Compression Garments and Stockings Market Size (2024 – 2030)

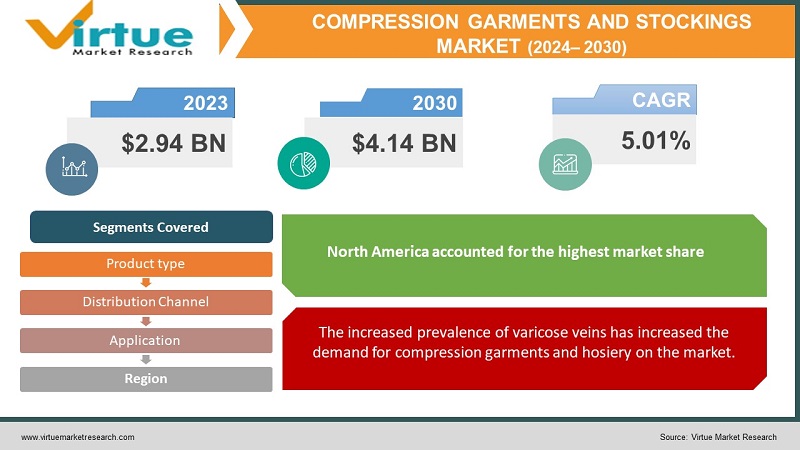

The Global compression garments and stockings market was valued at USD 2.94 billion and is projected to reach a market size of USD 4.14 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.01%.

In the past, compression garments and stockings were used as restraints as the use of staples such as bandages and tight clothing materials to reduce muscle problems increased. In addition, joint disorders, lymphedema, vein-related problems, and more have been treated with specialized treatments and surgeries. However, technological advances in medical clothing, compression garments, and hosiery have seen an increase in the market, especially among athletes and the elderly seeking support for treating muscle pain and swelling. This further led to the development of various innovative products such as compression socks, compression bras, compression knee pads, compression sleeves, compression stockings, and more. However, one-size-fits-all proved to be a problem for many consumers, which further led to the development of customized compression garments and hosiery services in the market. Many companies now offer custom design solutions in the compression clothing section that maximize comfort and minimize muscle and joint problems. In addition, the future of compression garments and hosiery is positive, with continuous advances in technology aimed at producing temperature-regulating compression garments that can help regulate the body's temperature with the outside environment. Additionally, consumer demand for sustainable clothing has further driven the development of eco-friendly compression garments and hosiery on the market.

Key Market Insights:

According to the Chicago Vein Institute, 50% of patients have a family history of varicose veins.

Furthermore, according to the WHO, approximately 1.71 billion people worldwide suffer from musculoskeletal disorders.

According to arthritis tests by SRL Diagnostics Laboratories in India, there are more than 180 million cases of arthritis in India, and about 14% of Indians seek medical intervention for joint disease.

According to Johns Hopkins Medicine, 62% of organized sports affiliates take place during practice.

Compression Garments and Stockings Market Drivers:

Growing demand from athletes has increased the demand for compression garments and hosiery on the market.

Athletes are among the main users of compression underwear and stockings, as they help them improve blood circulation and reduce muscle injuries during strenuous training and demanding practices. Additionally, compression garments such as ankle socks, wraps, compression bras, and more help minimize muscle fatigue and reduce stress on the body's veins. In addition, it helps increase their sports performance by providing support to the joints, ligaments, and tissues. In addition, compression sleeves help to quickly recover from injuries after exercise or training.

The increased prevalence of varicose veins has increased the demand for compression garments and hosiery on the market.

Varicose veins are a serious health problem that causes swelling and enlargement of the veins in the legs. They are very painful and reduce leg function by causing discomfort such as muscle spasms, throbbing, burning, and discoloration of the skin where the varicose veins are located. In addition, it is most often found in women, the elderly, obese people, and diabetic people. Compression garments and stockings are a preventative measure for people suffering from varicose veins, as they help improve blood circulation by applying pressure to the ankle and lower leg. In addition, compression stockings above the knees and thighs are widely used to treat varicose veins in the elderly.

Compression Garments and Stockings Market Restraints and Challenges:

Sizing issues can reduce the market demand for compression garments and hosiery. The increased presence of one-size-fits-all compression stockings may reduce the effectiveness of the garment and reduce consumer demand for it in the marketplace.

In addition, market saturation may reduce the demand for compression garments and hosiery in the market. Due to the presence of a large number of compression manufacturers in the market, competition is increasing, which often leads to price fluctuations and the production of similar-looking products in the market.

Moreover, a lack of consumer awareness about the benefits of compression garments and stockings may reduce the demand for compression garments and stockings in the market.

Compression Garments and Stockings Market Opportunities:

The compression garments and hosiery market is expected to provide lucrative opportunities for businesses that include acquisitions, partnerships, collaborations, product launches, and agreements during the forecast period. Furthermore, increasing demand for comfortable and cushioned clothing, especially from athletes and the elderly to reduce muscle pain, is projected to develop the compression garments and hosiery market and increase its future growth prospects.

COMPRESSION GARMENTS AND STOCKINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.01% |

|

Segments Covered |

By Product type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M, SIGVARIS, Therafirm, Santemol Group Medikal, Leonisa Inc, Comfort Plus Corporation, Medico International Inc, BIOCOMPRESSION SYSTEMS, Nouvelle, Tynor, Kinex Medical Company, Others |

Compression Garments and Stockings Market Segmentation: By Product Type

-

Compression garments

-

Compression stockings

In 2022, based on market segmentation by product type, compression stockings accounted for the highest market share of approximately 29%. The growth of this segment is attributed to the increase in musculoskeletal disorders, especially among the elderly population. Compression stockings include knee-high compression stockings, which are used to treat inefficiencies in the knees and lower legs; thigh-high compression stockings, which are used to cover the entire ice for compression of extreme conditions affecting the entire leg, such as varicose veins; and compression stockings over stockings, which are used to provide compression of the entire leg, starting from the abdomen.

Compression garments are the fastest-growing segment during the forecast period. The growth of this segment is attributed to the increasing demand for compression sleeves and suits from athletes and sportsmen to reduce muscle soreness and muscle vibration. Additionally, compression chest pieces such as compression bras are increasingly being used by athletes looking for support during strenuous activities.

Compression Garments and Stockings Market Segmentation: By Application

-

Varicose veins

-

Burns

-

Oncology

-

Wound care

-

Others

In 2022, based on market segmentation by application, varicose veins accounted for the highest share of approximately 36% of the market. Varicose veins cause leg swelling and pain, which can be reduced by using compression stockings. These stockings support the leg and help improve blood circulation by applying gentle pressure to the ankles and then to the entire leg. In addition, stockings for varicose veins are increasingly used by seniors who suffer from diabetes, obesity, problems with water retention in the legs, and others.

Oncology is the fastest-growing segment during the forecast period. Oncology applications of compression garments and stockings include sleeves, gloves, chest and back garments, and others, which are used primarily to treat damage caused by cancer treatment. In addition, cancer treatment can lead to a blockage of the lymphatic system, which affects the limb and leads to swelling and pain in the legs and the whole body. This can be reduced by using compression garments that reduce pain by applying pressure to the affected area.

Compression Garments and Stockings Market Segmentation: By Distribution Channel

-

Hospitals and clinics

-

Ambulatory Surgical Centers

-

Online sales

-

Others

In 2022, based on market segmentation by distribution channels, hospitals and clinics accounted for the highest market share of about 40%. Physiologists and orthopaedists often prescribe compression garments and stockings to treat musculoskeletal disorders that can affect leg and muscle function over the long term. In addition, many hospitals and clinics have stores that sell compression garments and hosiery, allowing patients easy access to medical clothing.

The online sales segment is the fastest-growing segment during the forecast period. Online channels offer customers easy delivery and comparison of compression garments and hosiery products, leading to increased demand for them in the online market. Moreover, the increased online presence of pharmaceutical and medical companies has further increased consumer demand for compression garments and hosiery in the market.

Compression Garments and Hosiery Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

In 2022, based on market segmentation by region, North America accounted for the highest market share of about 45%. The increased prevalence of varicose veins, especially among the elderly and women, and the presence of an advanced healthcare sector have contributed to the demand for compression garments and savings in the region.

Asia-Pacific registered as the fastest-growing region during the forecast period. Rising cases of arthritis among the elderly and increasing demand for compression garments such as sleeves and abdominal garments by athletes and sportsmen for better support of the joints and muscles of the body have contributed to the demand for compression garments and hosiery in the region.

COVID-19 Impact Analysis on the Compression Garments and Stockings Market

The pandemic has had a significant impact on the compression garment and stocking markets. The increase in infected patients in hospitals and clinics during the pandemic led to an increased demand for compression garments that improved patients' blood flow. However, the compression garment and hosiery market has seen a slowdown due to disrupted supply chains that have caused delays in the production and distribution of these garments to consumers. In addition, sports activities were temporarily stopped, which further reduced the demand for compression garments and hosiery on the market. Additionally, during the later phase of the lockdown, there was a surge in demand for compression garments and supplies from e-commerce platforms, particularly from home care patients.

Latest developments:

• In May 2023, CEP Compression launched a mid-cut, no-show training sock designed to protect against joint and ligament injuries during training. In addition, the product has a padded insole, which offers customers shock absorption and comfort. In addition, the mid-cut training socks offer 20–30 mmHg compression at the ankle during exercise, and the no-show training shocks offer comfortable cushioning to help reduce foot pain.

• In March 2023, England Athletics partnered with Pressio, a leading compression clothing brand. The goal of this partnership is to design and redefine compression products for athletes and runners. In addition, these products are biodegradable, sustainable, and based on dye-free technology.

Key Players:

-

3M

-

SIGVARIS

-

Therafirm

-

Santemol Group Medikal

-

Leonisa Inc

-

Comfort Plus Corporation

-

Medico International Inc

-

BIOCOMPRESSION SYSTEMS

-

Nouvelle

-

Tynor

-

Kinex Medical Company

-

Others

Chapter 1. Compression Garments and Stockings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Compression Garments and Stockings Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Compression Garments and Stockings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Compression Garments and Stockings Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Compression Garments and Stockings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Compression Garments and Stockings Market – By Application

6.1 Introduction/Key Findings

6.2 Varicose veins

6.3 Burns

6.4 Oncology

6.5 Wound care

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Compression Garments and Stockings Market – By Product

7.1 Introduction/Key Findings

7.2 Compression garments

7.3 Compression stockings

7.4 Y-O-Y Growth trend Analysis By Product

7.5 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 8. Compression Garments and Stockings Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Hospitals and clinics

8.3 Ambulatory Surgical Centers

8.4 Online sales

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Compression Garments and Stockings Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Distribution Channel

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Distribution Channel

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Distribution Channel

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Distribution Channel

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Distribution Channel

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Compression Garments and Stockings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 3M

10.2 SIGVARIS

10.3 Therafirm

10.4 Santemol Group Medikal

10.5 Leonisa Inc

10.6 Comfort Plus Corporation

10.7 Medico International Inc

10.8 BIOCOMPRESSION SYSTEMS

10.9 Nouvelle

10.10 Tynor

10.11 Kinex Medical Company

10.12 Others

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global compression garments and stockings market was valued at USD 2.94 billion and is projected to reach a market size of USD 4.14 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.01%.

Increasing demand by athletes and the increased prevalence of varicose veins are the market drivers of the compression garments and stockings market.

Varicose Veins, Burns, Oncology, Wound Care, and Others are the segments under the Compression Garments and Stockings Market by application.

North America is the most dominant region for the compression garments and stockings market.

Asia-Pacific is the fastest-growing region in the compression garments and stockings market.