Compression Stockings Market Size (2025 – 2030)

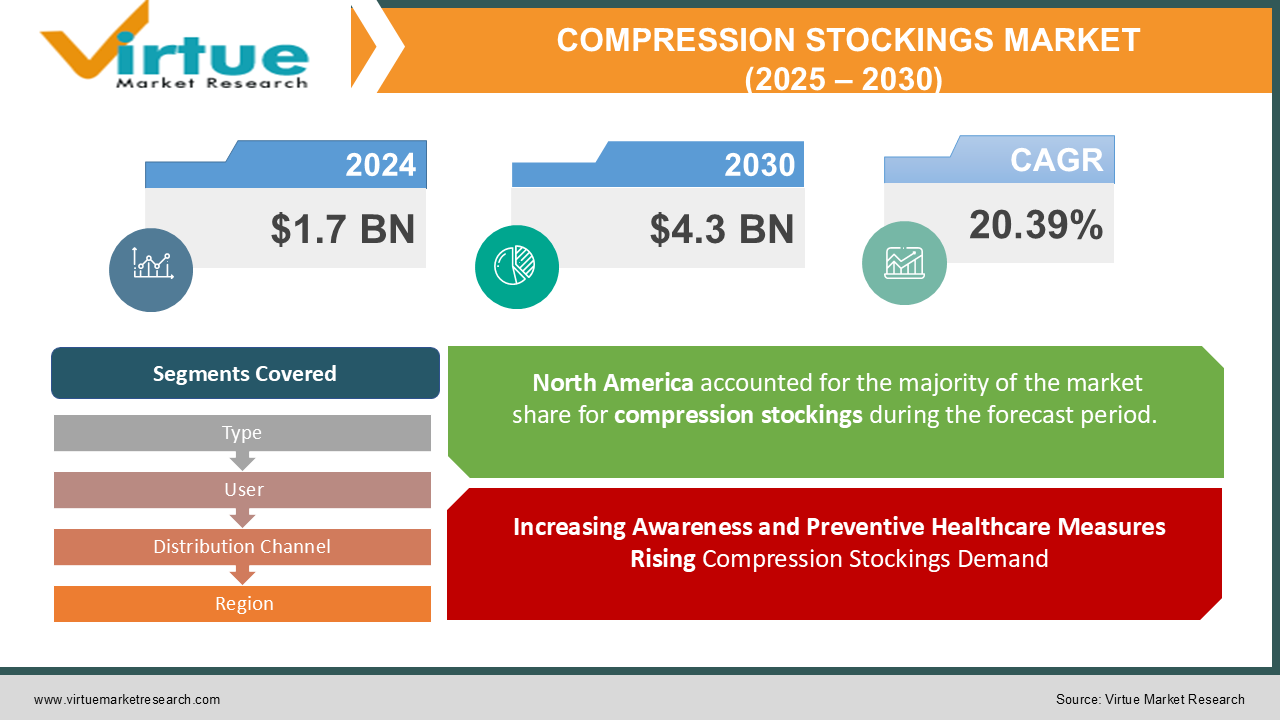

The Global Compression Stockings Market was valued at USD 1.7 billion in 2024 and is projected to reach a market size of USD 4.3 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.39%.

The compression stocking market are those industry that are involved in distributing, producing and selling of specialized garments which are designed in a way that helps to improve leg circulation and also have therapeutic benefits. This market includes manufacturers, suppliers, retailers, and healthcare professionals who cater to individuals seeking relief from conditions such as varicose veins, edema, or deep vein thrombosis. With increasing awareness and demand for leg health products, the compression stockings industry offers a range of options to meet various needs and preferences.

The compression stockings market is experiencing substantial growth, that are influenced by a multitude of industry trends and growth drivers. A prominent factor affecting the market is the escalating occurrence of venous disorders, including varicose veins, deep vein thrombosis (DVT), and chronic venous insufficiency (CVI). This surge in prevalence has created a heightened demand for compression stockings, recognized as an efficacious means of managing and treating these conditions.

Key Market Insights:

-

Athletic and sports applications of compression stockings are also in growth, as various professionals and amateur athletes increasingly using them for enhanced blood circulation and muscle recovery. As far research has shown that compression gear help improving oxygen delivery to muscles by up to 40%, reducing fatigue and enhancing endurance. As a result, the market is experiencing a surge in demand from fitness enthusiasts, marathon runners, and sports professionals, especially in developed markets.

-

Technological advancements are responsible for significantly shaping the compression stockings market, with innovations such as smart compression wear equipped with sensors that monitor blood flow and detect early signs of circulatory issues. Additionally, manufacturers are developing lightweight, breathable, and moisture-wicking fabrics to improve patient compliance. The rise of custom-fitted and gradient compression stockings, which provide 20-30% more effectiveness than standard compression socks, is further contributing to market growth.

-

E-commerce platforms are playing a crucial role in expanding the market, with online sales of compression stockings increasing by over 25% annually in recent years. Consumers prefer toward digital health and telemedicine solutions, purchasing compression garments based on online consultations. The convenience of home delivery and a wider variety of product options are boosting online retail sales, particularly in North America and Asia-Pacific.

-

In Europe, over 60% of prescribed compression stockings are reimbursed, making them more accessible to patients with circulatory disorders. With growing awareness, improved product accessibility, and advancements in material technology, the compression stockings market is expected to continue its upward trajectory in the coming years.

Compression Stocking Market Drivers:

Increasing Awareness and Preventive Healthcare Measures Rising Compression Stockings Demand

With a growing emphasis on preventive healthcare, individuals are becoming more concerned for circulatory disorders and the benefits of compression therapy. Health campaigns and medical professionals actively recommend compression stockings to prevent leg swelling, varicose veins, and deep vein thrombosis (DVT), especially for those in sedentary jobs or long travel durations. This increased awareness is driving early adoption, expanding the market beyond just medical necessity.

Rising Demand from Occupational Sectors with Long Hours of Standing or Sitting

Certain professions, such as healthcare workers, airline crew, retail employees, and office workers, require long standing or sitting, increasing the risk of leg fatigue and poor circulation. Studies shows that over 60% of professionals in standing jobs experience leg swelling or discomfort. The growing demand for workplace wellness solutions has led to an rise in the use of compression stockings as a preventive measure.

Government Initiatives and Insurance Coverage Enhancing Compression Therapy Accessibility

In several regions, government health programs and insurance providers are now offering reimbursement or partial coverage for medical-grade compression stockings. In Europe, more than 60% of prescribed compression stockings are covered by insurance, making them more approachable to patients. These initiatives encourage compliance and increase adoption rates among patients suffering from chronic venous diseases and post-surgical recovery needs.

Rising Demand for Maternity and Postpartum Compression Stockings

Pregnant women often experience swelling, leg pain, and an increased risk of varicose veins due to hormonal and circulatory disbalance. The demand for maternity compression stockings has raised as healthcare professionals recommend their use during and after pregnancy to improve blood circulation and prevent complications like deep vein thrombosis (DVT). This segment is gaining traction, particularly in North America and Europe, where maternal health awareness is high.

Compression Stockings Market Restraints and Challenges:

High Costs, Limited Awareness, and Compliance Issues Retarding the Widespread Adoption of Compression Stockings

Despite the rising demand for compression stockings, various challenges are restraining market expansion. High costs associated with medical-grade compression stockings make them less accessible, especially in low-income regions. Additionally, lack of awareness among the population about the benefits of compression therapy results in lower adoption rates. Many individuals also struggle with comfort and compliance issues, as some compression stockings can feel restrictive or hard to wear for extended periods. Furthermore, insurance coverage limitations in certain countries hinder affordability, restricting the market’s potential. Lastly, counterfeit and low-quality products flooding online markets pose a risk to consumer trust, impacting the sales of certified medical-grade compression stockings.

Compression Stockings Market Opportunities:

The compression stockings market is composed for significant expansion due to increasing applications beyond medical use, especially in sports, fitness, and maternity care. The development of smart compression stockings with real-time circulation monitoring is creating new growth avenues, attracting tech-savvy customers and healthcare providers. Additionally, the rapid growth of e-commerce platforms and direct-to-consumer sales is making compression stockings more accessible to a global audience. Emerging markets in Asia-Pacific and Latin America present untapped potential, driven by rising healthcare awareness and increasing disposable incomes. Furthermore, the increasing focus on preventive healthcare and insurance reimbursement policies in various regions is expected to further drive adoption and market penetration in the upcoming years.

COMPRESSION STOCKINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

20.39% |

|

Segments Covered |

By Type, User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sigvaris Group, Medi GmbH & Co. KG, Essity AB, 3M Company, BSN Medical (Essity), Therafirm (Knit-Rite, Inc.), Juzo, Bauerfeind AG, Tactile Medical, Santemol Group Medikal |

Compression Stockings Market Segmentation: By Type

-

Compression Socks

-

Compression Hosiery

Compression Socks, designed for daily wear, travel, and medical use, dominate the market due to their extensive adoption for preventing swelling, deep vein thrombosis (DVT), and varicose veins. They are mostly preferred by athletes, professionals with prolonged standing or sitting jobs, and individuals with circulatory disorders, making them dominant in the market.

As for Compression Hosiery, which includes stockings, tights, and leggings, is experiencing the fastest growth, driven by increasing demand among women, maternity wear users, and individuals seeking full-leg compression therapy. The growing popularity of fashionable, gradient-compression hosiery that combines medical benefits with aesthetics is fueling its rapid expansion, particularly in urban markets.

Compression Stockings Market Segmentation: By Distribution Channel

-

Offline

-

Online

Offline distribution channels, including pharmacies, medical supply stores, and hospital outlets, influence the market as they provide expert consultation, product trials, and immediate availability, making them the preferred choice for medical-grade compression stockings. Most consumers, especially the elderly and first-time users, rely on in-store purchases for proper fitting and recommendations from healthcare professionals.

However, the online segment is experiencing the fastest growth, driven by the rise of e-commerce platforms, direct-to-consumer brands, and digital health awareness. Online sales have expanded due to the convenience of home delivery, a wider variety of products, easy price comparisons, and increasing telemedicine consultations.

Compression Stockings Market Segmentation: By User

-

Adult Men

-

Adult Women

-

Aged Men

-

Aged Women

Adult Men influence the compression stockings market due to rising demand from athletes, professionals with prolonged standing jobs, and individuals managing circulatory disorders. The increasing awareness of compression therapy in sports recovery and workplace wellness further strengthens leadership in them.

Meanwhile, Aged Women are the fastest-growing segment, driven by rising cases of varicose veins, chronic venous insufficiency (CVI), and post-surgical recovery needs. Hormonal changes, pregnancy-related vascular issues, and an aging population subscribe to the growing demand for medical-grade compression stockings in this group. Additionally, the availability of fashionable, gradient-compression hosiery designed for older women is also fueling market growth.

Compression Stockings Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the compression stockings market, donating approximately 40% of the global share. The region's leadership is influenced by high awareness of venous disorders, a well-established healthcare system, and strong adoption of compression therapy for both medical and sports applications. Additionally, favorable insurance policies and the presence of key market players also reinforce its dominance.

Meanwhile, Asia-Pacific is the fastest-growing region, with a swiftly expanding market due to increasing healthcare awareness, rising disposable incomes, and a rising elderly population prone to circulatory issues. Countries like China, India, and Japan are experiencing high demand for compression wear, fueled by an increase in lifestyle diseases, expanding e-commerce penetration, and rising adoption in sports and fitness sectors.

COVID-19 Impact Analysis on the Global Compression Stocking Market:

The COVID-19 pandemic had a mixed impact on the global compression stocking market. Supply chain disruptions, manufacturing slowdowns, and reduced hospital visits led to a decline in sales, as medical treatments and non-urgent medical consultations were postponed. However, the pandemic also highlighted the importance of preventive healthcare and circulation management, especially for individuals who were housebound or had limited mobility due to extended periods of isolation. Additionally, an increase in remote work and sedentary lifestyles contributed increase in cases of deep vein thrombosis (DVT) and leg fatigue, influencing demand for compression stockings. The surge in e-commerce and direct-to-consumer sales further supported market recovery, as consumers increasingly turned to online platforms to purchase medical and wellness products.

Latest Trends/ Developments:

The compression stocking market is experiencing a surge in technological innovations, with the introduction of smart compression wear that integrates sensor-based monitoring for real-time circulation tracking. These next-generation stockings are designed to analyze blood flow, detect potential clotting risks, and provide users with instant feedback via mobile apps, making them highly tempting for both medical and fitness applications.

The rise of direct-to-consumer brands and e-commerce platforms is significantly transforming the market, making compression stockings more accessible across different regions. Online sales are rapidly increasing due to easy product comparisons, home delivery options, and personalized recommendations based on AI-driven sizing tools. Additionally, brands are offering custom-fit and fashion-oriented compression stockings, catering to younger consumers who enjoy both medical benefits and aesthetic appeal. The growing focus on sustainable and eco-friendly materials, such as recycled fibers, is also shaping consumer preferences, driving further innovation in the industry.

Key Players:

-

Sigvaris Group

-

Medi GmbH & Co. KG

-

Essity AB

-

3M Company

-

BSN Medical (Essity)

-

Therafirm (Knit-Rite, Inc.)

-

Juzo

-

Bauerfeind AG

-

Tactile Medical

-

Santemol Group Medikal

Chapter 1. Compression Stockings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Compression Stockings Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Compression Stockings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Compression Stockings Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Compression Stockings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Compression Stockings Market – By Distribution Channel

6.1 Introduction/Key Findings

6.2 Offline

6.3 Online

6.4 Y-O-Y Growth trend Analysis By Distribution Channel

6.5 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 7. Compression Stockings Market – By User

7.1 Introduction/Key Findings

7.2 Adult Men

7.3 Adult Women

7.4 Aged Men

7.5 Aged Women

7.6 Y-O-Y Growth trend Analysis By User

7.7 Absolute $ Opportunity Analysis By User, 2025-2030

Chapter 8. Compression Stockings Market – By Type

8.1 Introduction/Key Findings

8.2 Compression Socks

8.3 Compression Hosiery

8.4 Y-O-Y Growth trend Analysis By Type

8.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 9. Compression Stockings Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Distribution Channel

9.1.3 By User

9.1.4 By Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Distribution Channel

9.2.3 By User

9.2.4 By Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Distribution Channel

9.3.3 By User

9.3.4 By Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Distribution Channel

9.4.3 By User

9.4.4 By Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Distribution Channel

9.5.3 By User

9.5.4 By Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Compression Stockings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sigvaris Group

10.2 Medi GmbH & Co. KG

10.3 Essity AB

10.4 3M Company

10.5 BSN Medical (Essity)

10.6 Therafirm (Knit-Rite, Inc.)

10.7 Juzo

10.8 Bauerfeind AG

10.9 Tactile Medical

10.10 Santemol Group Medikal

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Compression Stockings Market was valued at USD 1.7 billion in 2024 and is projected to reach a market size of USD 4.3 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.39%.

Leading prevalence of venous disorders, growing aging population, and increasing awareness of compression therapy.

Based on type, the Global Compression Stockings market is segmented into compression socks and compression hosiery.

North-America is the dominant region of the Global Compression Stockings market.

Sigvaris Group, Medi GmbH & Co. KG, Essity AB, 3M Company are the leading companies of the Global Compression Stocking market.