DBS Devices for Huntington Disease Market Size (2024 –2030)

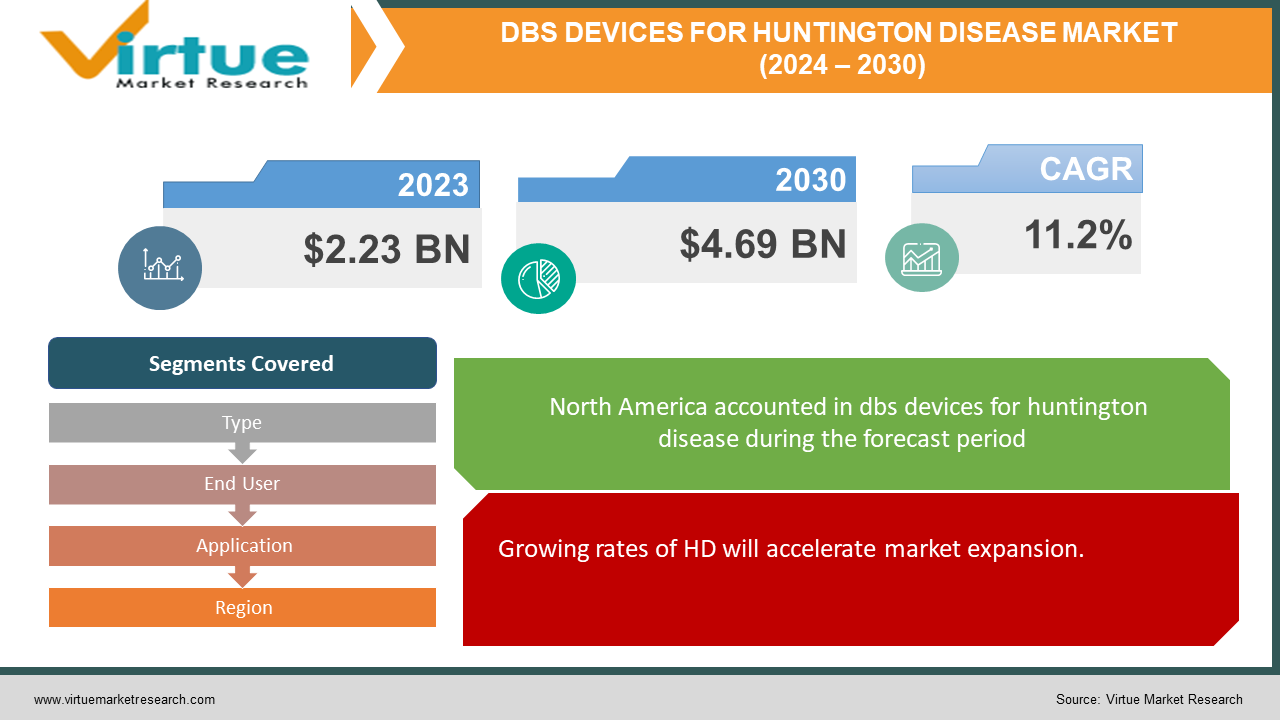

The Global DBS Devices for Huntington Disease Market was projected to be USD 2.23 billion in 2023, and by 2030 it is anticipated to be worth USD 4.69 billion. The market is estimated to expand at a CAGR of 11.2% between 2024 and 2030.

Deep brain stimulation (DBS) is a novel treatment being investigated for the movement, cognitive, and behavioral disorders associated with Huntington's disease (HD). While there aren't any FDA-approved DBS devices for HD at the moment, the market for DBS devices as a whole is expanding quickly as more businesses create new DBS technologies and broaden their applications. Though the majority of DBS surgeries are performed for other neurological conditions like Parkinson's disease, the market for DBS devices specifically targeting HD is relatively small. However as more clinical trials show that DBS for HD is safe and effective, the market for DBS devices specifically designed for HD is anticipated to expand.

Key Market Insights:

Approximately 200,000 patients worldwide are thought to be eligible for DBS treatment for Huntington's disease. For patients with Huntington's disease, the average cost of DBS surgery and device implantation is between $80,000 and $100,000. Huntington's disease-related DBS devices normally have a battery life of three to five years, necessitating recurrent surgeries. Clinical research indicates that DBS can enhance motor function in patients with Huntington's disease by about 40–60% when compared to baseline levels.

Global DBS Devices for Huntington Disease Market Drivers:

Growing rates of HD will accelerate market expansion.

A rare inherited disorder, Huntington's disease (HD) affects about one in every 10,000 people worldwide. Even though HD is less common than other neurological disorders, more people are anticipated to get HD shortly. This is partially attributable to developments in genetic testing, which have facilitated the diagnosis of HD and the identification of people who are susceptible to the illness. The number of HD cases will increase, necessitating the development of novel and cutting-edge therapies like deep brain stimulation (DBS).

Growing acceptance of DBS as a therapeutic option will propel market expansion.

As more research demonstrates the safety and efficacy of deep brain stimulation (DBS), physicians and patients alike are beginning to recognize the potential benefits of DBS for Huntington's disease (HD). DBS is a comparatively non-invasive surgical procedure that has been demonstrated to enhance motor function and quality of life in individuals with HD. It can be tailored to target particular brain regions, potentially improving the accuracy and efficacy of the treatment. There will likely be a rise in demand for DBS devices for HD as more people become aware of DBS as a treatment option.

DBS Devices for Huntington Disease Market Challenges and Restraints:

No deep brain stimulation (DBS) device intended for the treatment of Huntington's disease (HD) has received approval from the US Food and Drug Administration (FDA). While some DBS devices are approved for use with other neurological conditions like Parkinson's disease, some are used off-label for HD. Because of worries about regulations and reimbursement, medical professionals might be reluctant to suggest off-label treatments. The FDA's denial of approval for DBS devices for HD may restrict the creation of new goods and market expansion. Deep brain stimulation (DBS) may not be widely known as a treatment option because many patients and healthcare professionals are not well informed about Huntington's disease. The use of DBS devices to treat Huntington's disease (HD) may also be discouraged by stigma and misconceptions surrounding the condition. Because of their worries about possible risks and the invasiveness of the procedure, healthcare providers may be hesitant to recommend DBS. DBS for Huntington's disease may not be adopted and grow as a result of this lack of awareness and stigma.

DBS Devices for Huntington Disease Market Opportunities:

The market for DBS devices for Huntington's disease (HD) offers numerous chances for expansion and innovation. Demand for efficient treatments like DBS is rising as people become more conscious of HD and its symptoms. To meet unmet medical needs and enhance patient outcomes, specialized DBS devices designed for HD may be developed. Furthermore, improvements in neurostimulation methods and technology could result in more focused and accurate DBS treatments for HD, improving efficacy and minimizing side effects. Additionally, partnerships between medical device manufacturers, academic institutions, and healthcare providers can hasten the creation and uptake of DBS devices for HD, creating fresh opportunities for market growth.

DBS DEVICES FOR HUNTINGTON DISEASE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.2% |

|

Segments Covered |

By Type, End User, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Medtronic, Boston Scientific Corporation, Abbott Laboratories, Beijing PINS Medical Co., Ltd., SceneRay Corporation, Functional Neuromodulation Ltd., NeuroPace, Inc., AlevaNeurotherapeutics SA, Sapiens Steering Brain Stimulation B.V., Neuros Medical, Inc. |

DBS Devices for Huntington Disease Market Segmentation – By Type

-

Single-Channel DBS Devices

-

Multi-Channel DBS Devices

A sizable portion of the market is made up of single-channel DBS equipment. They use a single electrode positioned in a particular part of the brain. An implanted pulse generator (IPG) that delivers electrical signals to the brain is connected to this electrode. Multi-channel DBS devices, on the other hand, stimulate various brain regions using several electrodes. Targeting specific brain regions with greater flexibility and precision is possible with these devices, which can help treat complex HD symptoms.

DBS Devices for Huntington Disease Market Segmentation- By End User

-

Hospitals and Clinics

-

Home Care

Deep brain stimulation, or DBS, devices are primarily used in hospitals and clinics to treat Huntington's disease (HD). These facilities have dedicated departments that can handle both the surgical implant of the device and post-procedure care. Due to the specialized training and experience needed for the surgery, the use of DBS devices for HD is typically restricted to highly developed hospitals and clinics. With the assistance of caregivers or certified medical professionals, DBS devices for HD can occasionally be utilized in home care settings as well. For patients who have trouble traveling to hospitals or who require ongoing support at home, this option might be more practical.

DBS Devices for Huntington Disease Market Segmentation – By Application

-

Motor Symptoms

-

Psychiatric Symptoms

-

Cognitive Symptoms

Deep brain stimulation (DBS) devices are frequently used to treat motor symptoms, such as rigidity (stiffness), dystonia (muscle contractions), and chorea (involuntary movements), associated with Huntington's disease (HD). HD patients' quality of life can be significantly impacted by these symptoms, and DBS devices can help by enhancing motor control and minimizing involuntary movements. DBS can also be used to treat psychological symptoms like anxiety, irritability, and depression, though further study is required in this field. The use of DBS to treat cognitive symptoms like memory loss and difficulty thinking and making decisions is becoming more popular, but more research is needed to determine exactly how well it works to manage these aspects of HD.

DBS Devices for Huntington Disease Market Segmentation – By Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

Because of the high prevalence of HD and the availability of state-of-the-art healthcare facilities, North America is anticipated to continue to be the largest market for DBS (deep brain stimulation) devices for HD patients. The United States is expected to continue to hold its dominant position in the North American market. The market for DBS devices for HD is expected to be the second largest in Europe, where HD prevalence is also expected to be significant. Important nations like Germany, France, and the United Kingdom are anticipated to propel market expansion. The industry is expected to grow at the fastest rate in Asia-Pacific because of rising awareness and adoption of DBS devices for HD. Japan, China, and India are important markets boosting this expansion. On the other hand, the lack of advanced healthcare infrastructure and low awareness of the advantages of DBS devices for HD in these regions are expected to cause the market in Africa, the Middle East, and Latin America to grow slowly.

COVID-19 Impact on the Global DBS Devices for Huntington Disease Market:

The COVID-19 pandemic has affected sales of deep brain stimulation (DBS) devices for Huntington's disease. Patients with Huntington's disease now receive irregular medical care, which delays diagnosis and treatment. The industry must keep creating DBS devices and giving them to patients who require them for medical treatment despite these obstacles.

Latest Trend/Development:

Due to DBS's success in treating other neurological disorders, there has been a noticeable upsurge in interest among researchers and medical professionals in investigating DBS as a potential therapy for Huntington's disease (HD) in the market for DBS devices. To evaluate the efficacy and safety of DBS specifically for HD, several clinical trials are being conducted to gather more evidence in favor of its use. Furthermore, advanced brain stimulation technologies specifically designed for HD and other neurological conditions are the focus of partnerships and collaborations between neurostimulation companies and pharmaceutical companies. Constant improvements in DBS device technology are improving safety, efficacy, and precision and may open up new treatment options for HD. Regulatory progress may be made as agencies review data from ongoing studies, even though there are currently no FDA-approved DBS devices for HD. This indicates a growing interest in and investment in DBS as a potential treatment option for Huntington's disease.

Key Players:

-

Medtronic

-

Boston Scientific Corporation

-

Abbott Laboratories

-

Beijing PINS Medical Co., Ltd.

-

SceneRay Corporation

-

Functional Neuromodulation Ltd.

-

NeuroPace, Inc.

-

AlevaNeurotherapeutics SA

-

Sapiens Steering Brain Stimulation B.V.

-

Neuros Medical, Inc.

Market News:

-

A partnership was formed in November 2023 between Otsuka Pharmaceutical and Nexstim NBS Therapy system to develop brain stimulation technology for neurological and psychiatric disorders.

-

To expand the options for DBS therapy, Neuropace initiated a clinical trial in September 2023 to evaluate the use of its RNS System for Parkinson's disease.

-

Positive findings from the ACHIEVE study demonstrated the efficacy of Percept PC+ in treating Tourette Syndrome in August 2023.

Chapter 1. DBS Devices for Huntington Disease Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. DBS Devices for Huntington Disease Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. DBS Devices for Huntington Disease Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. DBS Devices for Huntington Disease Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. DBS Devices for Huntington Disease Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. DBS Devices for Huntington Disease Market – By Type

6.1 Introduction/Key Findings

6.2 Single-Channel DBS Devices

6.3 Multi-Channel DBS Devices

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. DBS Devices for Huntington Disease Market – By Application

7.1 Introduction/Key Findings

7.2 Motor Symptoms

7.3 Psychiatric Symptoms

7.4 Cognitive Symptoms

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. DBS Devices for Huntington Disease Market – By End User

8.1 Introduction/Key Findings

8.2 Hospitals and Clinics

8.3 Home Care

8.4 Y-O-Y Growth trend Analysis By End User

8.5 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. DBS Devices for Huntington Disease Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. DBS Devices for Huntington Disease Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Medtronic

10.2 Boston Scientific Corporation

10.3 Abbott Laboratories

10.4 Beijing PINS Medical Co., Ltd.

10.5 SceneRay Corporation

10.6 Functional Neuromodulation Ltd.

10.7 NeuroPace, Inc.

10.8 AlevaNeurotherapeutics SA

10.9 Sapiens Steering Brain Stimulation B.V.

10.10 Neuros Medical, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global DBS Devices for Huntington Disease Market was projected to be USD 2.23 billion in 2023, and by 2030 it is anticipated to be worth USD 4.69 billion. The market is estimated to expand at a CAGR of 11.2% between 2024 and 2030.

The Asia-Pacific region is likely to grow the most in the DBS devices for Huntington's disease market, due to the increasing prevalence of the disease in the region and the growing demand for advanced medical devices.

The high expense of DBS therapy, the scarcity of doctors who have undergone the necessary training, and the risk of adverse effects from using DBS devices are the main commercial obstacles for DBS devices for Huntington's disease.

The rising incidence of the condition, the rising need for minimally invasive surgical treatments, and the expanding knowledge of the advantages of DBS therapy are the main market drivers for DBS devices for Huntington's disease.

The hospitals segment is likely to grow the most in the DBS devices for Huntington's disease market, due to the increasing number of patients seeking treatment for the disease in hospital settings.