Thermal Management Technologies Market Size (2024 – 2030)

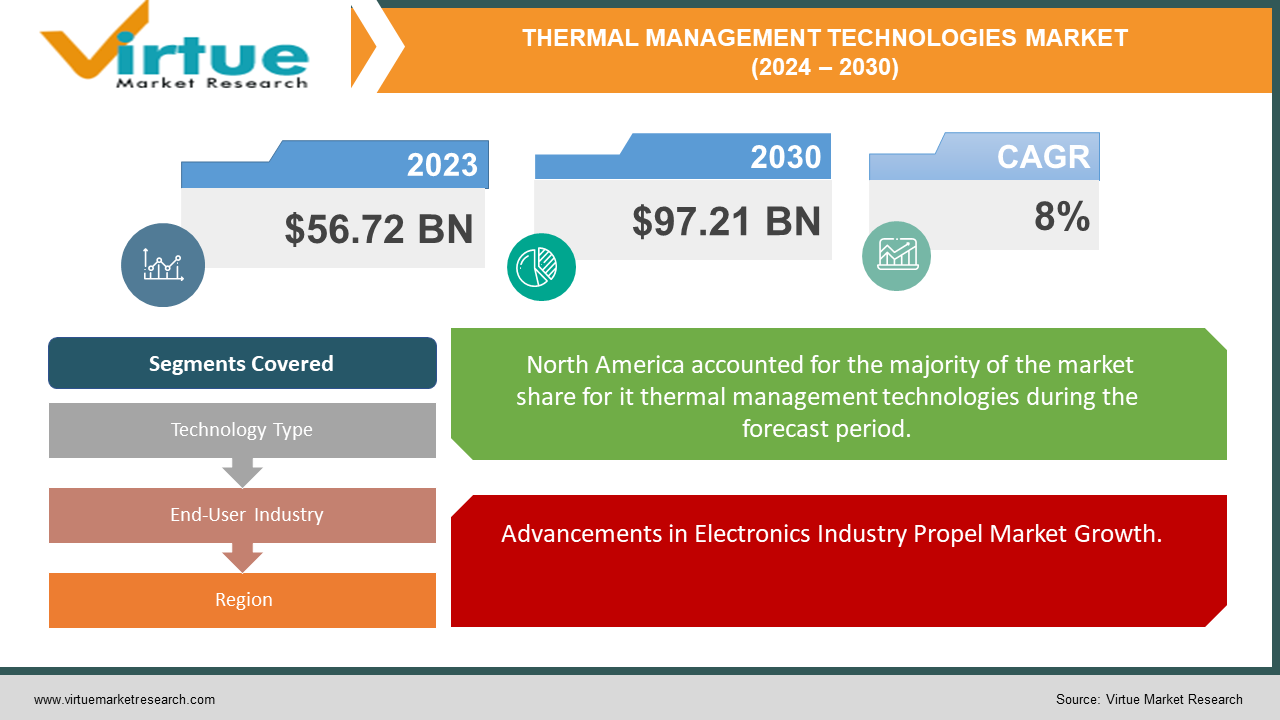

The market for thermal management technologies was estimated to be worth USD 56.72 billion in 2023 and is expected to increase to USD 97.21 billion by 2030, with a projected compound annual growth rate (CAGR) of 8% from 2024 to 2030.

The thermal management technologies market encompasses a diverse range of solutions crucial for dissipating heat efficiently across industries. With the proliferation of electronic devices, electric vehicles, renewable energy systems, and advanced manufacturing processes, the demand for effective thermal management has surged. This market is driven by the need to maintain optimal operating temperatures, enhance energy efficiency, prolong component lifespan, and ensure reliability in various applications. Key technologies such as air cooling, liquid cooling, thermoelectric cooling, phase change materials, and heat pipes continue to evolve to meet increasingly stringent performance requirements. Moreover, as sustainability becomes a paramount concern, there's a growing emphasis on eco-friendly and energy-efficient thermal management solutions. The market is characterized by intense competition, rapid technological advancements, and ongoing innovation, positioning it for robust growth in the coming years.

Key Insights:

The adoption of liquid cooling solutions is expected to witness significant growth, with a projected CAGR of 12% during the forecast period, driven by their superior thermal performance and increasing demand from data centers and high-performance computing applications.

Asia Pacific emerges as the fastest-growing region in the thermal management market, with a CAGR of 10% during the forecast period, fueled by rapid industrialization, urbanization, and the expanding electronics manufacturing sector in countries like China, India, and South Korea.

The automotive sector accounts for the largest share of the thermal management market, with approximately 35% of total revenue in 2023, driven by the rising demand for electric vehicles (EVs) and the need for efficient battery cooling solutions.

Global Thermal Management Technologies Market Drivers:

Advancements in Electronics Industry Propel Market Growth.

In recent years, the electronics industry has experienced unprecedented growth and innovation, characterized by the continuous miniaturization, increased functionality, and higher processing power of electronic devices. This rapid evolution, spanning smartphones, laptops, wearables, and IoT devices, has significantly elevated consumer expectations regarding performance and reliability. However, as devices become more compact and powerful, they generate higher levels of heat, posing challenges for thermal management. Consequently, there's a pressing need for innovative cooling solutions to dissipate heat effectively and maintain optimal operating temperatures. This demand is driving the growth of the global thermal management technologies market, as manufacturers invest in advanced cooling technologies such as liquid cooling systems, heat pipes, and phase change materials to address these challenges. Moreover, the proliferation of emerging technologies like 5G networks, edge computing, and AI-driven applications further amplifies the need for efficient thermal management solutions, positioning the market for substantial expansion in the coming years.

Escalating Demand for Electric Vehicles Fuels Market Expansion.

The automotive industry is undergoing a monumental shift towards electrification, driven by stringent emissions regulations, increasing environmental awareness, and advancements in battery technology. As electric vehicles (EVs) gain widespread acceptance, they present unique thermal management challenges, particularly concerning battery cooling and thermal management of power electronics. High-performance batteries are essential for the efficiency and range of EVs, but they are also prone to overheating, which can degrade performance and lifespan. Consequently, there's a growing demand for innovative thermal management solutions to ensure the efficient cooling of EV batteries and powertrain components. This demand is propelling the growth of the global thermal management technologies market, as automotive manufacturers and suppliers invest in technologies such as liquid cooling systems, thermal interface materials, and active cooling solutions to address these challenges. With the electrification trend expected to accelerate in the coming years, the market for thermal management technologies in the automotive sector is poised for significant expansion.

Proliferation of Data Centers Drives Need for Advanced Cooling Solutions.

The exponential growth of data storage and processing requirements, fueled by trends such as cloud computing, big data analytics, and IoT applications, has led to a corresponding surge in the construction of data centers worldwide. These data centers are critical infrastructure supporting the digital economy, but they also consume vast amounts of energy and generate significant heat. Efficient thermal management is essential to ensure the reliable operation and longevity of data center equipment while minimizing energy consumption and environmental impact. As a result, there's a growing demand for advanced cooling solutions that can effectively dissipate heat and maintain optimal operating temperatures in data center environments. This demand is driving the growth of the global thermal management technologies market, as data center operators and technology providers invest in solutions such as precision air conditioning, liquid cooling systems, and innovative airflow management techniques to address these challenges. With the relentless growth of data traffic and the ongoing expansion of cloud services, the demand for advanced thermal management technologies in the data center sector is expected to continue rising in the foreseeable future.

Global Thermal Management Technologies Market Restraints and Challenges:

Market Fragmentation and Lack of Standardization.

One significant challenge facing the global thermal management technologies market is the fragmentation of solutions and the lack of standardized practices across industries. With various technologies, such as air cooling, liquid cooling, and thermoelectric cooling, available in the market, there is often a lack of uniformity in specifications, performance metrics, and compatibility standards. This fragmentation can lead to interoperability issues, increased complexity in system integration, and difficulties for end-users in selecting the most suitable solutions for their specific requirements.

Environmental Concerns and Regulatory Pressures.

Another restraint impacting the market is the growing emphasis on environmental sustainability and regulatory pressures to reduce carbon emissions and energy consumption. Traditional thermal management technologies, particularly air cooling solutions, often rely on energy-intensive processes that contribute to greenhouse gas emissions and environmental pollution. Additionally, the disposal of thermal management equipment at the end of its lifecycle can pose environmental challenges. As a result, there is increasing scrutiny from regulators and stakeholders to adopt more energy-efficient and eco-friendly cooling solutions, which may require significant investments in research and development and changes in industry practices.

Cost Constraints and Economic Uncertainty.

Cost considerations remain a significant barrier to the widespread adoption of advanced thermal management technologies, particularly for small and medium-sized enterprises (SMEs) and budget-constrained industries. The initial investment costs associated with deploying sophisticated cooling solutions, such as liquid cooling systems or phase change materials, can be substantial, making them financially prohibitive for some organizations. Moreover, economic uncertainties and fluctuating market conditions can further deter investment in thermal management technologies, as companies prioritize cost-saving measures and short-term profitability over long-term efficiency gains.

Global Thermal Management Technologies Market Opportunities:

Rise of Electric Vehicles (EVs) and Renewable Energy.

One significant opportunity in the global thermal management technologies market stems from the rapid growth of electric vehicles (EVs) and the increasing adoption of renewable energy sources. With the global shift towards sustainable transportation and clean energy generation, there is a growing demand for advanced thermal management solutions to ensure the efficient cooling of EV batteries, power electronics, and renewable energy systems. Innovative cooling technologies, such as liquid cooling systems and phase change materials, can help enhance the performance, reliability, and longevity of EVs and renewable energy infrastructure, presenting lucrative opportunities for market players to capitalize on this burgeoning sector.

Expansion of Data Center Infrastructure.

The exponential growth of data storage and processing requirements, driven by trends such as cloud computing, big data analytics, and IoT applications, presents a significant opportunity for thermal management technologies in the data center sector. As data center operators strive to enhance energy efficiency, reduce operational costs, and minimize environmental impact, there is a growing demand for advanced cooling solutions that can effectively dissipate heat and maintain optimal operating temperatures. Technologies such as precision air conditioning, liquid cooling systems, and innovative airflow management techniques offer promising opportunities for market expansion in the data center segment, as companies seek to address the evolving needs of the digital economy.

Emerging Applications in High-Performance Computing (HPC) and AI.

The proliferation of high-performance computing (HPC) applications, artificial intelligence (AI), and machine learning (ML) presents exciting opportunities for thermal management technologies. With the increasing complexity and computational intensity of HPC and AI workloads, there is a growing demand for advanced cooling solutions that can handle the heat generated by high-density computing environments. Liquid cooling systems, immersion cooling technologies, and advanced thermal interface materials offer promising opportunities to address the unique cooling requirements of HPC and AI systems, enabling higher performance, greater efficiency, and improved reliability. As organizations continue to invest in HPC and AI-driven applications across industries such as finance, healthcare, and research, the demand for innovative thermal management solutions is expected to surge, creating new growth avenues for market players.

Integration of Thermal Management in Smart Buildings and IoT Devices.

The integration of thermal management technologies in smart buildings, IoT devices, and connected infrastructure presents promising opportunities for market expansion. With the growing adoption of IoT sensors, smart thermostats, and building automation systems, there is a need for intelligent thermal management solutions that can optimize energy usage, improve occupant comfort, and enhance building performance. Technologies such as predictive analytics, adaptive control algorithms, and distributed cooling systems offer innovative solutions to address the dynamic thermal management requirements of smart buildings and IoT ecosystems. By leveraging these technologies, companies can capitalize on the growing demand for energy-efficient, sustainable, and connected environments, driving market growth in the building automation and IoT sectors.

THERMAL MANAGEMENT TECHNOLOGIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Technology Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, Schneider Electric SE, Vertiv Holdings Co, Honeywell International Inc., Delta Electronics, Inc., Parker Hannifin Corporation, Aavid Thermalloy, LLC (A Subsidiary of Boyd Corporation), Laird Thermal Systems (Formerly Laird Technologies), Advanced Cooling Technologies, Inc., Henkel AG & Co. KGaA (Bergquist), European Thermodynamics Ltd., Boyd Corporation |

Thermal Management Technologies Market Segmentation: By Technology Type

-

Air Cooling

-

Liquid Cooling

-

Thermoelectric Cooling

-

Phase Change Materials (PCM)

-

Heat Pipes

Among the various technology types in the global thermal management technologies market, liquid cooling stands out as one of the most effective solutions for efficiently dissipating heat in diverse applications. Liquid cooling systems utilize coolants such as water or specialized fluids to absorb and transport heat away from heat-generating components, offering several advantages over traditional air cooling methods. Liquid cooling systems can achieve higher heat transfer rates and more uniform temperature distribution, enabling better thermal management of high-power electronics, dense computing environments, and high-performance applications. Moreover, liquid cooling solutions can be tailored to specific cooling requirements and integrated into compact form factors, making them suitable for space-constrained environments and emerging technologies such as electric vehicles and 5G infrastructure. With advancements in liquid cooling technology, including the development of advanced coolant formulations, innovative heat exchanger designs, and efficient pump systems, liquid cooling is poised to play a crucial role in addressing the evolving thermal management needs of modern industries.

Thermal Management Technologies Market Segmentation: By End-User Industry

-

Automotive

-

Electronics

-

Aerospace and Defense

-

Healthcare

-

Energy

-

Consumer Electronics

Among the various end-user industries in the thermal management technologies market, the automotive sector emerges as one of the most significant and impactful. The automotive industry relies heavily on thermal management solutions to ensure the efficient operation and longevity of vehicles, particularly with the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Thermal management technologies play a critical role in maintaining optimal operating temperatures for internal combustion engines, battery packs, power electronics, and electric drivetrains, enhancing vehicle performance, range, and reliability. With the global transition towards electrification and the development of autonomous and connected vehicles, the demand for innovative thermal management solutions in the automotive sector is expected to escalate further. This includes advanced cooling systems, thermal interface materials, and battery thermal management systems designed to address the unique challenges of EVs, such as thermal runaway and fast-charging requirements. Additionally, stringent emissions regulations, sustainability initiatives, and consumer preferences for energy-efficient and eco-friendly vehicles are driving automotive manufacturers to invest in thermal management technologies to improve overall vehicle efficiency and reduce environmental impact. As the automotive industry continues to evolve and embrace new technologies, thermal management solutions will remain integral to ensuring the performance, safety, and sustainability of vehicles in the future.

Thermal Management Technologies Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The global thermal management technologies market is characterized by a diverse distribution of market share across different regions. North America holds the largest share, accounting for approximately 30% of the market, driven by technological innovation, a strong manufacturing base, and robust demand from industries such as automotive, electronics, and data centers. Europe follows closely behind with a market share of 25%, propelled by a focus on sustainability, stringent environmental regulations, and significant investments in electric vehicles and renewable energy systems. Meanwhile, the Asia-Pacific region commands a substantial share of around 27%, driven by rapid industrialization, urbanization, and the proliferation of electronics manufacturing in countries like China, Japan, and South Korea. South America and the Middle East & Africa regions account for smaller but noteworthy shares of 10% and 8%, respectively, with growth opportunities arising from infrastructure development, industrial expansion, and the adoption of digital technologies. These regional variations in market share reflect the diverse economic, regulatory, and technological landscapes shaping the global thermal management technologies market, with each region offering unique growth prospects and challenges for market players.

COVID-19 Impact Analysis on the Global Thermal Management Technologies Market:

The COVID-19 pandemic has had a multifaceted impact on the global thermal management technologies market. While the initial phases of the pandemic led to disruptions in supply chains, manufacturing operations, and project timelines, resulting in temporary setbacks for market players, the subsequent acceleration of digital transformation initiatives and the shift towards remote work and online services created new opportunities for thermal management technologies. With the increased reliance on digital infrastructure, cloud computing, and data-intensive applications during lockdowns and social distancing measures, there was a heightened demand for efficient thermal management solutions to support the robust operation of data centers, telecommunications networks, and critical IT infrastructure. Additionally, the rapid adoption of remote working arrangements and e-commerce platforms drove demand for consumer electronics, smart devices, and connected appliances, further fueling the need for effective thermal management solutions. Looking ahead, as economies recover and industries adapt to the post-pandemic landscape, the global thermal management technologies market is poised for growth, driven by ongoing investments in digital infrastructure, sustainability initiatives, and the continued expansion of emerging technologies such as electric vehicles, renewable energy systems, and high-performance computing.

Latest Trends/ Developments:

The thermal management technologies market is witnessing several notable trends and developments that are shaping its trajectory and driving innovation across industries. One prominent trend is the increasing adoption of liquid cooling solutions, driven by the demand for more efficient and compact cooling technologies in high-performance computing, data centers, and electric vehicles. Liquid cooling offers superior thermal performance and energy efficiency compared to traditional air cooling methods, enabling higher power densities and improved system reliability. Another key trend is the integration of artificial intelligence (AI) and machine learning (ML) algorithms into thermal management systems, enabling predictive maintenance, real-time optimization, and adaptive cooling control. These AI-driven solutions leverage data analytics and sensor technologies to dynamically adjust cooling parameters and anticipate thermal issues before they occur, enhancing system efficiency and reliability. Additionally, there is a growing emphasis on sustainability and environmental responsibility in thermal management technologies, with a focus on developing eco-friendly cooling solutions, utilizing renewable energy sources, and minimizing carbon emissions. Innovations such as phase change materials, thermoelectric generators, and waste heat recovery systems are gaining traction as companies prioritize energy-efficient and environmentally sustainable cooling strategies. Furthermore, advancements in materials science, nanotechnology, and additive manufacturing are driving the development of novel thermal interface materials, heat sinks, and cooling solutions with enhanced thermal conductivity, durability, and form factor. These trends collectively reflect the evolving landscape of thermal management technologies, characterized by a convergence of advanced materials, digitalization, and sustainability principles, and are poised to shape the future of the market in the years to come.

Key Players:

-

Siemens AG

-

Schneider Electric SE

-

Vertiv Holdings Co

-

Honeywell International Inc.

-

Delta Electronics, Inc.

-

Parker Hannifin Corporation

-

Aavid Thermalloy, LLC (A Subsidiary of Boyd Corporation)

-

Laird Thermal Systems (Formerly Laird Technologies)

-

Advanced Cooling Technologies, Inc.

-

Henkel AG & Co. KGaA (Bergquist)

-

European Thermodynamics Ltd.

-

Boyd Corporation

Chapter 1. Thermal Management Technologies Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Thermal Management Technologies Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Thermal Management Technologies Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Thermal Management Technologies Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Thermal Management Technologies Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Thermal Management Technologies Market – By Technology Type

6.1 Introduction/Key Findings

6.2 Air Cooling

6.3 Liquid Cooling

6.4 Thermoelectric Cooling

6.5 Phase Change Materials (PCM)

6.6 Heat Pipes

6.7 Y-O-Y Growth trend Analysis By Technology Type

6.8 Absolute $ Opportunity Analysis By Technology Type, 2024-2030

Chapter 7. Thermal Management Technologies Market – By End-User Industry

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Electronics

7.4 Aerospace and Defense

7.5 Healthcare

7.6 Energy

7.7 Consumer Electronics

7.8 Y-O-Y Growth trend Analysis By End-User Industry

7.9 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. Thermal Management Technologies Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Technology Type

8.1.3 By End-User Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Technology Type

8.2.3 By End-User Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Technology Type

8.3.3 By End-User Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Technology Type

8.4.3 By End-User Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Technology Type

8.5.3 By End-User Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Thermal Management Technologies Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Siemens AG

9.2 Schneider Electric SE

9.3 Vertiv Holdings Co

9.4 Honeywell International Inc.

9.5 Delta Electronics, Inc.

9.6 Parker Hannifin Corporation

9.7 Aavid Thermalloy, LLC (A Subsidiary of Boyd Corporation)

9.8 Laird Thermal Systems (Formerly Laird Technologies)

9.9 Advanced Cooling Technologies, Inc.

9.10 Henkel AG & Co. KGaA (Bergquist)

9.11 European Thermodynamics Ltd.

9.12 Boyd Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for thermal management technologies was estimated to be worth USD 56.72 billion in 2023 and is expected to increase to USD 97.21 billion by 2030, with a projected compound annual growth rate (CAGR) of 8% from 2024 to 2030.

The primary drivers of the global thermal management technologies market include the increasing demand for energy-efficient cooling solutions, the rapid growth of electric vehicles and renewable energy systems, and the expansion of data center infrastructure to support cloud computing and digital transformation initiatives.

One of the key challenges facing the global thermal management technologies market is the fragmentation of solutions and lack of standardization, leading to interoperability issues and increased complexity in system integration.

In 2023, North America held the largest share of the global thermal management technologies market.

Siemens AG, Schneider Electric SE, Vertiv Holdings Co, Honeywell International Inc., Delta Electronics, Inc., Parker Hannifin Corporation, Aavid Thermalloy, LLC (A Subsidiary of Boyd Corporation), Laird Thermal Systems (Formerly Laird Technologies), Advanced Cooling Technologies, Inc., Henkel AG & Co. KGaA (Bergquist), European Thermodynamics Ltd., Boyd Corporation are the main players.