Decorative Paints & Coatings Market Size (2024 – 2030)

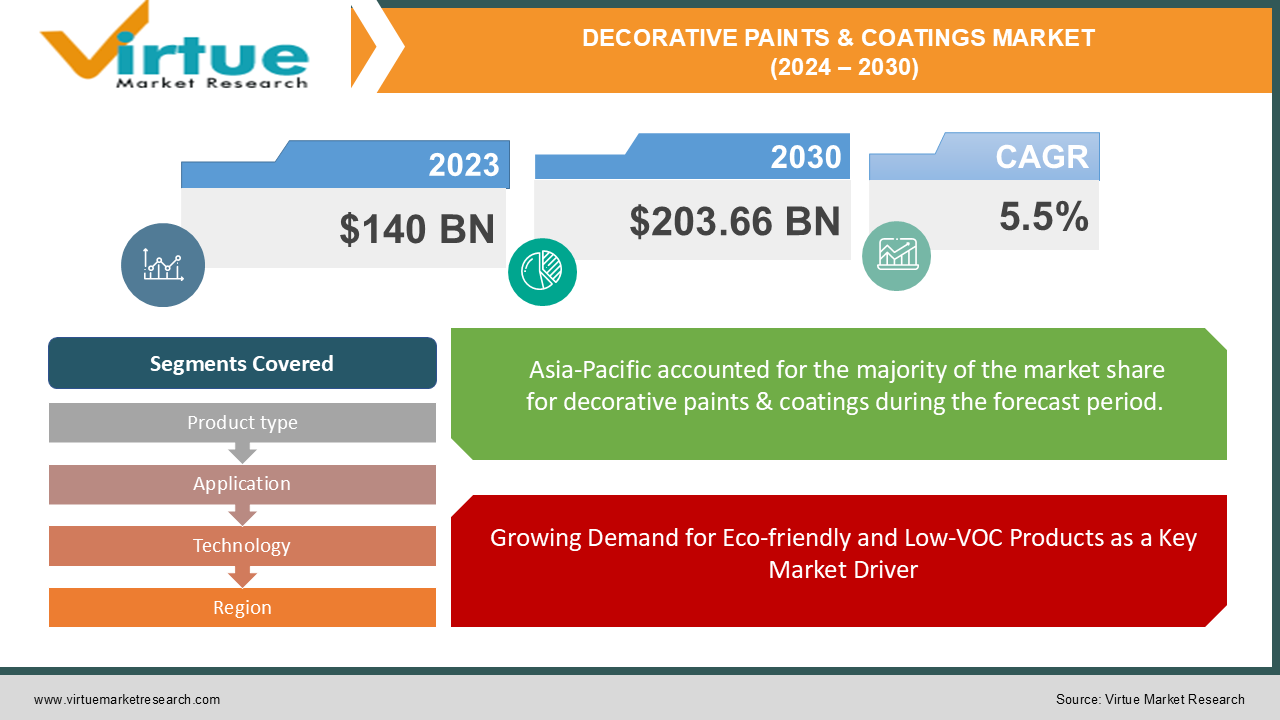

The Global Decorative Paints & Coatings Market was valued at USD 140 billion in 2023 and is projected to reach a market size of USD 203.66 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.5% between 2024 and 2030.

The Global Decorative Paints & Coatings Market is experiencing steady growth, driven by increasing demand for aesthetically appealing interiors and exteriors in both residential and commercial sectors. Decorative paints and coatings are primarily used to enhance the appearance of buildings, protect surfaces from environmental factors, and improve durability. With the rise in construction activities, particularly in emerging economies, there is a growing need for innovative and sustainable coatings that offer not only visual appeal but also long-term protection. The market is seeing a shift towards eco-friendly and low-VOC (volatile organic compounds) formulations, as consumers become more environmentally conscious and regulations on chemical emissions tighten. Additionally, technological advancements, such as the introduction of smart coatings and antimicrobial paints, are contributing to the evolving landscape of the decorative paints and coatings market. Innovations in color-matching technologies and custom finishes are also playing a role in boosting consumer interest. Urbanization, increased disposable income, and a rising preference for home renovation projects are further propelling market growth. As trends in modern architecture and interior design continue to evolve, the demand for high-quality, versatile decorative paints and coatings is expected to rise globally, driving continued market expansion in the coming years.

Key Market Insights:

-

Water-based coatings account for over 60% of the market due to lower environmental impact.

-

The residential sector contributes to nearly 55% of the global decorative paint demand.

-

Asia-Pacific holds over 40% of the global market share, driven by rapid urbanization and construction activities.

-

Low-VOC and eco-friendly paints are growing at a rate of over 7% annually, reflecting increased environmental awareness.

-

The premium segment of decorative coatings is expected to grow at a CAGR of 5.5% due to rising demand for advanced finishes and durability.

Decorative Paints & Coatings Market Drivers:

Rising Urbanization and Infrastructure Development as Key Growth Drivers in the Decorative Paints and Coatings Market

One of the key drivers of the global decorative paints and coatings market is the rapid urbanization and growing infrastructure development, particularly in emerging economies. As more people move to urban areas, the demand for residential housing and commercial spaces is increasing. This surge in construction activity has led to a higher need for decorative paints and coatings to enhance the aesthetics and protect the surfaces of buildings. Additionally, governments across the world are investing heavily in infrastructure projects, including roads, bridges, and public buildings, which also contributes to the rising demand for high-quality, durable paints. Decorative coatings are not only used for aesthetic purposes but also for their protective qualities, which help buildings withstand environmental factors like UV rays, moisture, and pollution. As the trend of modern urban living continues to evolve, the need for premium, versatile, and environmentally friendly coatings will further fuel the market's growth. This ongoing urbanization and the construction boom are expected to be long-term growth drivers for the decorative paints and coatings market.

Growing Demand for Eco-friendly and Low-VOC Products as a Key Market Driver

With growing awareness about environmental sustainability and stricter regulations on chemical emissions, there is a significant rise in demand for eco-friendly and low-VOC decorative paints and coatings. Traditional paints and coatings often contain volatile organic compounds (VOCs), which are harmful to both the environment and human health. In response, consumers and industries are increasingly seeking sustainable alternatives that offer the same level of durability and aesthetic appeal without the negative environmental impact. The development of water-based coatings and paints with reduced VOC content has become a major trend, driven by consumer preferences for greener solutions. Moreover, manufacturers are investing in research and development to create innovative products that meet these environmental standards while also offering unique finishes, antimicrobial properties, and enhanced durability. The push for sustainable building materials and eco-friendly home improvement products is expected to remain a significant market driver, as consumers prioritize health, sustainability, and regulatory compliance.

Decorative Paints & Coatings Market Restraints and Challenges:

The decorative paints and coatings market faces several restraints and challenges that could hinder its growth. One of the primary challenges is the volatility in raw material prices, particularly for key ingredients like titanium dioxide, pigments, and resins. These fluctuations can increase production costs, putting pressure on manufacturers to either absorb the costs or pass them on to consumers, potentially reducing demand. Additionally, stringent environmental regulations surrounding the use of volatile organic compounds (VOCs) in paints and coatings present another obstacle. Compliance with these regulations often requires expensive reformulations to reduce VOC content, which can be both time-consuming and costly for manufacturers. Furthermore, the growing demand for eco-friendly products has intensified competition in the market, as companies race to develop more sustainable and innovative solutions. In developing regions, economic instability and fluctuating currencies can also pose challenges to market expansion. Another issue is the limited availability of skilled labor for painting and coating applications, particularly in fast-growing markets, which may slow down the adoption of advanced products. Lastly, the market is also influenced by the slowdown in construction activities in certain regions, which directly affects the demand for decorative paints and coatings. Addressing these challenges will require strategic planning and investment in R&D for more cost-effective and sustainable solutions.

Decorative Paints & Coatings Market Opportunities:

The decorative paints and coatings market presents numerous opportunities for growth, particularly driven by the increasing consumer demand for sustainable and innovative solutions. As environmental concerns continue to rise, there is a growing market for eco-friendly paints that contain low or zero volatile organic compounds (VOCs). Manufacturers that invest in the development of green products, such as water-based and bio-based coatings, stand to benefit from this shift in consumer preferences. Additionally, advancements in technology are opening doors for the introduction of smart coatings, which can offer unique functionalities like self-cleaning, anti-microbial, or temperature-regulating properties. These innovations appeal to both residential and commercial customers who seek not only aesthetic value but also enhanced performance from their paint products. The rise of home improvement projects, driven by the DIY trend, presents another opportunity for decorative paint manufacturers to cater to individual homeowners. Emerging markets, particularly in the Asia-Pacific region, are also offering significant opportunities due to rapid urbanization, increased disposable income, and expanding construction activities. Furthermore, the growing focus on energy-efficient buildings creates a demand for heat-reflective and insulating paints, offering a new avenue for product differentiation. Overall, the market’s evolution towards sustainability and innovation presents vast opportunities for growth and expansion.

DECORATIVE PAINTS & COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product type, Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Akzo Nobel N.V., PPG Industries, Inc., Sherwin-Williams Company, BASF SE, Nippon Paint Holdings Co., Ltd., Asian Paints Limited, Jotun A/S, RPM International Inc., Axalta Coating Systems, LLC, Kansai Paint Co., Ltd., Hempel A/S, Masco Corporation, Benjamin Moore & Co. |

Decorative Paints & Coatings Market Segmentation: By Product Type

-

Interior Paints

-

Exterior Paints

-

Architectural Coatings

-

Wood Finishes

-

Specialized Coatings

In 2023, based on market segmentation by Product Type, Interior Paints had the highest share of the Global Decorative Paints & Coatings Market. Interior paints play a crucial role in the decorative paints and coatings market, owing to their extensive range of applications across various settings such as homes, offices, schools, hospitals, and other commercial establishments. One of the key factors driving the dominance of interior paints is the need for frequent repainting. Interiors tend to experience more wear and tear due to daily activities, exposure to cleaning agents, and changes in design preferences, which often leads to repainting projects. Additionally, concerns about indoor air quality have spurred demand for eco-friendly, low-VOC, and washable paints, further boosting the interior segment. Manufacturers have responded by offering a diverse array of interior paint products, catering to different consumer needs with various finishes, textures, and colors. These options range from matte to glossy finishes, along with specialty paints that offer anti-microbial properties or enhanced durability for high-traffic areas. This variety allows consumers to customize their interior spaces according to personal tastes and functional requirements. While exterior paints and other types hold substantial market shares, interior paints dominate due to their frequent use and versatility across multiple applications, making them a core component of the decorative paints and coatings market's growth.

Decorative Paints & Coatings Market Segmentation: By Application

-

Residential

-

Commercial

-

Industrial

-

Automotive

-

Marine

-

Aerospace

In 2023, based on market segmentation by Application, Residential had the highest share of the Global Decorative Paints & Coatings Market. The residential segment of the decorative paints and coatings market is a significant driver of demand due to several key factors. Frequent repainting is common in residential properties as a result of factors like wear and tear, evolving design preferences, and concerns over indoor air quality. Over time, walls and surfaces in homes experience degradation from daily use, necessitating periodic updates to maintain aesthetic appeal and address any deterioration. The growing DIY culture also plays a substantial role in boosting demand for residential paints, as homeowners increasingly engage in self-managed painting projects. This trend is supported by the availability of user-friendly products and resources that empower individuals to undertake painting tasks on their own. Additionally, the ongoing construction of new homes and the renovation of existing ones contribute to a steady demand for residential paints and coatings. While commercial and industrial applications also contribute to the overall market, the residential sector remains the largest due to the high volume of properties and the frequent need for repainting. The combination of these factors ensures that residential paints continue to be a dominant force in the decorative paints and coatings market.

Decorative Paints & Coatings Market Segmentation: By Technology

-

Water-Based

-

Solvent-Based

-

Powder Coatings

-

High-Performance Coatings

In 2023, based on market segmentation by Technology, Water-Based had the highest share of the Global Decorative Paints & Coatings Market. Water-based paints have become the dominant technology in the decorative paints and coatings market due to their numerous advantages over solvent-based paints. One of the key factors driving their popularity is environmental friendliness; water-based paints emit fewer volatile organic compounds (VOCs), which helps to reduce air pollution and mitigate health risks associated with high VOC levels. Additionally, water-based paints are known for their lower odor compared to solvent-based alternatives, making them more suitable for indoor applications and enhancing user comfort during painting projects. The faster drying time of water-based paints is another significant benefit, as it reduces application time and allows for quicker project completion, improving overall efficiency. Furthermore, the ease of cleanup associated with water-based paints is a major advantage; they can be easily cleaned with water and soap, simplifying the post-application process and minimizing the need for harsh chemicals. These combined benefits have led to a marked increase in the demand for water-based paints, solidifying their position as the preferred choice in the market for decorative paints and coatings.

Decorative Paints & Coatings Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, Asia-Pacific had the highest share of the Global Decorative Paints & Coatings Market. The Asia-Pacific region stands out as the dominant market for decorative paints and coatings due to several compelling factors. Rapid urbanization across countries like China, India, and Southeast Asian nations has led to a significant surge in construction activity, driving up the demand for decorative paints and coatings used in both residential and commercial buildings. Additionally, the growing middle class in the region has increased disposable income, allowing more individuals to invest in home improvement and renovation projects, further fueling the demand for high-quality decorative coatings. Cost-competitive manufacturing is another key advantage for the Asia-Pacific region, as many major paint manufacturers have established production facilities here to take advantage of lower labor costs and an abundance of raw materials. Moreover, the region's diverse industrial sectors, including automotive, aerospace, and marine industries, also contribute to the demand for specialized decorative coatings. While markets in North America and Europe remain significant, the Asia-Pacific region's unique combination of rapid urban growth, rising consumer spending, cost advantages, and diverse applications positions it as the leading market for decorative paints and coatings globally.

COVID-19 Impact Analysis on the Global Decorative Paints & Coatings Market.

The COVID-19 pandemic had a significant impact on the global decorative paints and coatings market, with both short-term disruptions and long-term shifts. In the early stages of the pandemic, the market faced severe challenges due to lockdowns, halted construction activities, and supply chain disruptions. The closure of manufacturing plants and restricted movement of goods led to delays in production and delivery of raw materials, affecting overall market performance. Furthermore, reduced consumer spending and delayed renovation projects slowed down demand in both residential and commercial sectors. However, as economies gradually reopened, the market saw a recovery, partly driven by a surge in home improvement projects as people spent more time indoors and focused on enhancing their living spaces. The DIY trend gained traction during the pandemic, boosting sales of decorative paints. Additionally, the shift towards sustainability accelerated as consumers and industries became more conscious of health and environmental factors, leading to increased demand for low-VOC and eco-friendly products. Post-pandemic, the market is expected to continue its recovery, with the construction sector regaining momentum and consumers maintaining their focus on renovation projects. While initial setbacks were severe, the pandemic has ultimately reshaped the decorative paints and coatings market towards innovation and sustainability.

Latest trends / Developments:

The global decorative paints and coatings market is witnessing several key trends and developments that are shaping its future. One of the most prominent trends is the growing demand for eco-friendly and low-VOC (volatile organic compound) paints, driven by increasing environmental regulations and consumer awareness about sustainability. Water-based paints and bio-based coatings are gaining popularity as they offer reduced environmental impact without compromising on quality or performance. Another significant trend is the rise of smart coatings with advanced functionalities. These include anti-microbial, self-cleaning, and temperature-regulating properties, which cater to consumers looking for both aesthetic appeal and added utility in their paint choices. Technological advancements are also playing a role in the development of digital tools, such as color-matching apps and virtual reality design software, enabling consumers to visualize and customize their painting projects before purchase. The DIY (Do-It-Yourself) trend continues to expand, particularly following the pandemic, as more homeowners take on renovation projects, increasing demand for user-friendly decorative paints. Additionally, the market is seeing a rise in demand for premium, high-performance coatings that offer durability, weather resistance, and enhanced finishes, particularly in the luxury residential and commercial segments. These trends are driving innovation and pushing the market towards more sustainable, functional, and technologically advanced products.

Key Players:

-

Akzo Nobel N.V.

-

PPG Industries, Inc.

-

Sherwin-Williams Company

-

BASF SE

-

Nippon Paint Holdings Co., Ltd.

-

Asian Paints Limited

-

Jotun A/S

-

RPM International Inc.

-

Axalta Coating Systems, LLC

-

Kansai Paint Co., Ltd.

-

Hempel A/S

-

Masco Corporation

-

Benjamin Moore & Co.

Chapter 1. Decorative Paints & Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Decorative Paints & Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Decorative Paints & Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Decorative Paints & Coatings Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Decorative Paints & Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Decorative Paints & Coatings Market – By Product Type

6.1 Introduction/Key Findings

6.2 Interior Paints

6.3 Exterior Paints

6.4 Architectural Coatings

6.5 Wood Finishes

6.6 Specialized Coatings

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Decorative Paints & Coatings Market – By Technology

7.1 Introduction/Key Findings

7.2 Water-Based

7.3 Solvent-Based

7.4 Powder Coatings

7.5 High-Performance Coatings

7.6 Y-O-Y Growth trend Analysis By Technology

7.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Decorative Paints & Coatings Market – By Application

8.1 Introduction/Key Findings

8.2 Residential

8.3 Commercial

8.4 Industrial

8.5 Automotive

8.6 Marine

8.7 Aerospace

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Decorative Paints & Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Technology

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Technology

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Technology

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Technology

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Technology

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Decorative Paints & Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Akzo Nobel N.V.

10.2 PPG Industries, Inc.

10.3 Sherwin-Williams Company

10.4 BASF SE

10.5 Nippon Paint Holdings Co., Ltd.

10.6 Asian Paints Limited

10.7 Jotun A/S

10.8 RPM International Inc.

10.9 Axalta Coating Systems, LLC

10.10 Kansai Paint Co., Ltd.

10.11 Hempel A/S

10.12 Masco Corporation

10.13 Benjamin Moore & Co

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Decorative Paints & Coatings market is expected to be valued at US$ 140 billion.

Through 2030, the Global Decorative Paints & Coatings market is expected to grow at a CAGR of 5.5%.

By 2030, Global Decorative Paints & Coatings Market is expected to grow to a value of US$ 230.66 billion.

North America is predicted to lead the Globa Decorative Paints & Coatings market.

The Global Decorative Paints & Coatings Market has segments By Application, Technology, Region, and Product Type.