Air Freight Forwarding Market Size (2025 – 2030)

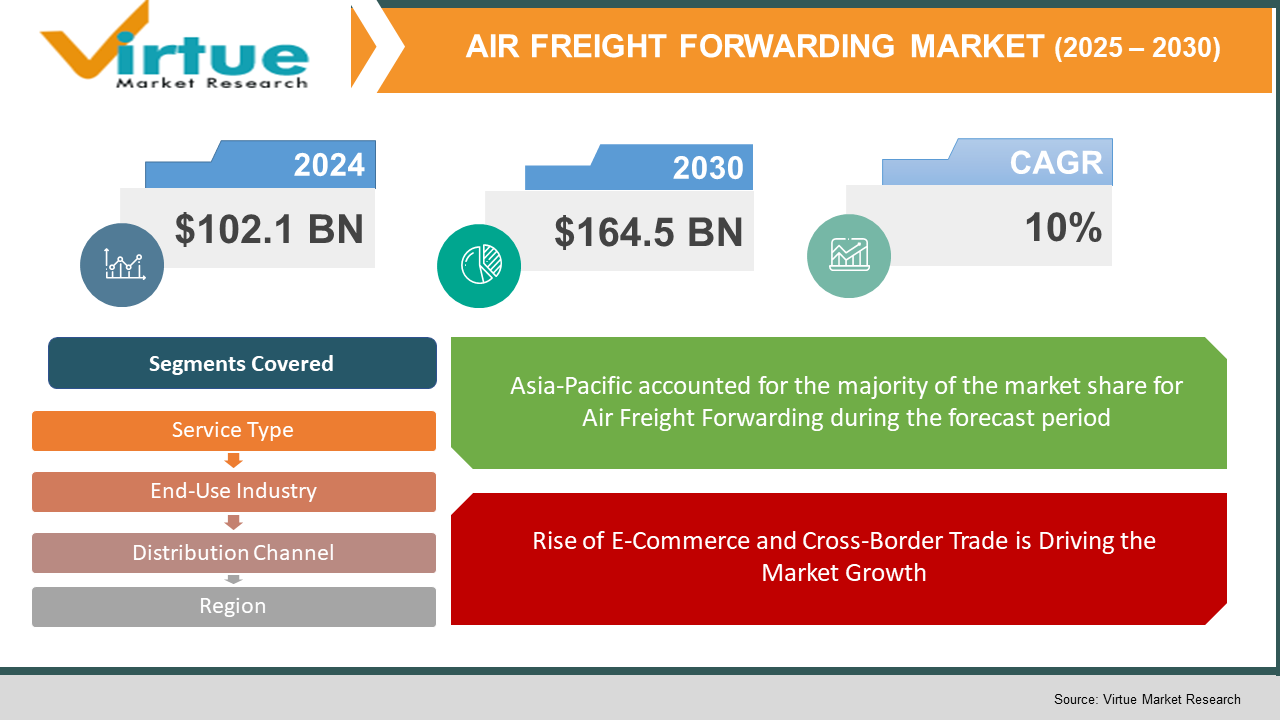

The Air Freight Forwarding Market was valued at $102.1 billion and is projected to reach a market size of $164.5 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10%.

Air freight forwarding is an intermediary between producers and transportation companies, which carries commodities to their ultimate delivery locations. It encompasses a range of functions such as warehousing, cargo reservation, freight consolidation, negotiation of charges, inland transportation monitoring, submission of insurance claims, and submission of shipping documents. It finds extensive application for the shipment of perishable and non-perishable commodities like electronics, automobile components, retail goods, healthcare products, and others. The expansion of worldwide trade and the boom in e-commerce have made air freight forwarding all the more popular, especially in the case of small and medium-sized enterprises (SMEs) handling cross-border operations. Growing web-based purchases of consumer electronics and fashion products have contributed as well. Business-to-business (B2B) shipping is also being driven by demand for automotive products, medical equipment, agricultural produce, and seafood. Even though the COVID-19 pandemic has affected global air freight services and logistics, the market is gradually coming back on track. Air freight is an essential component of international trade, providing quick, secure, and reliable delivery of high-value products, including vaccines, that need temperature-sensitive distribution. The sector is experiencing profound technological change, moving away from legacy systems to more sophisticated interfaces for aircraft operations, revenue accounting, and networking.

Key Market Insights:

- In August 2023 National Airlines (NASDAQ: NATUAL), a subsidiary of National Air Cargo Group, Inc., and Etihad Cargo (MENA, also known as Etihad Cargo), a dynamic Middle East-based freight carrier, signed an Interline Agreement for the successful rollout of the International Civil Aviation Regulations 23rd (ICAIR23) program for the U.S. Postal Service. This interline partnership creates a special partnership between National Airlines, with decades of experience in international freight carriage, and Etihad Cargo, with a global commercial network.

- In April 2022 DHL Supply Chain (a logistics and freight company) initiated a strategic partnership with ReverseLogix (one of the top cloud-based platforms to automate end-to-end reverse logistics for e-commerce brands). The news came as DHL Supply Chain continued to register strong growth for its e-commerce business, registering a 15% year-on-year growth in the 2021 peak season. It comes alongside overall national retail returns up 78% to over USD 761 billion. Based on figures released by the National Retail Federation, such a level of growth was paralleled with steep return volume increases from 2020 to 2021.

Air Freight Forwarding Market Key Drivers:

Rise of E-Commerce and Cross-Border Trade is Driving the Market Growth.

The accelerated growth of e-commerce has increased air freight service demand tremendously, especially for high-value and time-sensitive products. More people shop online, customers demand quicker delivery, and companies use air freight to fulfill their needs. Cross-border trade expansion also requires efficient logistics to cater to the surge in international shipments.

Technological Progress in Logistics.

Technological innovations in logistics, including artificial intelligence (AI), Internet of Things (IoT), and blockchain, are revolutionizing the air freight forwarding sector. The technologies make operations more efficient through real-time monitoring, enhanced visibility of the supply chain, and optimal route planning. The use of digital platforms and automation makes processes easier, minimizes errors, and lowers operational expenses, thus improving the overall efficiency of air freight operations.

Speed and Reliability in Global Supply Chains Demand.

With the globalized economy of today, there is an increasing focus on speed and reliability in logistics activities. Sectors like pharmaceuticals, electronics, and automotive parts need quick and reliable transportation of products to keep up with production timelines and consumer needs. Air freight provides a solution by having quicker transit times than other transport modes, guaranteeing timely delivery of vital shipments, and reducing the risk of supply chain interruptions.

Air Freight Forwarding Market Restraints and Challenges:

Challenges Confronting the Air Freight Forwarding Market Amidst Growing Demand and Operational Complexities.

The air freight forwarding industry is plagued by several major issues that affect its efficiency and profitability. One of the main concerns is a capacity shortage, especially during peak periods. The growth in demand for air cargo, fueled by rising e-commerce activities, has resulted in reduced cargo capacity on flights, leading to delays and increased shipping costs. Another major challenge is volatile fuel prices. Fuel costs form a large part of operational expenses in air freight, and fuel price volatility can cause uncertain shipping rates, impacting the financial health of logistics providers. Regulatory compliance is also a key challenge. The air freight sector has to comply with strict regulations regarding security, environmental requirements, and customs regulations. Compliance with these intricate regulations demands high investment in technology and processes, affecting operational efficiency and costs. In addition, geopolitical tensions and trade disputes can disrupt supply chains and introduce uncertainties in the air freight industry. Protectionist policies, including high tariffs on imports and stringent customs processes, can create delays and higher transaction costs for overseas shipping. Finally, cybersecurity threats are a new challenge. As more dependence is placed on digital platforms for logistics operations, the threat of cyberattacks has grown.

Air Freight Forwarding Market Opportunities:

Leveraging Growth and Opportunities in the Air Freight Forwarding Market Fueled by E-Commerce, Technology, and Sustainability.

The air freight forwarding industry is set for huge growth, driven by several key opportunities. The rise in global e-commerce, especially from fast-fashion retailers such as Shein and Temu, has radically boosted demand for air cargo services, with these firms commanding almost one-third of the world's long-distance cargo aircraft capacity. This development highlights the vital importance of air freight in satisfying consumer demands for quick delivery. Technological innovations are also transforming the sector. Convergence of digital platforms,

Artificial intelligence and automation increase efficiency in operations, allowing real-time monitoring and optimal logistics. The innovations not only enhance customer satisfaction but also offer freight forwarders tools to efficiently handle intricate supply chains. Sustainability initiatives offer other growth opportunities. The implementation of green logistics measures and carbon-free shipping is consistent with international environmental objectives and addresses growing consumer demand for environmentally friendly alternatives.

AIR FREIGHT FORWARDING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By service Type, end user industry, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kuehne + Nagel DHL Supply Chain & Global Forwarding (Germany), DSV (Denmark), DB Schenker (Germany), Sinotrans (China), UPS Supply Chain Solutions (USA), Expeditors International (USA), Nippon Express (Japan), Hellmann Worldwide Logistics (Germany), Shinhan Diamond Industrial Co., Ltd. |

Air Freight Forwarding Market Segmentation:

Air Freight Forwarding Market Segmentation: Service Type

- Freight Transportation

- Value-Added Services

Freight transportation services lead in the air freight forwarding industry, with a market share of more than 45% in 2023. The segment covers express, deferred, and charter services, meeting different shipping requirements. Express services focus on fast delivery, suitably meeting high-value and time-critical shipments. Deferred services provide a more cost-effective alternative for less urgent shipments, and charter services are appropriate for oversized freight or places inaccessible by normal flights. Global trade patterns, technological innovations, and the growing demand for speedy and reliable shipping options drive the dominance of freight transport.

In contrast, value-added services represent the most rapidly expanding sector within the air freight forwarding industry. Such services involve customs clearance, packaging, and door-to-door delivery, adding extra value to the core transportation services. The demand for value-added services is driven by the need for end-to-end logistics solutions that simplify the supply chain and increase customer satisfaction. With companies competing in a competitive market, incorporating value-added services into their products becomes imperative. The growth of e-commerce and the necessity of effective last-mile delivery also add to the fast-paced growth of the segment.

Air Freight Forwarding Market Segmentation: By End-Use Industry

- Manufacturing and Automotive

- Retail and Consumer Goods

- Pharmaceutical and Healthcare

- Aerospace and Defense

The Retail and Consumer Goods industry today is the leading growth segment within the air freight forwarding industry. This growth largely stems from e-commerce's growth at an exponential rate, fueled by players such as Shein and Temu, which considerably influence global demand for air cargo. These cheap-fashion retailers presently occupy almost one-third of all long-distance world cargo aircraft capacity, resulting in higher air freight rates and supply shortages. Their business strategies depend on the instant transportation of lightweight packages directly from China's production centers to buyers across the globe, requiring prompt and effective air freight services. The trend confirms the vital significance of air freight in satisfying the expectation of instant delivery in the era of e-commerce.

On the other hand, the Manufacturing and Automotive segment remains the largest category in the market of air freight forwarding. This is due to the industry's dependency on just-in-time production techniques, which need timely delivery of parts to keep production schedules running. Air freight forwarding offers the speed and dependability required to sustain these supply chains, allowing for uninterrupted production lines. The industry's international operations require efficient logistics solutions to facilitate the procurement of raw materials and distribution of finished goods in various markets. This continued demand underscores the industry's major contribution to the air freight forwarding market.

Air Freight Forwarding Market Segmentation: By Distribution Channel

- Forwarders and Brokers

- E-commerce Platforms

In the air freight forwarding industry, e-commerce websites have become the most rapidly growing distribution medium. The sheer growth of online shopping, especially from fast-fashion behemoths such as Shein and Temu, has heavily boosted demand for air freight services. They now occupy more than 30% of cargo capacity on some routes out of Asia, triggering a 40% hike in freight rates out of China's manufacturing centers. The demand for rapid, direct-to-consumer shipments has made air freight a vital part of e-commerce supply chains, particularly for high-volume and time-sensitive deliveries. The trend speaks volumes about the importance of air freight in satisfying consumers' expectations of faster delivery.

On the other hand, legacy forwarders and brokers remain the leaders in the air freight forwarding industry. These players handle a large volume of cargo shipments, especially in B2B transactions with high volumes and intricate logistics. Their experience in managing time-critical deliveries, value-added services, and international operations makes them irreplaceable for sectors such as manufacturing, wholesale distribution, and industrial products. As e-commerce fuels strong growth, the underlying role of forwarders and brokers in enabling international trade and handling complex supply chains guarantees their ongoing supremacy in the market.

Air Freight Forwarding Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

The air freight forwarding industry follows different regional patterns, with the Asia-Pacific region being the leader, occupying about 35% of the worldwide market share. Its dominance stems from the region's strong manufacturing sector, high economic growth, and flourishing e-commerce industry in nations such as China, Japan, and India. North America takes second place, with approximately 30% market share, helped by its superior logistics infrastructure and high demand for time-sensitive shipping. Europe still has a high profile with a 25% share, helped by its strategic positioning and well-developed transport network. The Middle East and African region accounts for approximately 5%, helped by its strategic location as a world logistics hub, especially in the Gulf Cooperation Council (GCC) nations. Latin America, which presently holds 5%, is a growth region based on expanding trade and the growth in infrastructure. All these regional breakdowns are pointers to the global aspect of the air freight forwarding industry and the diverse variables impacting each region's contribution

COVID-19 Impact Analysis on the Air Freight Forwarding Market:

The COVID-19 pandemic significantly impacted the air freight forwarding industry, revealing weaknesses and causing drastic operational changes. The shutdown of passenger flights, which formerly transported around 60% of international air cargo as belly cargo, resulted in a sudden decrease in cargo capacity. This abrupt shortage coincided with a boom in demand for basic items such as personal protective equipment (PPE), triggering freight rates to skyrocket—sometimes as high as $20 per kilogram on major routes like Asia to the U.S. In response, airlines converted passenger planes to cargo-only flights, stripping out seats to maximize capacity and keep supply chains intact. Despite these adjustments, the sector experienced challenges such as labor shortages, regulatory adjustments, and volatile patterns of demand. The pandemic also hastened the transition to e-commerce, with greater dependence on air freight for timely delivery. As economies started to recover, the air freight industry continued to struggle with capacity issues and high operational costs, pointing to the need for increased resilience and flexibility in global logistics networks.

Trends/Developments:

Freight forwarders are increasingly turning to digital platforms to streamline operations. These platforms ease processes like booking, tracking, and documentation, making logistics services more accessible to small shippers. The adoption of Artificial Intelligence (AI) and Machine Learning (ML) is improving predictive capabilities, optimizing routes, and enhancing customer service through AI-based chatbots.

In December 2022, Bolloré Logistics opened a new 2,500 m² facility in Rouen Petit-Couronne, expanding its logistics capacity. DB Schenker launched a CO₂-free air freight solution and unveiled plans for a state-of-the-art logistics center in the Czech Republic in November 2022. Silk Way West Airlines and NIPPON EXPRESS HOLDINGS signed an air cargo transport memorandum in December 2022, deepening their collaborative cooperation.

India is witnessing substantial upgrades in its air cargo infrastructure. Kannur International Airport in Kerala inaugurated a 1,200 m² cargo complex in February 2021 with plans to become a regional air cargo hub. Hyderabad airport's GMR Aero Technic introduced an "inflatable hangar" with sophisticated monitoring systems that can sustain extreme temperatures and wind speeds. Hubballi Airport in North Karnataka initiated operations of its exclusive domestic air cargo terminal in November 2021, with infrastructure for the handling of different categories of products. Kolkata airport has recently opened an international courier terminal to allow express cargo clearance, shortening transit times. Dimapur airport was approved for cargo operations, focusing on the export of horticultural products from Nagaland.

SpiceJet declared the transfer of its cargo and logistics business to its subsidiary, SpiceXpress, and Logistics Private Limited, to simplify operations and extend its cargo business to several Indian cities.

March 2022: Cargojet's recent gamble on additional aircraft saw it secure a widened deal with DHL Express. The duo made a five-year cooperation agreement, with a two-year option, for ACMI, CMI, charter, and dry leases. Canada's Cargojet currently operates 12 aircraft for DHL, adding five 767Fs in 2022 and next to accommodate 'expected cargo volume.' DHL increased capacity in the Americas by 18% during the 2021 peak season and introduced a weekly service from Vietnam to the US. In addition, Cargojet recently inked purchase and conversion deals for six additional 777s, totaling eight more through 2026.

Key Players:

- Kuehne + Nagel

- DHL Supply Chain & Global Forwarding (Germany)

- DSV (Denmark)

- DB Schenker (Germany)

- Sinotrans (China)

- UPS Supply Chain Solutions (USA)

- Expeditors International (USA)

- Nippon Express (Japan)

- Hellmann Worldwide Logistics (Germany)

- Shinhan Diamond Industrial Co., Ltd.

Chapter 1. Air Freight Forwarding Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Air Freight Forwarding Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Air Freight Forwarding Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging Service Type Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Air Freight Forwarding Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Air Freight Forwarding Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Air Freight Forwarding Market – By Service Type

6.1 Introduction/Key Findings

6.2 Freight Transportation

6.3 Value-Added Services

6.4 Y-O-Y Growth trend Analysis By Service Type

6.5 Absolute $ Opportunity Analysis By Service Type , 2025-2030

Chapter 7. Air Freight Forwarding Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Forwarders and Brokers

7.3 E-commerce Platforms

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. Air Freight Forwarding Market – By End-User

8.1 Introduction/Key Findings

8.2 Manufacturing and Automotive

8.3 Retail and Consumer Goods

8.4 Pharmaceutical and Healthcare

8.5 Aerospace and Defense

8.6 Y-O-Y Growth trend Analysis End-User

8.7 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. Air Freight Forwarding Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Distribution Channel

9.1.3. By End-User

9.1.4. By Service Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Distribution Channel

9.2.3. By End-User

9.2.4. By Service Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Distribution Channel

9.3.3. By End-User

9.3.4. By Service Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By End-User

9.4.3. By Distribution Channel

9.4.4. By Service Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By End-User

9.5.3. By Distribution Channel

9.5.4. By Service Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Air Freight Forwarding Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Kuehne + Nagel

10.2 DHL Supply Chain & Global Forwarding (Germany)

10.3 DSV (Denmark)

10.4 DB Schenker (Germany)

10.5 Sinotrans (China)

10.6 UPS Supply Chain Solutions (USA)

10.7 Expeditors International (USA)

10.8 Nippon Express (Japan)

10.9 Hellmann Worldwide Logistics (Germany)

10.10 Shinhan Diamond Industrial Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Air freight forwarding involves coordinating and shipping goods via air carriers, acting as intermediaries between shippers and transportation services to ensure timely and efficient delivery.

Key services include booking cargo space, warehousing and distribution, customs brokerage, freight consolidation, and providing value-added services to streamline the shipping process.

It offers rapid transit times, enhanced security, and the ability to transport high-value or perishable goods over long distances, supporting global trade and supply chain efficiency.

Costs are affected by factors such as cargo weight and dimensions, flight distance, fuel prices, demand fluctuations, and any additional services required, like expedited shipping or special handling.

The growth of e-commerce has significantly increased demand for fast and reliable shipping, leading to higher volumes of air cargo, especially during peak shopping seasons, and driving innovations in logistics to meet consumer expectations.