Food Packaging Technology & Equipment Market Size (2024 – 2030)

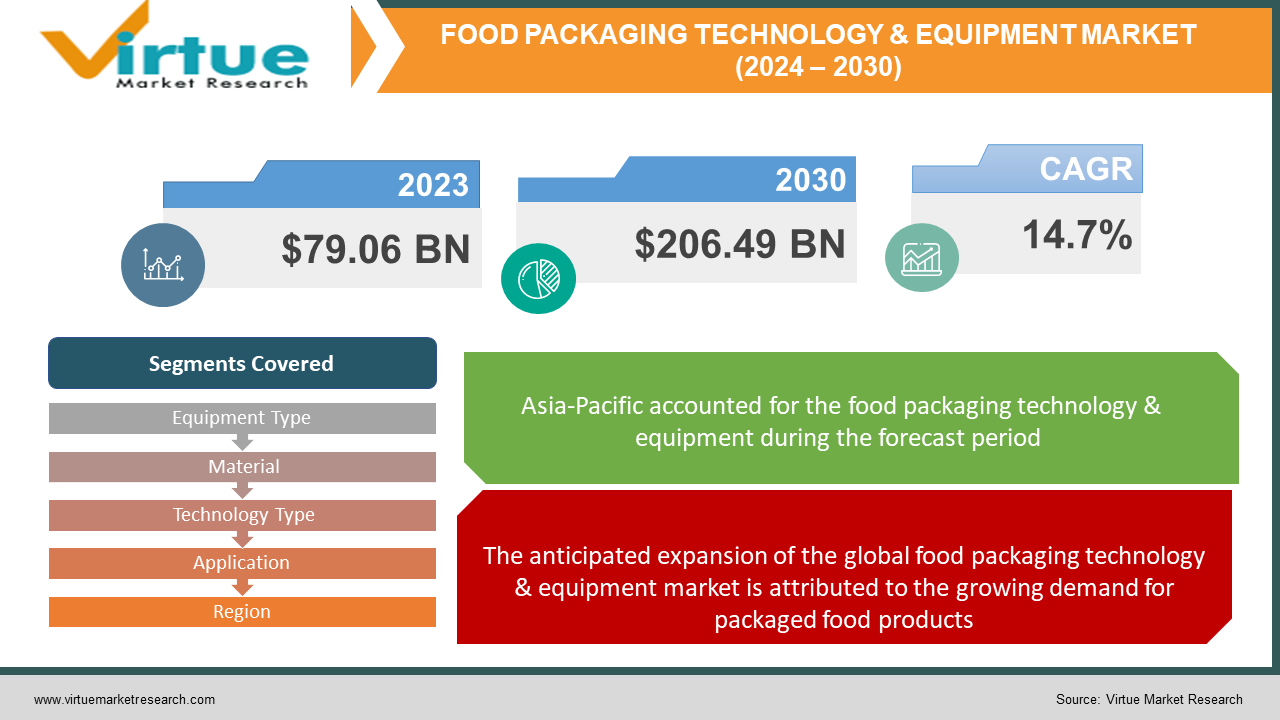

The Global Food Packaging Technology & Equipment Market size was exhibited at USD 79.06 billion in 2023 and is projected to hit around USD 206.49 billion by 2030, growing at a CAGR of 14.7% during the forecast period from 2024 to 2030.

The method employed to shield food items from contamination and uphold their quality by enclosing them in protective materials is referred to as food packaging. Within the realm of the food industry, packaging assumes a critical role as it ensures the safety of food, prolongs the shelf life of products, and facilitates the ease of distribution and transit. The act of encasing food items in protective coverings is pivotal to preventing contamination and upholding the quality of the goods. The significance of packaging in the food sector lies in its ability to extend the shelf life of products, uphold food safety standards, and streamline the processes of distribution and transit. Packaging serves multifaceted purposes beyond the mere protection and preservation of food. Furthermore, it serves as a means to provide consumers with essential information about the product, including nutritional content, ingredients, and usage instructions. Additionally, packaging can be strategically utilized as a marketing tool to attract customers and differentiate products from competitors.

Key Market Insights:

The technology and equipment employed in the packaging process of food products play a crucial role. The machinery and technology designed to safeguard food products from external threats stem from the increasing automation observed in the food and beverages (F&B) sector. Over the years, food packaging technology has undergone significant advancements, incorporating modern methods like modified atmosphere packaging (MAP) and oxygen scavengers. These innovations aid in controlling the oxygen levels that may come into contact with packaged food, preventing food oxidation, and inhibiting the growth of harmful microorganisms, ultimately enhancing the shelf life of the products. On the other hand, food packaging equipment constitutes machinery utilized for the rapid packaging of food products. It proves indispensable for achieving packaging optimization, allowing bulk food products to be packaged in a shorter timeframe compared to manual packaging. Various factors propel the growth of the global food packaging technology and equipment market, and an increase in revenue is anticipated during the projected period.

Global Food Packaging Technology & Equipment Market Drivers:

The anticipated expansion of the global food packaging technology & equipment market is attributed to the growing demand for packaged food products.

This encompasses essential commodities like grains, bakery items, snacks, cereals & breakfast foods, condiments & spices, frozen foods, and a comprehensive array of edible items. The surge in urbanization, coupled with increasingly hectic lifestyles, stands out as a primary catalyst driving the heightened consumption of packaged goods. A significant portion of the urban populace finds it challenging to prepare every meal from scratch due to time constraints. Furthermore, the quick preparation time associated with packaged foods, particularly frozen items or ready-to-eat meals, appeals to individuals seeking to minimize cooking time. Additionally, the proliferation of small to large-scale food retailers, such as supermarkets and hypermarkets, particularly in emerging economies, has facilitated greater access to packaged food products. A recent report revealed that approximately 70% of the American population incorporates some form of processed food into their diet.

Increased Sales Through the Introduction of Novel Food Packaging Equipment.

The escalating pressure on the food industry to meet the demands of a rapidly expanding global population has driven continuous advancements in research and development, leading to the introduction of innovative food packaging equipment. In June 2022, Grace Food Processing & Packaging Machinery, a prominent producer of snacks in the Indian market, unveiled its 'Hot air GRACE pellet snack expander' packaging equipment at the Snack & Bake Tec 2022 event. Subsequently, in August 2023, Ahlstrom, a manufacturer specializing in fiber-based products, collaborated with The Paper People, a sustainable packaging provider, to launch an eco-friendly packaging solution designed for frozen food.

Global Food Packaging Technology & Equipment Market Restraints and Challenges:

The potential expansion of the global food packaging technology & equipment market faces impediments primarily due to the elevated costs associated with the equipment.

Additionally, the advancement of innovative food packaging technology demands substantial research efforts accompanied by significant resource allocation. This scenario could pose obstacles for new entrants seeking to venture into the food packaging technology and equipment industry, while existing companies may grapple with the management of profit margins, particularly in the current volatile commercial landscape. Furthermore, the overall food industry is undergoing rapid transformation as consumers increasingly demand not only higher quality in the food, they consume but also sustainable outer packaging. Given that many plastic-based solutions are environmentally detrimental, companies providing food packaging solutions must align with evolving industry trends, thereby introducing additional barriers to growth.

The Influence of Equipment Downtime or Maintenance on Production Levels Presents a Challenge to Market Growth.

The machines utilized in food packaging operations necessitate periodic maintenance and quality checks, rendering them susceptible to extended downtime, thereby disrupting packaging assembly lines. This directly impacts business operations and poses a significant challenge for global market players to address, in addition to the health and safety concerns associated with the personnel operating the machinery.

Global Food Packaging Technology & Equipment Market Opportunities:

Potential for Growth in Emerging Economies' Food Industry:

There exists substantial untapped potential in the food sector of developing nations experiencing notable increases in per capita income and spending capabilities. As food companies explore these burgeoning regions, participants in the food packaging technology & equipment industry can anticipate heightened demand for innovative systems. In February 2023, Cargill India made a strategic entry into the South Asian market, investing a total of USD 35 million to acquire an existing edible oil manufacturing facility in the Andhra Pradesh region of India. Similarly, in July 2023, Granarolo SpA, Italy's foremost milk group, ventured into the Chinese market, introducing three products tailored to meet the nutritional needs of children up to three years old.

Rising Interest in Smart Food Packaging Technology for Expansion Opportunities.

The increasing adoption of advanced technology presents an avenue for achieving improved outcomes. This encompasses systems related to tracing and tracking, freshness indicators, tamper-evidence, quality sensors, and antimicrobial packaging. In August 2023, researchers at Yonsei University in South Korea delved into the application of cellulose-based hydrogels in food packaging solutions as a fundamental material. This initiative holds the potential to enhance the biocompatibility and biodegradability of packaging materials.

FOOD PACKAGING TECHNOLOGY & EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.7% |

|

Segments Covered |

By Equipment Type, Material, Technology Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bühler Group, Tetra Pak, IMA S.p.A., Robert Bosch GmbH, Uhlmann Group, Multivac, Krones AG, Bemis Company Inc. (Amcor), Coesia Group, GEA Group AG |

Global Food Packaging Technology & Equipment Market Segmentation: By Equipment Type

-

Filling and Dosing

-

Cartoning

-

Wrapping and Bundling

-

Form Fill Seal

-

Labeling and Coding

-

Case Packaging

-

Palletizing

-

Others

The equipment types are categorized into filling and dosing, cartoning, wrapping and bundling, form fill seal, labeling and coding, case packaging, palletizing, and others. The form-fill-seal segment emerged as the market leader, capturing approximately 38.12% market share in 2023. Its dominance is attributed to the heightened speed and adaptability it offers. Notably, snack manufacturers demand systems that can efficiently package diverse products and facilitate swift transitions between a wide array of packaging designs.

Global Food Packaging Technology & Equipment Market Segmentation: By Material

-

Glass & Wood

-

Plastics

-

Paper & Paperwood

-

Metal

-

Others

The materials are segmented into glass & wood, plastics, paper & paperwood, metal, and others. The plastics segment claimed a dominant position in the market, commanding a share of approximately 39.03% in 2023. Plastics have emerged as the preferred packaging material across various industries, including food and beverages. Their popularity is attributed to several advantages over traditional materials. Notably, polyolefins, a type of plastic that does not react with food, are considered a safer option for food packaging.

Global Food Packaging Technology & Equipment Market Segmentation: By Technology Type

-

Active

-

Controlled

-

Intelligent

-

Biodegradable

-

Aseptic

-

Others

The technology type segment is categorized into active, controlled, intelligent, biodegradable, aseptic, and others. The market was led by the biodegradable segment, capturing approximately 31.12% share in 2023. Biodegradable packaging refers to packaging that naturally decomposes and breaks down. It incorporates substances that microorganisms such as bacteria, algae, and fungi can degrade.

Global Food Packaging Technology & Equipment Market Segmentation: By Application

-

Bakery and Confectionery

-

Fruits and Vegetables

-

Dairy Products

-

Meat and Seafood

-

Convenience Food

-

Others

The application segment is divided into bakery and confectionery, fruits and vegetables, dairy products, meat and seafood, convenience food, and others. The dairy products segment emerged as the market leader, holding around 32.26% share in 2023. The adoption of novel biopolymers is on the rise, contributing to the creation of new biodegradable bags, bottles, and caps that resist sterilization and pasteurization. This innovation allows for the safe packaging of dairy products such as fresh milk and probiotic yogurts. Waxed cardboard, composed of approximately 20% plastic and 80% paper, presents an effective solution to prevent contamination in dairy products.

Global Food Packaging Technology & Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is anticipated to spearhead the global food packaging technology & equipment market throughout the forecast period. This prominence is primarily attributed to the rapid economic growth witnessed in Asian powerhouses like China and India, which boast some of the most revenue-generating Food & Beverage (F&B) sectors globally. The heightened regional growth can be attributed to factors such as a burgeoning population, widespread urbanization, and an increasing number of food distributors.

Moreover, developed nations within the Asia-Pacific region, notably Japan and South Korea, exhibit robust food industries, particularly in the domain of packaged food products. Asian countries also play a significant role as exporters of food commodities like sugar, wheat, and rice. The surge in international demand for these products has led to a notable increase in consumption levels related to food packaging technology and equipment.

North America is poised to achieve noteworthy outcomes, with the United States actively investing in research and innovation, thereby fostering the development of novel systems within the food packaging industry.

COVID-19 Impact on the Global Food Packaging Technology & Equipment Market:

The COVID-19 pandemic has significantly influenced the Global Food Packaging Technology & Equipment Market, reshaping its landscape and accelerating certain trends. With heightened consumer awareness regarding hygiene and safety, there has been an increased demand for packaging solutions that ensure the preservation and protection of food products. This has led to a surge in the adoption of advanced packaging technologies and equipment that enhance shelf life and maintain the quality of perishable goods.

Moreover, disruptions in the supply chain and logistics during the pandemic have prompted the industry to focus on sustainable and resilient packaging practices. The emphasis on eco-friendly materials and packaging innovations has gained traction as businesses strive to align with changing consumer preferences and environmental concerns.

As the world navigates through recovery phases, the Food Packaging Technology & Equipment Market is witnessing a transformation marked by innovation, sustainability, and adaptability to the evolving needs of a post-pandemic era. Companies are likely to continue investing in technologies that address food safety, convenience, and environmental sustainability.

Recent Trends and Innovations in the Global Food Packaging Technology & Equipment Market:

In March 2023, EW Cartons, a sustainable corrugated tray manufacturer, became part of Cepac, the United Kingdom's foremost and highly innovative corrugated packaging company.

May 2023 witnessed Amcor, a global leader in the creation of sustainable packaging solutions, completing the acquisition of Moda Systems, a prominent provider of advanced automated equipment for protein packaging.

The international freezing and cooling equipment manufacturer, FPS Food Process Solutions, expanded its portfolio in August 2023 by acquiring GEM Equipment, an Oregon-based company known for its production of fryers and blanchers.

In December 2023, SIG marked a significant development in the industry by inaugurating The Packaging Development Centre, an investment valued at US$10.8 million. This state-of-the-art facility is located at SIG's packaging facilities in Linnich, Germany.

Key Players:

-

Bühler Group

-

Tetra Pak

-

IMA S.p.A.

-

Robert Bosch GmbH

-

Uhlmann Group

-

Multivac

-

Krones AG

-

Bemis Company Inc. (Amcor)

-

Coesia Group

-

GEA Group AG

Chapter 1. Food Packaging Technology & Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Food Packaging Technology & Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Food Packaging Technology & Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Food Packaging Technology & Equipment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Food Packaging Technology & Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Food Packaging Technology & Equipment Market – By Equipment Type

6.1 Introduction/Key Findings

6.2 Filling and Dosing

6.3 Cartoning

6.4 Wrapping and Bundling

6.5 Form Fill Seal

6.6 Labeling and Coding

6.7 Case Packaging

6.8 Palletizing

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Equipment Type

6.11 Absolute $ Opportunity Analysis By Equipment Type, 2024-2030

Chapter 7. Food Packaging Technology & Equipment Market – By Material

7.1 Introduction/Key Findings

7.2 Glass & Wood

7.3 Plastics

7.4 Paper & Paperwood

7.5 Metal

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Material

7.8 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Food Packaging Technology & Equipment Market – By Technology Type

8.1 Introduction/Key Findings

8.2 Active

8.3 Controlled

8.4 Intelligent

8.5 Biodegradable

8.6 Aseptic

8.7 Others

8.8 Y-O-Y Growth trend Analysis End-Use Industry

8.9 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Food Packaging Technology & Equipment Market – By Application

9.1 Introduction/Key Findings

9.2 Bakery and Confectionery

9.3 Fruits and Vegetables

9.4 Dairy Products

9.5 Meat and Seafood

9.6 Convenience Food

9.7 Others

9.8 Y-O-Y Growth trend Analysis By Application

9.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 10. Food Packaging Technology & Equipment Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Equipment Type

10.1.2.1 By Material

10.1.3 By Technology Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Equipment Type

10.2.3 By Material

10.2.4 By Technology Type

10.2.5 By Application

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Equipment Type

10.3.3 By Material

10.3.4 By Technology Type

10.3.5 By Application

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Equipment Type

10.4.3 By Material

10.4.4 By Technology Type

10.4.5 By Application

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Equipment Type

10.5.3 By Material

10.5.4 By Technology Type

10.5.5 By Application

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Food Packaging Technology & Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Bühler Group

11.2 Tetra Pak

11.3 IMA S.p.A.

11.4 Robert Bosch GmbH

11.5 Uhlmann Group

11.6 Multivac

11.7 Krones AG

11.8 Bemis Company Inc. (Amcor)

11.9 Coesia Group

11.10 GEA Group AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Food Packaging Technology & Equipment Market size is valued at USD 79.06 billion in 2023.

The worldwide Global Food Packaging Technology & Equipment Market growth is estimated to be 14.7% from 2024 to 2030.

The Global Food Packaging Technology & Equipment Market is segmented By Equipment Type (Filling and Dosing, Cartoning, Wrapping and Bundling, Form Fill Seal, Labeling and Coding, Case Packaging, Palletizing and Others), By Material (Glass & Wood, Plastics, Paper & Paperwood, Metal and Others), By Technology Type (Active, Controlled, Intelligent, Biodegradable, Aseptic and Others), By Applications (Bakery and Confectionery, Fruits and Vegetables, Dairy Products, Meat and Seafood, Convenience Food and Others).

Future trends in the Global Food Packaging Technology & Equipment Market may include heightened adoption of sustainable materials, increased use of smart packaging technologies, and innovations in biodegradable solutions. Opportunities lie in emerging economies, technological advancements, and catering to the evolving preferences of health-conscious consumers, presenting a dynamic landscape.

The COVID-19 pandemic has accelerated the demand for hygienic and contactless packaging solutions, driving innovation in the Global Food Packaging Technology & Equipment Market. Companies are focusing on ensuring safety, resilience, and supply chain continuity.