focus on sustainability and supply chain robustness is forcing businesses to implement digital solutions to provide improved visibility and control. Fast-growing markets, including India, offer considerable growth opportunities, backed by government programs such as the "Digital India" initiative and higher usage of digital technologies in logistics. Strategic alliances and acquisitions, like Sennder's takeover of a U.S. competitor's European business to double its revenue, are also defining the market landscape. These events highlight the disruptive power of digital freight forwarding in improving global trade efficiency and resilience.

DIGITAL FREIGHT FORWARDING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

27.6% |

|

Segments Covered |

By Mode of transport, function, industry vertical, deployment mode, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Flexport, Uber Freight, DHL Global Forwarding, Kuehne + Nagel International AG Freightos, Forto GmbH, Twill (Maersk), iContainers, Zencargo, Cargofive |

Digital Freight Forwarding Market Segmentation:

Digital Freight Forwarding Market Segmentation: By Mode of Transport

- Sea Freight

- Air Freight

- Land Freight

Air freight is the most rapidly growing sector in the digital freight forwarding industry, driven by the explosion of global e-commerce and the need for quick delivery services. Shein and Temu have been among the leading companies that have greatly expanded their utilization of air cargo to speed up deliveries, resulting in a huge spike in air freight volumes. This expansion is complemented by the use of sophisticated digital solutions, such as AI-based route optimization and real-time tracking technologies, to increase operational efficiency and customer satisfaction. The use of electronic air waybills (e-AWB) and automated capacity management systems has simplified procedures, making air freight a top option for time-sensitive shipments. With consumer demand for quicker delivery increasing, the air freight sector is likely to continue its speedy growth path.Sea freight continues to be the leader in the digital freight forwarding industry, owing mainly to its affordability and ability to transport huge volumes of commodities. It commands a large percentage of global trade, with digital technology improving its efficiency and transparency. Blockchain adoption and digital platforms have enhanced end-to-end visibility, real-time tracking, automated documentation, facilitating container and port operations, and container management. Intelligent containers featuring Remote Container Management (RCM) systems cut costs by bringing end-to-end visibility and promoting reliability in supply chains. Global trade's continuing growth will only further reinforce the preeminence of sea freight, backed as it is by continuing digital transformations across the sea trade.

Digital Freight Forwarding Market Segmentation: By Function

- Transportation Management

- Warehouse Management

Transportation Management is the leading function in the digital freight forwarding industry. This segment involves the planning, execution, and optimization of freight movement to ensure timely and accurate delivery. The use of digital solutions like Transportation Management Systems (TMS) improves route optimization, load planning, and carrier management, which boosts the growth of this segment. The growing demand for effective and affordable transportation solutions has resulted in the extensive adoption of TMS, which provides real-time visibility and predictive analytics, thus enhancing supply chain visibility and lowering operational expenses. With global trade continuing to grow, the demand for strong transportation management solutions is likely to continue to be robust, cementing its top position in the market.

Warehouse Management is becoming the fastest-growing category in the digital freight forwarding industry. This activity entails the optimization of storage, movement, and handling of products in warehouse complexes. The incorporation of digital technologies in Warehouse Management Systems (WMS) has transformed inventory management, order fulfillment, and distribution operations. The growth of e-commerce and omnichannel retailing has accelerated the need for effective warehouse management solutions, propelling the use of digital technologies like WMS and automation solutions. These technologies allow real-time tracking of inventory, enhanced space utilization, and quicker order processing, which are essential in fulfilling the growing consumer demands for fast and precise deliveries. As companies seek to improve their logistics function, the warehouse management space is set to experience unprecedented growth in the years ahead.

Digital Freight Forwarding Market Segmentation: By Industry Vertical

- Automotive

- Retail & E-Commerce

- Manufacturing

- Healthcare

- Electronics

The Retail & E-Commerce industry is the quickest-growing vertical within the digital freight forwarding sector. Increased internet purchases have spurred a need for adaptable and expandable logistics arrangements. Digital freight forwarding platforms are also instrumental in optimizing inventory levels, order filling, and end-mile delivery to support retailers with shifting customer requirements for speedy and guaranteed deliveries. Convenience and availability of e-commerce websites have significantly influenced the industry's growth.

On the other hand, the Automotive industry controls the digital freight forwarding space. The auto industry depends significantly on effective logistics management to deal with intricate movements of components, parts, and autos within worldwide supply chains. Digital freight forwarding technology allows automotive manufacturers to maximize inventory levels, lower lead times, and improve supply chain visibility. Through the use of sophisticated tracking and tracing features, auto manufacturers can enhance inventory management, minimize stockouts, and optimize production processes, leading to operational excellence and customer satisfaction.

Digital Freight Forwarding Market Segmentation: By Deployment Mode

- Cloud-Based

- On-Premises

Cloud-based deployment is witnessing rapid growth in the digital freight forwarding market. Its flexibility, scalability, and cost savings make it a popular choice among businesses looking for effective logistics solutions. Cloud platforms allow access to real-time data, optimized processes, and better collaboration throughout global supply chains. The need for more transparency and agility in freight operations and the growth in e-commerce are driving the uptake of cloud-based solutions. Such platforms allow rapid deployment without any huge infrastructure investment at the initial stages, making them particularly popular with small and medium businesses seeking to streamline their logistics functions.

Cloud deployment is not only leading the way in growth but is also in the vanguard when it comes to the digital freight forwarding sector. Its adoption by companies stems from the requirement for convenient, real-time logistics management tools to sustain dynamic business ecosystems. Cloud solutions provide hassle-free integration with other digital applications, offering comprehensive visibility and control over freight operations. The dominance of cloud-based deployment depicts a larger industry trend toward digitalization, where agility, efficiency, and scalability are key. As companies continue to place high value on these qualities, cloud-based solutions will continue to lead the market.

Digital Freight Forwarding Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

The international digital freight forwarding market displays considerable regional divergence, with the Asia-Pacific region being the highest-growing region, which is driven by rapid growth in e-commerce, growing cross-border trade, and policies favorable to the sector by governments in nations such as China and India which account for a 25% market share. Growth is also catalyzed by the developing manufacturing sector in the region and the use of sophisticated digital technologies. On the other hand, North America has a commanding market share of 35% due to its established logistics network, high rates of digital adoption, and the presence of leading technology firms that drive innovation in freight services. Europe is next, with its strong industrial base and developed technological infrastructure and now has a market share of 30%. Other than this, other markets such as Latin America, and Middle East & Africa are slowly adopting digital freight solutions although with less speed due to infrastructural and regulatory issues with a 5% market share each.

COVID-19 Impact Analysis on the Digital Freight Forwarding Market:

The pandemic of COVID-19 critically disrupted the online freight forwarding business, revealing global supply chain weaknesses and hastening the digitalization of the industry. Lockdowns and quarantine measures resulted in massive port shutdowns, canceled flights, and a dramatic plunge in logistics operations, leading to major delays and supply-demand unbalances. Air freight capacity dropped by almost 50% with flights being grounded, leading to a modal shift to sea freight, which also experienced congestion and higher costs. These issues highlighted the need for real-time visibility and agile logistics solutions. Freight forwarders, therefore, quickly embraced digital technologies like cloud-based platforms, AI, and IoT to improve operational efficiency and resilience. These technologies facilitated contactless transactions, enhanced tracing, and streamlined communication, which were critical to riding out the pandemic disruption. The pandemic was a stimulus for lasting digital uptake, as firms saw the strategic value of resilient, technology-enabled supply chains. Consequently, the digital freight forwarding sector is set for continued growth, as lessons from the pandemic and the further development of global trade patterns take hold.

Trends/Developments:

October 2023: UPS revealed it had agreed with PayPal to purchase Happy Returns. Happy Returns is a reverse logistics provider that enables continuous, no-label, and box returns for both merchants and consumers. The acquisition is to take the digital logistics solution further.

August 2023: Blue Yonder and Seedcom, upgraded its logistics subsidiary, Seedcom Logistics, digitally. The company has now successfully implemented the Blue Yonder Warehouse Management System (WMS) to revamp its warehouse environment.

May 2023: Agraga, a digital logistics firm, raised USD 8.51 million in Series A funding. The firm plans to enhance delivery time on its platform and resolve problems facing many intermediaries.

March 2022: Autosled, the state-of-the-art automotive digital marketplace for logistics, completed its Series A round funding. On further strengthening its agenda of disrupting the automotive transportation segment, Autosled announced closing the USD 5.0 million Series A round.

Key Players:

- Flexport

- Uber Freight

- DHL Global Forwarding

- Kuehne + Nagel International AG

- Freightos

- Forto GmbH

- Twill (Maersk)

- iContainers

- Zencargo

- Cargofive

Chapter 1. DIGITAL FREIGHT FORWARDING MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. DIGITAL FREIGHT FORWARDING MARKET– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. DIGITAL FREIGHT FORWARDING MARKET– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. DIGITAL FREIGHT FORWARDING MARKET- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. DIGITAL FREIGHT FORWARDING MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DIGITAL FREIGHT FORWARDING MARKET– By Mode of Transport

6.1 Introduction/Key Findings

6.2 Sea Freight

6.3 Air Freight

6.4 Land Freight

6.5 Y-O-Y Growth trend Analysis By Mode of Transport

6.6 Absolute $ Opportunity Analysis By Mode of Transport , 2025-2030

Chapter 7. DIGITAL FREIGHT FORWARDING MARKET– By Function

7.1 Introduction/Key Findings

7.2 Transportation Management

7.3 Warehouse Management

7.4 Y-O-Y Growth trend Analysis By Function

7.5 Absolute $ Opportunity Analysis By Function , 2025-2030

Chapter 8. DIGITAL FREIGHT FORWARDING MARKET– By Industry Vertical

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Retail & E-Commerce

8.4 Manufacturing

8.5 Healthcare

8.6 Electronics

8.7 Y-O-Y Growth trend Analysis Industry Vertical

8.8 Absolute $ Opportunity Analysis Industry Vertical , 2025-2030

Chapter 9. DIGITAL FREIGHT FORWARDING Market– By Deployment Mode

9.1 Introduction/Key Findings

9.2 Cloud-Based

9.3 On-Premises

9.4 Y-O-Y Growth trend Analysis Deployment Mode

9.5 Absolute $ Opportunity Analysis Deployment Mode , 2025-2030

Chapter 10. DIGITAL FREIGHT FORWARDING MARKET, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Mode of Transport

10.1.3. By Industry Vertical

10.1.4. By Function

10.1.5. Deployment Mode

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Mode of Transport

10.2.3. By Industry Vertical

10.2.4. By Function

10.2.5. Deployment Mode

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Mode of Transport

10.3.3. By Deployment Mode

10.3.4. By Function

10.3.5. Industry Vertical

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Deployment Mode

10.4.3. By Function

10.4.4. By Mode of Transport

10.4.5. Industry Vertical

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Industry Vertical

10.5.3. By Deployment Mode

10.5.4. By Function

10.5.5. Mode of Transport

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. DIGITAL FREIGHT FORWARDING MARKET– Company Profiles – (Overview, Service Deployment Mode Product Mode of Transport Portfolio, Financials, Strategies & Developments)

11.1 Flexport

11.2 Uber Freight

11.3 DHL Global Forwarding

11.4 Kuehne + Nagel International AG

11.5 Freightos

11.6 Forto GmbH

11.7 Twill (Maersk)

11.8 iContainers

11.9 Zencargo

11.10 Cargofive

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market's expansion is fueled by the surge in e-commerce, demand for real-time shipment visibility, and the adoption of digital technologies like AI and IoT, which enhance efficiency and transparency in logistics operations.

Major industries include e-commerce, manufacturing, automotive, and healthcare, all seeking streamlined logistics solutions to meet growing consumer demands and global trade requirements.

AI optimizes routing, reduces empty miles, and enhances predictive analytics, leading to cost savings and improved operational efficiency in freight management.

North America leads due to its advanced logistics infrastructure and high digital adoption rates, while Asia-Pacific is rapidly growing, driven by expanding e-commerce and supportive government initiatives.

Key trends include the rise of digital freight matching platforms, increased use of blockchain for transparency, and the integration of AI for predictive analytics and route optimization.