Cultivated Seafood Market Size (2025-2030)

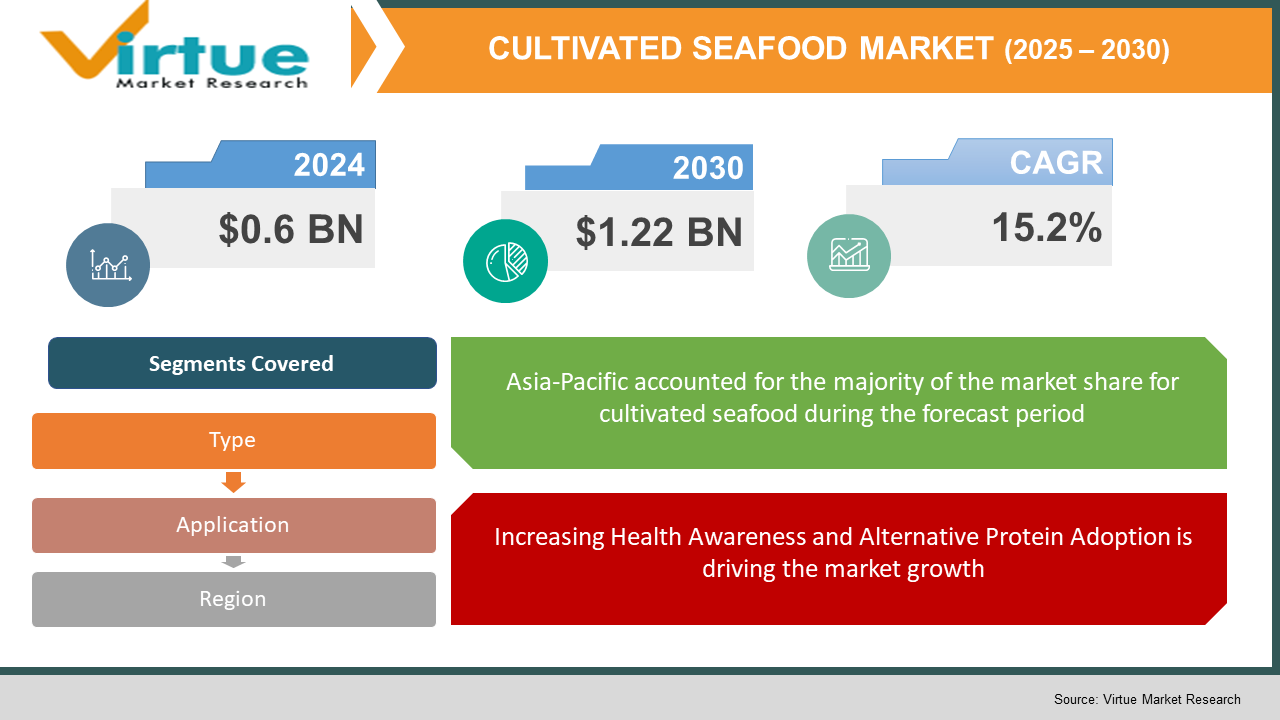

The Global Cultivated Seafood Market was valued at USD 0.6 billion in 2024 and is projected to grow at a CAGR of 15.2% from 2025 to 2030. The market is expected to reach USD 1.22 billion by 2030.

The Cultivated Seafood Market focuses on lab-grown seafood produced through cellular agriculture, offering a sustainable alternative to traditional seafood sources. The industry is gaining traction due to concerns over overfishing, environmental sustainability, and rising consumer demand for ethically sourced and nutritious seafood products. With increasing investments and regulatory approvals, cultivated seafood is set to transform the global seafood industry.

Key Market Insights

- Companies have raised over USD 500 million in funding for cultivated seafood innovation and large-scale production.

- Advancements in bioreactors and cell culture technology are reducing production costs by nearly 30%, enhancing affordability.

- Key players are expanding their product portfolios, with cultivated salmon and shrimp leading in commercialization. Major seafood distributors are partnering with cultivated seafood firms, integrating lab-grown products into mainstream retail chains.

Global Cultivated Seafood Market Drivers

Growing Concerns Over Overfishing and Sustainability is driving the market growth

Overfishing is a major ecological and economic issue, with global fish stocks depleting rapidly. The cultivated seafood market offers a viable alternative, reducing pressure on natural marine resources. Lab-grown seafood eliminates the need for large-scale fishing operations, minimizing the destruction of marine ecosystems. Additionally, it helps tackle bycatch, a problem where unintended marine species are caught and discarded. Sustainability-conscious consumers and industries are increasingly embracing cultivated seafood as a means to preserve aquatic biodiversity. Governments and environmental organizations are supporting this transition through policies promoting sustainable food sources. As awareness grows, the demand for cultivated seafood will continue to rise, making it a key driver of market expansion.

Advancements in Cellular Agriculture and Bioprocessing is driving the market growth

Technological breakthroughs in cellular agriculture, including enhanced bioreactor efficiency and cell scaffolding techniques, have accelerated the commercialization of cultivated seafood. Innovations in cell culture media, derived from plant-based and recombinant sources, have significantly reduced production costs. Companies are developing structured seafood products that mimic the texture and flavor of conventional seafood, improving consumer acceptance. Additionally, genetic engineering is optimizing cell growth rates, making production more scalable. As these advancements continue, cultivated seafood is expected to become a mainstream alternative to wild and farmed seafood, further boosting market growth.

Increasing Health Awareness and Alternative Protein Adoption is driving the market growth

Consumers are becoming more health-conscious, leading to rising demand for high-protein, low-contaminant seafood options. Traditional seafood is often exposed to pollutants, antibiotics, and microplastics, raising health concerns. Cultivated seafood provides a cleaner, controlled environment for seafood production, ensuring safety and nutritional consistency. Additionally, the market benefits from the increasing popularity of alternative proteins among flexitarians, vegetarians, and vegans seeking ethical food choices. The intersection of health awareness, clean-label food trends, and ethical consumerism is propelling the cultivated seafood industry forward.

Global Cultivated Seafood Market Challenges and Restraints

High Production Costs and Commercial Viability is restricting the market growth

Despite technological progress, cultivated seafood production remains expensive compared to traditional seafood. The high cost of cell culture media, bioreactors, and growth factors makes large-scale manufacturing challenging. Additionally, companies must navigate the complexities of achieving price parity with conventional seafood, which is subsidized in many regions. Without significant cost reductions, cultivated seafood may struggle to compete in mainstream markets, limiting its adoption among cost-sensitive consumers.

Regulatory Hurdles and Consumer Acceptance is restricting the market growth

The regulatory landscape for cultivated seafood is still evolving, with different countries implementing varied approval processes. Stringent food safety regulations and lengthy approval timelines pose challenges for companies seeking market entry. Additionally, consumer skepticism toward lab-grown food remains a barrier to widespread adoption. Effective regulatory frameworks, transparency in production methods, and public awareness campaigns will be essential to overcoming these challenges and fostering market growth.

Market Opportunities

The cultivated seafood market presents significant opportunities for investment and innovation. Governments worldwide are increasingly funding research in cellular agriculture, recognizing its potential to enhance food security and sustainability. Companies investing in bioprocess optimization and cost-effective culture media are well-positioned to capitalize on the growing demand for alternative seafood. Furthermore, partnerships between cultivated seafood producers and major retail chains are expanding distribution channels, making lab-grown seafood more accessible to consumers. The Asia-Pacific region, in particular, offers immense growth potential due to its high seafood consumption and progressive stance on food innovation. With ongoing advancements and regulatory support, the cultivated seafood industry is set for exponential growth, opening new avenues for businesses and stakeholders.

CULTIVATED SEAFOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

15.2% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BlueNalu, Shiok Meats, Finless Foods, Wildtype, Avant Meats, |

Cultivated Seafood Market Segmentation

Cultivated Seafood Market Segmentation By Type:

- Fish

- Crustaceans

- Mollusks

- Others

Fish is the dominant segment in the cultivated seafood market, accounting for the largest share due to high consumer demand and ongoing product innovation. Cultivated salmon and tuna are leading products, driven by their premium status and widespread consumption. Companies have focused on replicating the texture and taste of traditional fish through advanced cellular agriculture techniques. Additionally, the sustainability benefits of lab-grown fish make it a preferred alternative to wild-caught and farmed varieties. With increasing regulatory approvals and expanding distribution networks, the cultivated fish segment is expected to witness rapid growth in the coming years.

Cultivated Seafood Market Segmentation By Application:

- Food Industry

- Dietary Supplements

- Cosmetics

- Pharmaceuticals

The food industry holds the largest market share, as cultivated seafood primarily targets consumers seeking sustainable and ethical protein sources. Leading food companies and restaurant chains are integrating lab-grown seafood into their offerings, catering to eco-conscious consumers. The versatility of cultivated seafood allows for its use in various cuisines, from sushi to processed seafood products. Growing health concerns related to conventional seafood contaminants have also driven demand for cleaner alternatives. As consumer awareness increases and price parity improves, the food industry is expected to remain the dominant application segment.

Cultivated Seafood Market Regional Segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific dominates the cultivated seafood market, holding over 40% market share, driven by high seafood consumption and rapid technological advancements in cellular agriculture. Countries like Singapore and Japan are at the forefront of regulatory approvals and investment in cultivated seafood startups. Singapore became the first country to approve lab-grown meat and seafood, setting a precedent for wider adoption in the region. Additionally, Asia-Pacific has a strong demand for seafood-based diets, making it a lucrative market for cultivated seafood products. The region's focus on food security, coupled with government initiatives supporting alternative proteins, is further fueling market growth. Companies are establishing production facilities and forming partnerships with major seafood distributors to scale operations. With rising awareness of overfishing and environmental sustainability, the Asia-Pacific cultivated seafood market is poised for robust expansion.

COVID-19 Impact Analysis on the Cultivated Seafood Market

The unprecedented global disruption caused by the COVID-19 pandemic acted as a powerful catalyst for the alternative protein sector, particularly cultivated seafood, by exposing the vulnerabilities of traditional food supply chains. Lockdowns, travel restrictions, and reduced fishing activities severely impacted the global seafood market, creating shortages and highlighting the critical need for resilient food production systems that are less susceptible to external shocks. This period of instability heightened consumer awareness of food safety and contamination risks, driving a significant shift towards food produced in controlled environments, where hygiene and quality can be meticulously managed. Consequently, cultivated seafood, produced in sterile laboratory settings, emerged as a particularly attractive option, offering a safer and more predictable alternative to wild-caught or farmed seafood. Simultaneously, the pandemic triggered a surge in investor interest in cellular agriculture, with venture capitalists and private equity firms recognizing the long-term potential of cultivated meat and seafood to address food security and sustainability challenges. This influx of capital provided crucial funding for cultivated seafood startups, enabling them to accelerate research and development, scale up production, and advance commercialization efforts. Although the initial stages of the pandemic presented challenges to R&D and production timelines due to lockdowns and resource constraints, the post-pandemic period has witnessed a remarkable acceleration in commercialization efforts. Companies have focused on optimizing production processes, expanding facilities, and forging strategic partnerships to bring cultivated seafood products to market. This surge in activity, coupled with increased consumer awareness and investor confidence, has positioned the cultivated seafood industry for sustained and rapid growth, fostering a more diversified and resilient global food system capable of navigating future disruptions and meeting the evolving demands of a growing population.

Latest Trends/Developments

The burgeoning cultivated seafood sector is experiencing a period of dynamic evolution marked by multifaceted advancements across regulatory frameworks, strategic partnerships, technological innovation, and consumer engagement. Governments worldwide are increasingly recognizing the potential of cultivated seafood to address pressing environmental and food security challenges, leading to the development of tailored regulatory pathways that clarify approval processes and ensure consumer safety, thereby streamlining market access for emerging companies. Simultaneously, a strong focus on economic viability is driving substantial investment in cost-reduction strategies, with companies actively pursuing the optimization of plant-based growth media and the implementation of scalable bioprocesses to minimize production expenses and enhance efficiency. This pursuit of affordability is further bolstered by strategic alliances between established seafood giants and pioneering cultivated seafood firms, facilitating the integration of lab-grown products into existing supply chains and distribution networks, thereby accelerating market penetration and mainstream adoption. The collaborative synergy between traditional and novel seafood production models is fostering a more robust and diversified industry landscape. Moreover, a concerted effort to educate consumers about the environmental and nutritional benefits of cultivated seafood is playing a pivotal role in shaping public perception and driving acceptance. Through targeted marketing campaigns, educational initiatives, and transparent communication, companies are effectively addressing consumer concerns and highlighting the sustainability advantages of lab-grown seafood, positioning it as a viable and responsible alternative to traditional fishing practices. This comprehensive approach, encompassing regulatory clarity, technological innovation, strategic partnerships, and consumer education, is propelling the cultivated seafood industry towards a future of sustainable growth and widespread market adoption, ultimately contributing to a more resilient and environmentally conscious global food system.

Key Players

- BlueNalu

- Shiok Meats

- Finless Foods

- Wildtype

- Avant Meats

- Seafuture

- Umami Bioworks

- CellX

- Forsea Foods

- Bluu Seafood

Chapter 1. CULTIVATED SEAFOOD MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. CULTIVATED SEAFOOD MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. CULTIVATED SEAFOOD MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. CULTIVATED SEAFOOD MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. CULTIVATED SEAFOOD MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CULTIVATED SEAFOOD MARKET – By Type

6.1 Introduction/Key Findings

6.2 Fish

6.3 Crustaceans

6.4 Mollusks

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. CULTIVATED SEAFOOD MARKET – By Application

7.1 Introduction/Key Findings

7.2 Food Industry

7.3 Dietary Supplements

7.4 Cosmetics

7.5 Pharmaceuticals

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. CULTIVATED SEAFOOD MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. CULTIVATED SEAFOOD MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 BlueNalu

9.2 Shiok Meats

9.3 Finless Foods

9.4 Wildtype

9.5 Avant Meats

9.6 Seafuture

9.7 Umami Bioworks

9.8 CellX

9.9 Forsea Foods

9.10 Bluu Seafood

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cultivated Seafood Market was valued at USD 0.6 billion in 2024 and is projected to grow at a CAGR of 15.2% from 2025 to 2030. The market is expected to reach USD 1.22 billion by 2030.

Sustainability concerns, advancements in cellular agriculture, and rising consumer demand for ethical seafood.

Segmented by product type (fish, crustaceans, mollusks, others) and application (food industry, dietary supplements, cosmetics, pharmaceuticals).

Asia-Pacific holds over 40% market share due to high seafood consumption and regulatory support.

BlueNalu, Shiok Meats, Finless Foods, Wildtype, Avant Meats, and others.