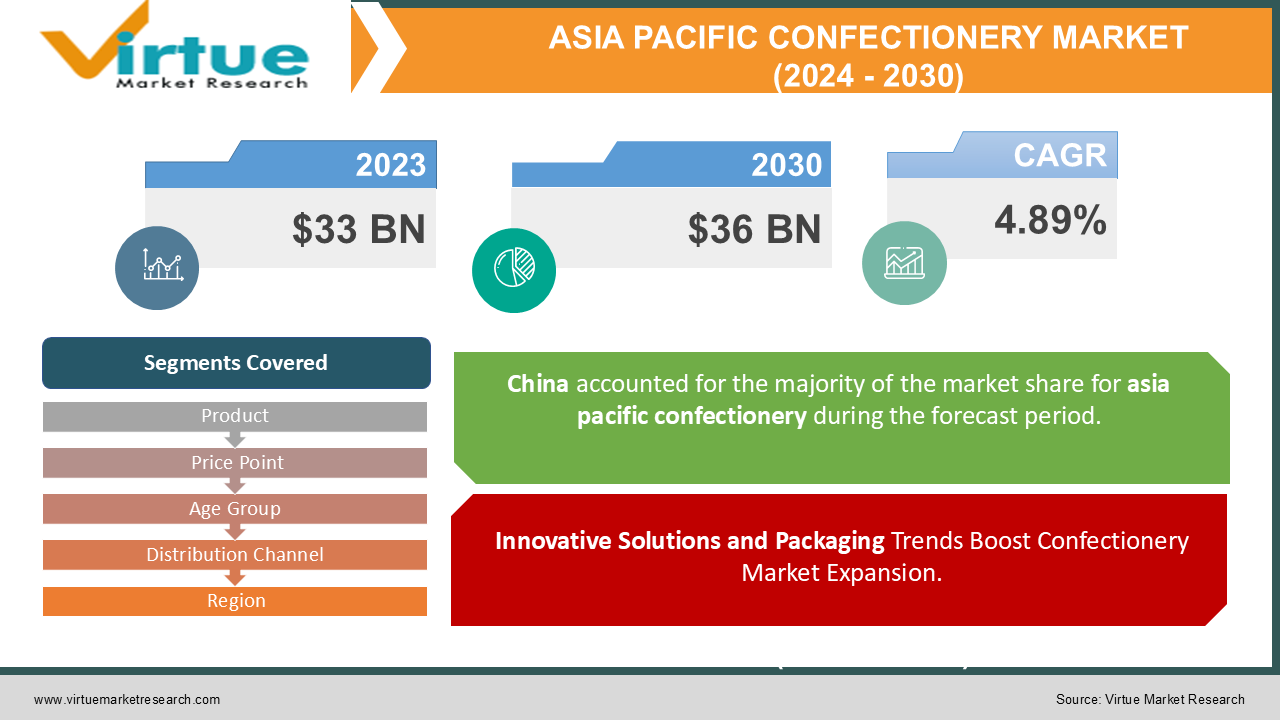

Asia Pacific Confectionery Market Size (2024-2030)

The Asia Pacific Confectionery Market was valued at USD 33 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 36 billion by 2030, growing at a CAGR of 4.89%.

Confectionery involves the art of blending or processing ingredients to produce sweet or flavorful treats, typically high in sugar and carbohydrates. Thus, confectionery processing equipment refers to the machinery used in creating confectionery products like chewing gum, gummies, jellies, hard candies, and soft sweets.

Consumer habits, tastes, and preferences are continually evolving, driving innovation in the confectionery industry and fueling market growth. Manufacturers are broadening their product lines by adding functional ingredients, organic herbal fillings, tropical fruits, and exotic nut-based flavors to meet changing consumer demands. Moreover, the trend of gifting confectionery items such as cookies, chocolates, and bakery goods has notably fueled market expansion in recent years. Brands are employing unique and engaging strategies to attract consumer attention, as many confectionery purchases are driven by impulse buying.

Key Market Insights:

Urbanization and globalization have increased the availability and accessibility of confectionery products through supermarkets, convenience stores, online retail platforms, and specialty shops. The convenience-oriented lifestyles of urban consumers lead to more impulse purchases and on-the-go snacking behaviors. Modern urban lifestyles and a preference for convenience drive these impulse buys and on-the-go snacking habits among consumers.

Asia Pacific Confectionery Market Drivers:

Innovative Solutions and Packaging Trends Boost Confectionery Market Expansion.

Innovation, processing, and packaging are crucial drivers of market growth in the confectionery industry. Health awareness, consumer consciousness, and diverse eating habits fuel innovation. Manufacturers diversify their product lines by including functional ingredients, organic herbal fillings, tropical fruits, and exotic nut-based flavors to meet changing consumer demands. Innovative packaging, such as attractive jars, family-sized packs, resealable options, and bags and tubs, further enhances product sales.

Diversified Retail Market increases market growth.

The retail industry includes companies and individuals who sell finished products to end users. Confectionery products are widely available through various retail channels, including hypermarkets, supermarkets, convenience stores, discounters, forecourt retailers, and grocery stores. Among these, internet retailing, discounters, and convenience stores are experiencing the fastest growth in the confectionery sector. These retail outlets serve as effective marketing tools, boosting brand exposure and creating a premium image for various confectionery products.

Asia Pacific Confectionery Market Restraints and Challenges:

Rise in Health Awareness hinders market growth.

Sugar is widely recognized as a significant contributor to rising obesity and diabetes rates. A Credit Suisse Equity Research survey found that 86% of medical professionals link obesity to high sugar consumption. Consequently, increasing health awareness among consumers has resulted in a decline in the sales volume of sugar confectionery products.

Asia Pacific Confectionery Market Opportunities:

Demand for Organic and Premium Candies creates opportunities.

The trend towards organic and premium candies has attracted a wider consumer base. Many consumers are willing to pay more for organic candies, viewing them as offering additional benefits. The high acceptance of organic chocolates, known for their antioxidant properties, has also been observed. The market for dark and organic sweets is experiencing substantial growth, driven by the health benefits of dark chocolate and its pure ingredients.

ASIA PACIFIC CONFECTIONERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.89% |

|

Segments Covered |

By Product, price point, age group, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China , Japan , India, South Korea , Australia & New Zealand , Rest of Asia-Pacific (APAC) |

|

Key Companies Profiled |

Ferrero Group Mars Incorporated, Chocoladefabriken Lindt & Sprüngli AG, Meiji Co. Ltd., Nestlé S.A., Mondelez International Inc., The Hershey Company, Ezaki Glico Co. Ltd., Pladis, Haribo GmbH & Co. K.G. |

Asia Pacific Confectionery Market Segmentation:

Asia Pacific Confectionery Market Segmentation- By Product:

- Hard Candies

- Chocolates

- Soft Confectionery

- medicated confectionery

- Chewing Gums

- Gummies and Jellies

- Others

During the forecast period, the chocolate segment was the largest contributor to the market. Chocolate is categorized by its cocoa content, with milk chocolate containing 10% cocoa accounting for over 50% of all chocolate consumption, while dark chocolate contains more than 60% cocoa. Chocolate confectionery includes various forms such as boxed assortments, tablets, seasonal chocolates, countlines, alfajores, bagged soft lines, chocolates with toys, and more. Key raw materials for chocolate confections are cocoa butter, milk, lecithin, and flavorings like vanillin. The production process involves roasting, grinding, mixing/refining, and conching. Important factors for manufacturers include gloss retention, bloom stability, flavor, ideal viscosity, and cost. Dark chocolate, rich in antioxidants, is noted for its benefits in preventing cardiac diseases, controlling blood pressure, and reducing wrinkles.

Conversely, the medicated confectionery segment is anticipated to grow rapidly during the forecast period. The increase in minor ailments and rising consumer demand for over-the-counter medications and dietary supplements have led to greater incorporation of active ingredients such as antacids, vitamins, and herbal extracts into confectionery products. These factors are significantly driving the expansion of the medicated confectionery segment.

Australia continues to be the leading chocolate consumer in the Asia-Pacific region. In 2022, Australians spent an average of USD 125.86 per person on chocolate confectionery. In 2021, 49% of Australian adults reported regularly snacking on candy and chocolate.

Asia Pacific Confectionery Market Segmentation- By Age Group:

- Children

- Adult

- Geriatric

The adult segment led the market during the forecast period. The demand for sugar-free gum has risen due to health concerns regarding snacking calories and sugar intake. As a result, gum marketers are developing enjoyable and flavorful products using non-caloric sweeteners. Additionally, the growing trend of veganism among adults has increased the demand for plant-based milk alternatives in bakery confections, such as milk from oats, almonds, coconut, flax, and cashews. Manufacturers can leverage this trend to create lucrative growth opportunities in the fine bakery wares segment.

Asia Pacific Confectionery Market Segmentation- By Price Point:

- Economy

- Mid-range

- Luxury

The economy segment dominated the market during the forecast period. Value remains a significant trend across many markets. Confectionery products in this category are typically sold through supermarkets and hypermarkets, providing a variety of options and multiple purchase deals. These factors collectively present lucrative opportunities for the economy segment.

However, the mid-range segment is expected to experience a higher Compound Annual Growth Rate (CAGR) throughout the forecast period. This growth is driven by increasing disposable incomes, product innovations, evolving consumer preferences and lifestyles, and enhanced marketing and promotional efforts. These elements together contribute to the expansion of the confectionery market within the mid-range product segment.

Asia Pacific Confectionery Market Segmentation- By Distribution Channel:

- Supermarket/hypermarket

- Convenience stores

- Pharmaceutical & drug stores

- Food services

- Duty-free outlets

- E-commerce

- Others

The supermarket/hypermarket segment is dominating the market during the forecast period. The expansion of these retail formats in both developed and developing economies has fueled the segment's growth in the confectionery market. The one-stop shopping experience offered by supermarkets and hypermarkets is highly favored by consumers. These stores, typically located in accessible areas, provide a wide range of products at competitive prices, allowing customers to meet all their shopping needs in one location. This convenience saves time and enhances the appeal of this market segment.

The rise of online portals for confectionery products, especially in developing countries with large internet user bases, is also driving market growth. These platforms provide various discounts and incentives to attract customers to purchase confectionery items online. Technological advancements further boost the growth of online businesses, offering consumers easy access and convenience for shopping for confectionery products from their homes.

Asia Pacific Confectionery Market Segmentation- by region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

China holds the largest market share in the region, driven by its highest consumption of confectionery products. The sales value of confectionery products in China rose by 3.51% in 2023 compared to 2022, attributed to consumer preferences for premium chocolates and a growing interest in intercontinental flavors.

Japan ranks second in the region for confectionery product sales. The sales value of confectionery products in Japan is projected to grow at a CAGR of 3.38% from 2023 to 2030. Consumer trends show a shift towards premium, healthier, sustainable, and ethical products. Consequently, both smaller-scale and medium-to-large-scale manufacturers are operating in the market, which is expected to boost demand for confectionery products during the forecast period.

Australia is the fastest-growing country for confectionery product sales in the region. In 2022, Australians spent an average of USD 133.07 per capita on chocolate products.

COVID-19 Pandemic: Impact Analysis

The COVID-19 outbreak had a significant impact on the confectionery market. Stringent regulations and lockdown measures in 2020 disrupted various aspects of the confectionery industry, including raw material supplies (such as agricultural produce, food ingredients, and intermediate food products), trade and logistics, demand-supply fluctuations, uncertain consumer demand, and workforce challenges. A notable effect was a decline in confectionery sales due to reduced gifting and impulse buying behaviors among consumers during the lockdown period.

Latest Trends/ Developments:

May 2023: Nature Valley introduced its latest innovation, the Nature Valley Savory Nut Crunch Bar, marking the brand's first venture into savory snacks. These bars will be available in three flavors: Everything Bagel, White Cheddar, and Smoky BBQ.

May 2023: The Hershey Company expanded its operations by opening a new research and development center in Johor, Malaysia.

April 2023: The Hershey Company launched the Peanut Butter & Jelly Flavored Protein Bar under the ONE brand. The ONE Limited Edition Peanut Butter & Jelly bars feature 20 grams of protein, 1 gram of sugar, and the classic taste of peanut butter and strawberry jelly.

Key Players:

These are the top 10 players in the Asia Pacific Confectionery Market:

- Ferrero Group

- Mars Incorporated

- Chocoladefabriken Lindt & Sprüngli AG

- Meiji Co. Ltd.

- Nestlé S.A.

- Mondelez International Inc.

- The Hershey Company

- Ezaki Glico Co. Ltd.

- Pladis

- Haribo GmbH & Co. K.G.

Chapter 1. ASIA PACIFIC CONFECTIONERY MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ASIA PACIFIC CONFECTIONERY MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. ASIA PACIFIC CONFECTIONERY MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. ASIA PACIFIC CONFECTIONERY MARK ET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. ASIA PACIFIC CONFECTIONERY MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ASIA PACIFIC CONFECTIONERY MARKET – By Product

6.1 Introduction/Key Findings

6.2. Hard Candies

6.3. Chocolates

6.4. Soft Confectionery

6.5. medicated confectionery

6.6. Chewing Gums

6.7. Gummies and Jellies

6.8. Others

6.9 . Y-O-Y Growth trend Analysis By Product Type

6.10. Absolute $ Opportunity Analysis By Product Type, 2023-2030

Chapter 7. ASIA PACIFIC CONFECTIONERY MARKET – By Age Group

7.1. Introduction/Key Findings

7.2. Children

7.3. Adult

7.4. Geriatric

7.5. Y-O-Y Growth trend Analysis By Age Group

7.6. Absolute $ Opportunity Analysis By Age Group , 2023-2030

Chapter 8. ASIA PACIFIC CONFECTIONERY MARKET – By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience Stores

8.4. Pharmaceutical & drug stores

8.5. Food services

8.6. Duty-free outlets

8.7. E-commerce

8.8. Others

8.9. Y-O-Y Growth trend Analysis Distribution Channel

8.10. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. ASIA PACIFIC CONFECTIONERY MARKET –By Price Point

9.1. Introduction/Key Findings

9.2. Economy

9.3. Mid-range

9.4. Luxury

9.5. Y-O-Y Growth trend Analysis Price Point

9.6. Absolute $ Opportunity Analysis Price Point , 2023-2030

Chapter 10. ASIA PACIFIC CONFECTIONERY MARKET – By Region

10.1. Asia Pacific

10.1.1. By Country

10.1.1.1. China

10.1.1.2. Japan

10.1.1.3. South Korea

10.1.1.4. India

10.1.1.5. Australia & New Zealand

10.1.1.6. Rest of Asia-Pacific

10.1.2. By Distribution Channel

10.1.3. By Age Group

10.1.4. By Price Point

10.1.5. By Product Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. ASIA PACIFIC CONFECTIONERY MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Ferrero Group

11.2. Mars Incorporated

11.3. Chocoladefabriken Lindt & Sprüngli AG

11.4. Meiji Co. Ltd.

11.5. Nestlé S.A.

11.6. Mondelez International Inc.

11.7. The Hershey Company

11.8. Ezaki Glico Co. Ltd.

11.9. Pladis

11.10. Haribo GmbH & Co. K.G.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Urbanization and globalization have increased the availability and accessibility of confectionery products through supermarkets, convenience stores, online retail platforms, and specialty shops

The top players operating in the Asia Pacific Confectionery Market are - Ferrero Group

Mars Incorporated, Chocoladefabriken Lindt & Sprüngli AG, Meiji Co. Ltd., Nestlé S.A., Mondelez International Inc., The Hershey Company, Ezaki Glico Co. Ltd., Pladis, Haribo GmbH & Co. K.G.

The COVID-19 outbreak had a significant impact on the confectionery market. Stringent regulations and lockdown measures in 2020 disrupted various aspects of the confectionery industry, including raw material supplies (such as agricultural produce, food ingredients, and intermediate food products), trade and logistics, demand-supply fluctuations, uncertain consumer demand, and workforce challenges

May 2023: Nature Valley introduced its latest innovation, the Nature Valley Savory Nut Crunch Bar, marking the brand's first venture into savory snacks. These bars will be available in three flavors: Everything Bagel, White Cheddar, and Smoky BBQ.

Australia is the fastest-growing country for confectionery product sales in the region. In 2022, Australians spent an average of USD 133.07 per capita on chocolate products.