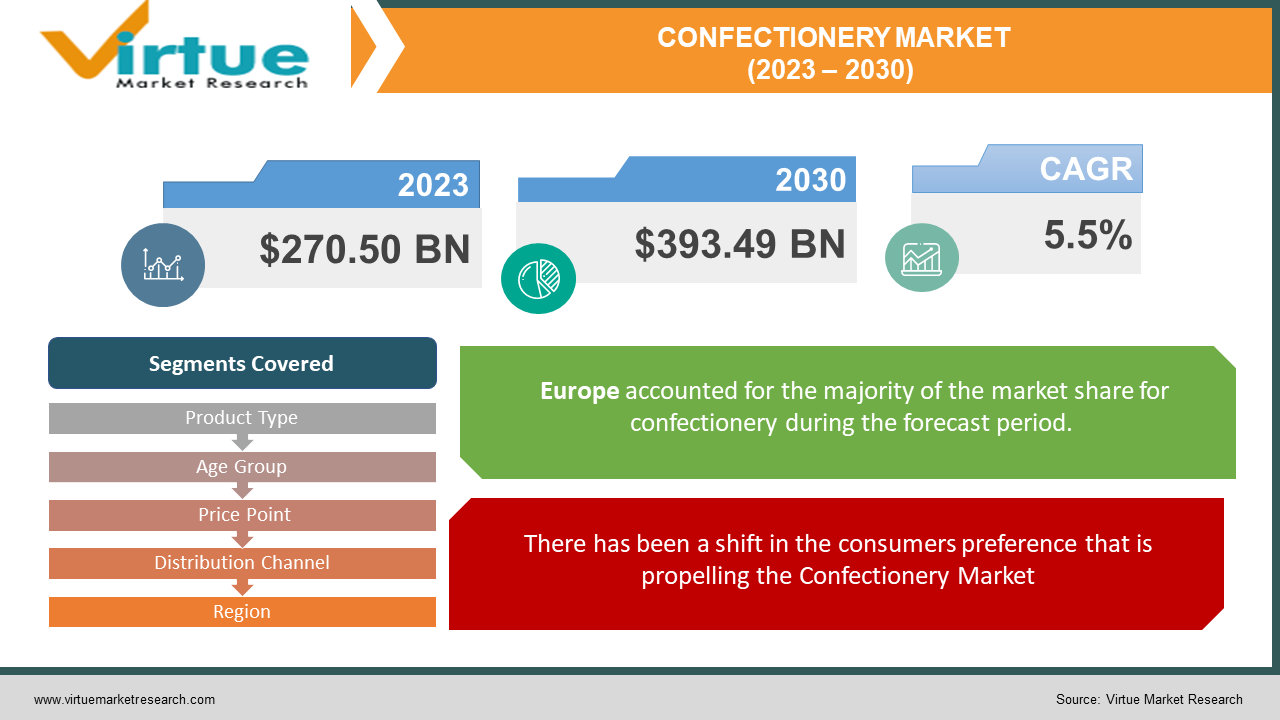

Global Confectionery Market Size (2023-2030)

The Global Confectionery Market was valued at USD 270.50 Billion and is projected to reach a market size of USD 393.49 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.5%.

Confectionery encompasses a wide-ranging category of sweet food items, skillfully crafted to delight the senses. This category includes a delightful array of sugary treats, such as candies, chocolates, pastries, and various sweet indulgences. Confectionery products are a source of joy, often enjoyed as desserts, snacks, or thoughtful gifts. They are the result of a culinary artistry that combines expertise and creativity. These delectable creations can range from intricately designed cakes to simple yet satisfying candies. Confectionery holds a universal appeal, adding sweetness to diverse occasions and celebrations while showcasing the seamless blend of culinary mastery and imaginative craftsmanship.

The confectionery market is experiencing growth due to the ongoing trend toward healthier snacking options and the increasing demand for convenient snacks that offer both great taste and adequate nutritional benefits. Organic snack segments within the confectionery market, particularly those featuring sugar and chocolate products, have gained prominence globally. The rise of modernization and the challenges of a fast-paced lifestyle, where individuals juggle both professional and personal responsibilities, have led to an increased preference for convenient snacks that are easy to prepare and quick to consume. Furthermore, substantial investments by key market players in advertising campaigns, promotional activities, and social media marketing are contributing to the accelerated growth of this market.

Key Market Insights:

Based on data from the National Bureau of Statistics in China, the annual per capita disposable income of urban households in China witnessed a notable increase, rising from USD 2,271.0 in 2008 to USD 3,408.5 in 2012. Similarly, in India, the overall annual disposable income, specifically the median household income, climbed from USD 1,366.2 billion in 2010 to USD 1,587.6 billion in 2013. This rise in income has contributed to the growing preference for confectionery products among consumers with busy schedules, as these treats offer both delectable flavors and convenience. Furthermore, the increasing number of women in the workforce is a significant driver of the global confectionery market, as it leads to higher disposable income for families.

According to data from the U.S. Department of Labor in 2013, there were approximately 127.1 million working women in the United States, a number projected to grow by 5.4% by 2022. Urban populations are more inclined towards the consumption of confectionery compared to their rural counterparts.

The United Nations Department of Economic and Social Affairs (UN DESA) reported that in 2013, the most substantial growth in urban populations occurred in Asian countries, particularly in India and China. By the year 2050, India is anticipated to have 404 million urban dwellers, while China is expected to reach 292 million urban residents.

Global Confectionery Market Drivers:

There has been a shift in the consumers preference that is propelling the Confectionery Market

The global confectionery market is under the significant influence of shifting consumer preferences, which are not solely motivated by convenience and indulgence but also by an expanding spectrum of dietary and cultural considerations. Consumers are increasingly in search of convenient and indulgent snacks that provide immediate satisfaction, a trend further accentuated by the demands of hectic lifestyles, urbanization, and the need for on-the-go snacks. Confectionery products are well-suited to meet these evolving demands, offering a wide range of flavors, textures, and portion sizes to cater to diverse tastes and preferences. Furthermore, the confectionery industry has responded adeptly to the growing demand for dietary inclusivity, introducing options that accommodate various dietary restrictions, including gluten-free, vegan, and allergen-free alternatives. This shift is opening up lucrative opportunities for market expansion.

Manufacturers are offering a wide array of confectionery products which is augmenting the growth of the market

Manufacturers are actively engaged in the creation of enticing flavors and are showing an increasing awareness of health and sustainability concerns. They are consistently introducing innovative products that align with the evolving tastes and preferences of consumers. This innovation involves experimentation with a wide range of ingredients and flavor combinations while prioritizing clean labels, transparency, and ethical sourcing practices. Manufacturers are also incorporating functional benefits into their products, including added vitamins, minerals, and natural ingredients that promote overall wellness. Furthermore, the confectionery industry has witnessed a transformation with the introduction of premium and artisanal options that cater to a growing segment of consumers seeking unique and indulgent experiences. These products often feature intricate packaging that showcases the craftsmanship involved, appealing to consumers' desires for both visual and gustatory delight. This focus on functionality is driving the market's growth.

Extensive distribution networks for confectionery products significantly contribute to the market's expansion.

The global confectionery market is shaped by a dynamic interplay of various retail channels designed to cater to diverse consumer preferences and shopping behaviors. While traditional retail avenues like supermarkets, convenience stores, and specialty shops maintain their significance in product distribution, the landscape has undergone substantial transformation with the rapid ascent of e-commerce. Online platforms have not only introduced convenience to consumers by enabling them to purchase confectionery items from the comfort of their homes but have also revolutionized how manufacturers engage with their audiences. The shift to e-commerce has provided manufacturers with access to a wealth of consumer data, allowing for more personalized and precisely targeted marketing efforts. Moreover, the digital realm offers a platform for innovative and interactive marketing strategies, including immersive website experiences, social media campaigns, and collaborations with influencers. These avenues enable brands to establish direct connections with their audience and foster brand loyalty.

Increasing demand for clean-label and organic-based confectionery products is fueling the Market

The emerging trend among consumers is a preference for healthier snacking options that prioritize convenience and taste, prompting major companies to adopt this strategy to meet the growing demand for health-conscious snacks. Organic chocolate is experiencing a surge in demand as it is free from added chemicals that can pose health risks. Consumers are increasingly opting for vegan, organic, gluten-free, and sugar-free chocolates as they prioritize their health and well-being. As a response to this trend, prominent confectionery companies are introducing new flavored chocolates with innovative packaging that allows consumers to enjoy them in small portions while preserving the remainder for later consumption. The increasing export of organic chocolates is also expected to boost demand for the organic-based confectionery market. Leading companies are diversifying their product offerings by incorporating functional ingredients, tropical fruits, flavor fillings, and nut-based and exotic flavors into organic chocolates to meet evolving customer preferences, thereby driving global growth in the confectionery market.

Global Confectionery Market Opportunities:

The global market for indulgent and premium confectionery experiences is expanding as consumers seek unique and artisanal treats. E-commerce platforms have become essential channels for reaching consumers directly and collecting valuable data for personalized marketing efforts. Furthermore, the increasing consumer focus on sustainability and ethical sourcing provides opportunities for companies to develop eco-friendly packaging and sourcing practices. Finally, expanding into emerging markets, especially in Asia, presents significant growth potential as disposable incomes rise and urbanization continues, leading to increased demand for confectionery products. The global concern over high sugar consumption and its association with various health issues has led many individuals to opt for sugar-free products when indulging in sweets. These sugar-free confectioneries often utilize artificial sweeteners and sugar alcohols in their production. For instance, Hershey, the largest chocolate company in the United States, offers sugar-free versions of popular brands like Hershey's and Reese's, utilizing polyglycerol and maltitol instead of sugar. The growing preference among consumers for healthier lifestyles has fueled the demand for sugar-free confectionery products. Consequently, the introduction of new products with reduced sugar content by manufacturers presents significant opportunities for market growth during the forecast period.

Global Confectionery Market Restraints and Challenges:

Two essential raw ingredients, sugar, and cocoa, are integral to the production of confectionery products worldwide. However, the prices of cocoa and sugar have experienced fluctuations in recent years due to rapid changes in production and demand within the global market. Factors such as adverse weather conditions, labor availability, stock ratios, crop diseases, and various economic issues can all influence the yields of cocoa and sugar, disrupting the seamless balance between supply and demand in the confectionery industry. Consequently, the annual prices of these raw materials exhibit significant fluctuations, oscillating between low and high levels, leading to instances of surplus or understock in the sugar and chocolate goods market. As a result, changes in raw material prices are expected to have a significant impact on overall demand in the coming years.

CONFECTIONERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product Type,Age Group, Price Point, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé S.A., Meiji Co., Ltd., Ferrero Group, Mars, Incorporated, Meiji Holdings Co., Ltd., Mondelez International, Inc., The Hershey Company, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle, Ezaki Glico Co., Ltd |

Global Confectionery Market Segmentation

Global Confectionery Market Segmentation: By Product Type

- Mints

- Chocolate

- Hard-boiled Sweets

- Jellies

- Caramels & Toffees

- Sugar Confectionery

- Fine Bakery

- Others

In 2022, the chocolate segment held the largest market share, contributing to over 45% of the market. The escalating demand for chocolate products spanning all age groups, driven by their irresistible taste, is a key driver of market growth. Chocolate also stands out as the most consumed confectionery product per capita when compared to other confectionery items worldwide. Furthermore, the increasing appetite for organic and premium chocolate products is expected to drive market expansion during the forecast period.

The sugar confectionery segment is poised for the fastest growth rate. Evolving consumer lifestyles and dietary habits are propelling market growth, alongside factors like a growing middle-class population, rising disposable incomes, and urbanization on a global scale. These factors collectively contribute to the positive outlook for market expansion.

Global Confectionery Market Segmentation: By Age Group

- Children

- Adult

- Geriatric

In 2022, the adult category emerged as the dominant segment, capturing a substantial 60% market share. The majority of the global population that consumes confectionery products falls within the adult age range, typically spanning from 16 to 60 years. Notably, millennials are among the most significant consumers of chocolate products, driving this trend. Furthermore, brands are strategically targeting their confectionery products toward this demographic by incorporating innovative features such as unique colors, popping candy, spicy and cooling flavor options, as well as interactive and personalized packaging. However, it is worth noting that the geriatric segment is projected to exhibit a higher compound annual growth rate (CAGR) during the forecast period.

Global Confectionery Market Segmentation: By Price Point

- Economy

- Mid-Range

- Luxury

In 2022, the economy category stood as the dominant segment, capturing a substantial 46% share of the market. Confectionery products categorized as the economy are designed for mass consumption and typically consist of the most affordable options accessible to consumers across various economic strata. Particularly in the realm of chocolate selection, consumers often seek good value for their money. Nevertheless, it's noteworthy that the mid-range segment is anticipated to exhibit a higher compound annual growth rate (CAGR) during the forecast period. Factors such as increasing disposable income, product innovation, evolving consumer preferences and lifestyles, as well as intensified marketing and promotional activities, are expected to drive market growth in the mid-range confectionery products segment.

Global Confectionery Market Segmentation: By Distribution Channel

- Supermarkets/ Hypermarkets

- Convenience stores

- Food Services

- E-Commerce

- Others

In 2022, the supermarket/hypermarket category held a dominant position, commanding a substantial 39% share of the market. The growth of this segment within the confectionery market is attributed to the increasing adoption of supermarkets and hypermarkets in both mature and emerging markets. The convenience of finding a wide range of products under one roof has made these retail formats highly popular among consumers. However, it's noteworthy that the e-commerce segment is projected to exhibit a higher compound annual growth rate (CAGR) during the forecast period. The establishment of online platforms for confectionery products, particularly in developing countries with a large population of internet users, is driving market expansion. These online platforms often offer attractive discounts to attract more customers, and the emergence of advanced technology further facilitates the growth of online businesses worldwide.

Global Confectionery Market Segmentation: Regional Analysis

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

In 2022, Europe played a pivotal role in the global market, contributing over 35% to the overall market share. The market's growth is primarily driven by the increasing popularity and demand for chocolate confectionery products. Furthermore, consumers in this region are showing a growing preference for organic and value-added natural ingredient products, which is a significant factor fueling market expansion. Additionally, the ever-evolving lifestyles and dietary habits of consumers are acting as catalysts for market growth.

On the other hand, the Asia-Pacific region is emerging as the fastest-growing market, poised to witness a notable CAGR of 5.0% from 2022 to 2030. Countries such as China, India, and Japan boast substantial consumer bases for confectionery products, contributing to the regional demand. Moreover, this region is expected to exhibit the highest growth rate over the forecast period, driven by increasing disposable incomes and a rising population.

COVID-19 Impact on the Global Confectionery Market:

The global confectionery market, like many other industries, experienced significant disruptions due to the COVID-19 pandemic. With lockdowns, travel restrictions, and social distancing measures in place, consumer behavior underwent notable changes. The initial stages of the pandemic saw panic buying, leading to increased sales of confectionery products as consumers sought comfort foods. However, as the pandemic continued, there was a shift towards healthier snacking and more conscious choices, impacting the market for traditional sweets and chocolates. Additionally, supply chain disruptions and production challenges posed hurdles for manufacturers. Nevertheless, as the situation stabilized, the confectionery market adapted by introducing new product variants that catered to evolving consumer preferences, including healthier and functional options. E-commerce also played a vital role, as consumers turned to online platforms for their confectionery needs during lockdowns. While the pandemic brought challenges, it also prompted innovation and highlighted the resilience of the confectionery industry in responding to changing market dynamics.

Latest Trends/ Developments:

Consumers are increasingly seeking confectionery products with reduced sugar content, organic ingredients, and natural sweeteners. This shift towards healthier indulgence is driving the innovation of sugar-free and functional confectionery items, such as those fortified with vitamins, minerals, and other wellness-promoting ingredients. Sustainability and ethical sourcing have gained significant importance in the confectionery industry. Consumers are showing a preference for brands that prioritize sustainability, ethical practices, and responsible sourcing of raw materials like cocoa and sugar. As a result, many confectionery companies are making commitments to reduce their environmental footprint and support fair trade practices. In terms of flavors and varieties, the market is witnessing an influx of unique and exotic flavor combinations. Manufacturers are experimenting with diverse ingredients and textures to offer consumers novel taste experiences. Additionally, personalized packaging and artisanal offerings are becoming increasingly popular, catering to consumers' desire for visually appealing and distinctive confectionery products. The confectionery market is embracing the digital age, with the rapid growth of e-commerce channels. Online platforms provide a convenient way for consumers to access a wide range of confectionery products, and brands are using e-commerce for personalized marketing campaigns and direct engagement with their customer base. These trends reflect the dynamic nature of the confectionery market as it adapts to evolving consumer preferences and market demands.

Key Market Players:

- Nestlé S.A.

- Meiji Co., Ltd.

- Ferrero Group

- Mars, Incorporated

- Meiji Holdings Co., Ltd.

- Mondelez International, Inc.

- The Hershey Company

- Chocoladefabriken Lindt & Sprüngli AG

- Perfetti Van Melle

- Ezaki Glico Co., Ltd

In June 2023, in a strategic maneuver aimed at expanding its packaged foods offerings, DS Group completed the acquisition of Good Stuff Pvt Ltd, the owner of the popular chocolate and confectionery brand LuvIt. This move is set to bolster DS Group's position in the chocolates and confectionery segment, aligning with its recent collaboration with Swiss chocolate brand Laderach for the Indian market.

In June 2023, Montezuma's, a chocolate company headquartered in the UK, was acquired by the local enterprise Paramount Retail Group for an undisclosed sum.

Chapter 1. Global Confectionery Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Confectionery Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Confectionery Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Confectionery Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Confectionery Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Confectionery Market– By Product Type

6.1. Introduction/Key Findings

6.2. Mints

6.3. Chocolate

6.4. Hard-boiled Sweets

6.5. Jellies

6.6. Caramels & Toffees

6.7. Sugar Confectionery

6.8. Fine Bakery

6.9. Others

6.10. Y-O-Y Growth trend Analysis By Product Type

6.11. Absolute $ Opportunity Analysis By Product Type , 2023-2030

Chapter 7. Global Confectionery Market– By Age Group

7.1. Introduction/Key Findings

7.2. Children

7.3. Adult

7.4. Geriatric

7.5. Y-O-Y Growth trend Analysis By Age Group

7.6. Absolute $ Opportunity Analysis By Age Group, 2023-2030

Chapter 8. Global Confectionery Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/ Hypermarkets

8.3. Convenience stores

8.4. Food Services

8.5. E-Commerce

8.6. Others

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.8. Absolute $ Opportunity Analysis Distribution Channel, 2023-2030

Chapter 9. Global Confectionery Market– By Price Point

9.1. Introduction/Key Findings

9.2. Economy

9.3. Mid-Range

9.4. Luxury

9.5. Y-O-Y Growth trend Analysis Price Point

9.6. Absolute $ Opportunity Analysis Price Point , 2023-2030

Chapter 10. Global Confectionery Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Product Type

10.1.3. By Age Group

10.1.4. By Price Point

10.1.5. Distribution Channel

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Product Type

10.2.3. By Age Group

10.2.4. By Price Point

10.2.5. Distribution Channel

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Product Type

10.3.3. By Age Group

10.3.4. By Price Point

10.3.5. Distribution Channel

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Product Type

10.4.3. By Age Group

10.4.4. By Price Point

10.4.5. Distribution Channel

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Product Type

10.5.3. By Age Group

10.5.4. By Price Point

10.5.5. Distribution Channel

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Confectionery Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Nestlé S.A.

11.2. Meiji Co., Ltd.

11.3. Ferrero Group

11.4. Mars, Incorporated

11.5. Meiji Holdings Co., Ltd.

11.6. Mondelez International, Inc.

11.7. The Hershey Company

11.8. Chocoladefabriken Lindt & Sprüngli AG

11.9. Perfetti Van Melle

11.10. Ezaki Glico Co., Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Confectionery Market was valued at USD 256.4 Billion and is projected to reach a market size of USD 393.49 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.5%.

A wide array of confectionery products coupled with an extensive distribution network are the drivers.

Based on Product Type, the Global Confectionery Market is segmented into Mints, Chocolate, Hard-boiled Sweets, Jellies, Caramels and Toffees, Sugar Confectionery, Fine Bakery, and Others

China is the most dominant country in Asia-Pacific for the Confectionery Market

Nestlé S.A., Meiji Co., Ltd., Ferrero Group, Mars, Incorporated, Meiji Holdings Co., Ltd., Mondelez International, Inc., The Hershey Company, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle, Ezaki Glico Co., Ltd