Data Center Liquid Cooling Market Size (2025-2030)

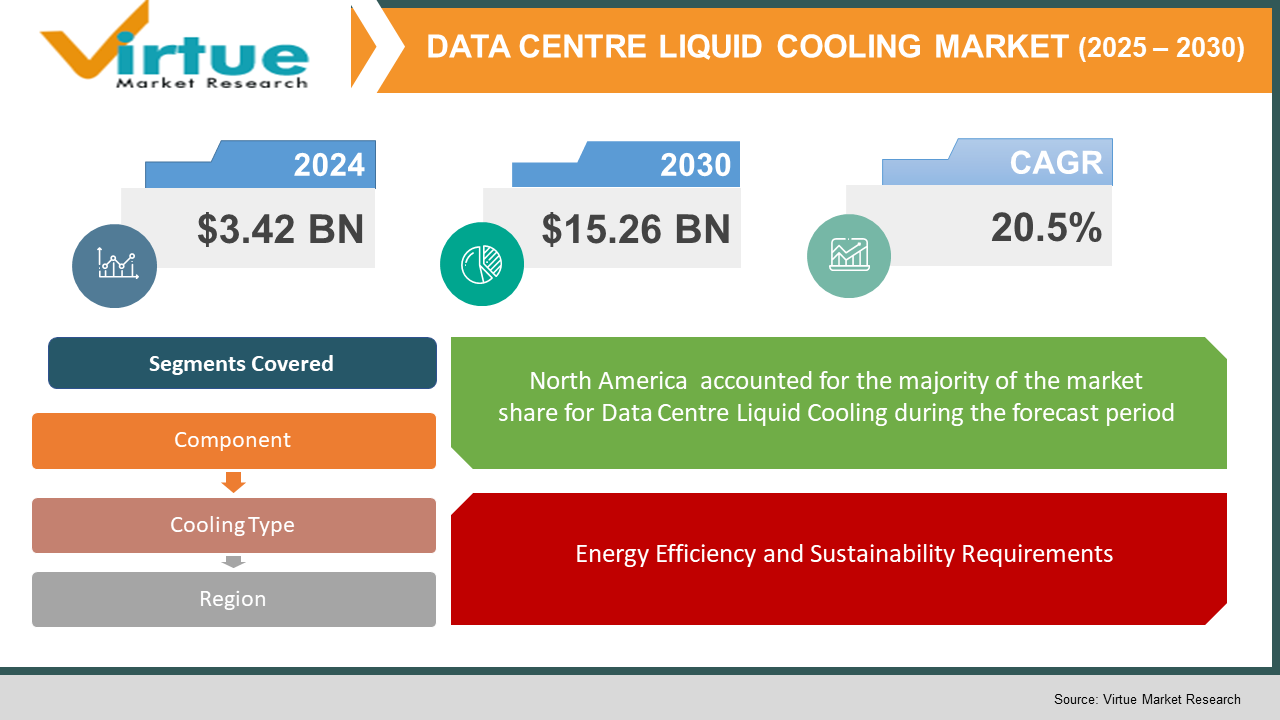

The Global Data Centre Liquid Cooling Market was valued at USD 3.42 billion in 2022 and is projected to reach a market size of USD 15.26 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.5%.

Data Centre Liquid Cooling is an advanced thermal management solution that uses liquid-based coolants to remove heat from high-density computing equipment. As data centres continue to increase in density and computational power, traditional air-cooling methods have proven insufficient, driving the adoption of more efficient liquid cooling technologies to manage thermal loads and reduce energy consumption. The emerging modular data centre segment represents an avenue for growth, with pre-engineered liquid cooling solutions reducing implementation complexity and accelerating deployment schedules by approximately 35% compared to traditional builds, appealing to organisations seeking rapid capacity expansion.

Key Market Insights:

According to a survey by the Uptime Institute in 2022, data centers implementing liquid cooling solutions reported an average of 25% reduction in overall cooling energy consumption, with some facilities achieving reductions as high as 40%, depending on implementation scale and technology choice.

Research from Green Grid indicates that nearly 68% of enterprise data centres face thermal management challenges with their existing cooling infrastructure, creating significant opportunities for liquid cooling adoption as rack densities continue to increase beyond 15kW per rack.

A 2024 industry analysis revealed that data centres utilizing direct liquid cooling systems experienced approximately 30% lower PUE (Power Usage Effectiveness) rates compared to traditional air-cooled facilities, resulting in operational cost savings averaging $1.2 million annually for large-scale deployments.

The International Data Corporation (IDC) projects that by 2025, over 52% of hyperscale data centres will have implemented some form of liquid cooling technology, representing a significant shift from the 18% adoption rate observed in 2021 and indicating accelerated market acceptance.

Data Centre Liquid Cooling Market Drivers:

Increasing Computational Density and heat generation in Modern Data Centres is driving up demand in the liquid cooling market, which is also reinforced by AI advancements as they require large data centres.

The exponential growth in computational demands driven by artificial intelligence, machine learning, and high-performance computing applications has fundamentally transformed the thermal landscape of modern data centers. According to industry benchmarks, the latest generation of AI accelerators and high-performance GPUs can generate heat loads exceeding 700W per component, far surpassing the capabilities of traditional air cooling systems, which struggle to effectively manage thermal loads beyond 15kW per rack. This thermal challenge is compounded by the continued miniaturization of computing components and increased rack densities, with leading hyperscale operators now deploying racks exceeding 45kW in power consumption. Liquid cooling technologies, with their superior thermal conductivity properties—approximately 1,000 times more efficient than air—enable the safe operation of these high-density computing environments. The technology's ability to directly address hotspots at the component level results in more consistent operating temperatures, extending hardware lifespan by an estimated 20-30% and reducing thermal-related failures by up to 40% according to data from the Silicon Valley Leadership Group. Additionally, liquid cooling systems operate with significantly less noise than traditional fan-based systems, allowing for higher density deployments in space-constrained urban environments where noise regulations might otherwise limit operational capacity.

Energy Efficiency and Sustainability Requirements

The data centre industry faces mounting pressure to improve energy efficiency as computational demands accelerate at a pace that outstrips improvements in traditional cooling technology. Liquid cooling systems offer a compelling solution by reducing cooling energy consumption by 30-50% compared to conventional air cooling methods. This efficiency gain stems from the elimination of energy-intensive fans and the ability to capture waste heat at higher temperatures, making it viable for reuse in district heating or other secondary applications. With global data centre electricity consumption projected to reach 8% of total worldwide usage by 2030, operators implementing liquid cooling can achieve significant progress toward sustainability goals while simultaneously reducing operational expenses. The technology aligns with increasingly stringent environmental regulations in key markets like the European Union, where the Energy Efficiency Directive establishes mandatory efficiency targets. Additionally, major cloud providers have announced carbon-neutral or carbon-negative objectives, further accelerating adoption of energy-efficient cooling technologies across the industry.

Data Centre Liquid Cooling Market Restraints and Challenges:

Cooling systems are increasingly complex and have high initial costs to set up, they also need to be standardised so as to work properly for a particular data Centre.

Despite its numerous advantages, the adoption of data centre liquid cooling faces several significant obstacles. The initial capital expenditure for liquid cooling systems typically exceeds traditional air cooling by 25-40%, creating a financial barrier, especially for smaller operators, despite the long-term operational savings. Implementation complexity presents another challenge, as retrofitting existing facilities requires specialized expertise and potential downtime. Industry surveys indicate that 65% of data center managers express concerns about potential leaks and system reliability, although modern systems have failure rates below 0.01%. Standardisation issues further complicate adoption, with competing proprietary technologies creating interoperability challenges—only 30% of current solutions offer cross-vendor compatibility according to the Open Compute Project.

Data Centre Liquid Cooling Market Opportunities:

The data centre liquid cooling market presents substantial growth opportunities driven by the expanding edge computing ecosystem and the global transition to 5G networks. As computational workloads move closer to data generation points, edge facilities face unique thermal challenges in diverse environmental conditions and space-constrained deployments where traditional cooling solutions prove impractical. Liquid cooling's compact footprint and efficiency make it ideally suited for these applications, potentially expanding the addressable market by over $2.8 billion by 2027. The circular economy represents another significant opportunity, with heat recapture systems capable of repurposing waste heat from liquid-cooled data centres for district heating networks, agricultural applications, or industrial processes. Several Scandinavian implementations have demonstrated economic viability, reducing facility heating costs by up to 80% while creating new revenue streams for operators.

DATA CENTRE LIQUID COOLING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

20.5% |

|

Segments Covered |

By component, cooling type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Asetek, Rittal GmbH & Co. KG, Green Revolution Cooling, Vertiv Group Corp., Schneider Electric, Submer Technologies, Chilldyne, CoolIT Systems, Fujitsu Limited, Asperitas |

Data Centre Liquid Cooling Market Segmentation:

Data Center Liquid Cooling Market Segmentation: By Component:

- Solutions

- Services

The solutions segment accounted for the largest market share in 2022, representing approximately 68.5% of the total market value. This category encompasses the physical infrastructure components including cooling distribution units, heat exchangers, containment systems, and coolant delivery networks. The high value of these components, coupled with their essential role in system functionality, drives the segment's dominant market position.

The services segment is anticipated to grow at a CAGR of 22.7% during the forecast period, outpacing the overall market growth rate. This segment includes installation, maintenance, optimization, and consulting services related to liquid cooling deployments. The technical complexity of liquid cooling systems has created significant demand for specialized expertise, with approximately 70% of new installations involving some level of third-party service engagement. Managed cooling services, where providers assume operational responsibility for cooling infrastructure, represent the fastest-growing sub-segment, appealing to organizations seeking to focus internal resources on core business operations rather than facility management.

Data Center Liquid Cooling Market Segmentation: By Cooling Type

- Direct Cooling

- Immersion Cooling.

Direct liquid cooling technologies dominated the market in 2022, accounting for approximately 62% of market share by revenue. This segment includes cold plate technologies that directly contact heat-generating components through thermally conductive materials and specialized coolant delivery systems. The superior thermal performance of these solutions—capable of handling heat loads exceeding 100kW per rack—has made them particularly attractive for high-performance computing installations and AI/ML applications where computational density is prioritized.

The immersion cooling segment is projected to experience the fastest growth rate during the forecast period, with an estimated CAGR of 25.3%. This technology submerges server components directly in dielectric fluids that conduct heat but not electricity, eliminating the need for heat sinks and fans while providing exceptional thermal performance. Single-phase immersion systems are gaining particular traction among cryptocurrency mining operations and high-density enterprise applications, while two-phase immersion cooling—utilizing the fluid's phase change properties—is emerging as the preferred solution for the most demanding computational workloads.

Data Center Liquid Cooling Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America currently leads the data centre liquid cooling market. This dominance is attributed to the presence of major IT and telecom companies such as Google, Amazon, Microsoft, Facebook, and Apple, particularly in the U.S. and Canada. The region's focus on sustainability and government initiatives promoting eco-friendly practices further bolsters market growth. Europe holds a significant share of the market, with a strong emphasis on energy efficiency and sustainability. The region's stringent regulations regarding energy consumption and carbon emissions have led data centre operators to adopt liquid cooling solutions.

Asia-Pacific is projected to be the fastest-growing region in the data centre liquid cooling market during the forecast period. This rapid growth is driven by increasing investments in data centre infrastructure and the rising adoption of cloud computing services. The Middle East and Africa region is in the early stages of adopting data centre liquid cooling technologies. The growing focus on establishing data centres to support digital transformation initiatives, particularly in countries like the United Arab Emirates and South Africa, presents potential growth opportunities.

COVID-19 Impact Analysis on the Data Centre Liquid Cooling Market:

The COVID-19 pandemic initially disrupted the data centre liquid cooling market through supply chain challenges and installation delays, with approximately 40% of planned deployments experiencing postponements of three months or longer during 2020. Component manufacturing was particularly affected, with production capacity for specialized heat exchangers and cooling distribution units reduced by up to 60% during peak lockdown periods. However, these short-term disruptions were counterbalanced by pandemic-induced acceleration of digital transformation initiatives across virtually all industry sectors, significantly increasing computational demands and consequently the thermal management challenges faced by data centre operators. The pandemic ultimately served as a catalyst for liquid cooling adoption as organizations adapted to remote work models and increased reliance on digital infrastructure. The spike in cloud service usage—increasing by 47% year-over-year in 2020—placed unprecedented pressure on data centre cooling systems, highlighting the limitations of traditional approaches and accelerating the evaluation of more efficient alternatives.

Trends/Developments:

The emergence of specialized liquid cooling solutions optimized for AI accelerators represents a significant market trend, with major manufacturers like NVIDIA and AMD collaborating with cooling providers to develop integrated thermal management systems capable of handling the 700W+ thermal envelope of the latest training and inference processors.

Increasing standardization efforts through industry consortia such as the Open Compute Project and the Green Grid are addressing interoperability challenges, with the recent release of the Open Liquid Cooling specification establishing baseline requirements for vendor compatibility and simplified implementation.

Microsoft's Project Natick has demonstrated the viability of sealed, immersion-cooled data centres deployed in underwater environments, achieving a server failure rate 80% lower than comparable land-based facilities by eliminating air exposure and utilizing the natural cooling properties of surrounding seawater, potentially opening entirely new deployment scenarios for the industry.

Key Players:

- Asetek

- Rittal GmbH & Co. KG

- Green Revolution Cooling

- Vertiv Group Corp.

- Schneider Electric

- Submer Technologies

- Chilldyne

- CoolIT Systems

- Fujitsu Limited

- Asperitas

Chapter 1. DATA CENTER LIQUID COOLING MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DATA CENTER LIQUID COOLING MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. DATA CENTER LIQUID COOLING MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. DATA CENTER LIQUID COOLING MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. DATA CENTER LIQUID COOLING MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DATA CENTER LIQUID COOLING MARKET – By Component

6.1 Introduction/Key Findings

6.2 Solutions

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. DATA CENTER LIQUID COOLING MARKET – By Cooling Type

7.1 Introduction/Key Findings

7.2 Direct Cooling

7.3 Immersion Cooling.

7.4 Y-O-Y Growth trend Analysis By Cooling Type

7.5 Absolute $ Opportunity Analysis By Cooling Type , 2025-2030

Chapter 8. DATA CENTER LIQUID COOLING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Cooling Type

8.1.3. By Component

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Component

8.2.3. By Cooling Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Component

8.3.3. By Cooling Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Component

8.4.3. By Cooling Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Component

8.5.3. By Cooling Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. DATA CENTER LIQUID COOLING MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Asetek

9.2 Rittal GmbH & Co. KG

9.3 Green Revolution Cooling

9.4 Vertiv Group Corp.

9.5 Schneider Electric

9.6 Submer Technologies

9.7 Chilldyne

9.8 CoolIT Systems

9.9 Fujitsu Limited

9.10 Asperitas

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Liquid cooling is becoming more popular as it offers better heat dissipation, improved energy efficiency, and supports high-density computing, which is essential for AI, cloud, and HPC applications

Liquid cooling provides higher cooling efficiency, reduces energy consumption, minimizes carbon footprint, and enables compact data centre designs while maintaining optimal performance

Industries such as cloud computing, AI, cryptocurrency mining, banking, and healthcare are increasingly adopting liquid cooling to manage high-performance workloads efficiently.

Challenges include high initial investment, integration complexities, potential leakage risks, and the need for specialized infrastructure and maintenance compared to traditional cooling systems

Liquid cooling reduces water and power consumption, lowers carbon emissions, and supports green initiatives by making data centres more energy-efficient and environmentally friendly.