Crates and Pallets Packaging Market Size (2024-2030)

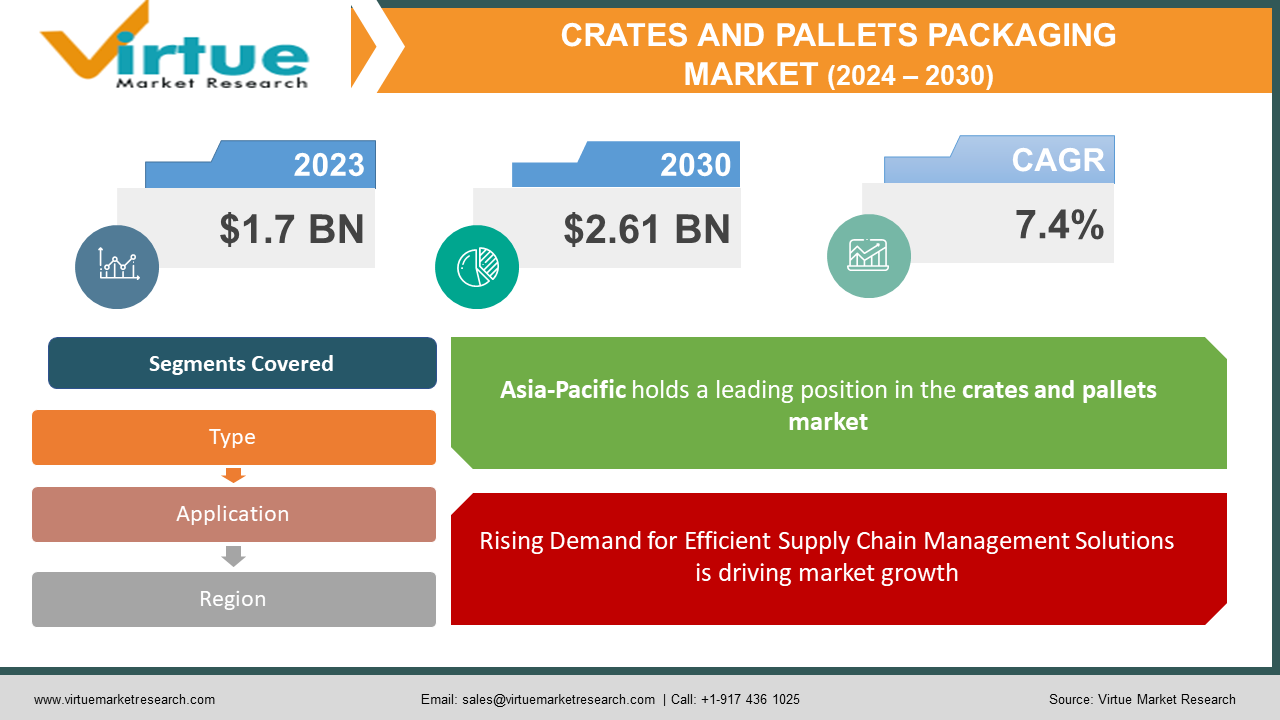

The Global Crates and Pallets Packaging Market was valued at USD 1.7 billion in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2030. By 2030, the market is expected to reach USD 2.61 billion.

Crates and pallets are fundamental to the global supply chain, offering durable, reliable solutions for transporting goods across industries. Used predominantly in logistics, manufacturing, agriculture, and retail sectors, crates and pallets enable efficient storage, handling, and transport of goods. The increasing demand for organized, safe, and efficient supply chain operations across various industries and the shift towards sustainability have spurred the growth of this market. As companies seek durable yet eco-friendly alternatives, wooden, plastic, and metal pallets and crates remain popular, while newer materials such as composite materials are emerging.

Key Market Insights

- Wooden pallets dominate the market, accounting for approximately 75% of global demand due to their cost-effectiveness, durability, and ease of recyclability.

- The plastic pallets segment is growing rapidly, with an estimated CAGR of 5.8% due to their durability, resistance to chemicals, and popularity in hygiene-sensitive industries such as food and pharmaceuticals.

- The Asia-Pacific region holds a dominant market position, representing over 45% of global demand, primarily driven by high industrial activity and significant exports in countries like China and India.

- The e-commerce sector, projected to grow at an annual rate of over 10%, is fueling demand for efficient packaging solutions like crates and pallets for streamlined warehousing and distribution.

Global Crates and Pallets Packaging Market Drivers

Rising Demand for Efficient Supply Chain Management Solutions is driving market growth:

In an increasingly globalized economy, efficient supply chain management is crucial for companies striving to remain competitive. Crates and pallets provide the structural support necessary for safe, streamlined logistics, facilitating goods movement from manufacturers to end customers. Pallets, in particular, are integral to the smooth operation of automated warehousing systems as they allow easy stacking, movement, and storage of goods. With the rise of just-in-time inventory systems, companies require standardized, durable, and reusable pallets to ensure supply chain continuity. Crates and pallets support the high-volume handling required in modern logistics, and as industries adopt these supply chain models, the demand for robust and reliable packaging solutions is expected to remain strong.

Sustainability Goals Driving Demand for Recyclable and Reusable Materials is driving market growth:

Environmental concerns and strict government regulations on waste and emissions are pushing companies to adopt sustainable practices across the supply chain, including packaging materials. Wood, the most common material for pallets, is renewable and can be recycled or repurposed at the end of its lifecycle, aligning with sustainable business practices. Plastic pallets, although initially more expensive, are reusable, durable, and resistant to contaminants, making them popular in sectors with stringent hygiene requirements. Companies increasingly prefer materials that meet environmental standards and offer long-term cost savings. This shift is driving demand for pallets and crates made from recyclable or biodegradable materials, propelling market growth as companies adopt sustainable supply chain practices.

Growing E-commerce and Retail Sectors Requiring Efficient Warehousing Solutions is driving market growth:

The rapid expansion of e-commerce is transforming global supply chains, creating demand for efficient warehousing, handling, and packaging solutions. Pallets and crates play a crucial role in facilitating these requirements, providing essential support for organized storage and quick movement of goods. E-commerce companies require standardized packaging solutions that ensure the safe transport of goods across long distances while minimizing space utilization in warehouses. As the e-commerce industry continues to grow at a double-digit rate, demand for crates and pallets is expected to increase proportionately. With the increasing preference for quick, direct-to-consumer deliveries, companies are investing in pallets that enable rapid order fulfillment, contributing significantly to market expansion.

Global Crates and Pallets Packaging Market Challenges and Restraints

Fluctuations in Raw Material Prices is restricting market growth:

The crates and pallets market heavily depends on raw materials such as wood, plastic, and metal, whose prices are subject to frequent fluctuations due to various factors including supply chain disruptions, inflation, and environmental regulations. The wood pallet segment, which holds the largest market share, is particularly affected by changes in timber prices influenced by deforestation policies, logging regulations, and transportation costs. Plastic and metal prices are similarly volatile, with plastic affected by fluctuations in crude oil prices and metals by mining restrictions and global supply. These cost variations impact the manufacturing expenses for pallets and crates, posing a challenge for companies to maintain profit margins while offering competitive pricing to consumers. Although demand for pallets and crates is strong, raw material cost volatility remains a key restraint for manufacturers, influencing their pricing strategies and profit margins.

Environmental Concerns and Regulatory Challenges is limiting market growth:

As environmental concerns intensify, governments worldwide are implementing stricter regulations on packaging materials to reduce waste and carbon emissions. Wood pallets face regulatory challenges as they often need to meet ISPM-15 standards to prevent the spread of pests across borders, especially for international shipments. For plastic pallets, environmental policies promoting the reduction of plastic waste present a regulatory obstacle, as governments impose stricter recycling mandates and taxes on single-use plastics. These regulatory requirements necessitate additional costs for compliance, certifications, and potential redesigns of products to meet eco-friendly standards. Companies that fail to comply risk fines and loss of market share, especially in markets like the EU, where environmental standards are stringent. Thus, environmental regulations are both a challenge and a catalyst, pushing companies towards more sustainable solutions but adding layers of compliance and costs to the industry.

Market Opportunities

The crates and pallets packaging market offers substantial growth opportunities driven by technological advancements, sustainable solutions, and emerging markets. Automated warehouse systems, increasingly adopted by e-commerce and retail sectors, require standardized pallet sizes that ensure compatibility with robotic handling and inventory systems, creating opportunities for manufacturers to innovate and produce pallets tailored for automated systems. Additionally, as global trade grows, demand for export-grade pallets that meet international shipping standards is rising, particularly in emerging economies. Sustainability is another key area for opportunity; companies are exploring alternative materials such as recycled composites, biodegradable plastics, and even hybrid pallets to meet consumer and regulatory demand for eco-friendly options. Emerging markets in regions such as Asia-Pacific, Africa, and South America, experiencing rapid industrial growth, present lucrative opportunities for pallets and crates manufacturers to support the expanding manufacturing, agriculture, and logistics sectors. Overall, as companies adapt to more sustainable and automated supply chains, the crates and pallets packaging market is poised for significant expansion in the coming years.

CRATES AND PALLETS PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.4% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Brambles Limited, ORBIS Corporation, Schoeller Allibert, Rehrig Pacific Company, Craemer Holding, Loscam, PalletOne Inc., CABKA Group, Falkenhahn AG, Nefab Group |

Crates and Pallets Packaging Market Segmentation

Crates and Pallets Packaging Market Segmentation By Type:

- Wooden Pallets and Crates

- Plastic Pallets and Crates

- Metal Pallets and Crates

- Composite Pallets and Crates

Wooden pallets are the most widely used segment due to their cost-effectiveness, ease of availability, and recyclability, making them a popular choice in industries like manufacturing, agriculture, and logistics.

Crates and Pallets Packaging Market Segmentation By Application:

- Logistics and Transportation

- Manufacturing

- Retail

- Agriculture

- Pharmaceuticals

Logistics and transportation represent the dominant application segment due to the essential role of pallets and crates in streamlining the supply chain, facilitating easy handling and movement of goods across various stages of transportation.

Crates and Pallets Packaging Market Regional Segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific holds a leading position in the crates and pallets market, driven by rapid industrialization, growth in manufacturing activities, and increasing exports from countries like China, India, and Japan. This region’s expanding e-commerce industry also creates significant demand for pallets and crates to support warehousing and distribution needs. Government initiatives supporting infrastructure development and the presence of low-cost labor and raw materials make Asia-Pacific a hub for crates and pallets manufacturing. With an increasing focus on organized logistics and sustainable packaging practices, the region continues to drive global market demand.

COVID-19 Impact Analysis on the Crates and Pallets Packaging Market

The COVID-19 pandemic impacted the crates and pallets packaging market significantly. Disruptions in global supply chains initially led to reduced demand from key sectors such as manufacturing, logistics, and retail, which paused operations or faced restricted trade. However, as the demand for essential goods surged, particularly through e-commerce, there was a shift towards increasing warehouse capacity and investing in efficient packaging solutions, including pallets and crates, to streamline inventory and transportation. Companies began prioritizing resilient, durable packaging solutions that could withstand extended storage and handling times due to the unpredictable market conditions. In addition, hygiene concerns boosted demand for plastic pallets in food and pharmaceutical industries, where washable and chemical-resistant solutions were preferred. Post-pandemic, companies are increasingly focused on robust and agile supply chains, contributing to a steady rebound and growth in the crates and pallets market. Overall, the pandemic highlighted the critical role of efficient packaging in supply chain resilience, fostering a renewed focus on pallets and crates as essential components.

Latest Trends/Developments

Several notable trends are reshaping the crates and pallets packaging market. One significant trend is the shift towards automation and digitization in warehousing and logistics, where pallets compatible with automated systems and IoT-enabled tracking solutions are becoming popular. This technology allows companies to track shipments, optimize inventory, and improve efficiency. Another trend is the growing emphasis on sustainability, with companies adopting reusable and recyclable pallets and exploring eco-friendly materials such as bioplastics and recycled wood composites. The rising demand for hygienic and chemical-resistant pallets in food and pharmaceuticals is driving the market for plastic pallets. Additionally, with the continued growth of e-commerce, demand for lightweight, stackable, and durable pallets and crates is on the rise to support efficient warehousing and quick order fulfillment. These trends reflect the market’s adaptation to technological and environmental changes, enhancing its resilience and appeal across industries.

Key Players

- Brambles Limited

- ORBIS Corporation

- Schoeller Allibert

- Rehrig Pacific Company

- Craemer Holding

- Loscam

- PalletOne Inc.

- CABKA Group

- Falkenhahn AG

- Nefab Group

Chapter 1. GLOBAL CONSUMER HEALTHCARE MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL CONSUMER HEALTHCARE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL CONSUMER HEALTHCARE MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL CONSUMER HEALTHCARE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL CONSUMER HEALTHCARE MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL CONSUMER HEALTHCARE MARKET– BY Type

6.1. Introduction/Key Findings

6.2. Wooden Pallets and Crates

6.3. Plastic Pallets and Crates

6.4. Metal Pallets and Crates

6.5. Composite Pallets and Crates

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL CONSUMER HEALTHCARE MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Logistics and Transportation

7.3. Manufacturing

7.4. Retail

7.5. Agriculture

7.6. Pharmaceuticals

7.7. Y-O-Y Growth trend Analysis By APPLICATION

7.8. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL CONSUMER HEALTHCARE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL CONSUMER HEALTHCARE MARKET – Company Profiles – (Overview, Type Type s Portfolio, Financials, Strategies & Development

9.1. Brambles Limited

9.2. ORBIS Corporation

9.3. Schoeller Allibert

9.4. Rehrig Pacific Company

9.5. Craemer Holding

9.6. Loscam

9.7. PalletOne Inc.

9.8. CABKA Group

9.9. Falkenhahn AG

9.10. Nefab Group

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Crates and Pallets Packaging Market was valued at USD 1.7 billion in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2030. By 2030, the market is expected to reach USD 2.61 billion.

Key drivers include the growing need for efficient supply chain management, sustainability goals encouraging recyclable materials, and the booming e-commerce industry requiring effective warehousing and transportation solutions.

Market segments include wooden, plastic, metal, and composite pallets and crates by product, and logistics, manufacturing, retail, agriculture, and pharmaceuticals by application.

Asia-Pacific is the dominant region, with robust growth in industrialization, manufacturing, and exports, supported by a strong presence in the e-commerce sector.

Leading players include Brambles Limited, ORBIS Corporation, Schoeller Allibert, Rehrig Pacific Company, and PalletOne Inc.